2020 Form 941 Pdf

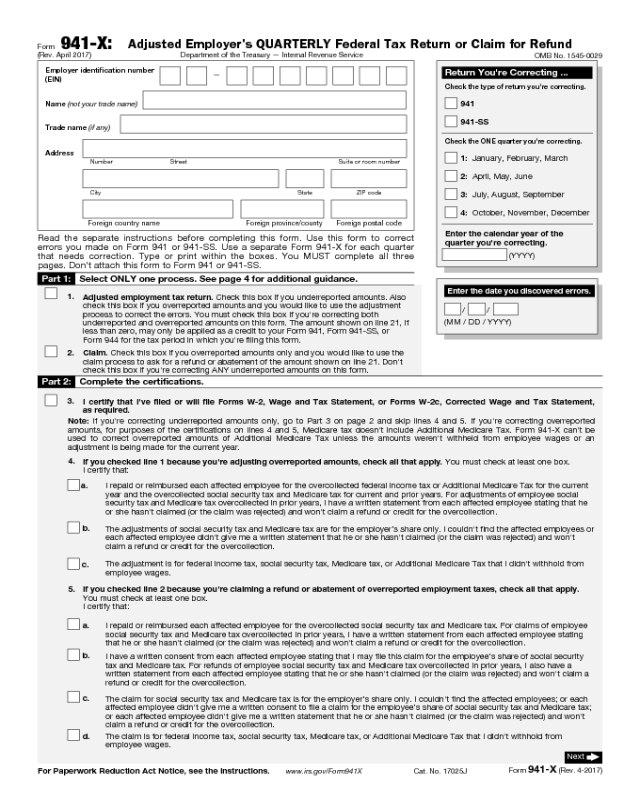

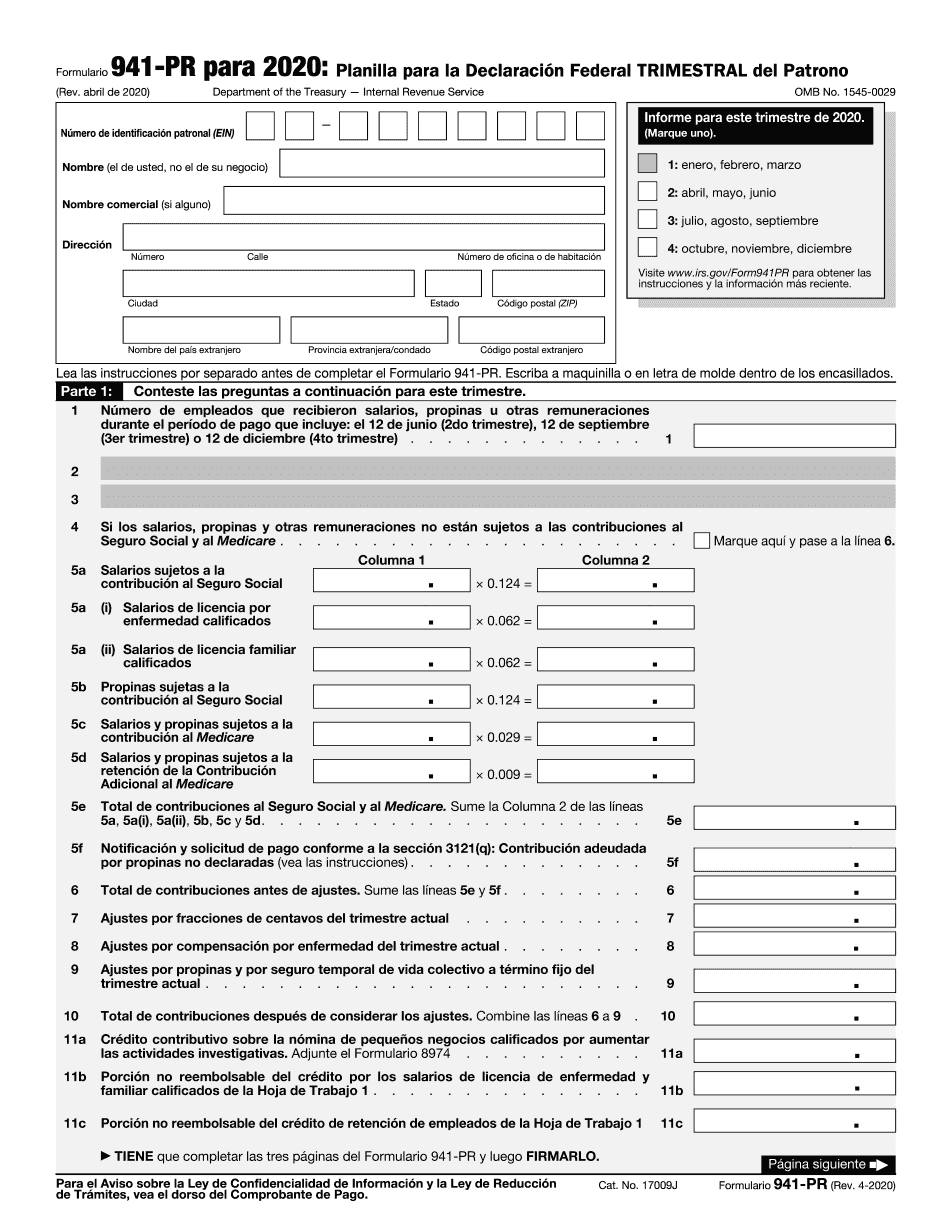

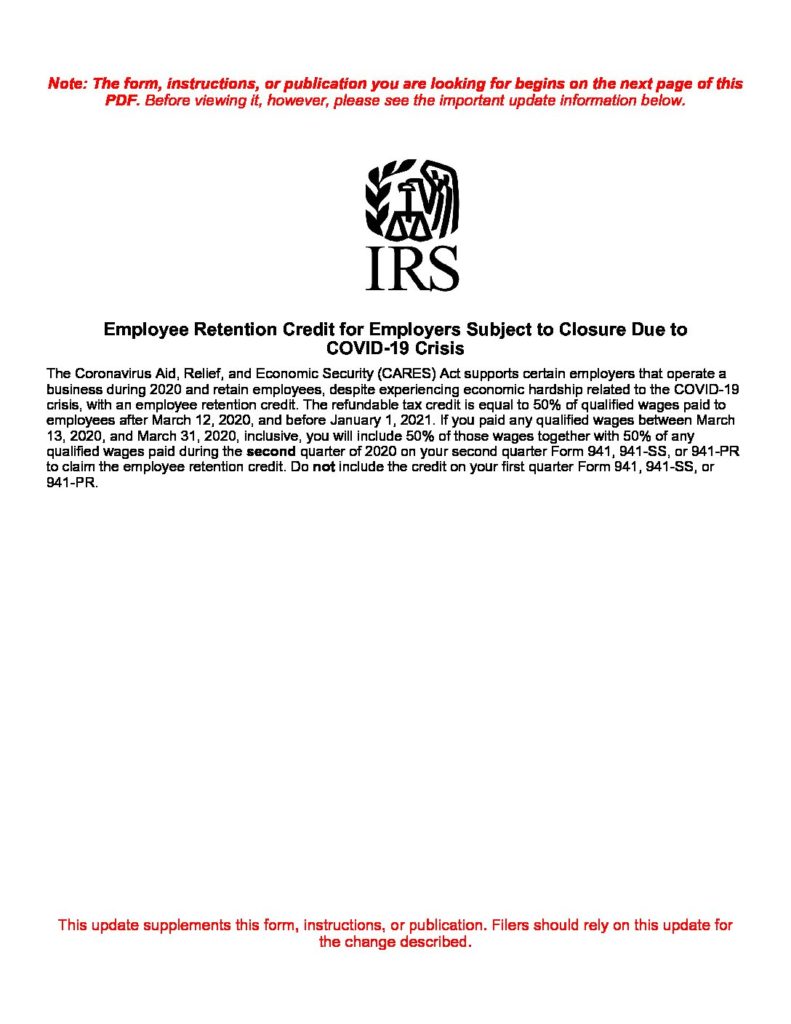

2020 Form 941 Pdf - Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. For more information, see the instructions for form For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Correcting a previously filed form 941. Instructions for form 941 (2021) pdf. Instructions for form 941 (rev. The following significant changes have been made to form 941 to allow for the reporting of new employment tax credits and other tax. Web f.3d 1074, 1079 (9th cir. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Employer identification number (ein) — name (not your trade name) trade name (if.

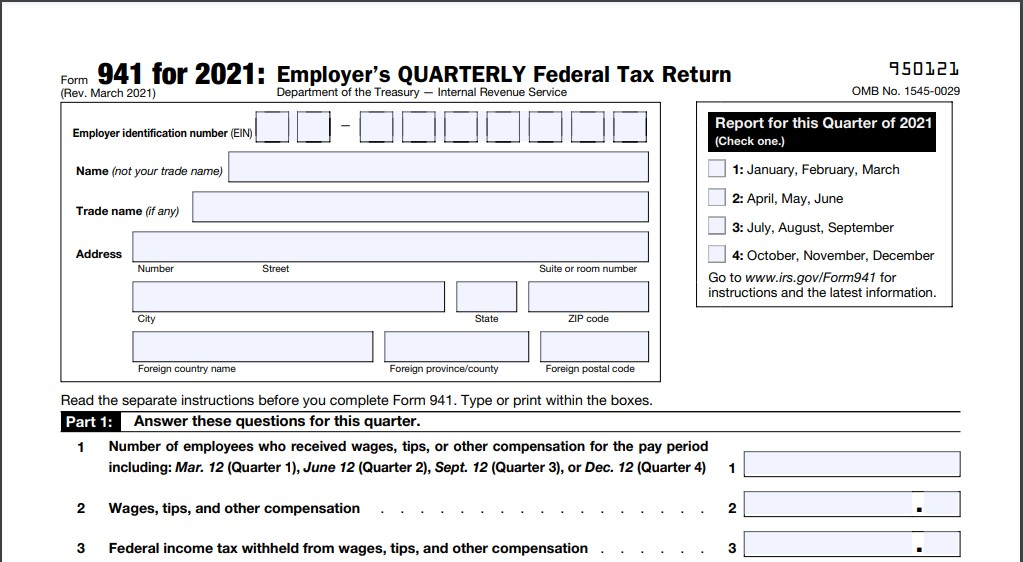

Correcting a previously filed form 941. For more information, see the instructions for form Web for the best experience, open this pdf portfolio in acrobat x or adobe reader x, or later. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web employer's quarterly federal tax return for 2021. The following significant changes have been made to form 941 to allow for the reporting of new employment tax credits and other tax. Instructions for form 941 (rev. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. The use of a counterfeit “is obviously intended to confuse consumers,” and we have described a counterfeiting claim as “merely the hard core or first degree of trademark infringement.” January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no.

Instructions for form 941 (2021) pdf. The use of a counterfeit “is obviously intended to confuse consumers,” and we have described a counterfeiting claim as “merely the hard core or first degree of trademark infringement.” Web for the best experience, open this pdf portfolio in acrobat x or adobe reader x, or later. Web f.3d 1074, 1079 (9th cir. Employer identification number (ein) — name (not your trade name) trade name (if. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Employer s quarterly federal tax return keywords: Instructions for form 941, employer's quarterly federal tax return created date: For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b).

2022 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Instructions for form 941, employer's quarterly federal tax return created date: Employer identification number (ein) — name (not your trade name) trade name (if. Instructions for form 941 (rev. Web employer's quarterly federal tax return for 2021. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no.

Printable 941 Form 2021 Printable Form 2022

The following significant changes have been made to form 941 to allow for the reporting of new employment tax credits and other tax. Instructions for form 941 (rev. Web f.3d 1074, 1079 (9th cir. Instructions for form 941, employer's quarterly federal tax return created date: January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service.

Printable 941 For 2020 Printable World Holiday

July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web for the best experience, open this pdf portfolio in acrobat x or adobe reader x, or later. Instructions for.

