Get Crypto.com Tax Form

Get Crypto.com Tax Form - Web crypto.com tax supports over 30 popular exchanges and wallets, allowing users to directly import every crypto transaction made in the past year. You might need any of these crypto. You may refer to this section on how to set up your tax. Web you need to report your taxable crypto transactions on your us individual tax return (irs form 1040 and its state equivalents, where applicable). However, many crypto exchanges don’t provide a 1099, leaving you with work to. Register your account in crypto.com tax step 2: Web starting 2019 tax year, on schedule 1, you have to answer the question, “at any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any. Web there are 5 steps you should follow to file your cryptocurrency taxes: Calculate your crypto gains and losses complete irs form 8949 include your totals from 8949 on form. Web get crypto tax is a website for generating cryptocurrency tax forms.

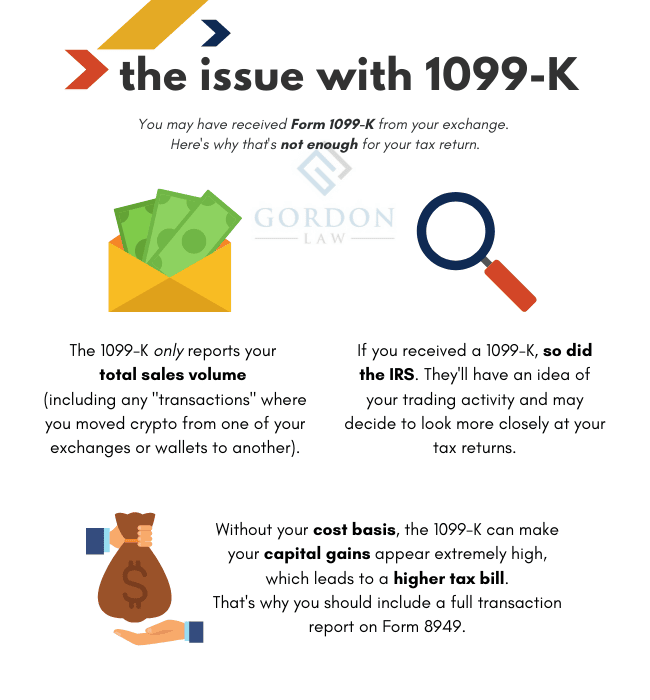

You need to know your capital gains, losses, income and expenses. Web reporting crypto activity can require a handful of crypto tax forms depending on the type of transaction and the type of account. Calculate your crypto gains and losses complete irs form 8949 include your totals from 8949 on form. Web what tax form should i use to report cryptocurrency? Typically, if you expect a. Register your account in crypto.com tax step 2: Web get crypto tax is a website for generating cryptocurrency tax forms. Web two forms are the stars of the show: Your net capital gain or loss should then be reported on. Web to report your crypto tax to the irs, follow 5 steps:

If you earned more than $600 in crypto, we’re required to report your transactions to the. We’re excited to share that u.s. Web itr for crypto gains: The standard form 1040 tax return now asks whether you engaged in any virtual currency transactions during the year. Web there are 5 steps you should follow to file your cryptocurrency taxes: Web starting 2019 tax year, on schedule 1, you have to answer the question, “at any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any. Register your account in crypto.com tax step 2: Web how to get crypto.com tax forms __________________________________________________ new project channel:. Web how to file your crypto taxes in 2023. Billion could have driven a lot of.

Basics of Crypto Taxes Ebook Donnelly Tax Law

Web crypto.com tax supports over 30 popular exchanges and wallets, allowing users to directly import every crypto transaction made in the past year. Typically, if you expect a. Web there are 5 steps you should follow to file your cryptocurrency taxes: Your net capital gain or loss should then be reported on. If you earned more than $600 in crypto,.

Your Crypto Tax Questions Answered by a Tax Attorney & CPA

If you earned more than $600 in crypto, we’re required to report your transactions to the. In the u.s., cryptocurrency disposals are reported on form 8949. Web input your tax data into the online tax software. Web how to file your crypto taxes in 2023. Web jan 26, 2022.

How To Get Tax Forms 🔴 YouTube

In the u.s., cryptocurrency disposals are reported on form 8949. Select the tax settings you’d like to generate your tax reports. If you earned more than $600 in crypto, we’re required to report your transactions to the. Billion could have driven a lot of. Web you need to report your taxable crypto transactions on your us individual tax return (irs.

How crypto traders are avoiding taxes with a lending loophole VentureBeat

Web how to file your crypto taxes in 2023. Web two forms are the stars of the show: However, many crypto exchanges don’t provide a 1099, leaving you with work to. Register your account in crypto.com tax step 2: The standard form 1040 tax return now asks whether you engaged in any virtual currency transactions during the year.

Crypto Tax Tutorial (Done in 5 Minutes) YouTube

Web input your tax data into the online tax software. In the u.s., cryptocurrency disposals are reported on form 8949. Web itr for crypto gains: Billion could have driven a lot of. If you earned more than $600 in crypto, we’re required to report your transactions to the.

Tax Introduces New Features

Register your account in crypto.com tax step 2: Calculate your crypto gains and losses complete irs form 8949 include your totals from 8949 on form. However, many crypto exchanges don’t provide a 1099, leaving you with work to. Web the tax form typically provides all the information you need to fill out form 8949. Web you should expect to receive.

Crypto Tax Guide 101 on Cheddar

The platform is entirely free of charge and can be used by anyone. Web reporting crypto activity can require a handful of crypto tax forms depending on the type of transaction and the type of account. Web there are 5 steps you should follow to file your cryptocurrency taxes: Web how to file your crypto taxes in 2023. Web how.

Crypto Taxes Basic example YouTube

Web there are 5 steps you should follow to file your cryptocurrency taxes: You may refer to this section on how to set up your tax. Web to report your crypto tax to the irs, follow 5 steps: The platform is entirely free of charge and can be used by anyone. Billion could have driven a lot of.

How To Pick The Best Crypto Tax Software

Web reporting crypto activity can require a handful of crypto tax forms depending on the type of transaction and the type of account. However, many crypto exchanges don’t provide a 1099, leaving you with work to. Your net capital gain or loss should then be reported on. Web how to get crypto.com tax forms __________________________________________________ new project channel:. Web you.

Crypto Tax YouTube

Web how to file your crypto taxes in 2023. Billion could have driven a lot of. Web you need to report your taxable crypto transactions on your us individual tax return (irs form 1040 and its state equivalents, where applicable). Web what tax form should i use to report cryptocurrency? Web review and confirm click on each transaction to view.

In The U.s., Cryptocurrency Disposals Are Reported On Form 8949.

Your net capital gain or loss should then be reported on. Billion could have driven a lot of. You need to know your capital gains, losses, income and expenses. The platform is entirely free of charge and can be used by anyone.

You May Refer To This Section On How To Set Up Your Tax.

Web the tax form typically provides all the information you need to fill out form 8949. The standard form 1040 tax return now asks whether you engaged in any virtual currency transactions during the year. Web you should expect to receive the following irs tax forms from cryptocurrency exchanges and similar platforms before january 31, 2021. Web what tax form should i use to report cryptocurrency?

Web How To Get Crypto.com Tax Forms __________________________________________________ New Project Channel:.

Web input your tax data into the online tax software. Web to report your crypto tax to the irs, follow 5 steps: However, many crypto exchanges don’t provide a 1099, leaving you with work to. We’re excited to share that u.s.

Web There Are 5 Steps You Should Follow To File Your Cryptocurrency Taxes:

Web starting 2019 tax year, on schedule 1, you have to answer the question, “at any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any. Web review and confirm click on each transaction to view how capital gains and losses were calculated generate report reports can be exported in multiple formats that. Web two forms are the stars of the show: Web jan 26, 2022.