1120S Extension Form

1120S Extension Form - If you are an individual, the deadline is the 15th day of the third month after the tax year ends. Web file request for extension by the due date of the return. Web application for automatic extension of time to file corporation, partnership, and exempt organization returns | arizona department of revenue. Select business income tax payment to get started. The irs has extended the due date of form 1120s by six months. And the total assets at the end of the tax year are: Part i automatic extension for certain business income tax, information, and other returns. Alternatively, businesses can file on the next business day. See instructions before completing this form. This equates to 0.5% of your tax liability, and this fee accrues each month until the taxes are fully paid.

If you are an individual, the deadline is the 15th day of the third month after the tax year ends. Web what is the extended due date for the 1120s form? This form is used to report the gains, deductions, income, and losses of the business during the current tax year. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Part i automatic extension for certain business income tax, information, and other returns. Your payment on mydorway automatically extends your time to file. Enter the form code for the return listed below that this application is for. Web file request for extension by the due date of the return. The irs has extended the due date of form 1120s by six months. Corporations have to file their returns by that date.

Web in the event that you file your federal taxes late, the irs is authorized to impose a late payment penalty. Web file request for extension by the due date of the return. Select business income tax payment to get started. Part i automatic extension for certain business income tax, information, and other returns. Form 7004 is used to request an automatic extension to file the certain returns. This form is used to report the gains, deductions, income, and losses of the business during the current tax year. Alternatively, businesses can file on the next business day. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york,. Web what is the extended due date for the 1120s form? And the total assets at the end of the tax year are:

How to File an Extension for Your SubChapter S Corporation

If you are an individual, the deadline is the 15th day of the third month after the tax year ends. Web file request for extension by the due date of the return. Enter the form code for the return listed below that this application is for. Your payment on mydorway automatically extends your time to file. Connecticut, delaware, district of.

Learn How to Fill the Form 1120 U.S. Corporation Tax Return

Web application for automatic extension of time to file corporation, partnership, and exempt organization returns | arizona department of revenue. This equates to 0.5% of your tax liability, and this fee accrues each month until the taxes are fully paid. Enter the form code for the return listed below that this application is for. Part i automatic extension for certain.

U.S. TREAS Form treasirs1120sschedulek11995

Web in the event that you file your federal taxes late, the irs is authorized to impose a late payment penalty. Form 7004 is used to request an automatic extension to file the certain returns. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related.

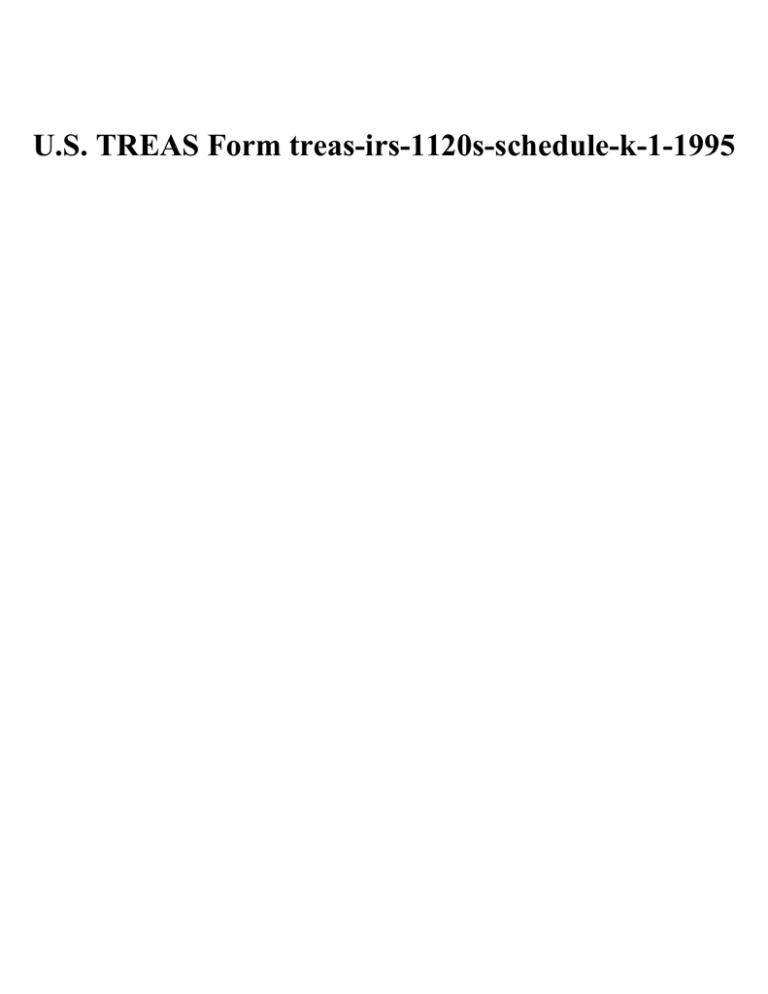

Fillable Form Mo1120s S Corporation Tax Return 2014

Select business income tax payment to get started. Form 7004 is used to request an automatic extension to file the certain returns. Part i automatic extension for certain business income tax, information, and other returns. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york,. Your payment on mydorway automatically extends.

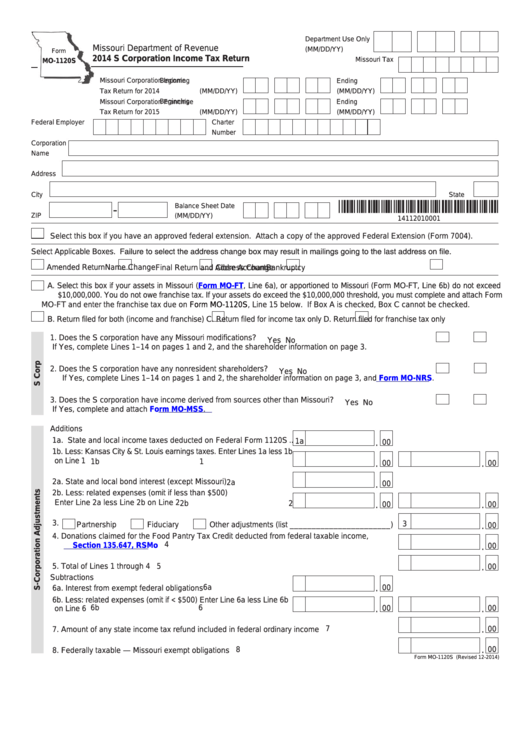

Fillable Form Il1120V Payment Voucher For Corporation And

Use the following irs center address: Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york,. This form is used to report the gains, deductions, income, and losses of the business during the current tax year. If you are an individual, the deadline is the 15th day of the third month.

IRS Borang 1120S Definisi, Muat Turun, & Arahan 1120S Perakaunan 2020

5/3/22) dor.sc.gov 3096 request a filing extension using our free tax portal, mydorway, at dor.sc.gov/pay. This equates to 0.5% of your tax liability, and this fee accrues each month until the taxes are fully paid. The penalty, although seemingly minimal, can accumulate quickly, significantly increasing your overall tax liability. Web file request for extension by the due date of the.

How to Complete Form 1120S Tax Return for an S Corp

Web in the event that you file your federal taxes late, the irs is authorized to impose a late payment penalty. Web file request for extension by the due date of the return. Web what is the extended due date for the 1120s form? This form is used to report the gains, deductions, income, and losses of the business during.

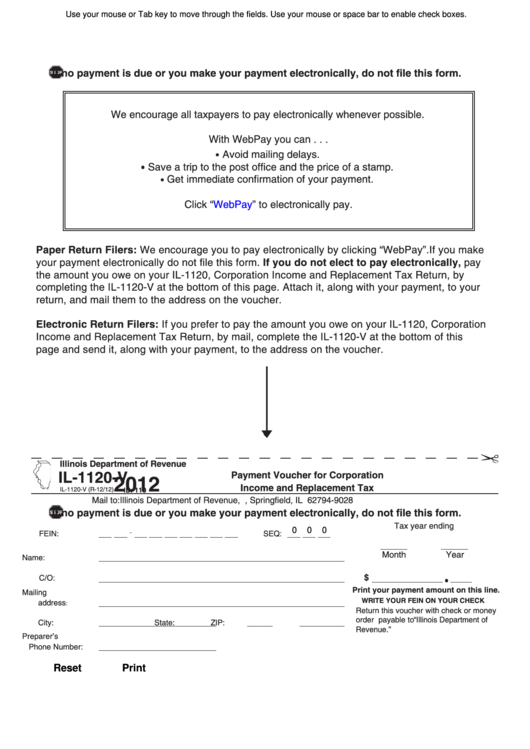

IRS 1120S Schedule K1 2020 Fill out Tax Template Online US Legal

Corporations have to file their returns by that date. Web in the event that you file your federal taxes late, the irs is authorized to impose a late payment penalty. The irs has extended the due date of form 1120s by six months. See instructions before completing this form. Enter the form code for the return listed below that this.

Form Mo1120S 2015 SCorporation Tax Return Edit, Fill, Sign

Alternatively, businesses can file on the next business day. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Enter the form code for the return listed below that this application is for. See instructions before completing this.

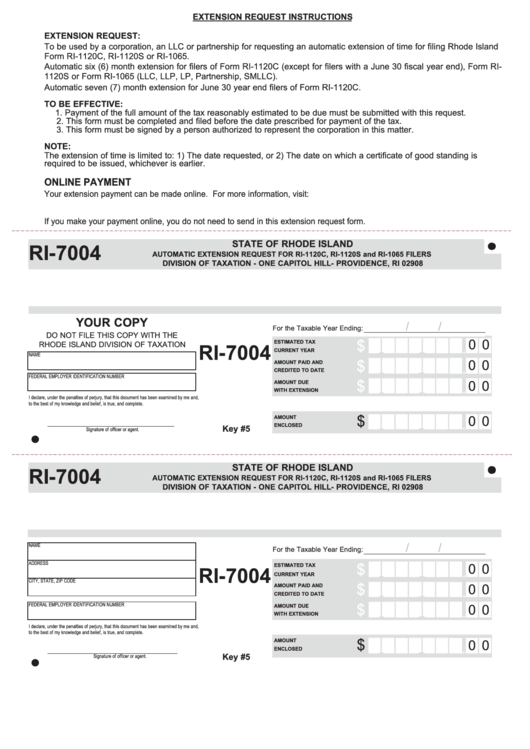

Fillable Form Ri7004 Automatic Extension Request For Ri1120c, Ri

Use the following irs center address: Part i automatic extension for certain business income tax, information, and other returns. This equates to 0.5% of your tax liability, and this fee accrues each month until the taxes are fully paid. Corporations have to file their returns by that date. Your payment on mydorway automatically extends your time to file.

Connecticut, Delaware, District Of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York,.

See instructions before completing this form. Web application for automatic extension of time to file corporation, partnership, and exempt organization returns | arizona department of revenue. The penalty, although seemingly minimal, can accumulate quickly, significantly increasing your overall tax liability. 5/3/22) dor.sc.gov 3096 request a filing extension using our free tax portal, mydorway, at dor.sc.gov/pay.

Corporations Have To File Their Returns By That Date.

This equates to 0.5% of your tax liability, and this fee accrues each month until the taxes are fully paid. Use the following irs center address: Web file request for extension by the due date of the return. Your payment on mydorway automatically extends your time to file.

Select Business Income Tax Payment To Get Started.

And the total assets at the end of the tax year are: Web in the event that you file your federal taxes late, the irs is authorized to impose a late payment penalty. The irs has extended the due date of form 1120s by six months. If you are an individual, the deadline is the 15th day of the third month after the tax year ends.

Alternatively, Businesses Can File On The Next Business Day.

Form 7004 is used to request an automatic extension to file the certain returns. Web what is the extended due date for the 1120s form? Part i automatic extension for certain business income tax, information, and other returns. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file.