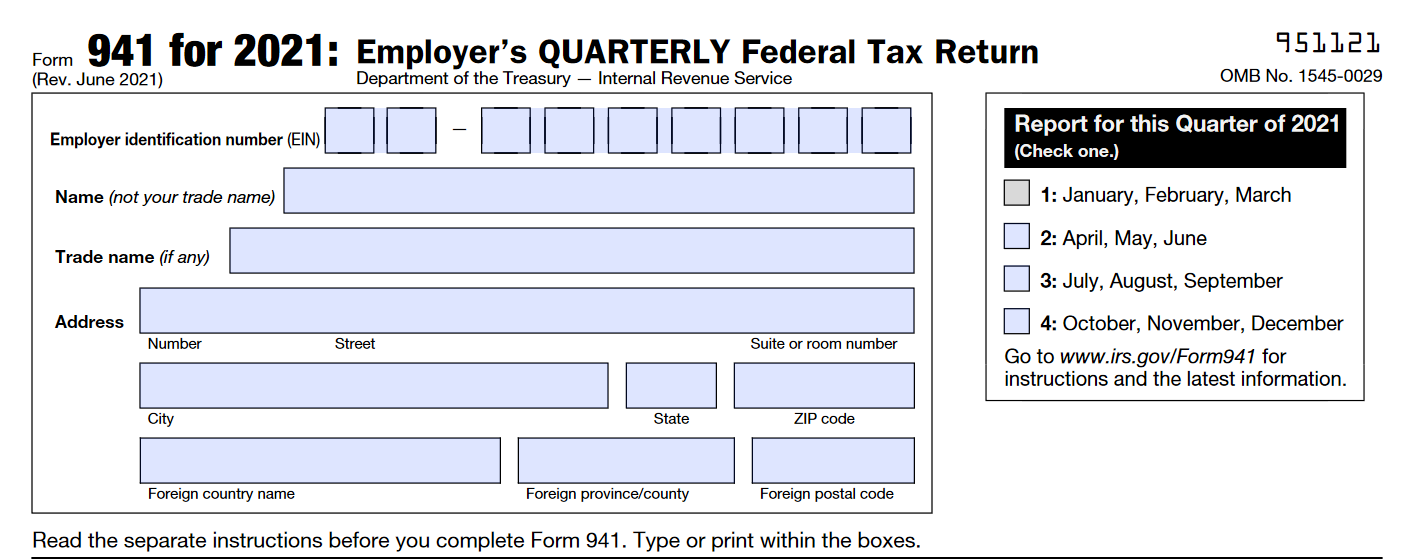

2022 Federal 941 Form

2022 Federal 941 Form - Web we last updated federal form 941 from the internal revenue service in july 2022. Web learn more about patriot payroll what is form 941? If changes in law require additional. At this time, the irs. Web we last updated federal form 941 in july 2022 from the federal internal revenue service. These worksheets should only be used by employers that need to calculate and claim. Ad edit, sign and print irs 941 tax form on any device with dochub. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. Form 941 is used by employers. Web february 28, 2022 · 9 minute read.

