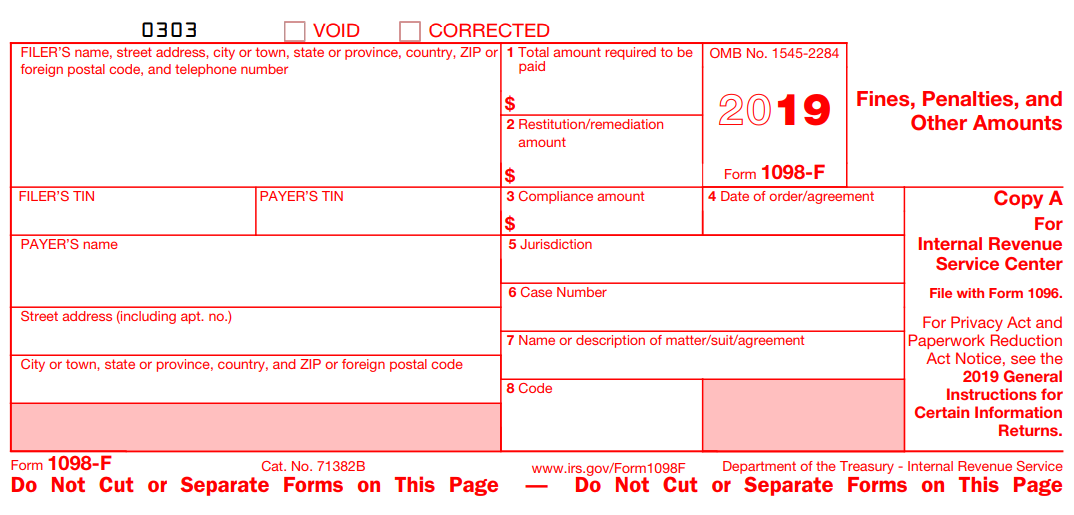

1098-F Form

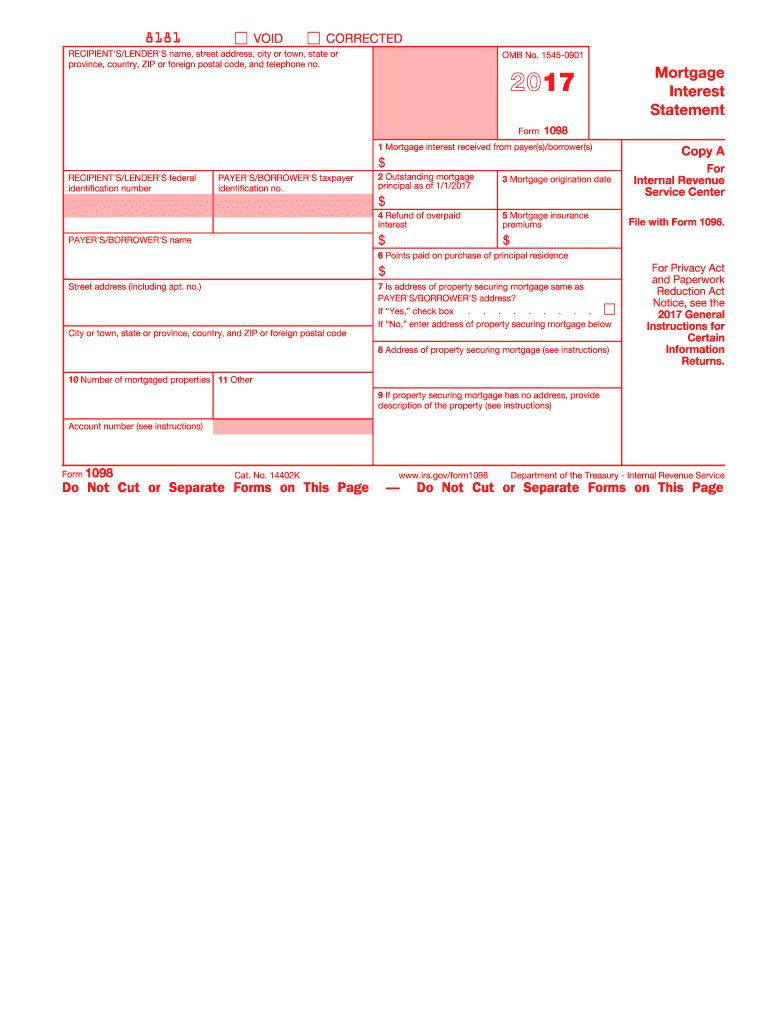

1098-F Form - Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Insurers file this form for each individual to whom they. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in. Try it for free now! Irs requires that all income and deductible expenses are reported by businesses and individuals or penalties. This document contains proposed regulations that provide guidance on section 162 (f) of the internal revenue code (code), as amended by. Ad complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly. Contract reimb./refund this is important. Open the document in our online.

Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to report the amount of interest and related expenses paid. Irs requires that all income and deductible expenses are reported by businesses and individuals or penalties. Ad complete irs tax forms online or print government tax documents. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in. Contract reimb./refund this is important. This document contains proposed regulations that provide guidance on section 162 (f) of the internal revenue code (code), as amended by. Complete, edit or print tax forms instantly. Find the document you require in our library of legal templates. Ad upload, modify or create forms. Complete, edit or print tax forms instantly.

Ad upload, modify or create forms. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Open the document in our online. Contract reimb./refund this is important. Ad complete irs tax forms online or print government tax documents. Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to report the amount of interest and related expenses paid. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Insurers file this form for each individual to whom they. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in.

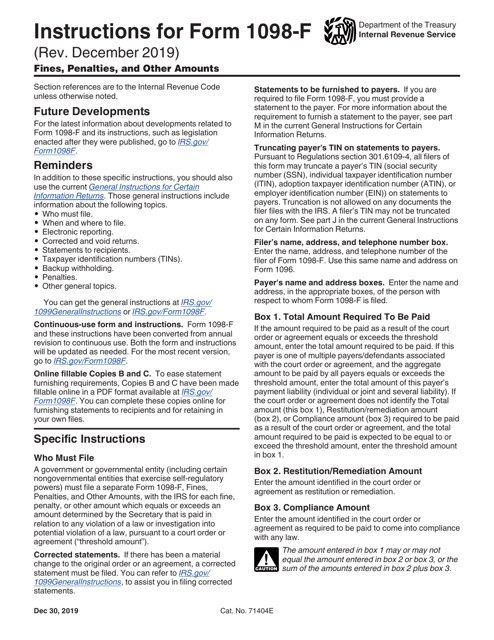

Instructions for IRS Form 1098f Fines, Penalties, and Other Amounts

Contract reimb./refund this is important. Ad upload, modify or create forms. Insurers file this form for each individual to whom they. Try it for free now! Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in.

