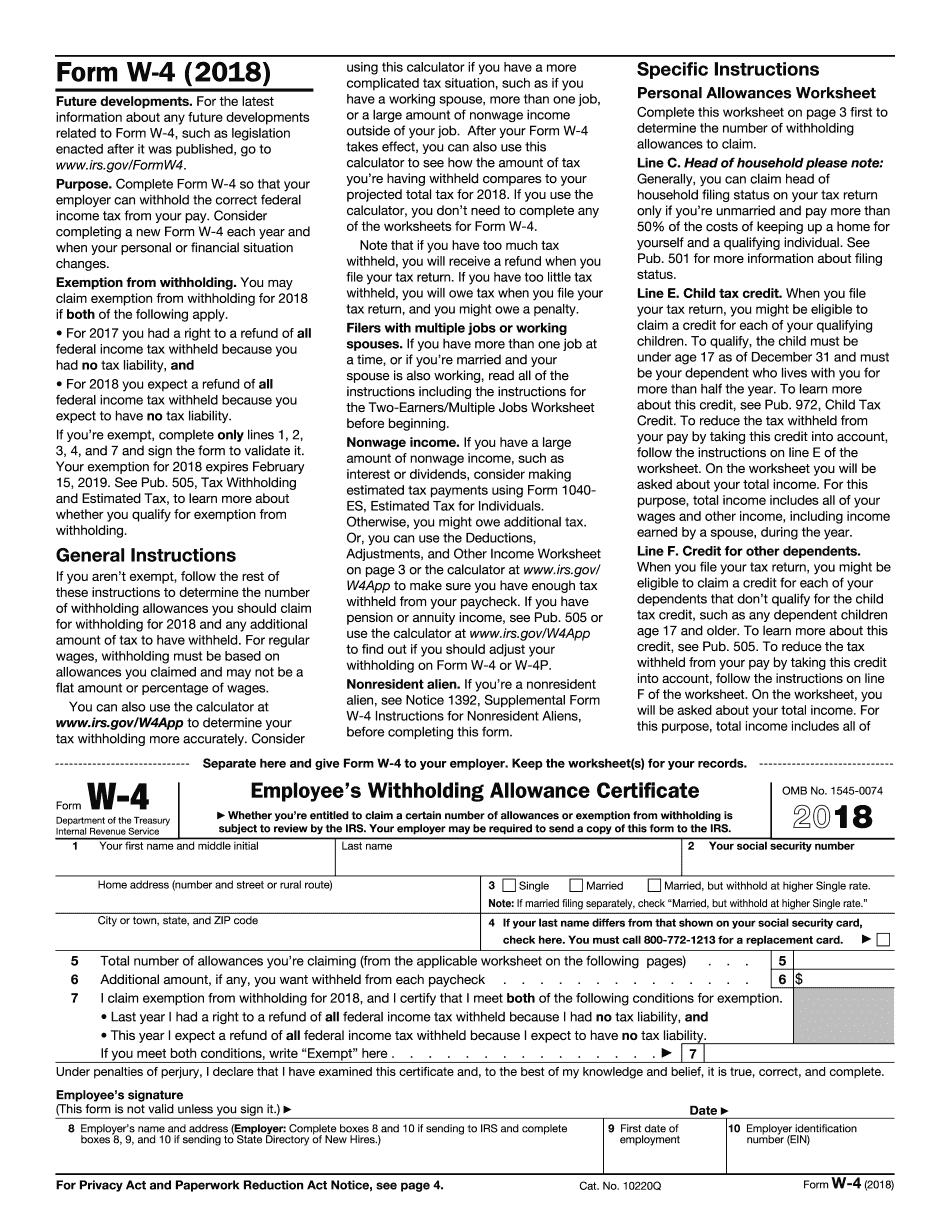

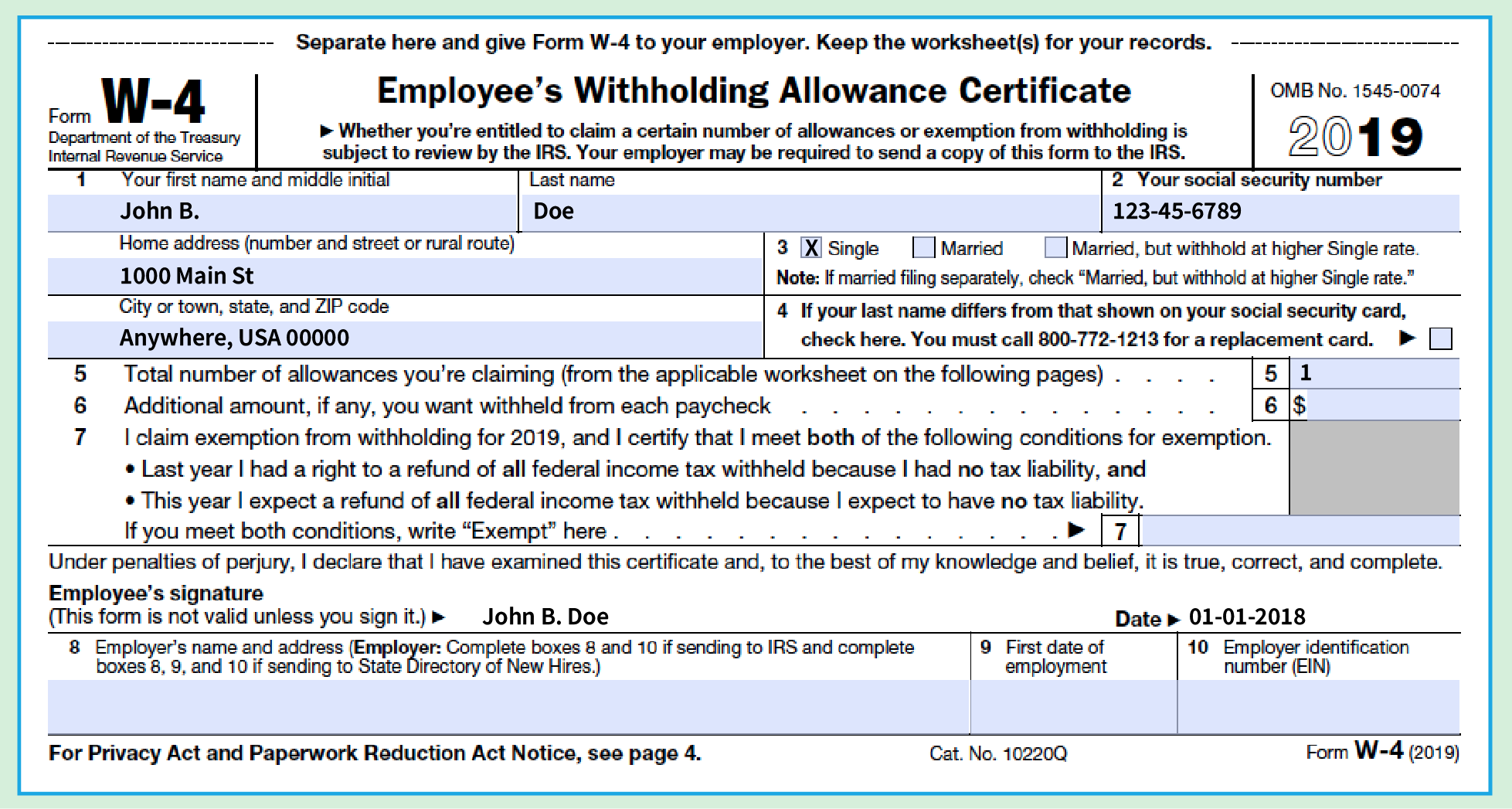

2019 W4 Form

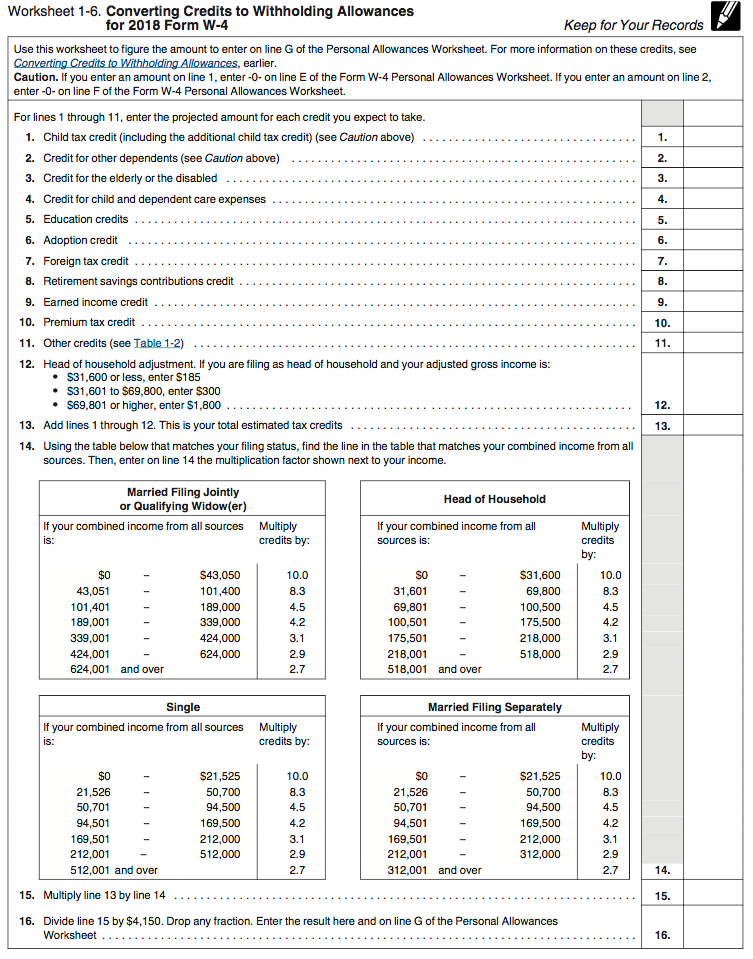

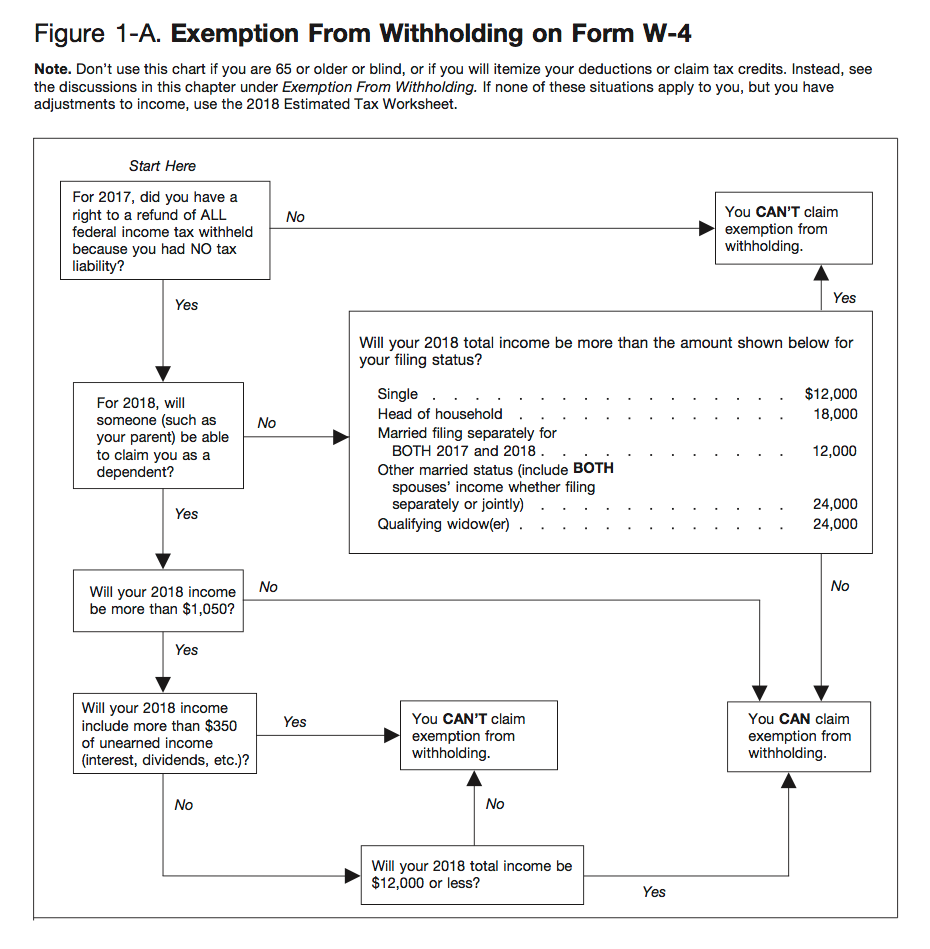

2019 W4 Form - Form w‐4p is for u.s. People often claim 0 to 3 withholding allowances to fill out a. The number of allowances you were claiming. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Any additional amount you wanted to be withheld from your paycheck. If too much is withheld, you

People often claim 0 to 3 withholding allowances to fill out a. If too much is withheld, you Form w‐4p is for u.s. The number of allowances you were claiming. Any additional amount you wanted to be withheld from your paycheck. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s).

Any additional amount you wanted to be withheld from your paycheck. The number of allowances you were claiming. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. People often claim 0 to 3 withholding allowances to fill out a. Form w‐4p is for u.s. If too much is withheld, you Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s).

