2021 Form 1099 R Instructions

2021 Form 1099 R Instructions - Web filing instructions — your annuity is reportable on your income tax return every year, unless your total income is below the amount required to file a return. Also, this is the amount that is directly converted,. The plan administrator should issue statements. Web see part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. This is the amount distributed before any income taxes are withheld. Most public and private pension plans that aren't part of. Must be removed before printing. • the 2021 general instructions for certain information returns, and • the 2021 instructions for. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web instructions for 2022 tax year 1.

• the 2021 general instructions for certain information returns, and • the 2021 instructions for. Web filing instructions — your annuity is reportable on your income tax return every year, unless your total income is below the amount required to file a return. Must be removed before printing. Web instructions for 2022 tax year 1. Web see part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Please note that copy b. The plan administrator should issue statements. Also, this is the amount that is directly converted,. Web 2021 consolidated form 1099 generally, there have been no significant relevant changes or enhancements to forms 1099 for the 2021 tax year.

Web instructions for 2022 tax year 1. Web 2021 consolidated form 1099 generally, there have been no significant relevant changes or enhancements to forms 1099 for the 2021 tax year. Please note that copy b. Web filing instructions — your annuity is reportable on your income tax return every year, unless your total income is below the amount required to file a return. • the 2021 general instructions for certain information returns, and • the 2021 instructions for. This is the amount distributed before any income taxes are withheld. Most public and private pension plans that aren't part of. The plan administrator should issue statements. Also, this is the amount that is directly converted,. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations.

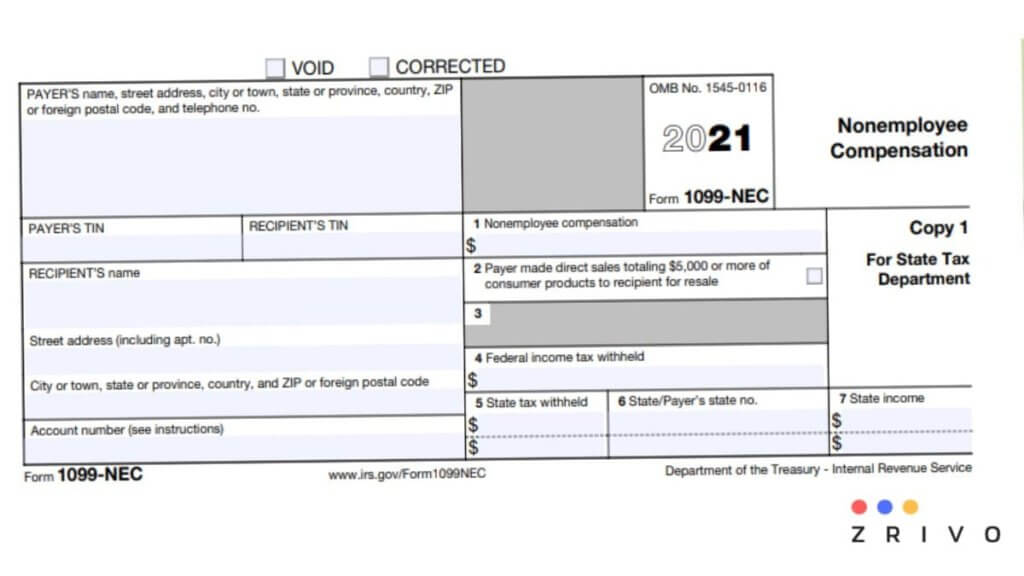

1099 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

The plan administrator should issue statements. Web filing instructions — your annuity is reportable on your income tax return every year, unless your total income is below the amount required to file a return. Most public and private pension plans that aren't part of. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations..

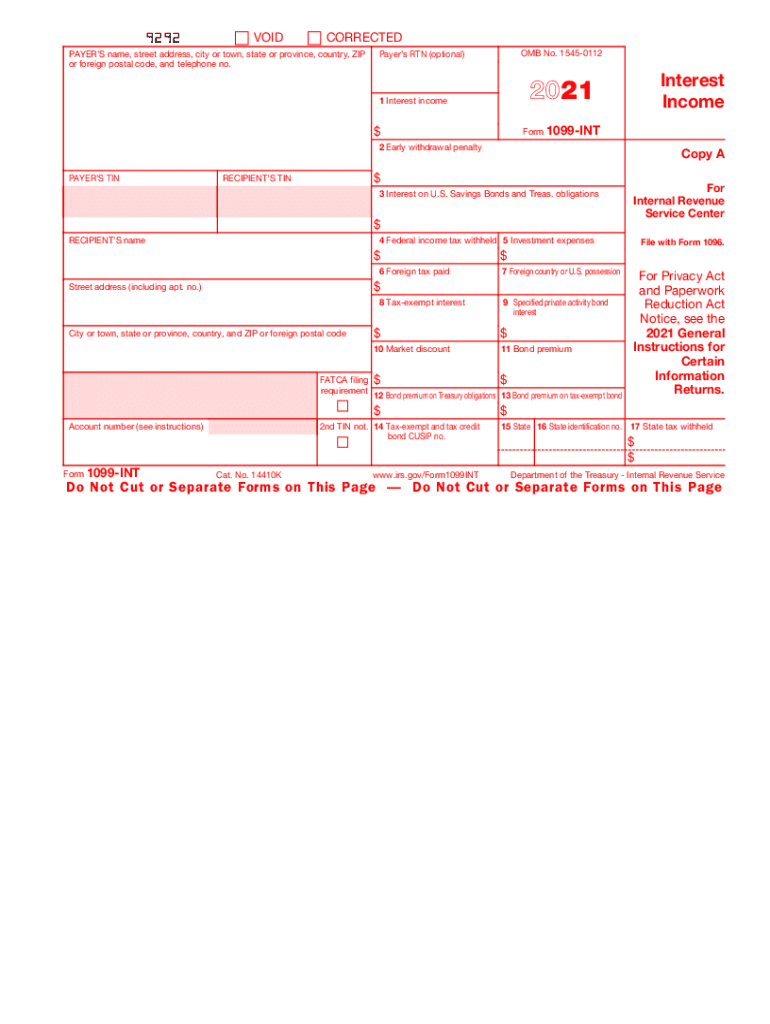

2021 Form IRS 1099INT Fill Online, Printable, Fillable, Blank pdfFiller

The plan administrator should issue statements. Form csa 1099r, form csf 1099r and; Web 2021 consolidated form 1099 generally, there have been no significant relevant changes or enhancements to forms 1099 for the 2021 tax year. Web see part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Most public and.

Efile 2022 Form 1099R Report the Distributions from Pensions

Form csa 1099r, form csf 1099r and; Most public and private pension plans that aren't part of. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. This is the amount distributed before any income taxes are withheld. The plan administrator should issue statements.

Federal Withholding Tax Tables For Pensions Review Home Decor

The plan administrator should issue statements. Web filing instructions — your annuity is reportable on your income tax return every year, unless your total income is below the amount required to file a return. • the 2021 general instructions for certain information returns, and • the 2021 instructions for. Also, this is the amount that is directly converted,. Ad ap.

FPPA 1099R Forms

Most public and private pension plans that aren't part of. Must be removed before printing. Web instructions for 2022 tax year 1. Web see part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Also, this is the amount that is directly converted,.

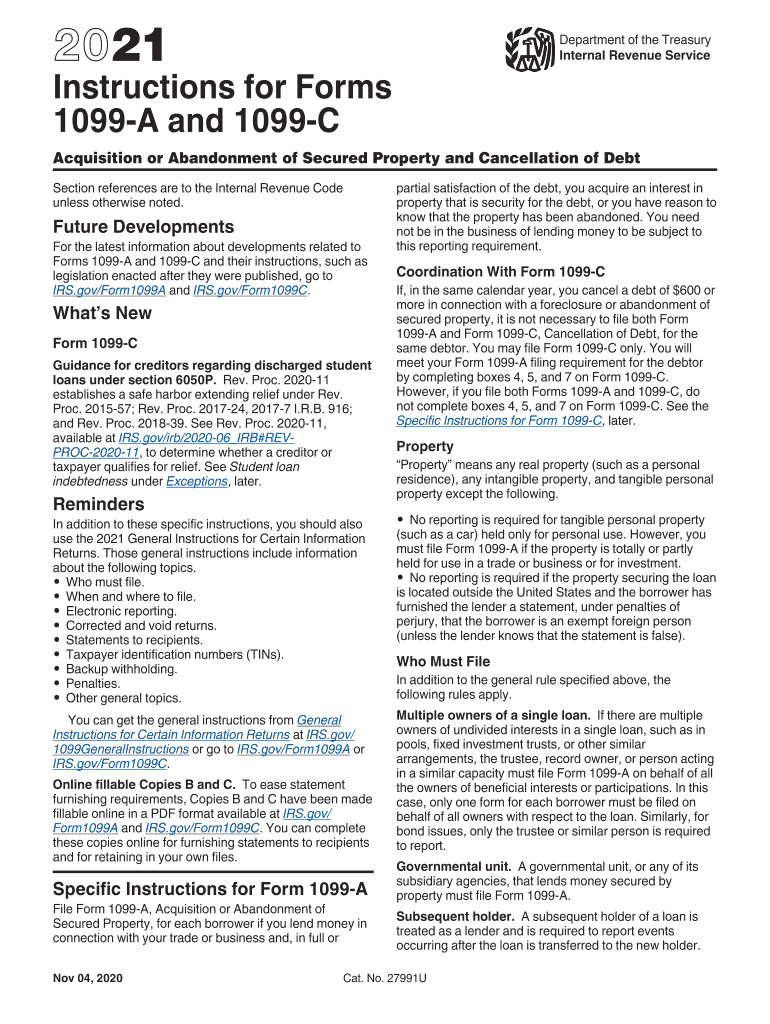

IRS Instruction 1099A & 1099C 20212022 Fill out Tax Template

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. This is the amount distributed before any income taxes are withheld. Most public and private pension plans that aren't part of. The plan administrator should issue statements.

Printable Form Ssa 1099 Printable Form 2022

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web 2021 consolidated form 1099 generally, there have been no significant relevant changes or enhancements to forms 1099 for the 2021 tax year. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web filing instructions — your.

2021 Winter Topics & Report Newsletter Teachers' Retirement System

Most public and private pension plans that aren't part of. Web filing instructions — your annuity is reportable on your income tax return every year, unless your total income is below the amount required to file a return. Please note that copy b. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web.

2021 Laser 1099R, Federal Copy A

Form csa 1099r, form csf 1099r and; • the 2021 general instructions for certain information returns, and • the 2021 instructions for. Web see part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. The.

1099NEC Instructions

This is the amount distributed before any income taxes are withheld. The plan administrator should issue statements. Web 2021 consolidated form 1099 generally, there have been no significant relevant changes or enhancements to forms 1099 for the 2021 tax year. Web see part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about.

The Plan Administrator Should Issue Statements.

Web filing instructions — your annuity is reportable on your income tax return every year, unless your total income is below the amount required to file a return. Form csa 1099r, form csf 1099r and; Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Must be removed before printing.

Please Note That Copy B.

Web 2021 consolidated form 1099 generally, there have been no significant relevant changes or enhancements to forms 1099 for the 2021 tax year. Also, this is the amount that is directly converted,. Most public and private pension plans that aren't part of. • the 2021 general instructions for certain information returns, and • the 2021 instructions for.

Web Instructions For 2022 Tax Year 1.

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web see part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. This is the amount distributed before any income taxes are withheld.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png?resize=1040%2C688&ssl=1)