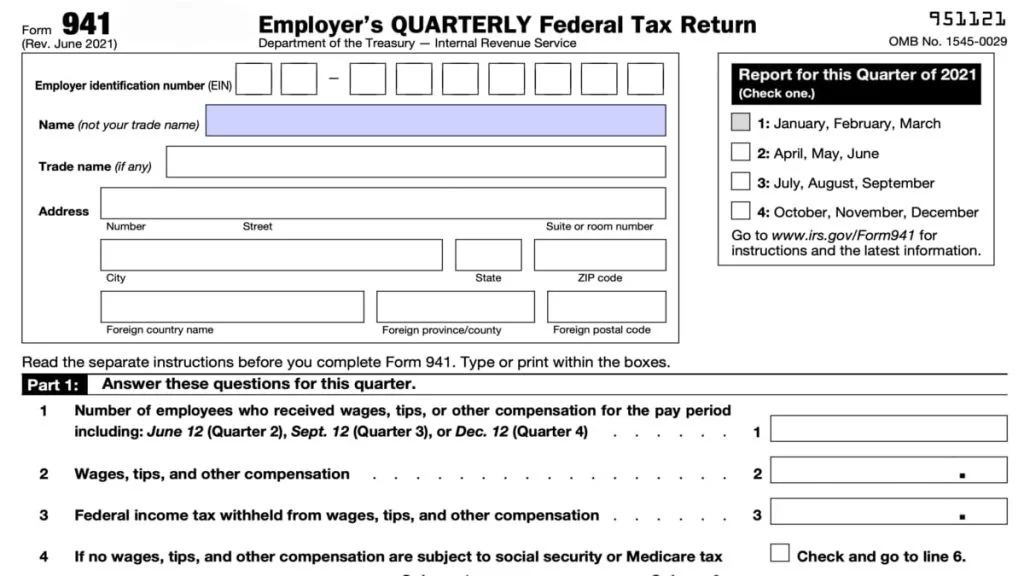

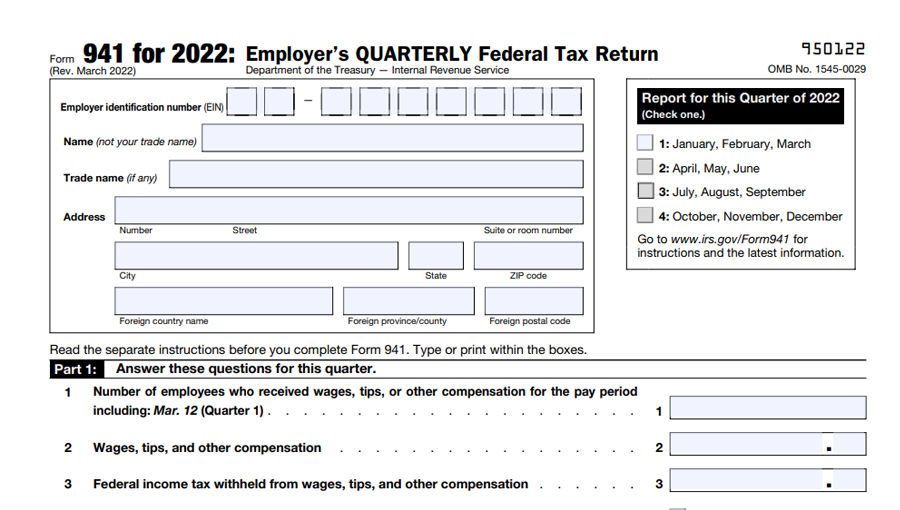

Web we last updated federal form 941 in july 2022 from the federal internal revenue service. Don't use an earlier revision to report taxes for 2023. Complete, edit or print tax forms instantly. If changes in law require additional. Web yes, there will still be two worksheets for form 941 for the third quarter. Web you file form 941 quarterly. Web february 28, 2022 · 9 minute read. Web finalized versions of the 2022 form 941, its instructions, and schedules were issued feb. Web form 941, employer’s quarterly federal tax return, is the tax form that reports wages paid to employees, tips they reported, and taxes withheld from their paychecks, including. Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out.

Web you file form 941 quarterly. Web yes, there will still be two worksheets for form 941 for the third quarter. 28 by the internal revenue service. Don't use an earlier revision to report taxes for 2023. If changes in law require additional. The irs has officially named this form as quarterly employer’s. Web finalized versions of the 2022 form 941, its instructions, and schedules were issued feb. The deadline is the last day of the month following the end of the quarter. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. If you reported more than $50,000, you’re a.

