1120S Amended Form

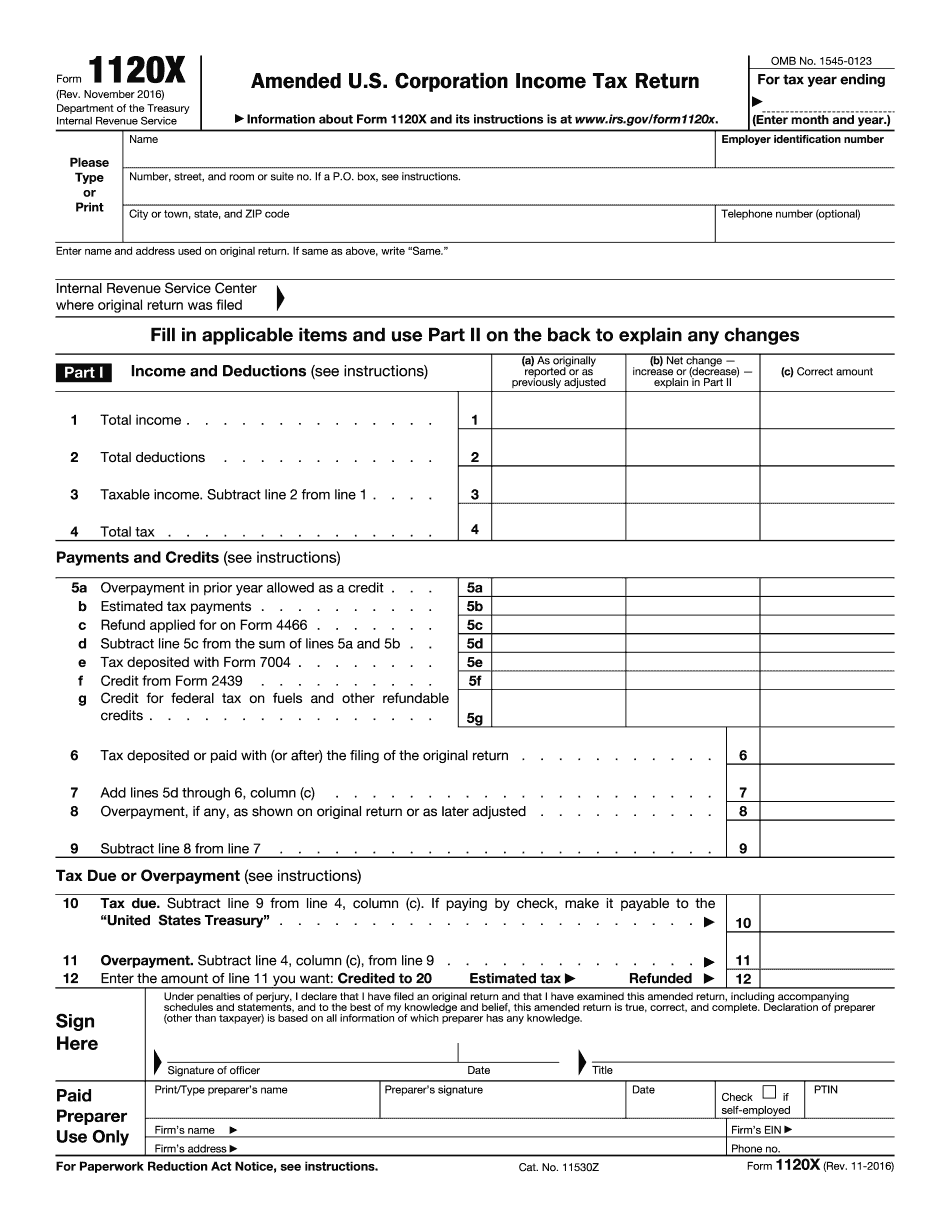

1120S Amended Form - Go through and make the changes. Web create a copy of the return. Amending a return is a four step process. Web follow these steps to amend an 1120s return. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. Corporation income tax return, allows businesses to correct mistakes made on their already filed form 1120. Make the necessary changes to the return. To access this checkbox through the. Web form 1120x, amended u.s. Easy guidance & tools for c corporation tax returns.

