2020 Form 5471 Instructions

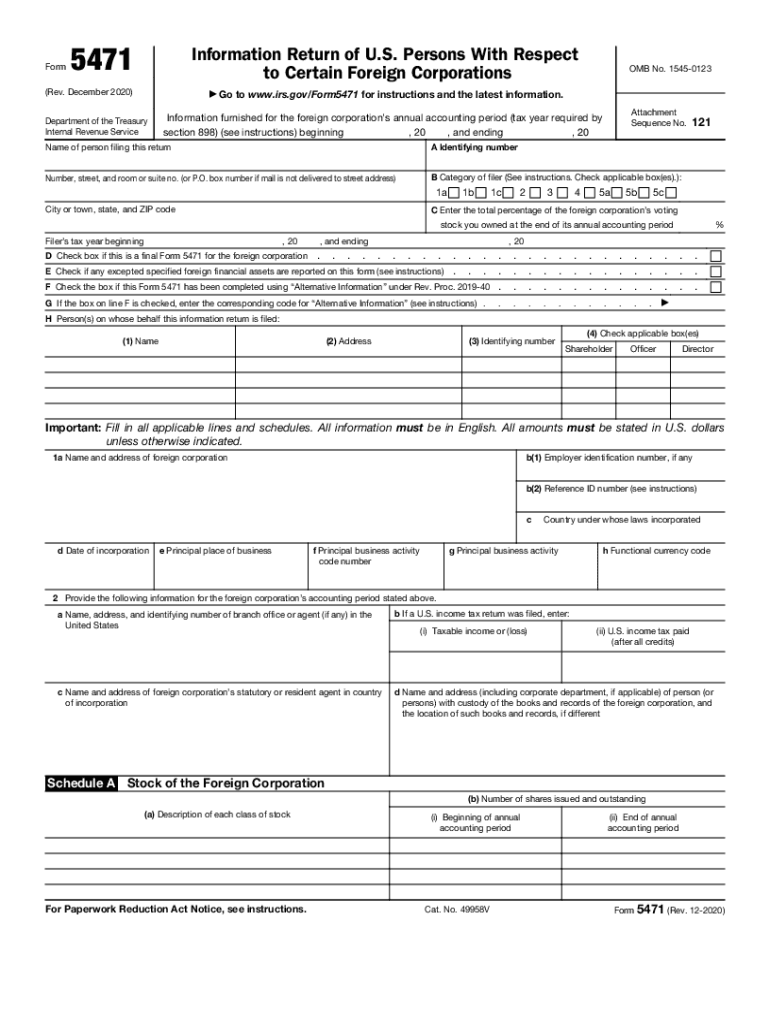

2020 Form 5471 Instructions - Upload, modify or create forms. Shareholder, while a 5c filer is a related constructive u.s. Web 2020 form 5471 instructions on january 28, 2021, the irs published instructions for form 5471, which include significant changes. Persons with respect to certain foreign corporations. Irs form 5471 is an information return of u.s. Web 01 dec 2020 by anthony diosdi introduction schedule p of form 5471 is used to report ptep of the u.s. Web instructions for form 5471, information return of u.s. Web in 2020, the irs proposed new changes to the information return of u.s. Web the instructions to form 5471 describes a category 5a filer as a u.s. Income, war profits, and excess profits taxes paid or accrued.

Web schedule e (form 5471) (rev. Shareholder who doesn't qualify as either a category 5b or 5c filer. Income, war profits, and excess profits taxes paid or accrued. So let's jump right into it. Web 2020 form 5471 instructions on january 28, 2021, the irs published instructions for form 5471, which include significant changes. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b, and 1c. Web instructions for form 5471, information return of u.s. For this portion of the discussion, we're going to be discussing the purpose of form 5471, including the 5 filing categories, and an overview of the schedules that are required to be. Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of u.s. Web in 2020, the irs proposed new changes to the information return of u.s.