W4 Forms 2020 Printable Pdf 2022 W4 Form

Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). Form w‐4p is for u.s. The number of allowances you were claiming. People often claim 0 to 3 withholding allowances to fill out a. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other.

2019 W4 Form How To Fill It Out and What You Need to Know

Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). People often claim 0 to 3 withholding allowances to fill out a. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Citizens, resident aliens, or their estates who are recipients.

How to Calculate 2020 Federal Withhold Manually with New 2020 W4

If too much is withheld, you If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Form w‐4p is for u.s. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Any additional amount you wanted to be withheld.

2019 W4 Form How To Fill It Out and What You Need to Know

Form w‐4p is for u.s. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Use form w‐4p to tell payers the correct amount of federal income tax to.

The new W4 More trouble than it’s worth? Accounting Today

If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too much is withheld, you Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities),.

Il W 4 2020 2022 W4 Form

Form w‐4p is for u.s. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). People often claim 0 to 3 withholding allowances to fill out a. Any additional amount you.

2019 W4 Form How To Fill It Out and What You Need to Know

Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. People often claim 0 to 3 withholding allowances to fill out a. Any additional amount you wanted to be withheld from your.

2019 W4 Form How To Fill It Out and What You Need to Know

Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. People often claim 0 to 3 withholding allowances to fill out a. If too much is withheld, you Form w‐4p is.

IRS W4(SP) 2019 Fill and Sign Printable Template Online US Legal Forms

Form w‐4p is for u.s. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. People often claim 0 to 3 withholding allowances to fill out a. Any additional amount you wanted to be withheld from your paycheck. Use form w‐4p to tell payers the correct amount of federal.

2019 Form W4 Federal Tax Form Rea CPA

Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). Any additional amount you wanted to be withheld from your paycheck. People often claim 0 to 3 withholding allowances to fill out a. If too little is withheld, you will generally owe tax when you file your tax return and may owe.

The Number Of Allowances You Were Claiming.

If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. People often claim 0 to 3 withholding allowances to fill out a. Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). If too much is withheld, you

Any Additional Amount You Wanted To Be Withheld From Your Paycheck.

Form w‐4p is for u.s. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation.