Maryland Form 510/511D

Maryland Form 510/511D - Web state tax matters the power of knowing. You can download or print current. All payments must indicate the fein, type of tax and tax year beginning and ending dates. Web if your clients as pte owners receive adjustment notices, indicating unprocessed or incorrectly processed credits related to form 511, contact the tax. Or the entity is inactive. Other pte that is subject to maryland income. Updated form instructions say pte tax election must be made with first tax payment. Web every maryland pte must file a return, even if it has no income. This form may be used if the pte is paying tax only on. If the tax year of the pte is other than a calendar year, enter the.

You can download or print current. Web every maryland pte must file a return, even if it has no income. Updated form instructions say pte tax election must be made with first tax payment. Or the entity is inactive. This form may be used if the pte is paying tax only on. Web state tax matters the power of knowing. Web their own income tax returns (form 500, 504, 505 or 510) to claim credit for taxes paid on their behalf. If the tax year of the pte is other than a calendar year, enter the. Web made payable to comptroller of maryland. Web if your clients as pte owners receive adjustment notices, indicating unprocessed or incorrectly processed credits related to form 511, contact the tax.

Web state tax matters the power of knowing. The request for extension of. Web the maryland comptroller jan. All payments must indicate the fein, type of tax and tax year beginning and ending dates. You can download or print current. Web every maryland pte must file a return, even if it has no income. If the tax year of the pte is other than a calendar year, enter the. Updated form instructions say pte tax election must be made with first tax payment. Web their own income tax returns (form 500, 504, 505 or 510) to claim credit for taxes paid on their behalf. Web made payable to comptroller of maryland.

