1099 Employee Form Printable

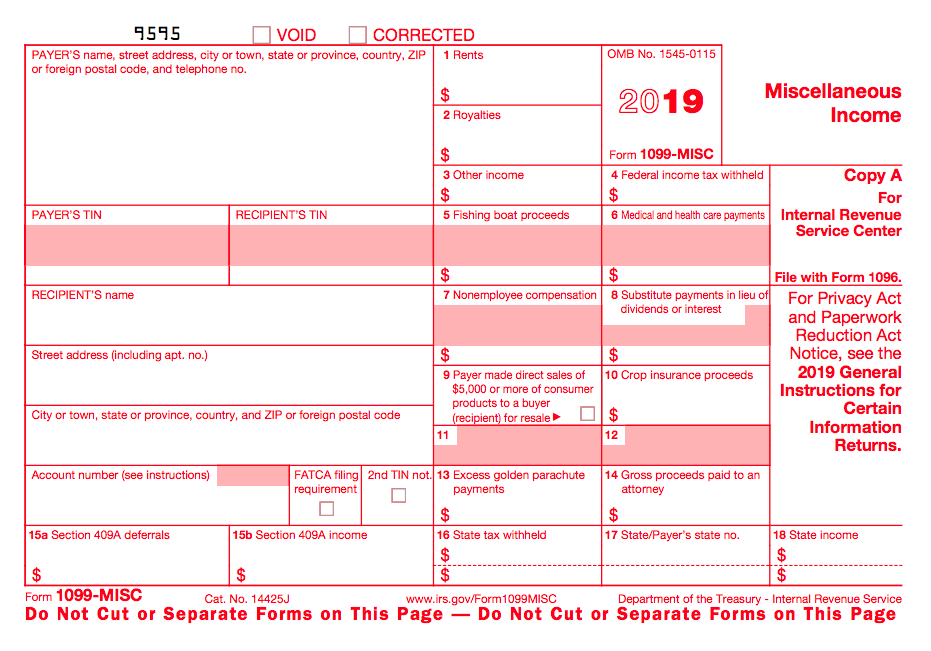

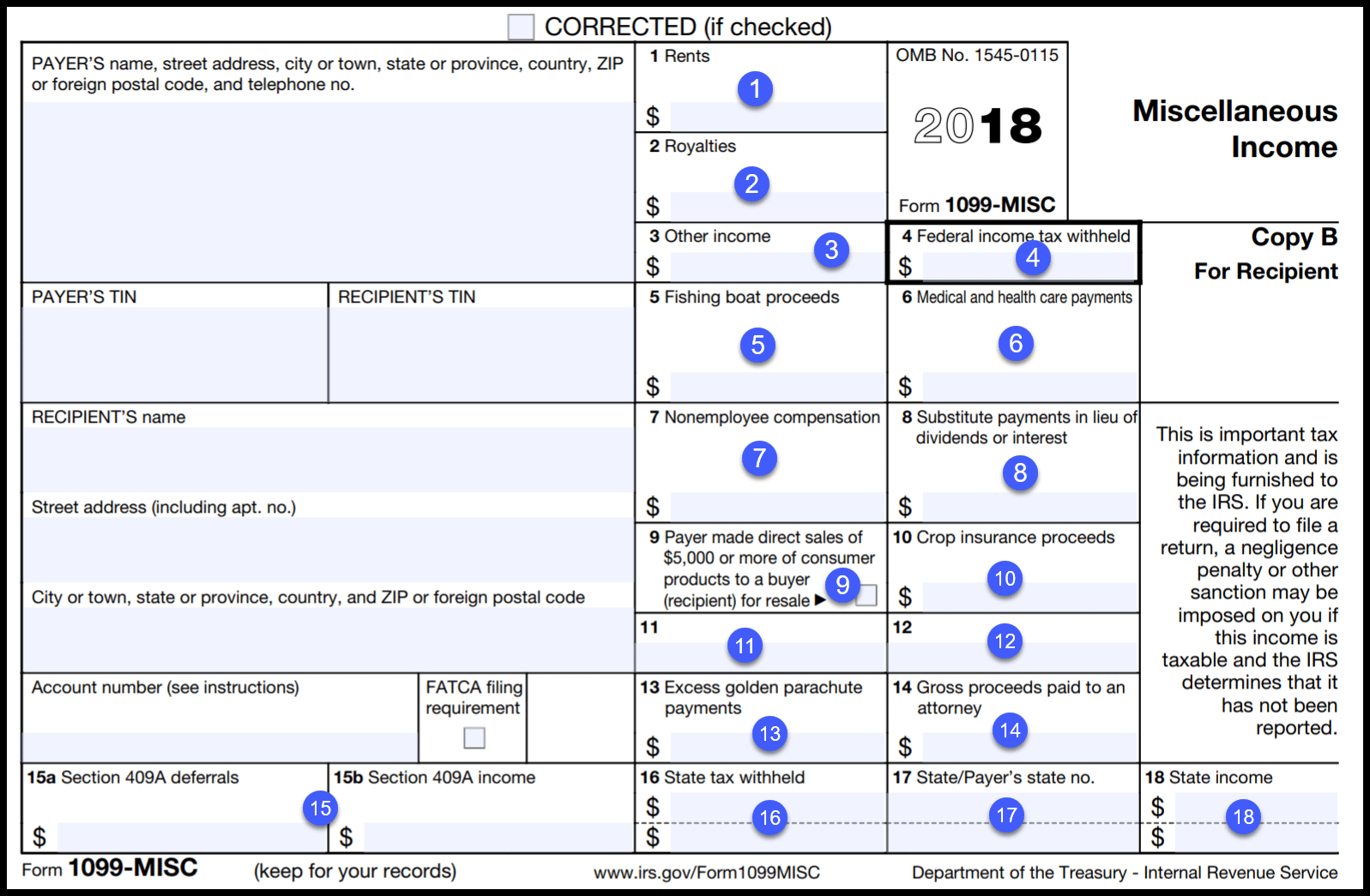

1099 Employee Form Printable - Although these forms are called information returns, they serve different functions. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Report wages, tips, and other compensation paid to an employee. Sandra akins expert review onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Web a 1099 employee doesn’t receive benefits or have taxes deducted from their paycheck. Click “print 1099” or “print 1096” if you only want that form. Select each contractor you want to print 1099s for. Web use the form to calculate your gross income on schedule c. Simple instructions and pdf download updated:

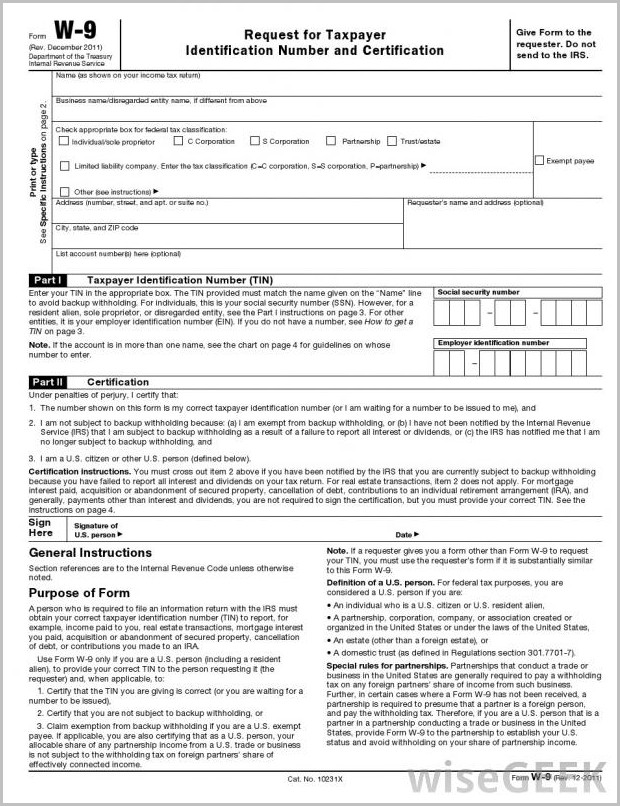

Verify your printer settings, and click “print”. Web use the form to calculate your gross income on schedule c. Although these forms are called information returns, they serve different functions. Sandra akins expert review onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. Both the forms and instructions will be updated as needed. 12.4% goes to social security. It’s the contractor’s responsibility to report their income and pay their taxes. Web a 1099 employee doesn’t receive benefits or have taxes deducted from their paycheck. Select each contractor you want to print 1099s for. Web instructions for recipient recipient’s taxpayer identification number (tin).