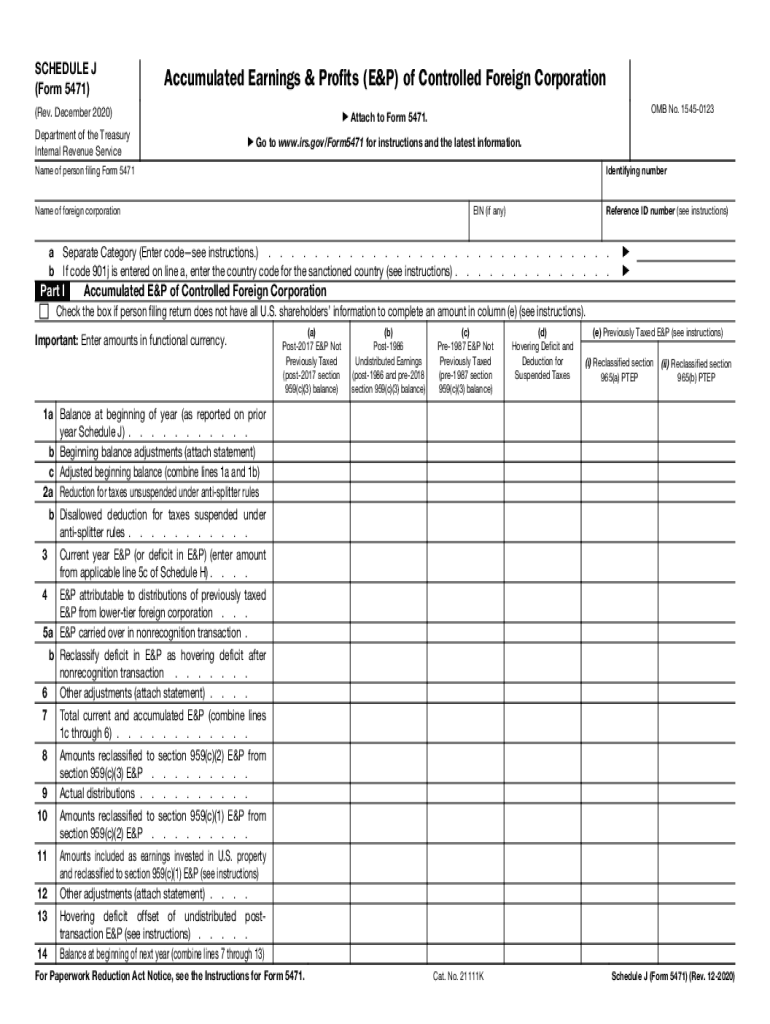

Web form 5471 (2020) form 5471: For instructions and the latest. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Web the most recent instructions to form 5471 were just revised in february 2020, and part i of schedule j has seven new columns, and those in the prior versions were rearranged. Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements. Upload, modify or create forms. For instructions and the latest. Web and today, we're going to give you an overview of the form 5471. The term ptep refers to earnings and profits (“e&p”) of a foreign. For this portion of the discussion, we're going to be discussing the purpose of form 5471, including the 5 filing categories, and an overview of the schedules that are required to be.

Demystifying the All New 2020 Tax Year IRS Form 5471 Schedule P

Persons with respect to certain foreign corporations. Web instructions for form 5471, information return of u.s. It is an annual reporting requirement for some u.s. For this portion of the discussion, we're going to be discussing the purpose of form 5471, including the 5 filing categories, and an overview of the schedules that are required to be. Web information about.

IRS 5471 Schedule J 20202022 Fill out Tax Template Online US

Web schedule e (form 5471) (rev. 5 form 5471 is filed when the tax return due 6 how to file a 5471 extension 7 no 7004 extension required 8 multiple. For instructions and the latest. So, a 5a filer is an unrelated section 958(a) u.s. Web 01 dec 2020 by anthony diosdi introduction schedule p of form 5471 is used.

