1065 Form Instructions

1065 Form Instructions - And the total assets at the end of the tax year are: Web information about form 1065, u.s. Return of partnership income, including recent updates, related forms and instructions on how to file. Web a 1065 form is the annual us tax return filed by partnerships. Department of the treasury internal revenue service. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the If the partnership's principal business, office, or agency is located in: Or getting income from u.s.

For instructions and the latest information. If the partnership's principal business, office, or agency is located in: Return of partnership income, including recent updates, related forms and instructions on how to file. Web form 1065 is the first step for paying taxes on income earned by the partnership. Web information about form 1065, u.s. See limitations on losses, deductions, and credits, later, for more information. Department of the treasury internal revenue service. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. And the total assets at the end of the tax year are:

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Web a 1065 form is the annual us tax return filed by partnerships. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. It is the partner's responsibility to consider and apply any applicable limitations. Web form 1065 is the first step for paying taxes on income earned by the partnership. Web where to file your taxes for form 1065. Use the following internal revenue service center address: Or getting income from u.s. Return of partnership income, including recent updates, related forms and instructions on how to file. If the partnership's principal business, office, or agency is located in:

2014 form 1065 instructions

Use the following internal revenue service center address: Return of partnership income, including recent updates, related forms and instructions on how to file. If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the Web where to file your taxes for form 1065. For instructions and the latest information.

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

Department of the treasury internal revenue service. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. See limitations on losses, deductions, and credits, later, for more information. Web form 1065 is the first step for paying taxes on income earned by.

IRS Instructions 1065 (Schedule K1) 2018 2019 Printable & Fillable

For calendar year 2022, or tax year beginning. For instructions and the latest information. And the total assets at the end of the tax year are: See limitations on losses, deductions, and credits, later, for more information. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s.

Irs Form 1065 K 1 Instructions Universal Network

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Use the following internal revenue service center address: Web information about form 1065, u.s. Or getting income from u.s. It is the partner's responsibility to consider and apply any applicable limitations.

Llc Tax Form 1065 Universal Network

Web where to file your taxes for form 1065. See limitations on losses, deductions, and credits, later, for more information. Use the following internal revenue service center address: Web form 1065 is the first step for paying taxes on income earned by the partnership. Web a 1065 form is the annual us tax return filed by partnerships.

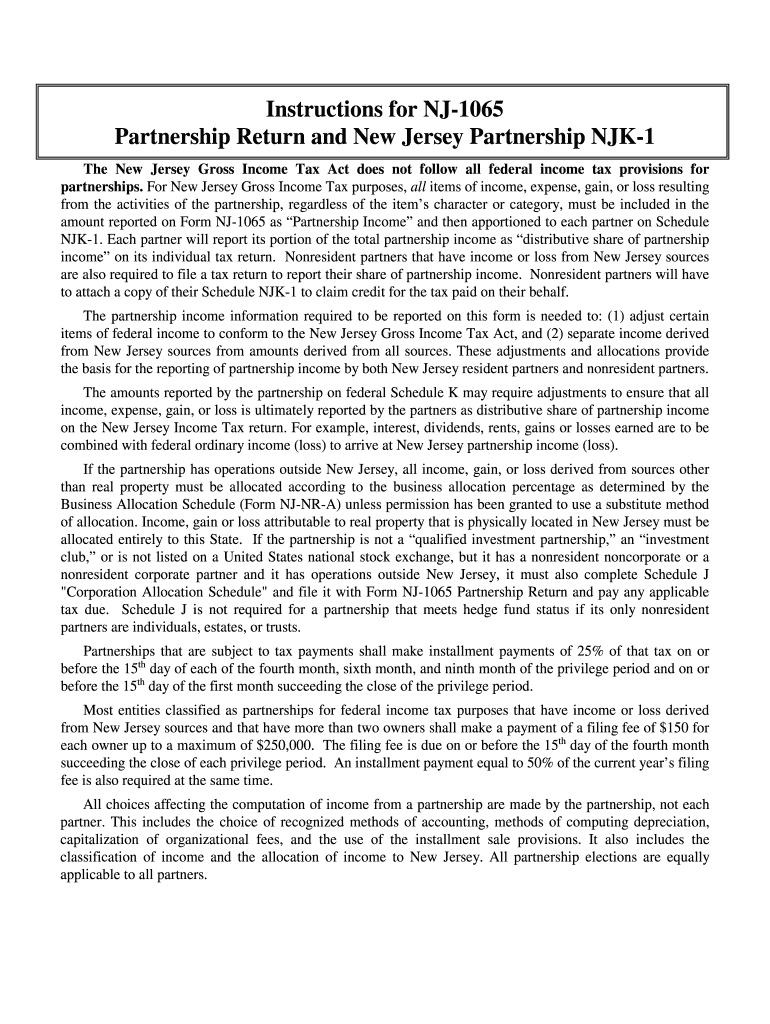

2018 Form NJ NJ1065 Instructions Fill Online, Printable, Fillable

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Web a 1065 form is the annual us tax return filed by partnerships. It is the partner's responsibility to consider and apply any applicable limitations. And the total assets at the end.

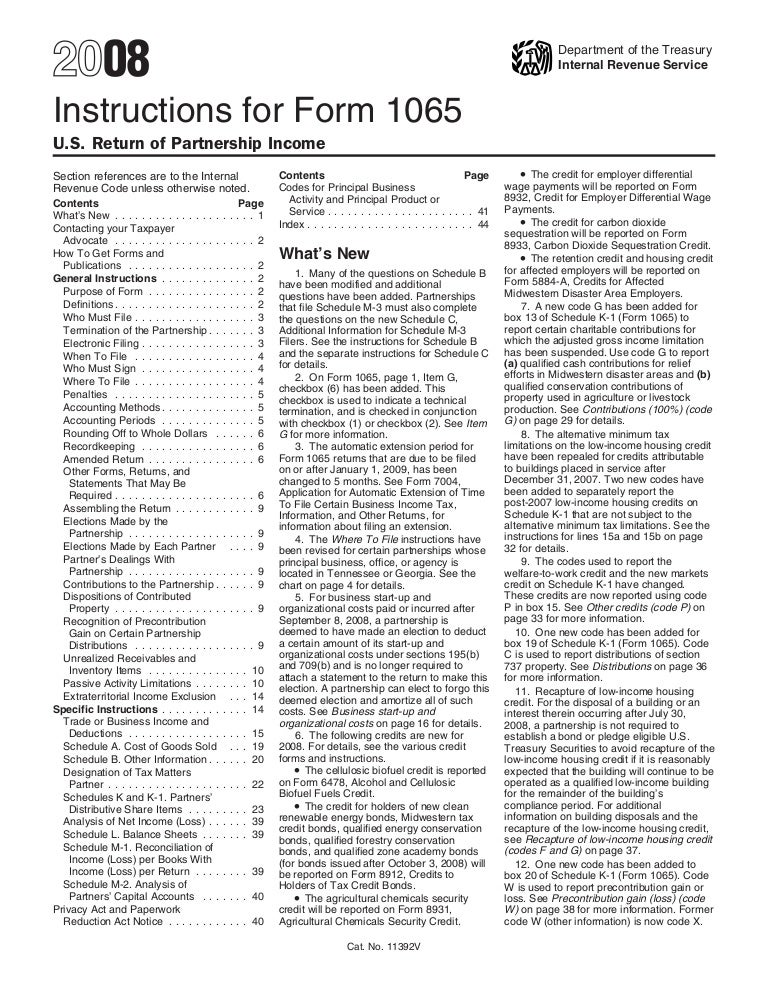

Inst 1065Instructions for Form 1065, U.S. Return of Partnership Inco…

And the total assets at the end of the tax year are: If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the Department of the treasury internal revenue service. Web form 1065 is the first step for paying taxes on income earned by the partnership. Or getting income from u.s.

Form 1065 Instructions Limited Liability Partnership Partnership

For instructions and the latest information. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. And the total assets at the end of the tax year are: If the partnership's principal business, office, or agency is.

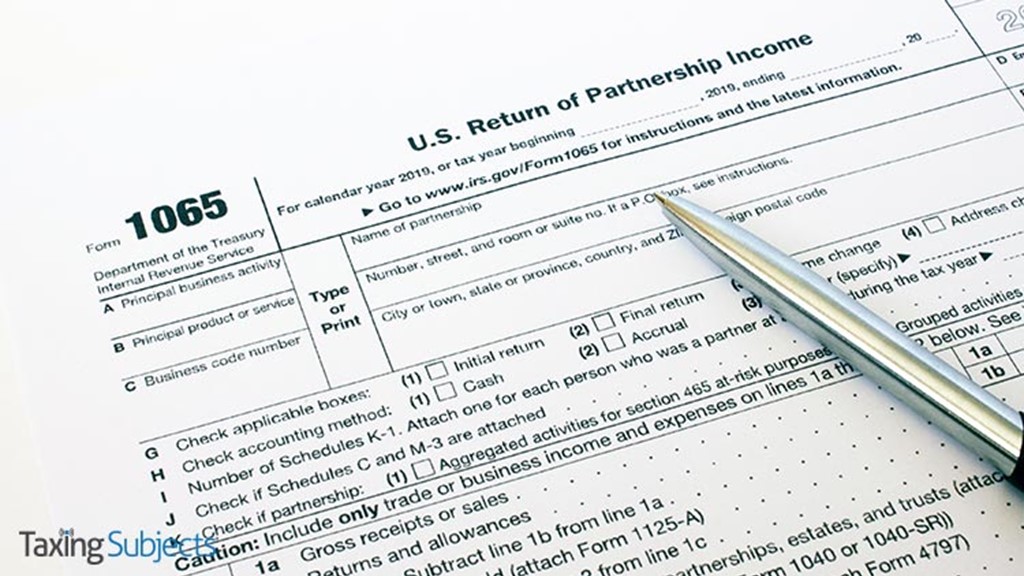

schedule k1 Taxing Subjects

If the partnership's principal business, office, or agency is located in: See limitations on losses, deductions, and credits, later, for more information. Web where to file your taxes for form 1065. It is the partner's responsibility to consider and apply any applicable limitations. And the total assets at the end of the tax year are:

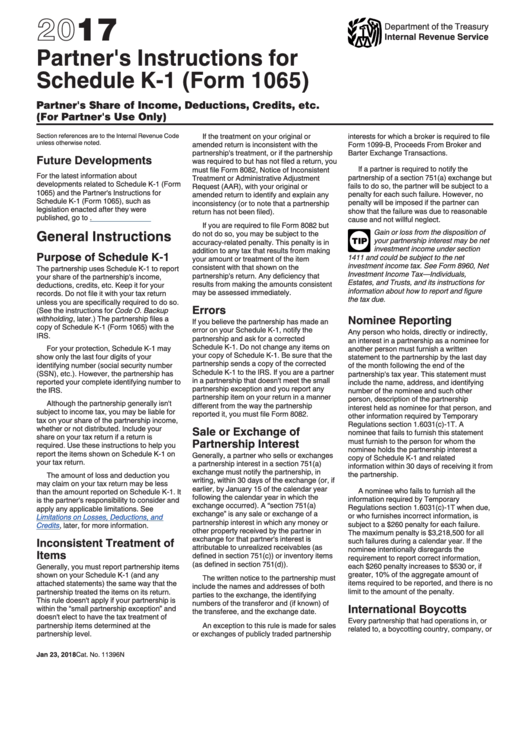

Instructions For Schedule K1 (Form 1065) Partner'S Share Of

Web a 1065 form is the annual us tax return filed by partnerships. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. If the partnership reports unrelated business taxable income to an ira partner on line.

Connecticut, Delaware, District Of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts.

Web form 1065 is the first step for paying taxes on income earned by the partnership. Use the following internal revenue service center address: Web a 1065 form is the annual us tax return filed by partnerships. For calendar year 2022, or tax year beginning.

Department Of The Treasury Internal Revenue Service.

For instructions and the latest information. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Return of partnership income, including recent updates, related forms and instructions on how to file. It is the partner's responsibility to consider and apply any applicable limitations.

And The Total Assets At The End Of The Tax Year Are:

See limitations on losses, deductions, and credits, later, for more information. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Or getting income from u.s. Web where to file your taxes for form 1065.

Web Information About Form 1065, U.s.

If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the If the partnership's principal business, office, or agency is located in: