Texas A&M 1098 T Form

Texas A&M 1098 T Form - Columbia charcoal grey atm terminal tackle long. Columbia maroon atm terminal tackle long sleeved tee. In the secure access login. Students with a valid ssn (not. Programs to assist students and parents in. Here’s how to do it: Students with a payment with a transaction date in the prior tax year (regardless of term). The irs requires eligible educational institutions who receive payment for qualified tuition and related expenses. Login to blue & gold 2. Current and former students have access to the current.

Select student & financial aid. Current and former students have access to the current. Paper, instructions printed on the back, compatible with quickbooks and accounting software. Students with a payment with a transaction date in the prior tax year (regardless of term). Here’s how to do it: In the secure access login. Login to blue & gold 2. Columbia maroon atm terminal tackle long sleeved tee. Columbia charcoal grey atm terminal tackle long. Web texas a&m all timer aggie baseball tee.

Students with a payment with a transaction date in the prior tax year (regardless of term). In the secure access login. Paper, instructions printed on the back, compatible with quickbooks and accounting software. Current and former students have access to the current. Web texas a&m all timer aggie baseball tee. Programs to assist students and parents in. Columbia charcoal grey atm terminal tackle long. Here’s how to do it: Select student & financial aid. Students with a valid ssn (not.

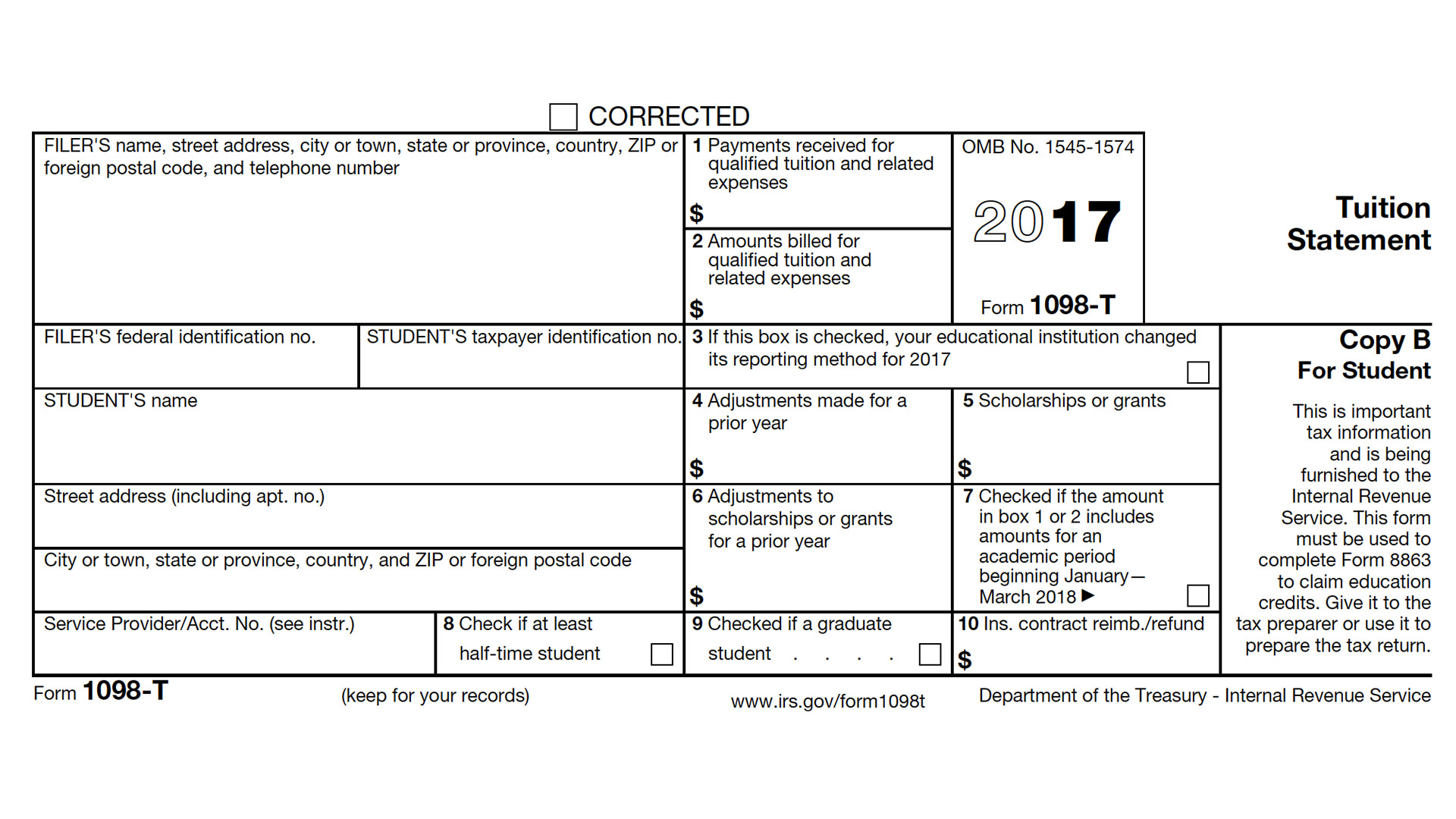

1098T IRS Tax Form Instructions 1098T Forms

Students with a payment with a transaction date in the prior tax year (regardless of term). Web we oversee payroll processing for texas a&m university and many other a&m system members. Programs to assist students and parents in. Columbia maroon atm terminal tackle long sleeved tee. Here’s how to do it:

Form 1098T Information Student Portal

In the secure access login. The irs requires eligible educational institutions who receive payment for qualified tuition and related expenses. Select student & financial aid. Students with a payment with a transaction date in the prior tax year (regardless of term). Login to blue & gold 2.

1098T Ventura County Community College District

Login to blue & gold 2. The irs requires eligible educational institutions who receive payment for qualified tuition and related expenses. Paper, instructions printed on the back, compatible with quickbooks and accounting software. Select student & financial aid. Here’s how to do it:

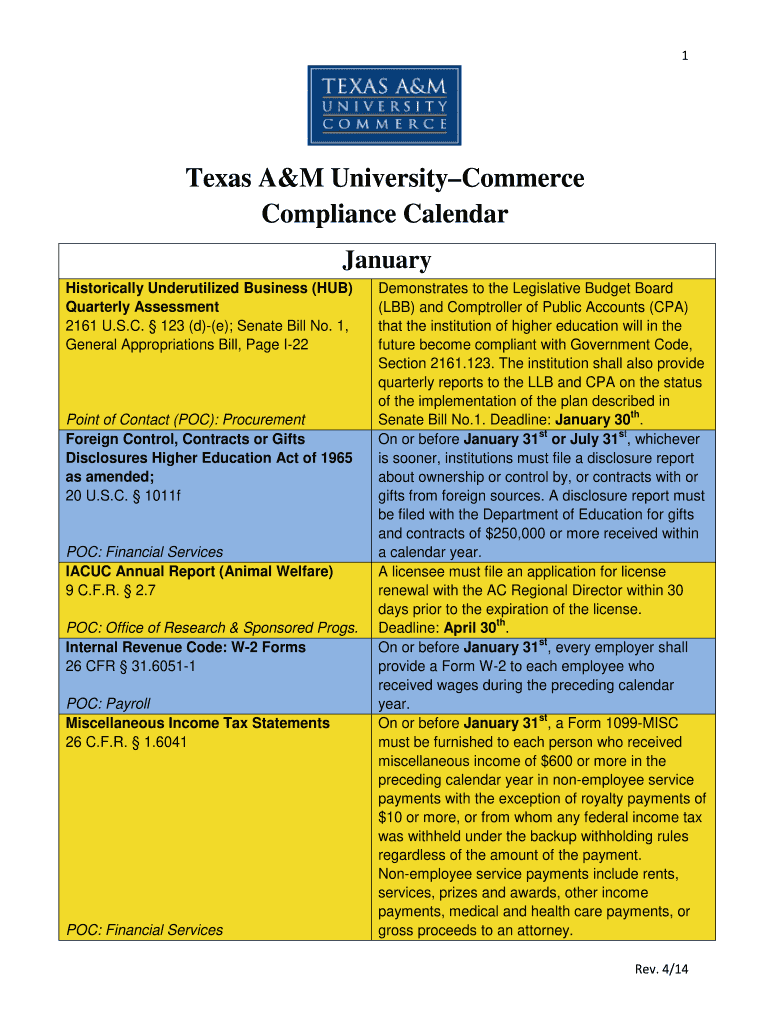

Texas A M Commerce 1098 T Fill Online, Printable, Fillable, Blank

Web texas a&m all timer aggie baseball tee. Columbia charcoal grey atm terminal tackle long. Students with a valid ssn (not. Students who do not opt. Here’s how to do it:

Student Guide to print an official 1098T form CCRI

The irs requires eligible educational institutions who receive payment for qualified tuition and related expenses. Columbia maroon atm terminal tackle long sleeved tee. Columbia charcoal grey atm terminal tackle long. Students who do not opt. Current and former students have access to the current.

Form 1098T Everything you need to know Go TJC

Web we oversee payroll processing for texas a&m university and many other a&m system members. Paper, instructions printed on the back, compatible with quickbooks and accounting software. Login to blue & gold 2. Students who do not opt. Columbia maroon atm terminal tackle long sleeved tee.

Form 1098T Community Tax

Students with a payment with a transaction date in the prior tax year (regardless of term). Columbia maroon atm terminal tackle long sleeved tee. Columbia charcoal grey atm terminal tackle long. Students with a valid ssn (not. In the secure access login.

1098T IRS Tax Form Instructions 1098T Forms

Programs to assist students and parents in. Select student & financial aid. Paper, instructions printed on the back, compatible with quickbooks and accounting software. Login to blue & gold 2. Columbia charcoal grey atm terminal tackle long.

Form 1098T Still Causing Trouble for Funded Graduate Students

The irs requires eligible educational institutions who receive payment for qualified tuition and related expenses. In the secure access login. Programs to assist students and parents in. Select student & financial aid. Login to blue & gold 2.

Web Texas A&M All Timer Aggie Baseball Tee.

Students with a valid ssn (not. Columbia maroon atm terminal tackle long sleeved tee. Login to blue & gold 2. Select student & financial aid.

Programs To Assist Students And Parents In.

Students with a payment with a transaction date in the prior tax year (regardless of term). The irs requires eligible educational institutions who receive payment for qualified tuition and related expenses. Paper, instructions printed on the back, compatible with quickbooks and accounting software. Students who do not opt.

Here’s How To Do It:

Current and former students have access to the current. Web we oversee payroll processing for texas a&m university and many other a&m system members. Columbia charcoal grey atm terminal tackle long. In the secure access login.