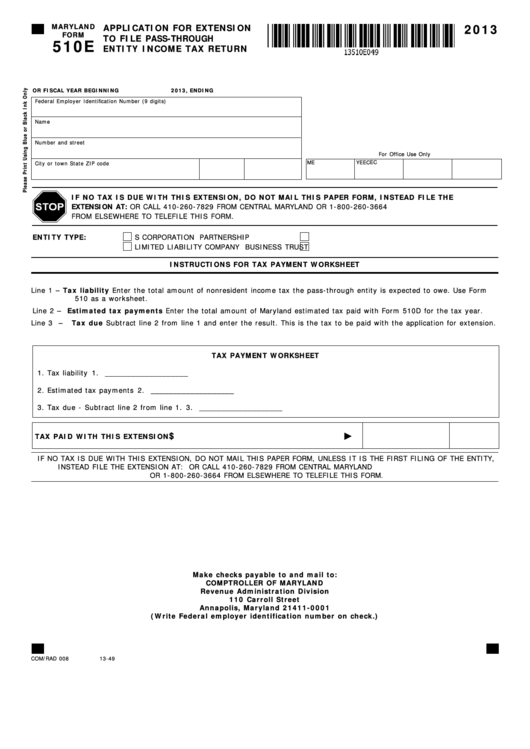

Fillable Maryland Form 510e Application For Extension To File Pass

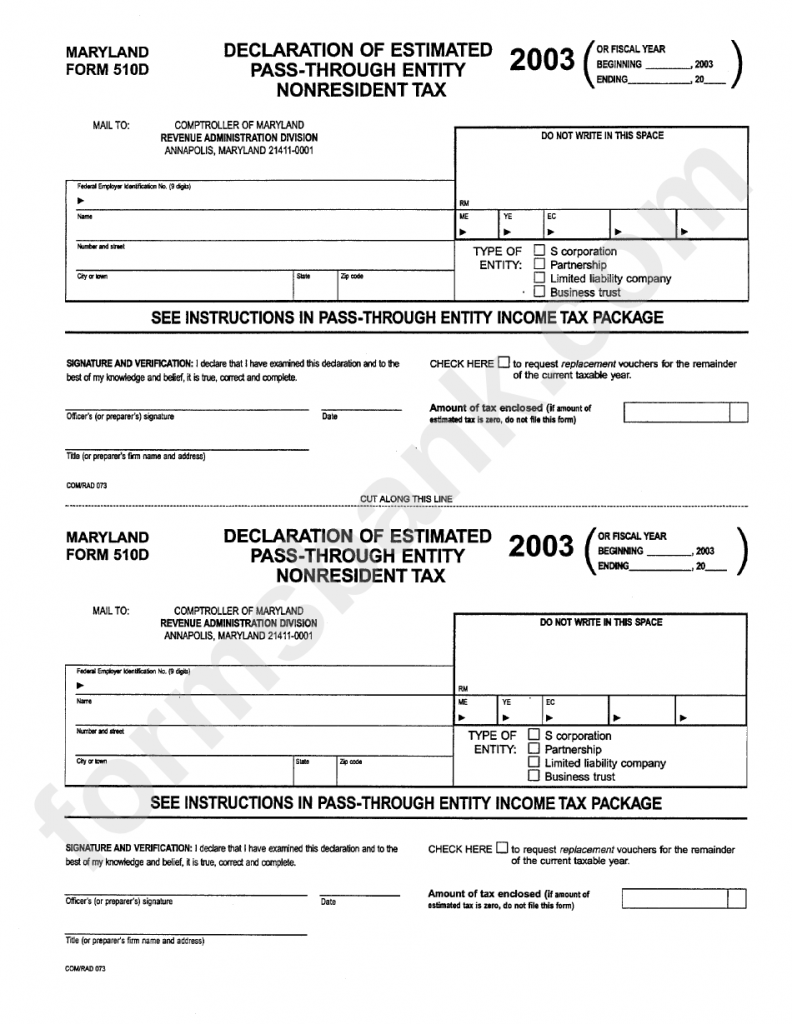

Or the entity is inactive. Tax rate the current 2012 tax rate for nonresident individual members is. The request for extension of. This form may be used if the pte is paying tax only on. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation.

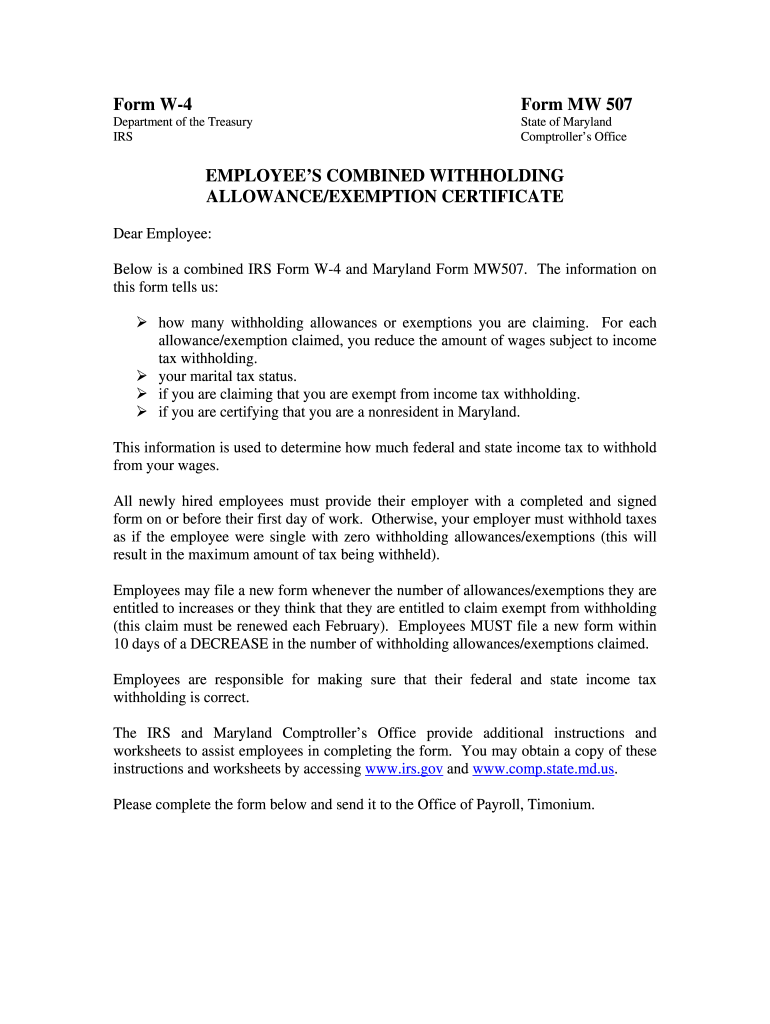

Maryland W4 Form Fill Out and Sign Printable PDF Template signNow

All payments must indicate the fein, type of tax and tax year beginning and ending dates. Web state tax matters the power of knowing. Updated form instructions say pte tax election must be made with first tax payment. Web made payable to comptroller of maryland. This form may be used if the pte is paying tax only on.

Maryland form 511 Intuit Accountants Community

Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Web their own income tax returns (form 500, 504, 505 or 510) to claim credit for taxes paid on their behalf. Web made payable to comptroller of maryland. Web if your clients as pte owners receive adjustment notices, indicating.

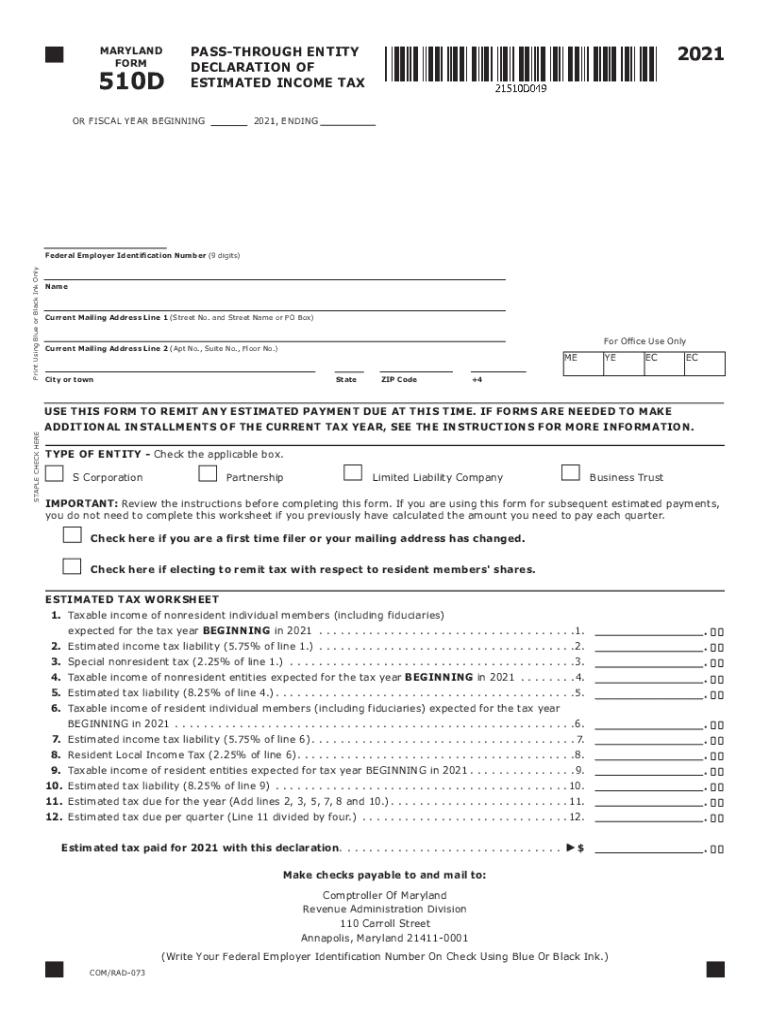

2021 MD Form 510D Fill Online, Printable, Fillable, Blank pdfFiller

Electing ptes must file form 511. Web every maryland pte must file a return, even if it has no income. Or the entity is inactive. Web made payable to comptroller of maryland. Web if your clients as pte owners receive adjustment notices, indicating unprocessed or incorrectly processed credits related to form 511, contact the tax.

Maryland Form 502d Fill Online, Printable, Fillable, Blank pdfFiller

Web their own income tax returns (form 500, 504, 505 or 510) to claim credit for taxes paid on their behalf. You can download or print current. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. If the tax year of the pte is other than a calendar.

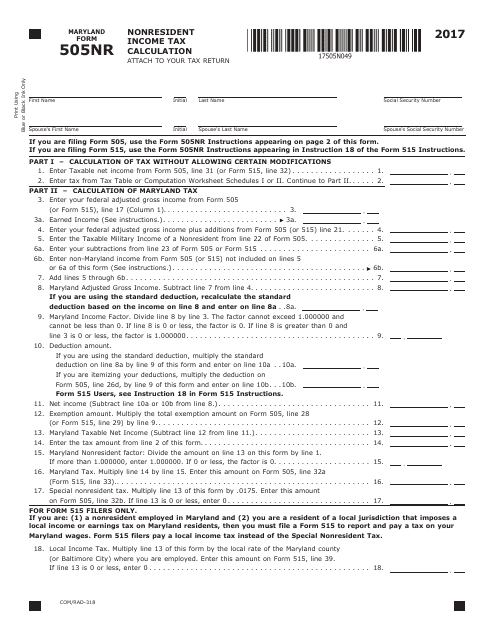

Maryland Form 505NR Download Fillable PDF or Fill Online

If the tax year of the pte is other than a calendar year, enter the. Tax rate the current 2012 tax rate for nonresident individual members is. Web first filing of the entity 510c filed inactive entity business trust this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Web 510c filed.

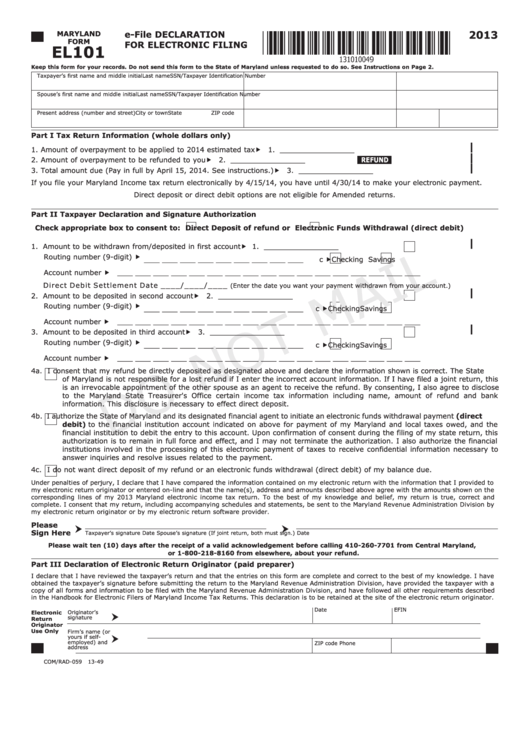

Fillable Maryland Form El101 EFile Declaration For Electronic Filing

Web made payable to comptroller of maryland. Web if your clients as pte owners receive adjustment notices, indicating unprocessed or incorrectly processed credits related to form 511, contact the tax. Or the entity is inactive. This form may be used if the pte is paying tax only on. Other pte that is subject to maryland income.

Maryland Printable Tax Forms Printable Form 2022

Updated form instructions say pte tax election must be made with first tax payment. Or the entity is inactive. Tax rate the current 2012 tax rate for nonresident individual members is. All payments must indicate the fein, type of tax and tax year beginning and ending dates. Web 510c filed this tax year's beginning and ending dates are different from.

elliemeyersdesigns Maryland Form 510

You can download or print current. Web if your clients as pte owners receive adjustment notices, indicating unprocessed or incorrectly processed credits related to form 511, contact the tax. Web first filing of the entity 510c filed inactive entity business trust this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Web.

Fill Free fillable forms Comptroller of Maryland

All payments must indicate the fein, type of tax and tax year beginning and ending dates. Web every maryland pte must file a return, even if it has no income. If the tax year of the pte is other than a calendar year, enter the. Electing ptes must file form 511. Web made payable to comptroller of maryland.

Web The Maryland Comptroller Jan.

Web state tax matters the power of knowing. Web if your clients as pte owners receive adjustment notices, indicating unprocessed or incorrectly processed credits related to form 511, contact the tax. Web every maryland pte must file a return, even if it has no income. If the tax year of the pte is other than a calendar year, enter the.

Web First Filing Of The Entity 510C Filed Inactive Entity Business Trust This Tax Year's Beginning And Ending Dates Are Different From Last Year's Due To An Acquisition Or Consolidation.

Web their own income tax returns (form 500, 504, 505 or 510) to claim credit for taxes paid on their behalf. This form may be used if the pte is paying tax only on. The request for extension of. Other pte that is subject to maryland income.

Updated Form Instructions Say Pte Tax Election Must Be Made With First Tax Payment.

Electing ptes must file form 511. You can download or print current. Or the entity is inactive. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation.

Tax Rate The Current 2012 Tax Rate For Nonresident Individual Members Is.

Web made payable to comptroller of maryland. All payments must indicate the fein, type of tax and tax year beginning and ending dates.