Make the necessary changes to the return. Go to screen 3.1, misc./other info./amended. Open the originally filed return. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. Easy guidance & tools for c corporation tax returns. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. Get ready for tax season deadlines by completing any required tax forms today. Create a second version of the return. Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1.

Amending a return is a four step process. To access this checkbox through the. Web create a copy of the return. Go to screen 3.1, misc./other info./amended. Web thomson reuters tax & accounting. Scroll to the amended return (form 1120s). Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1. While in the original return, click file > save a s. Web follow these steps to amend an 1120s return. Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick.

3.11.217 Form 1120S Corporation Tax Returns Internal Revenue

For steps to amend the return. Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. Web follow these steps to amend an 1120s return. Corporation income tax return, allows businesses to correct mistakes made on their already filed form 1120. Web.

3.11.16 Corporate Tax Returns Internal Revenue Service

Notes you should create a copy of the return before you enter amended. Corporation income tax return, allows businesses to correct mistakes made on their already filed form 1120. Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1. Scroll to the amended return (form 1120s). Amending a.

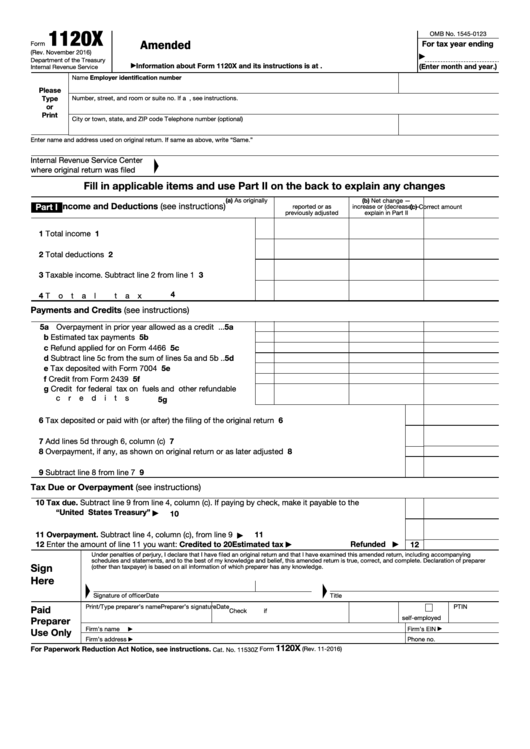

Fillable Form 1120X Amended U.s. Corporation Tax Return

Web the following video shows how to amend a business return. Scroll to the amended return (form 1120s). Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. While in the original return, click file > save a s. Complete, edit or.

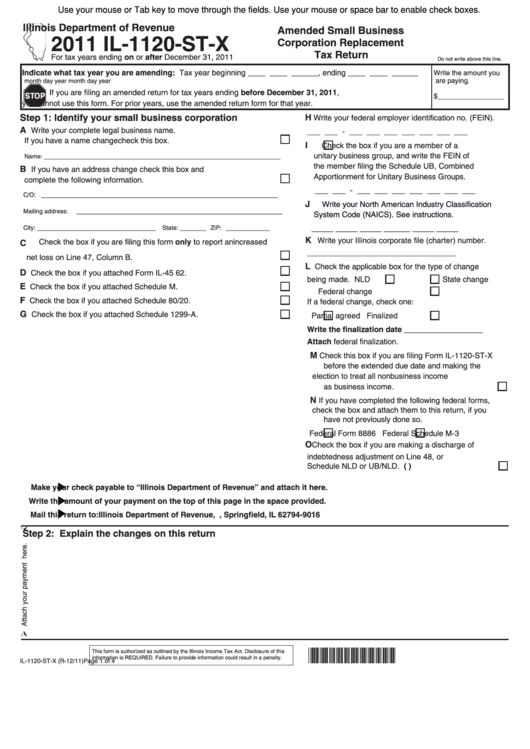

Fillable Form Il1120StX Amended Small Business Corporation

This checkbox can be accessed. Make the necessary changes to the return. Web create a copy of the return. Create a second version of the return. Web correct a form 1120 as originally filed, or as later adjusted by an amended return, a claim for refund, or an examination, or make certain elections after the prescribed deadline.