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Select each contractor you want to print 1099s for. Verify your printer settings, and click “print”. Click “print 1099” or “print 1096” if you only want that form. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Report wages, tips, and other compensation paid to an employee. Although these forms are called information returns, they serve different functions. For internal revenue service center. Current general instructions for certain information returns. Simple instructions and pdf download updated:

1099 Archives Deb Evans Tax Company

Web use the form to calculate your gross income on schedule c. Select each contractor you want to print 1099s for. Make sure you’ve got the right paper in your printer. Although these forms are called information returns, they serve different functions. It’s the contractor’s responsibility to report their income and pay their taxes.

Free Printable 1099 Misc Forms Free Printable

Web a 1099 employee doesn’t receive benefits or have taxes deducted from their paycheck. For internal revenue service center. Although these forms are called information returns, they serve different functions. Current general instructions for certain information returns. 12.4% goes to social security.

1099 forms free download DriverLayer Search Engine

Click “print 1099” or “print 1096” if you only want that form. Select each contractor you want to print 1099s for. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). For internal revenue service center. Make.

Where To Get Official 1099 Misc Forms Universal Network

Report wages, tips, and other compensation paid to an employee. Current general instructions for certain information returns. 12.4% goes to social security. Simple instructions and pdf download updated: For internal revenue service center.

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

For internal revenue service center. Current general instructions for certain information returns. 12.4% goes to social security. Report wages, tips, and other compensation paid to an employee. Web use the form to calculate your gross income on schedule c.

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

Sandra akins expert review onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. Make sure you’ve got the right paper in your printer. Web use the form to calculate your gross income on schedule c. For your protection, this form may show only the last four digits of your.

Printable 1099 Form For Employees Form Resume Examples

It’s the contractor’s responsibility to report their income and pay their taxes. Click “print 1099” or “print 1096” if you only want that form. Simple instructions and pdf download updated: Report wages, tips, and other compensation paid to an employee. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer.

What Is a 1099 Form, and How Do I Fill It Out? Bench Accounting

Although these forms are called information returns, they serve different functions. Web a 1099 employee doesn’t receive benefits or have taxes deducted from their paycheck. Report the employee's income and social security taxes withheld and other information. Web instructions for recipient recipient’s taxpayer identification number (tin). Verify your printer settings, and click “print”.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

12.4% goes to social security. Web use the form to calculate your gross income on schedule c. Verify your printer settings, and click “print”. Select each contractor you want to print 1099s for. Current general instructions for certain information returns.

Free Printable 1099 Form 2018 Free Printable

Report the employee's income and social security taxes withheld and other information. Make sure you’ve got the right paper in your printer. Verify your printer settings, and click “print”. Simple instructions and pdf download updated: Current general instructions for certain information returns.

Make Sure You’ve Got The Right Paper In Your Printer.

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Sandra akins expert review onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. Select each contractor you want to print 1099s for. Current general instructions for certain information returns.

Report The Employee's Income And Social Security Taxes Withheld And Other Information.

Web a 1099 employee doesn’t receive benefits or have taxes deducted from their paycheck. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Web use the form to calculate your gross income on schedule c. Report wages, tips, and other compensation paid to an employee.

For Internal Revenue Service Center.

Click “print 1099” or “print 1096” if you only want that form. Web instructions for recipient recipient’s taxpayer identification number (tin). Simple instructions and pdf download updated: Verify your printer settings, and click “print”.

12.4% Goes To Social Security.

Although these forms are called information returns, they serve different functions. It’s the contractor’s responsibility to report their income and pay their taxes. Both the forms and instructions will be updated as needed.