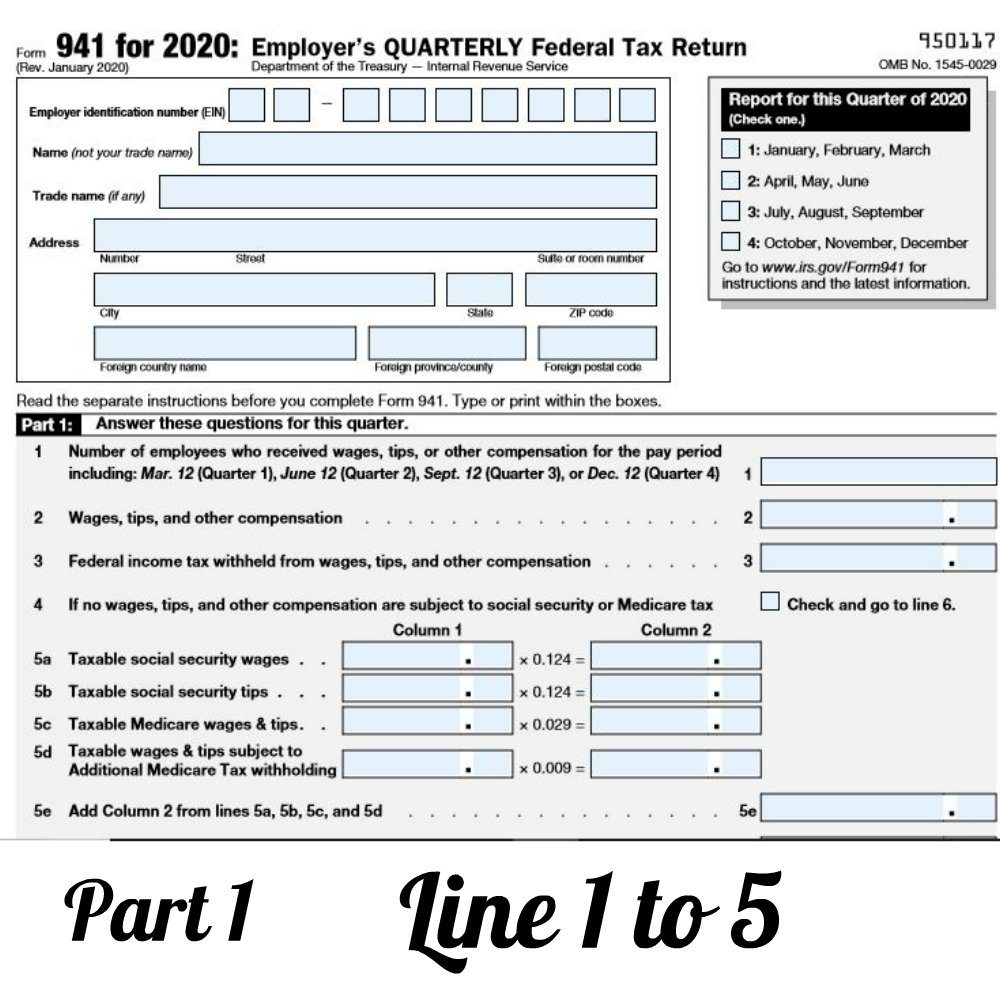

How to Complete 2020 Form 941 Employer’s Quarterly Federal Tax Return

Web f.3d 1074, 1079 (9th cir. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Correcting a previously filed form 941. Employer s quarterly federal tax return keywords: Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how.

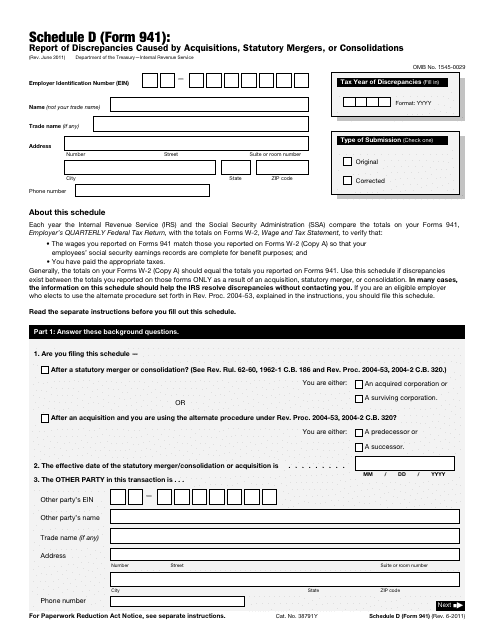

IRS Form 941 Schedule D Download Fillable PDF or Fill Online Report of

The following significant changes have been made to form 941 to allow for the reporting of new employment tax credits and other tax. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue.

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

Web f.3d 1074, 1079 (9th cir. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Instructions for form 941, employer's quarterly federal tax return created date: Web employer's quarterly federal tax return for 2021. Employer s quarterly federal tax return keywords:

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

Instructions for form 941 (rev. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Form 941 is used by employers who withhold.

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

For more information, see the instructions for form Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web employer's quarterly federal tax return for 2021. The use of a counterfeit “is obviously intended to confuse consumers,” and we have described a counterfeiting claim as “merely the hard core.

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

Web f.3d 1074, 1079 (9th cir. Employer identification number (ein) — name (not your trade name) trade name (if. The use of a counterfeit “is obviously intended to confuse consumers,” and we have described a counterfeiting claim as “merely the hard core or first degree of trademark infringement.” July 2020) adjusted employer’s quarterly federal tax return or claim for refund.

941 Worksheet 1 2020 Fillable Pdf

The following significant changes have been made to form 941 to allow for the reporting of new employment tax credits and other tax. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and.

Web For The Best Experience, Open This Pdf Portfolio In Acrobat X Or Adobe Reader X, Or Later.

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Employer identification number (ein) — name (not your trade name) trade name (if. Web f.3d 1074, 1079 (9th cir. Instructions for form 941 (2021) pdf.

For More Information, See The Instructions For Form

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Employer s quarterly federal tax return keywords: Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Instructions for form 941, employer's quarterly federal tax return created date:

The Use Of A Counterfeit “Is Obviously Intended To Confuse Consumers,” And We Have Described A Counterfeiting Claim As “Merely The Hard Core Or First Degree Of Trademark Infringement.”

For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). The following significant changes have been made to form 941 to allow for the reporting of new employment tax credits and other tax. Instructions for form 941 (rev. Web employer's quarterly federal tax return for 2021.

July 2020) Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund Department Of The Treasury — Internal Revenue Service Omb No.

Correcting a previously filed form 941.