3.11.217 Form 1120S Corporation Tax Returns Internal Revenue

Web correct a form 1120 as originally filed, or as later adjusted by an amended return, a claim for refund, or an examination, or make certain elections after the prescribed deadline. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. Complete, edit or print.

Form 1120X Amended U.S. Corporation Tax Return (2012) Free

Web the following video shows how to amend a business return. Scroll to the amended return (form 1120s). Make the necessary changes to the return. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Corporation income tax return, allows businesses to correct mistakes made on their already filed form 1120.

amended return explanation of changes examples 1120s Fill Online

While in the original return, click file > save a s. Web create a copy of the return. This checkbox can be accessed. Web form 1120x, amended u.s. Create a second version of the return.

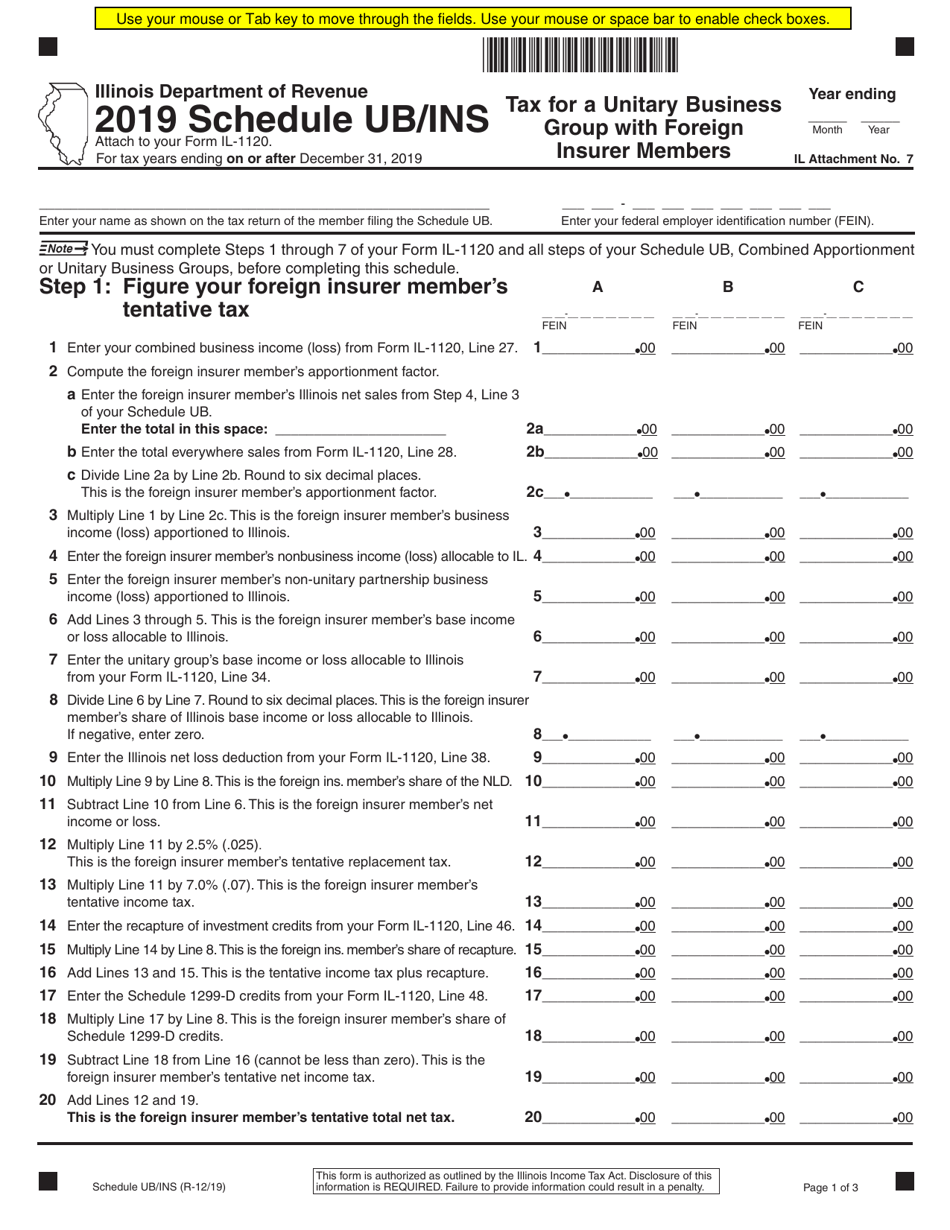

Form IL1120 Schedule UB/INS Download Fillable PDF or Fill Online Tax

Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. For steps to amend the return. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. Corporation.

Form 1120X Amended U.S. Corporation Tax Return (2012) Free

Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1. Easy guidance & tools for c corporation tax returns. For steps to amend the return. To access this checkbox through the. Web thomson reuters tax & accounting.

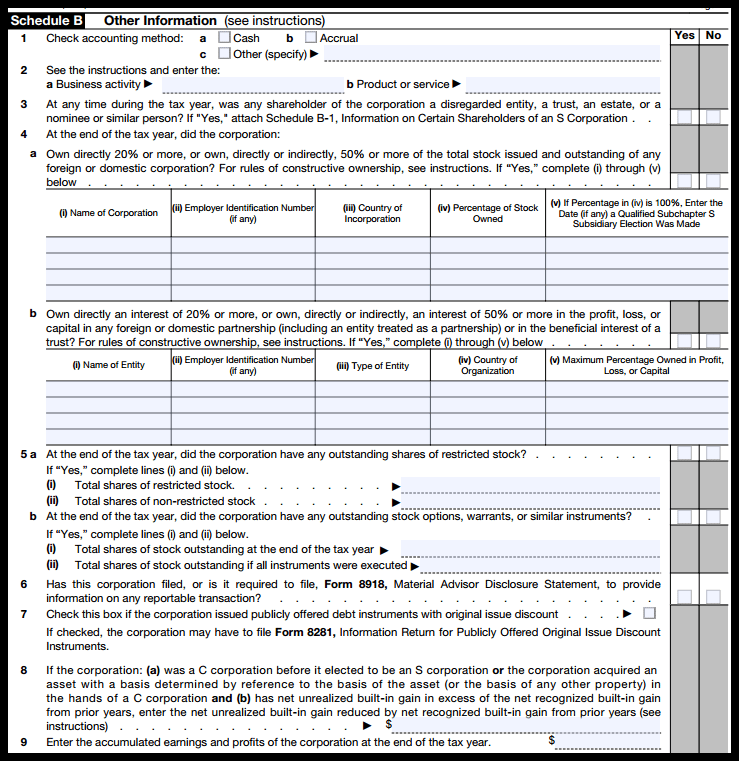

How to Complete Form 1120S Tax Return for an S Corp

Every s corporation must file form. Web create a copy of the return. While in the original return, click file > save a s. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. Amending a return is a four step process.

Web Under The Families First Coronavirus Response Act (Ffcra), As Amended, An Eligible Employer Can Take A Credit Against Payroll Taxes Owed For Amounts Paid For Qualified Sick.

Complete, edit or print tax forms instantly. Web correct a form 1120 as originally filed, or as later adjusted by an amended return, a claim for refund, or an examination, or make certain elections after the prescribed deadline. Create a second version of the return. Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1.

Web An Amended 1120S Is Not Filed Using Form 1120X, But Is Done Through Superseding (Or Supplanting) The Original 1120S Return With The Revised Version.

Easy guidance & tools for c corporation tax returns. Make the necessary changes to the return. Go to screen 3.1, misc./other info./amended. This checkbox can be accessed.

To Access This Checkbox Through The.

Web amended and superseding corporate returns. Every s corporation must file form. Amending a return is a four step process. Web follow these steps to amend an 1120s return.

Corporation Income Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

Scroll to the amended return (form 1120s). For steps to amend the return. Get ready for tax season deadlines by completing any required tax forms today. Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1.