147 C Request For Ein Form

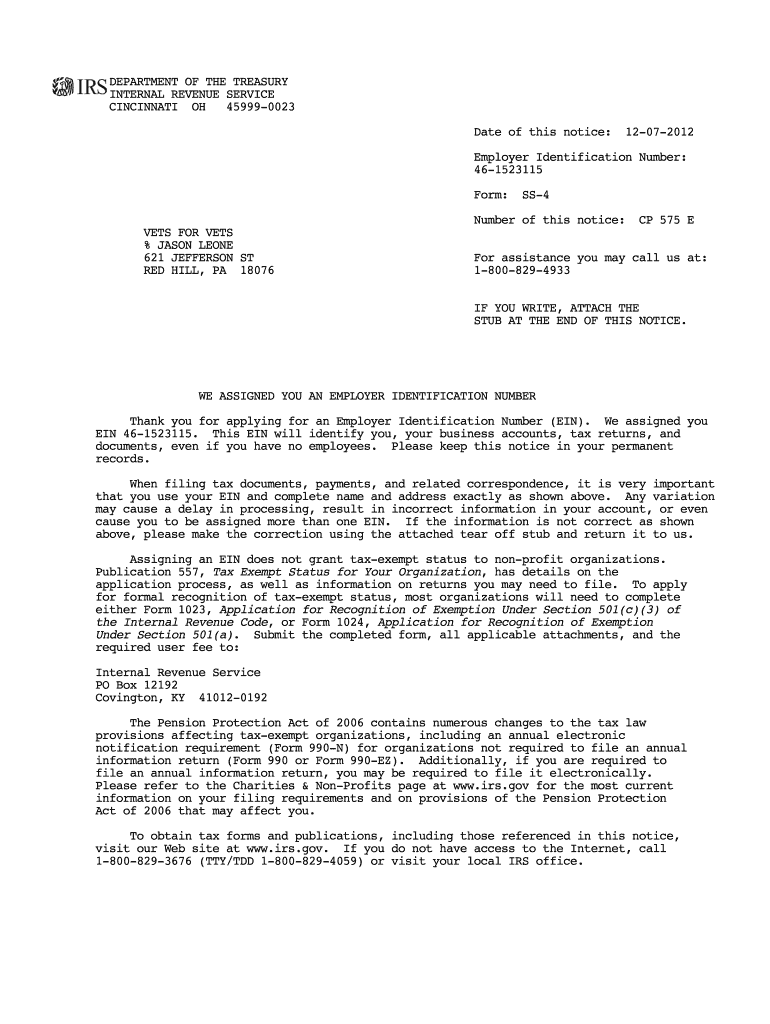

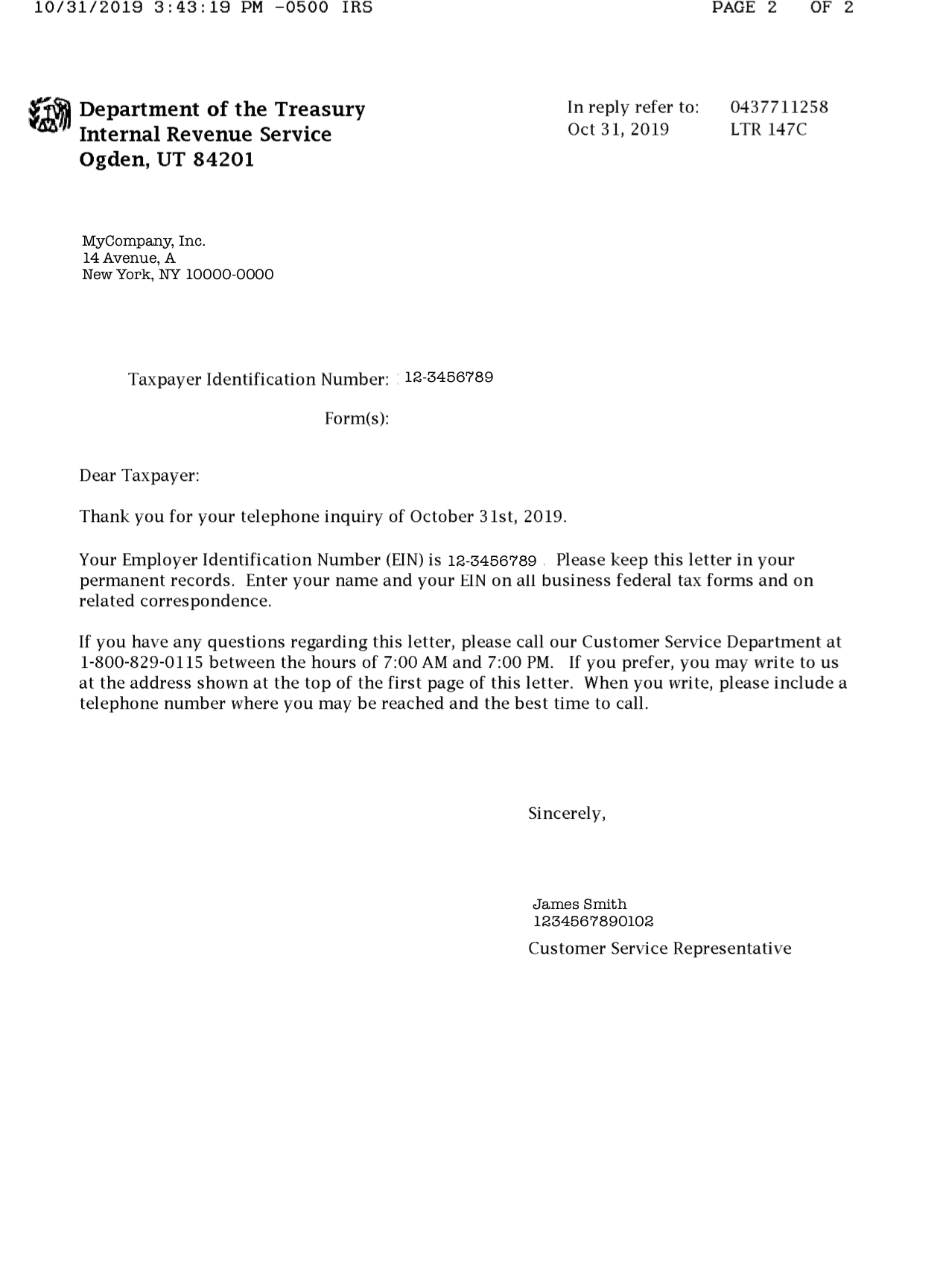

147 C Request For Ein Form - Web a 147c letter, ein verification letter, is a tax document used to request information about an already established employer identification number (ein). If you previously applied for and received an employer. The business can contact the irs directly and request a replacement confirmation letter called a 147c. By globalbanks updated feb 22, 2023 lost your. Web updated jan 16, 2023 in this article, we’ll explain the 147c form irs requires business owners to submit in order to confirm their ein. Web an irs letter 147c, also known as an ein verification letter, is a letter the internal revenue service (irs) sends a company when it has lost or misplaced its employer identification. The 147c letter is used to verify that the business has a valid ein and that the business. Web requesting a lost ein. That said, if you want a free step. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in.

Web there is a solution if you don’t have possession of the ein confirmation letter. Web updated jan 16, 2023 in this article, we’ll explain the 147c form irs requires business owners to submit in order to confirm their ein. Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification number (ein. Taxpayers may need to use. That said, if you want a free step. The 147c letter is used to verify that the business has a valid ein and that the business. Web a 147c letter, ein verification letter, is a tax document used to request information about an already established employer identification number (ein). There are a few options you can undertake if you have misplaced your ein: Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in. Web you can get your ^existing ein _ from the irs by asking them for a ^147c letter.

Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in. Web a 147c letter, ein verification letter, is a tax document used to request information about an already established employer identification number (ein). Web requesting a lost ein. That said, if you want a free step. Web an irs letter 147c, also known as an ein verification letter, is a letter the internal revenue service (irs) sends a company when it has lost or misplaced its employer identification. The business can contact the irs directly and request a replacement confirmation letter called a 147c. Web find out what you need to do if you have lost or misplaced your employer identification number (ein). Web what does letter 147c stand for? The 147c letter is used to verify that the business has a valid ein and that the business. If you previously applied for and received an employer.

Breanna Form 2848 Instructions 2019

That said, if you want a free step. Web what does letter 147c stand for? Business owners should be prepared to. Web find out what you need to do if you have lost or misplaced your employer identification number (ein). You may apply for an ein online if your principal business is located in the united states or u.s.

Ein Confirmation Letter Pdf Fill Online, Printable, Fillable, Blank

Web find out what you need to do if you have lost or misplaced your employer identification number (ein). Web a 147c letter, ein verification letter, is a tax document used to request information about an already established employer identification number (ein). Web an irs letter 147c, also known as an ein verification letter, is a letter the internal revenue.

Cover Letter To Irs Sample Cover Letter

Web if your clergy and/or employees are unable to e‐file their income tax returns because of a problem with your fein ore ein (federal employer identification number), you can. The 147c letter is used to verify that the business has a valid ein and that the business. Web there is a solution if you don’t have possession of the ein.

Getting 147C Online (EIN Designation Confirmation Letter) 911 WeKnow

Web the letter requests information about the business’s ein or employer identification number. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in. Web updated jan 16, 2023 in this article, we’ll explain the 147c form irs requires.

How To Change The Address Of My Ein Number

Web the letter requests information about the business’s ein or employer identification number. Web updated jan 16, 2023 in this article, we’ll explain the 147c form irs requires business owners to submit in order to confirm their ein. The person applying online must have. Web there is a solution if you don’t have possession of the ein confirmation letter. Web.

W 147 Form Fill Online, Printable, Fillable, Blank pdfFiller

The 147c letter is used to verify that the business has a valid ein and that the business. By globalbanks updated feb 22, 2023 lost your. The letter will confirm the employer name and ein connected with the personal security information. Web requesting a lost ein. The person applying online must have.

Ein Verification Letter 147c certify letter

By globalbanks updated feb 22, 2023 lost your. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in. Web an irs letter 147c, also known as an ein verification letter, is a letter the internal revenue service (irs).

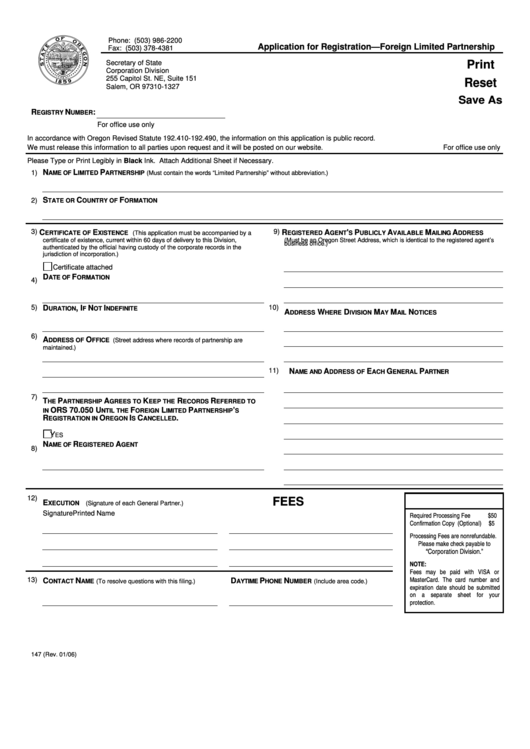

Fillable Form 147 Application For RegistrationForeign Limited

You may apply for an ein online if your principal business is located in the united states or u.s. Business owners should be prepared to. Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification number (ein. Web a 147c letter,.

How Long Does It Take To Get A Ein

Web what does letter 147c stand for? If you previously applied for and received an employer. That said, if you want a free step. The person applying online must have. Web if your clergy and/or employees are unable to e‐file their income tax returns because of a problem with your fein ore ein (federal employer identification number), you can.

gangster disciples litature irs form 147c

If you previously applied for and received an employer. The business can contact the irs directly and request a replacement confirmation letter called a 147c. Web there is a solution if you don’t have possession of the ein confirmation letter. Web find out what you need to do if you have lost or misplaced your employer identification number (ein). Web.

Web You Can Get Your ^Existing Ein _ From The Irs By Asking Them For A ^147C Letter.

Web what does letter 147c stand for? Web the letter requests information about the business’s ein or employer identification number. Web an irs letter 147c, also known as an ein verification letter, is a letter the internal revenue service (irs) sends a company when it has lost or misplaced its employer identification. Business owners should be prepared to.

You May Apply For An Ein Online If Your Principal Business Is Located In The United States Or U.s.

Web a 147c letter, ein verification letter, is a tax document used to request information about an already established employer identification number (ein). If you previously applied for and received an employer. By globalbanks updated feb 22, 2023 lost your. There are a few options you can undertake if you have misplaced your ein:

The Letter Will Confirm The Employer Name And Ein Connected With The Personal Security Information.

The business can contact the irs directly and request a replacement confirmation letter called a 147c. Web find out what you need to do if you have lost or misplaced your employer identification number (ein). The 147c letter is used to verify that the business has a valid ein and that the business. Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification number (ein.

Taxpayers May Need To Use.

Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in. Web updated jan 16, 2023 in this article, we’ll explain the 147c form irs requires business owners to submit in order to confirm their ein. Web requesting a lost ein. That said, if you want a free step.