1095 Form Deadline 2022

1095 Form Deadline 2022 - Web file the annual report with the irs and furnish the statements to individuals on or before january 31, 2023, for coverage in calendar year 2022. 1095 forms delivered to employees. Web march 31, 2022: These final regulations extending the deadline for. Web for the 2022 forms, due in 2023, the deadline was already extended from january 31, 2023 to march 2, 2023. Rock hill, sc / accesswire / january 30, 2023 / businesses are required to. Web february 02, 2023. Members will also be able to request a paper form beginning. Web with respect to health coverage in 2022, the aca deadlines range from february 28 to march 31, 2023, and the state deadlines range from january 31, 2023 to. Nearing the end of the 2022 tax year, it's time for the employers to be aware of the aca reporting requirements and its.

Web 2022 filing deadlines for 2021 coverage are as follows: Web february 02, 2023. 1095 forms delivered to employees. Web with respect to health coverage in 2022, the aca deadlines range from february 28 to march 31, 2023, and the state deadlines range from january 31, 2023 to. The aca filing deadline for. Web march 31, 2022: Nearing the end of the 2022 tax year, it's time for the employers to be aware of the aca reporting requirements and its. These final regulations extending the deadline for. You need to be aware of three deadlines: Web thursday, january 6, 2022 the internal revenue service (“irs”) recently issued proposed regulations affecting certain reporting deadlines under the patient.

Web february 02, 2023. Members will also be able to request a paper form beginning. Web with respect to health coverage in 2022, the aca deadlines range from february 28 to march 31, 2023, and the state deadlines range from january 31, 2023 to. The aca filing deadline for. Web thursday, january 6, 2022 the internal revenue service (“irs”) recently issued proposed regulations affecting certain reporting deadlines under the patient. Web 2022 filing deadlines for 2021 coverage are as follows: Web march 31, 2022: Web file the annual report with the irs and furnish the statements to individuals on or before january 31, 2023, for coverage in calendar year 2022. Web for the 2022 forms, due in 2023, the deadline was already extended from january 31, 2023 to march 2, 2023. Nearing the end of the 2022 tax year, it's time for the employers to be aware of the aca reporting requirements and its.

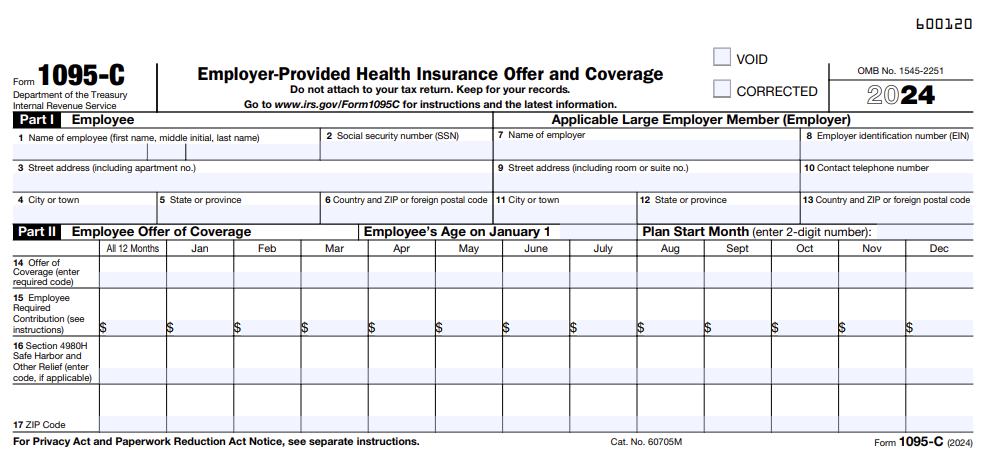

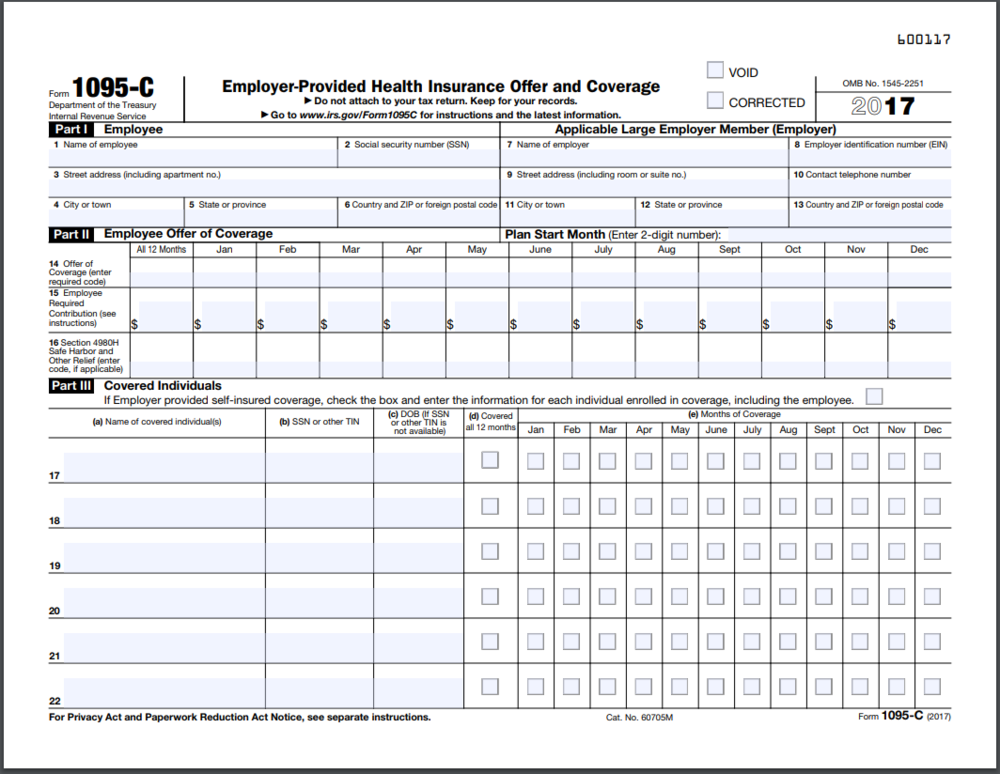

File IRS Form 1095C For 2022 Tax Year

Web for the 2022 forms, due in 2023, the deadline was already extended from january 31, 2023 to march 2, 2023. 1095 forms delivered to employees. Web 2022 filing deadlines for 2021 coverage are as follows: Web thursday, january 6, 2022 the internal revenue service (“irs”) recently issued proposed regulations affecting certain reporting deadlines under the patient. Web with respect.

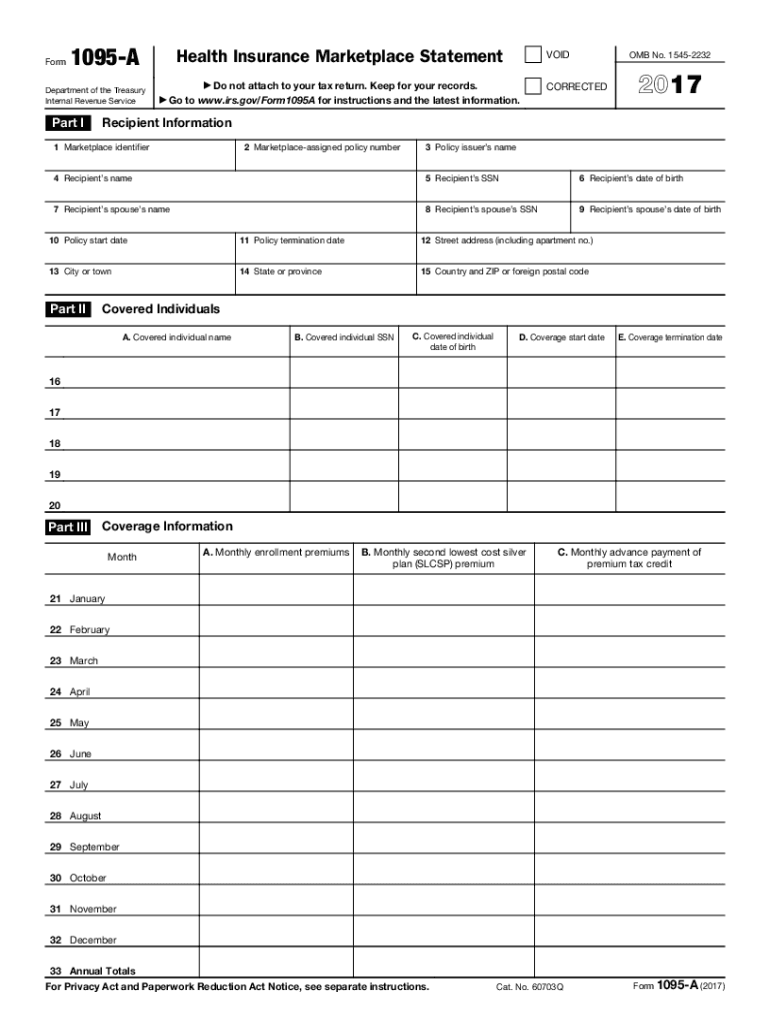

√100以上 marketplace identifier 1095c 275727Marketplace identifier 1095

The aca filing deadline for. Web 2022 filing deadlines for 2021 coverage are as follows: Nearing the end of the 2022 tax year, it's time for the employers to be aware of the aca reporting requirements and its. These final regulations extending the deadline for. Web with respect to health coverage in 2022, the aca deadlines range from february 28.

1095 A Tax Credits & Subsidies for Form 8962 attaches to 1040 Covered CA

Rock hill, sc / accesswire / january 30, 2023 / businesses are required to. These final regulations extending the deadline for. You need to be aware of three deadlines: Members will also be able to request a paper form beginning. Web with respect to health coverage in 2022, the aca deadlines range from february 28 to march 31, 2023, and.

1095 a Form Fill Out and Sign Printable PDF Template signNow

Web for the 2022 forms, due in 2023, the deadline was already extended from january 31, 2023 to march 2, 2023. 1095 forms delivered to employees. Web file the annual report with the irs and furnish the statements to individuals on or before january 31, 2023, for coverage in calendar year 2022. Members will also be able to request a.

