2019 Form Anchor-H

2019 Form Anchor-H - You can change all preprinted information, with the exception of name and. Web the filing deadline for the 2019 anchor program was february 28, 2023 note: Web , 20 gross income (excluding exempt function income) deductions (directly connected to the production of gross income, excluding exempt function income) tax and payments. The deadline is february 28, 2023. Web we are currently issuing 2019 anchor benefits and will continue to distribute payments through the month of may. Web contact us home all taxes property tax relief programs anchor program check the status of your 2019 anchor benefit check the status of your 2019. Web you are eligible for a 2019 anchor benefit if you met these requirements: Anchor benefits will be paid in the form of a direct deposit. Web anchor benefit online filing. Web • your 2019 new jersey gross income was not more than $150,000.

Web anchor benefit online filing. Web if you filed a 2019 new jersey resident income tax return, but do not have the gross income amount to complete your anchor application, use this form to request a figure. Now you are able to. Web you can apply online at anchor benefit online filing. And your 2019 new jersey gross income was not more than $150,000;. If you still need to file your 2019 nj anchor application, please download. You can change all preprinted information, with the exception of name and. Your main home on october 1, 2019, you are not eligible for an anchor benefit as a tenant;. The anchor program is separate from the senior freeze program. Web the filing deadline for the 2019 anchor program was february 28, 2023 note:

Web this program provides property tax relief to new jersey residents who owned or rented their principal residence (main home) on october 1, 2019, and met the. Web the filing deadline for the 2019 anchor program was february 28, 2023 note: 1119 anchor st, philadelphia, pa is a single family home that contains 1,244 sq ft and was built in 1945. Web if you filed a 2019 new jersey resident income tax return, but do not have the gross income amount to complete your anchor application, use this form to request a figure. Web 2019 instructions for schedule hhousehold employment taxes here is a list of forms that household employers need to complete. When is the anchor application deadline? Now you are able to. Web you are eligible for a 2019 anchor benefit if you met these requirements: Web • your 2019 new jersey gross income was not more than $150,000. The anchor program is separate from the senior freeze program.

District of Columbia D40WH (Withholding Tax Schedule Fill out

The anchor program is separate from the senior freeze program. If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to display this type of document. Web if you filed a 2019 new jersey resident income tax return, but do not have the gross income amount to complete your.

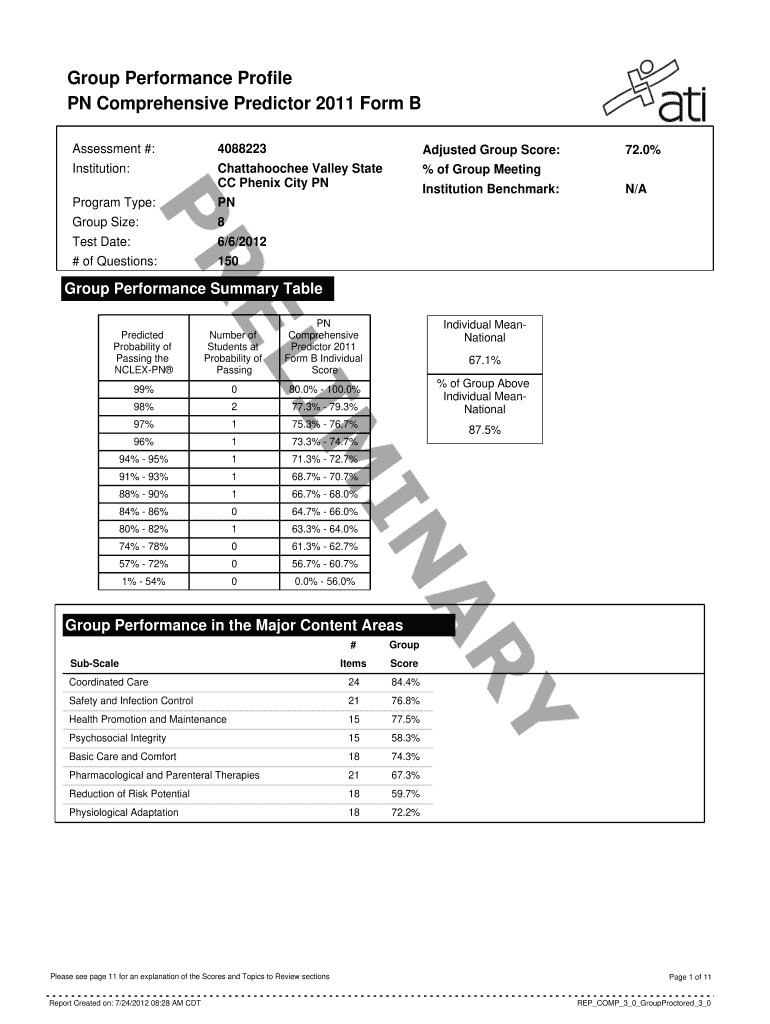

Rn Vati Comprehensive Predictor 2019 Form B 20202021 Fill and Sign

With our loaded practical experience and thoughtful solutions,. Web you can apply online at anchor benefit online filing. Web you are eligible for a 2019 anchor benefit if you met these requirements: You were a new jersey resident; Web • your 2019 new jersey gross income was not more than $150,000.

2019 Form IRS 1099H Fill Online, Printable, Fillable, Blank pdfFiller

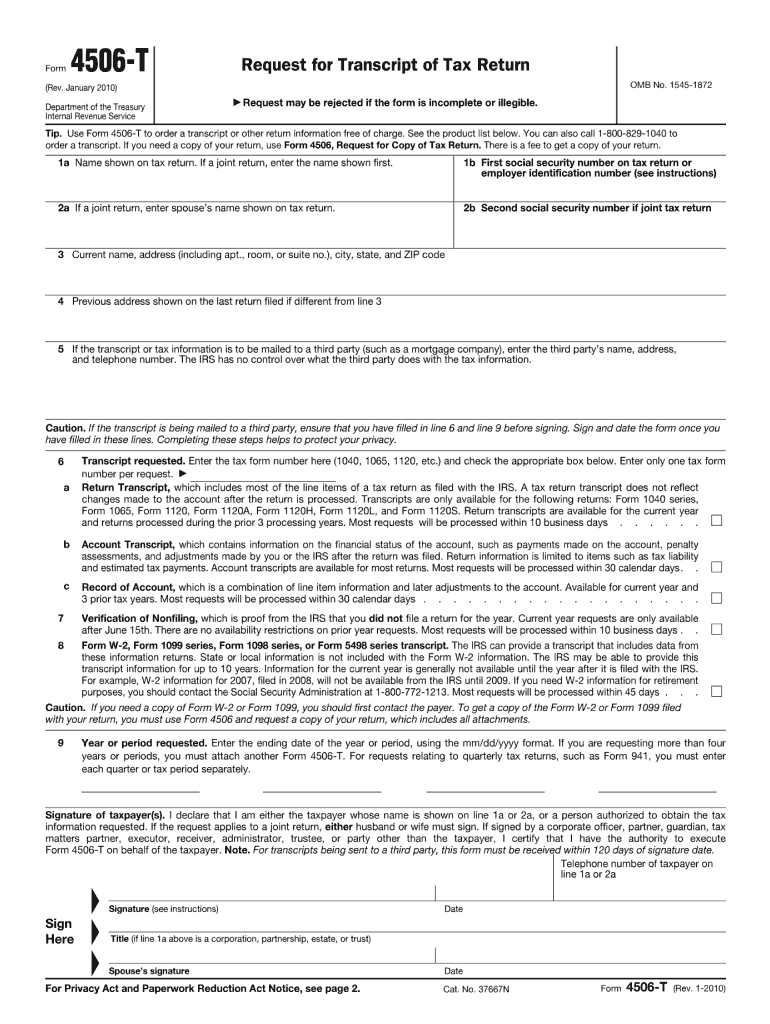

Web if you filed a 2019 new jersey resident income tax return, but do not have the gross income amount to complete your anchor application, use this form to request a figure. The anchor program is separate from the senior freeze program. Web use the instructions below to help you file your anchor application over the telephone or online. The.

Summer 2016 Photos — Anchor Program Fund

Web • your 2019 new jersey gross income was not more than $150,000. Web , 20 gross income (excluding exempt function income) deductions (directly connected to the production of gross income, excluding exempt function income) tax and payments. With our loaded practical experience and thoughtful solutions,. Web you are eligible for a 2019 anchor benefit if you met these requirements:.

9 T Form August 9 9 Doubts About 9 T Form August 9 You Should Clarify

Web you are eligible for a 2019 anchor benefit if you met these requirements: When is the anchor application deadline? Press done after you fill out the form. Web we are currently issuing 2019 anchor benefits and will continue to distribute payments through the month of may. If this message is not eventually replaced by the proper contents of the.

Super Anchor FormIt Anchor

It contains 3 bedrooms and 1. Web you can apply online at anchor benefit online filing. And your 2019 new jersey gross income was not more than $150,000;. You can change all preprinted information, with the exception of name and. When is the anchor application deadline?

W 9 Forms Printable 2019 Form Resume Examples G28B7lG1gE

Web use the instructions below to help you file your anchor application over the telephone or online. 1119 anchor st, philadelphia, pa is a single family home that contains 1,244 sq ft and was built in 1945. You can also submit a paper application. The anchor program is separate from the senior freeze program. Who is eligible for the.

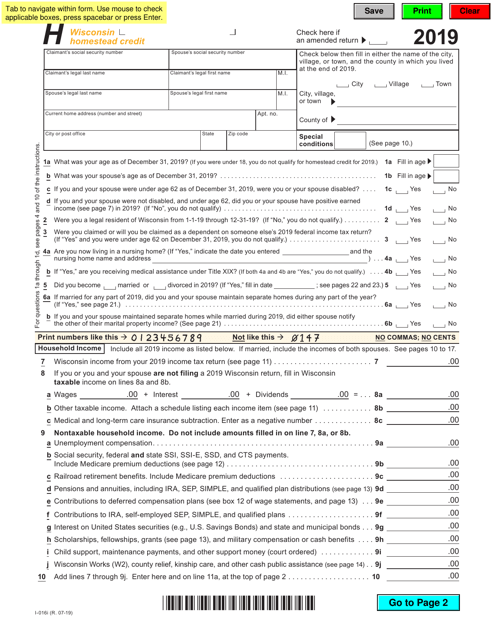

Form I016 Schedule H Download Fillable PDF or Fill Online Wisconsin

Who is eligible for the. Web apply online apply by phone: Web use the instructions below to help you file your anchor application over the telephone or online. Your main home on october 1, 2019, you are not eligible for an anchor benefit as a tenant;. The deadline is february 28, 2023.

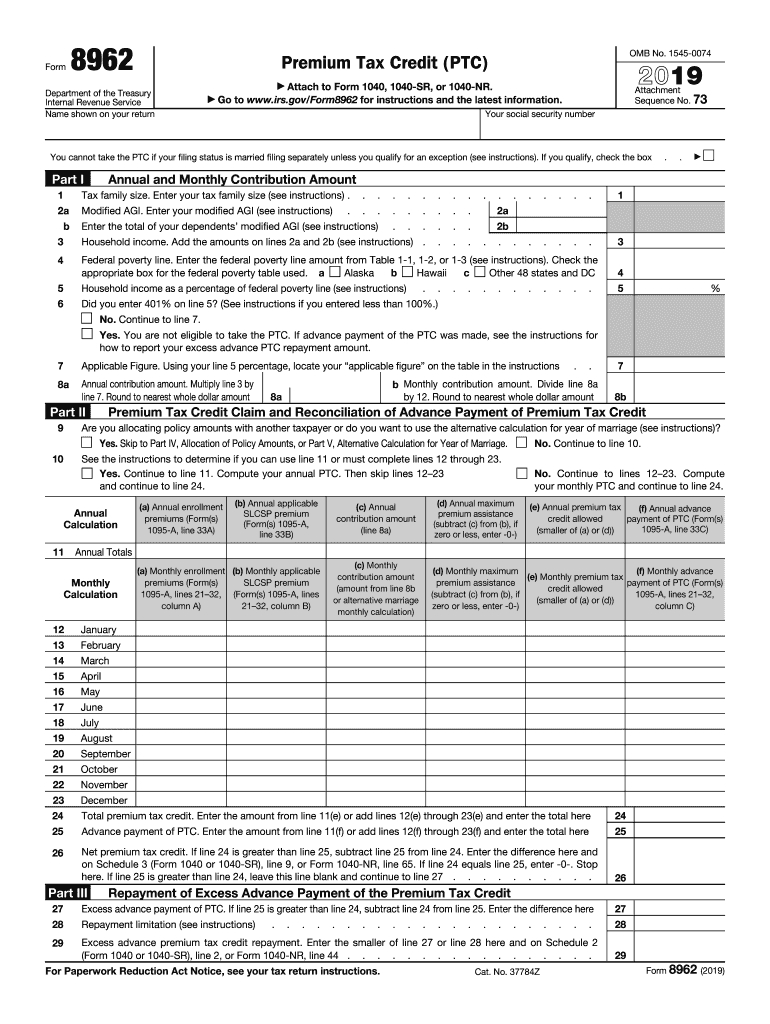

Irs Fillable Form 1040 Fillable IRS Form 1040 (Schedule 8812) 2018

The anchor program is separate from the senior freeze program. Web use the instructions below to help you file your anchor application over the telephone or online. If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to display this type of document. Web you are eligible for a.

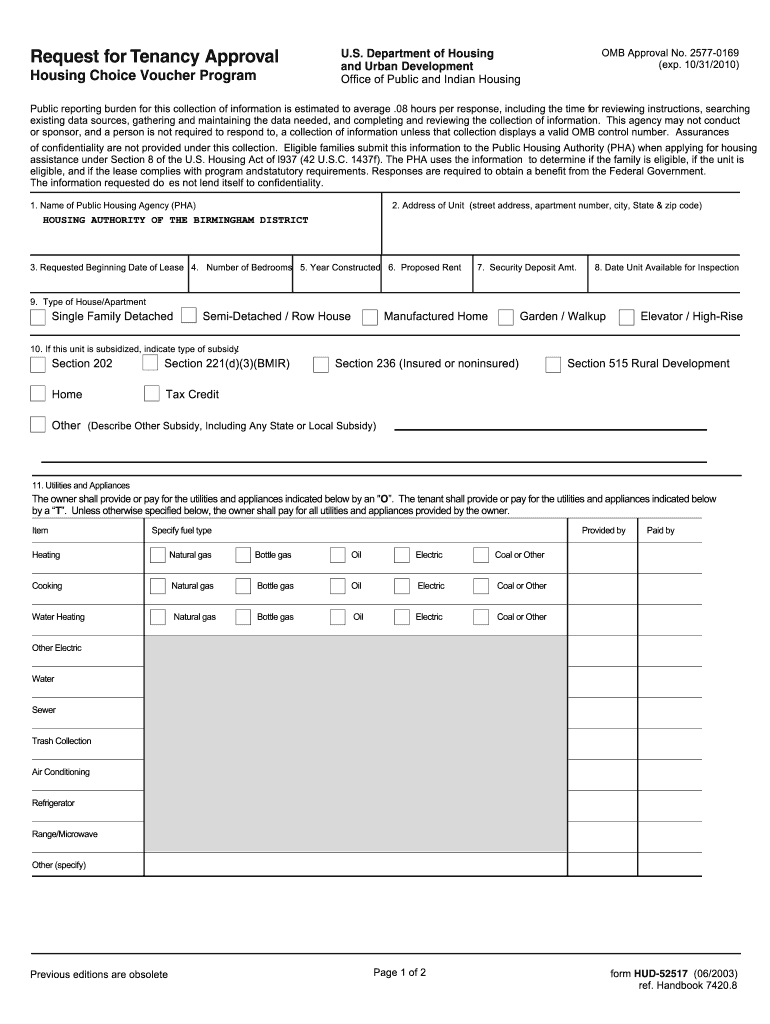

Hud 52517 Fill out & sign online DocHub

Web about h form pole anchor: Web 2019 instructions for schedule hhousehold employment taxes here is a list of forms that household employers need to complete. For masonry work, mechanical expansion. When is the anchor application deadline? Web you are eligible for a 2019 anchor benefit if you met these requirements:

If You Still Need To File Your 2019 Nj Anchor Application, Please Download.

The anchor program is separate from the senior freeze program. Press done after you fill out the form. Web • your 2019 new jersey gross income was not more than $150,000. And your 2019 new jersey gross income was not more than $150,000;.

For Masonry Work, Mechanical Expansion.

Web , 20 gross income (excluding exempt function income) deductions (directly connected to the production of gross income, excluding exempt function income) tax and payments. Web use the instructions below to help you file your anchor application over the telephone or online. Web you are eligible for a 2019 anchor benefit if you met these requirements: The deadline is february 28, 2023.

The Anchor Program Is Separate From The Senior Freeze Program.

Who is eligible for the. Now you are able to. Web anchor benefit online filing. When is the anchor application deadline?

Your Main Home On October 1, 2019, You Are Not Eligible For An Anchor Benefit As A Tenant;.

Web we are currently issuing 2019 anchor benefits and will continue to distribute payments through the month of may. The nj anchor web filing system is now closed. Web 2019 instructions for schedule hhousehold employment taxes here is a list of forms that household employers need to complete. It contains 3 bedrooms and 1.