2012 form 5471 instructions Fill out & sign online DocHub

5 form 5471 is filed when the tax return due 6 how to file a 5471 extension 7 no 7004 extension required 8 multiple. Web complete a separate schedule q with respect to each applicable category of income (see instructions). Persons with respect to certain foreign corporations). Web the instructions to form 5471 describes a category 5a filer as a.

2020 Form IRS 5471 Fill Online, Printable, Fillable, Blank pdfFiller

There are significant changes to other schedules, questions on the form,. Irs form 5471 is an information return of u.s. Upload, modify or create forms. File form 5471 to satisfy the reporting requirements of. Web form 5471 (2020) form 5471:

FORM 5471 TOP 6 REPORTING CHALLENGES Expat Tax Professionals

It is an annual reporting requirement for some u.s. For instructions and the latest. Web form 5471 (2020) form 5471: File form 5471 to satisfy the reporting requirements of. Web complete a separate schedule q with respect to each applicable category of income (see instructions).

2020 Form 5471 Instructions

Shareholder, while a 5c filer is a related constructive u.s. Web form 5471 (2020) form 5471: Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories.

IRS 3520A 2020 Fill out Tax Template Online US Legal Forms

Web 01 dec 2020 by anthony diosdi introduction schedule p of form 5471 is used to report ptep of the u.s. Web schedule e (form 5471) (rev. Also, the checkbox for category 5 has been deleted and replaced with. Persons with respect to certain foreign corporations. When and where to file.

Demystifying the All New 2020 Tax Year IRS Form 5471 Schedule E

Web and today, we're going to give you an overview of the form 5471. The term ptep refers to earnings and profits (“e&p”) of a foreign. Ad register and subscribe now to work on your irs instructions 5471 & more fillable forms. Shareholder, while a 5c filer is a related constructive u.s. For instructions and the latest.

Demystifying the All New 2020 Tax Year IRS Form 5471 Schedule J SF

Ad register and subscribe now to work on your irs instructions 5471 & more fillable forms. Persons with respect to certain foreign corporations. There are significant changes to other schedules, questions on the form,. There have been revisions to the form in both 2017 and 2018, with a major revision in 2019. Income, war profits, and excess profits taxes paid.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

December 2022) department of the treasury internal revenue service. Upload, modify or create forms. Shareholder who doesn't qualify as either a category 5b or 5c filer. Web information about form 5471, information return of u.s. So, a 5a filer is an unrelated section 958(a) u.s.

December 2022) Department Of The Treasury Internal Revenue Service.

Web the instructions to form 5471 describes a category 5a filer as a u.s. Web changes to form 5471. Web instructions for form 5471, information return of u.s. Web 2020 form 5471 instructions on january 28, 2021, the irs published instructions for form 5471, which include significant changes.

5 Form 5471 Is Filed When The Tax Return Due 6 How To File A 5471 Extension 7 No 7004 Extension Required 8 Multiple.

Shareholder of a controlled foreign currency (“cfc”) in the cfc’s functional currency. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b, and 1c. Web and today, we're going to give you an overview of the form 5471. Web 01 dec 2020 by anthony diosdi introduction schedule p of form 5471 is used to report ptep of the u.s.

Web The Golding & Golding Form 5471 Instructions Are Designed To Simplify Your Understanding Of The Reporting Requirements.

For this portion of the discussion, we're going to be discussing the purpose of form 5471, including the 5 filing categories, and an overview of the schedules that are required to be. Persons with respect to certain foreign corporations. Web schedule e (form 5471) (rev. Also, the checkbox for category 5 has been deleted and replaced with.

There Have Been Revisions To The Form In Both 2017 And 2018, With A Major Revision In 2019.

Persons with respect to certain foreign corporations. Enter separate category code with respect to which this schedule q is being completed (see instructions for codes) if category code “pas” is entered on line a,. The term ptep refers to earnings and profits (“e&p”) of a foreign. Web the most recent instructions to form 5471 were just revised in february 2020, and part i of schedule j has seven new columns, and those in the prior versions were rearranged.