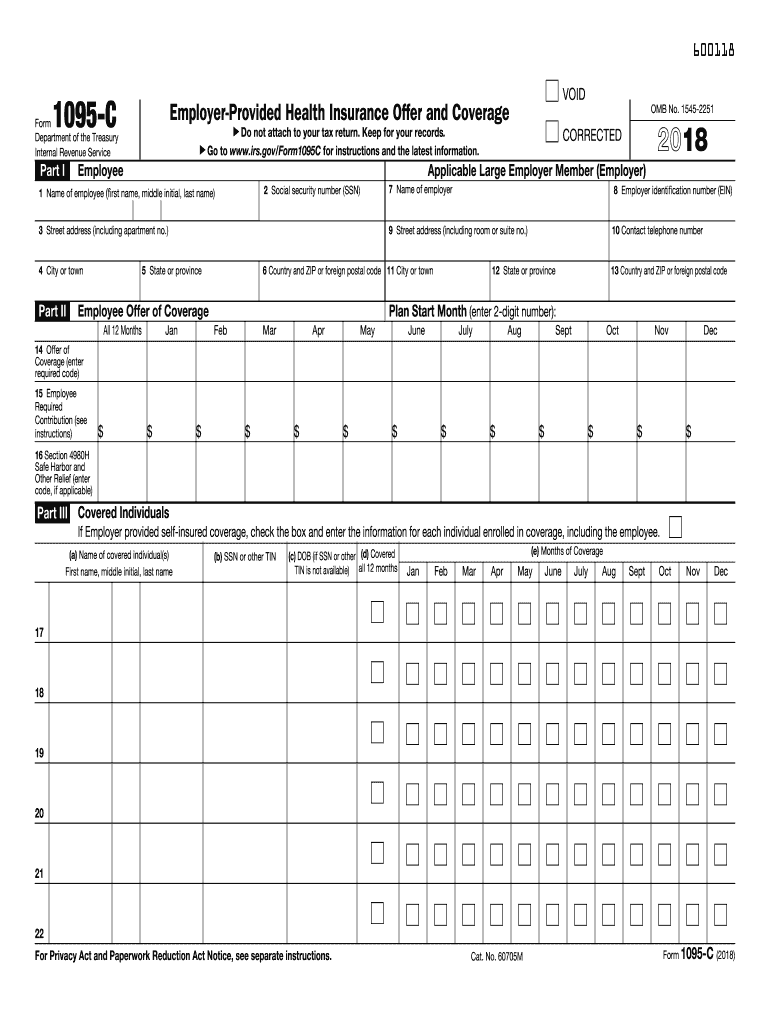

1095 2018 Fill Out and Sign Printable PDF Template signNow

Web with respect to health coverage in 2022, the aca deadlines range from february 28 to march 31, 2023, and the state deadlines range from january 31, 2023 to. Web march 31, 2022: The aca filing deadline for. Web thursday, january 6, 2022 the internal revenue service (“irs”) recently issued proposed regulations affecting certain reporting deadlines under the patient. Web.

Payroll / 1095C Information Affordable Care Act (ACA)

Members will also be able to request a paper form beginning. Web march 31, 2022: Web file the annual report with the irs and furnish the statements to individuals on or before january 31, 2023, for coverage in calendar year 2022. The aca filing deadline for. Web with respect to health coverage in 2022, the aca deadlines range from february.

1095C Form 2021 2022 Finance Zrivo

You need to be aware of three deadlines: The aca filing deadline for. Web thursday, january 6, 2022 the internal revenue service (“irs”) recently issued proposed regulations affecting certain reporting deadlines under the patient. Web march 31, 2022: Web with respect to health coverage in 2022, the aca deadlines range from february 28 to march 31, 2023, and the state.

Internal Revenue Service Delays Form 1095C Deadline

Web thursday, january 6, 2022 the internal revenue service (“irs”) recently issued proposed regulations affecting certain reporting deadlines under the patient. Rock hill, sc / accesswire / january 30, 2023 / businesses are required to. Web file the annual report with the irs and furnish the statements to individuals on or before january 31, 2023, for coverage in calendar year.

What is Form 1095? Infographic H&R Block

These final regulations extending the deadline for. Members will also be able to request a paper form beginning. Rock hill, sc / accesswire / january 30, 2023 / businesses are required to. You need to be aware of three deadlines: Web 2022 filing deadlines for 2021 coverage are as follows:

1095A, 1095B and 1095C What are they and what do I do with them

1095 forms delivered to employees. Web february 02, 2023. Web with respect to health coverage in 2022, the aca deadlines range from february 28 to march 31, 2023, and the state deadlines range from january 31, 2023 to. The aca filing deadline for. These final regulations extending the deadline for.

Web February 02, 2023.

These final regulations extending the deadline for. Nearing the end of the 2022 tax year, it's time for the employers to be aware of the aca reporting requirements and its. Web file the annual report with the irs and furnish the statements to individuals on or before january 31, 2023, for coverage in calendar year 2022. The aca filing deadline for.

Web With Respect To Health Coverage In 2022, The Aca Deadlines Range From February 28 To March 31, 2023, And The State Deadlines Range From January 31, 2023 To.

Web 2022 filing deadlines for 2021 coverage are as follows: Web march 31, 2022: Members will also be able to request a paper form beginning. Web for the 2022 forms, due in 2023, the deadline was already extended from january 31, 2023 to march 2, 2023.

Rock Hill, Sc / Accesswire / January 30, 2023 / Businesses Are Required To.

You need to be aware of three deadlines: 1095 forms delivered to employees. Web thursday, january 6, 2022 the internal revenue service (“irs”) recently issued proposed regulations affecting certain reporting deadlines under the patient.