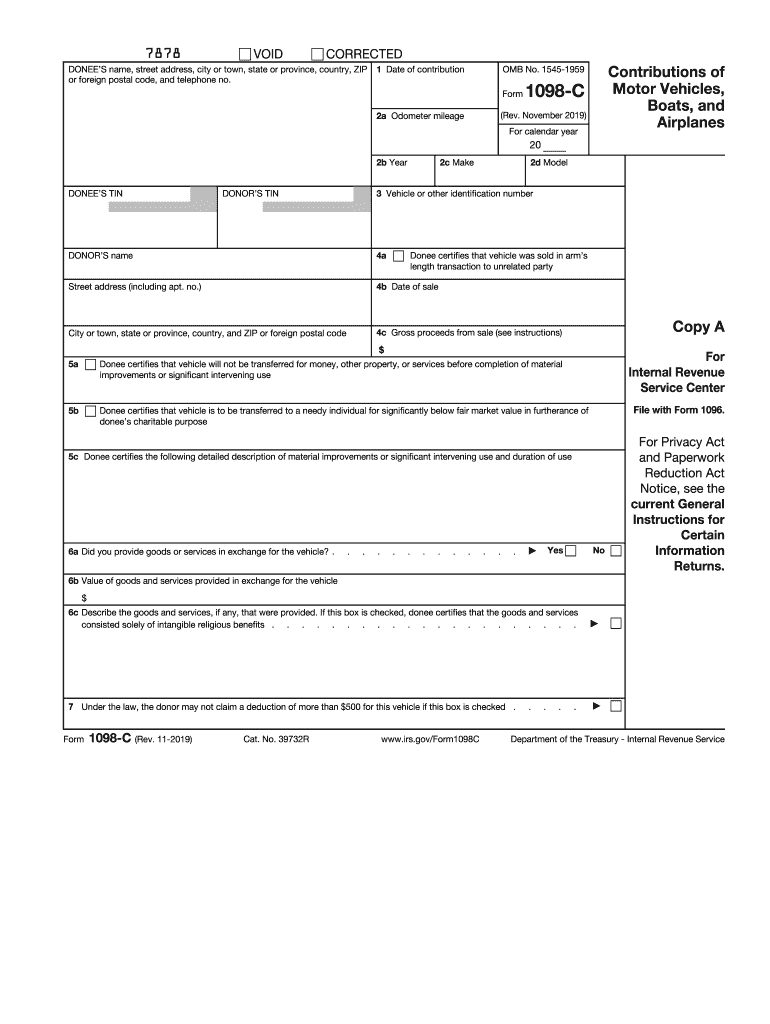

IRS 1098C 20192021 Fill and Sign Printable Template Online US

Ad complete irs tax forms online or print government tax documents. This document contains proposed regulations that provide guidance on section 162 (f) of the internal revenue code (code), as amended by. Insurers file this form for each individual to whom they. Try it for free now! Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined.

How to Print and File Tax Form 1098F, Fines, Penalties, and Other Amounts

Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to report the amount of interest and related expenses paid. Insurers.

1098T Tax Form Frequently Asked Questions

Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Try it for free now! Ad complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly. This document contains proposed.

1098 Explained

Complete, edit or print tax forms instantly. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in. This document contains proposed regulations that provide guidance on section 162 (f) of the internal revenue code (code), as amended by. Complete, edit or print tax forms instantly. Open.

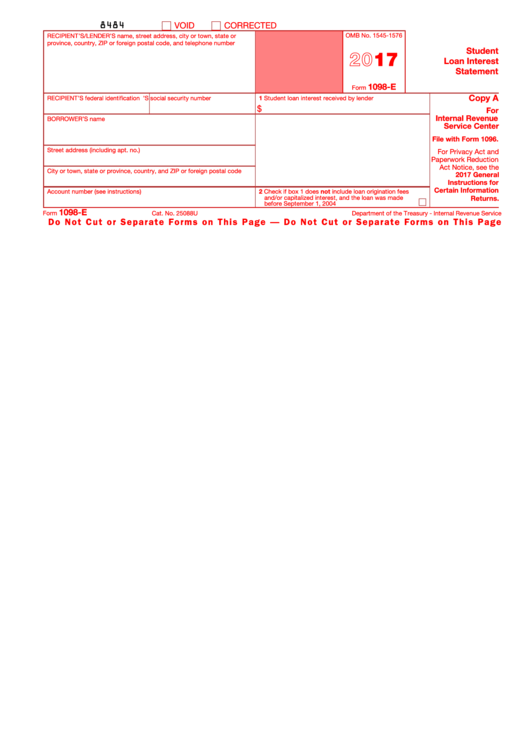

Form 1098E Student Loan Interest Statement 2017 printable pdf download

Contract reimb./refund this is important. Open the document in our online. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in. Ad complete irs tax forms online or print government tax documents. Find the document you require in our library of legal templates.

Download Instructions for IRS Form 1098F Fines, Penalties, and Other

Complete, edit or print tax forms instantly. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Contract reimb./refund this is important. Irs requires that all income and deductible expenses are reported by businesses and individuals or.

2017 Form IRS 1098 Fill Online, Printable, Fillable, Blank pdfFiller

Open the document in our online. This document contains proposed regulations that provide guidance on section 162 (f) of the internal revenue code (code), as amended by. Ad complete irs tax forms online or print government tax documents. Ad upload, modify or create forms. Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers.

1098 Software Printing Electronic Reporting EFile TIN Matching

Complete, edit or print tax forms instantly. Ad complete irs tax forms online or print government tax documents. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Contract reimb./refund this is important. Try it for free.

Form 1FP1098 Download Fillable PDF or Fill Online Order/Notice to

Open the document in our online. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in. Ad complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly. Contract reimb./refund this is important.

Use Form 1098, Mortgage Interest Statement, To Report Mortgage Interest (Including Points, Defined Later) Of $600 Or More You Received During The Year In.

Ad upload, modify or create forms. This document contains proposed regulations that provide guidance on section 162 (f) of the internal revenue code (code), as amended by. Try it for free now! Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction.

Find The Document You Require In Our Library Of Legal Templates.

Complete, edit or print tax forms instantly. Open the document in our online. Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to report the amount of interest and related expenses paid. Contract reimb./refund this is important.

Ad Complete Irs Tax Forms Online Or Print Government Tax Documents.

Insurers file this form for each individual to whom they. Complete, edit or print tax forms instantly. Irs requires that all income and deductible expenses are reported by businesses and individuals or penalties.