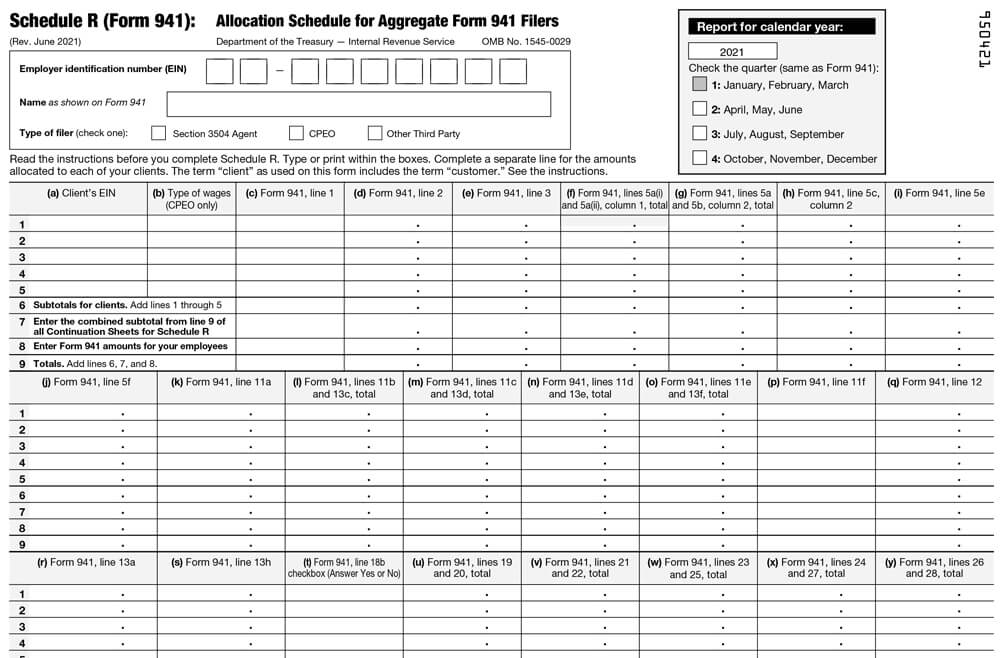

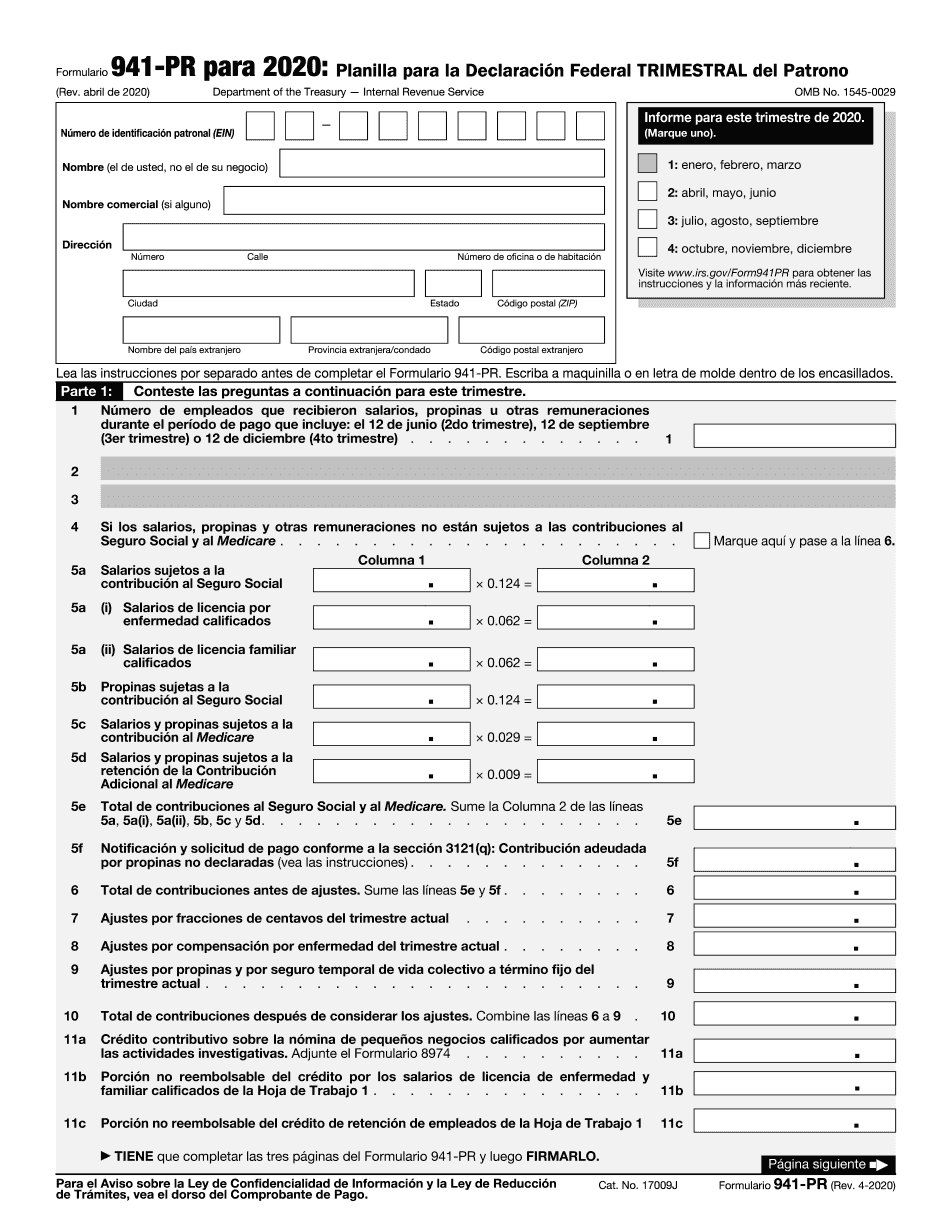

Revised IRS Form 941 Schedule R 2nd quarter 2021

Web yes, there will still be two worksheets for form 941 for the third quarter. Web form 941 for 2023: Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to. 28 by the internal revenue service. Ad edit, sign and print irs 941 tax form on any device with dochub.

Customers

Web you file form 941 quarterly. Web learn more about patriot payroll what is form 941? Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web we last updated federal.

941 Form 2023

The deadline is the last day of the month following the end of the quarter. Ad get ready for tax season deadlines by completing any required tax forms today. Web yes, there will still be two worksheets for form 941 for the third quarter. These worksheets should only be used by employers that need to calculate and claim. Web we.

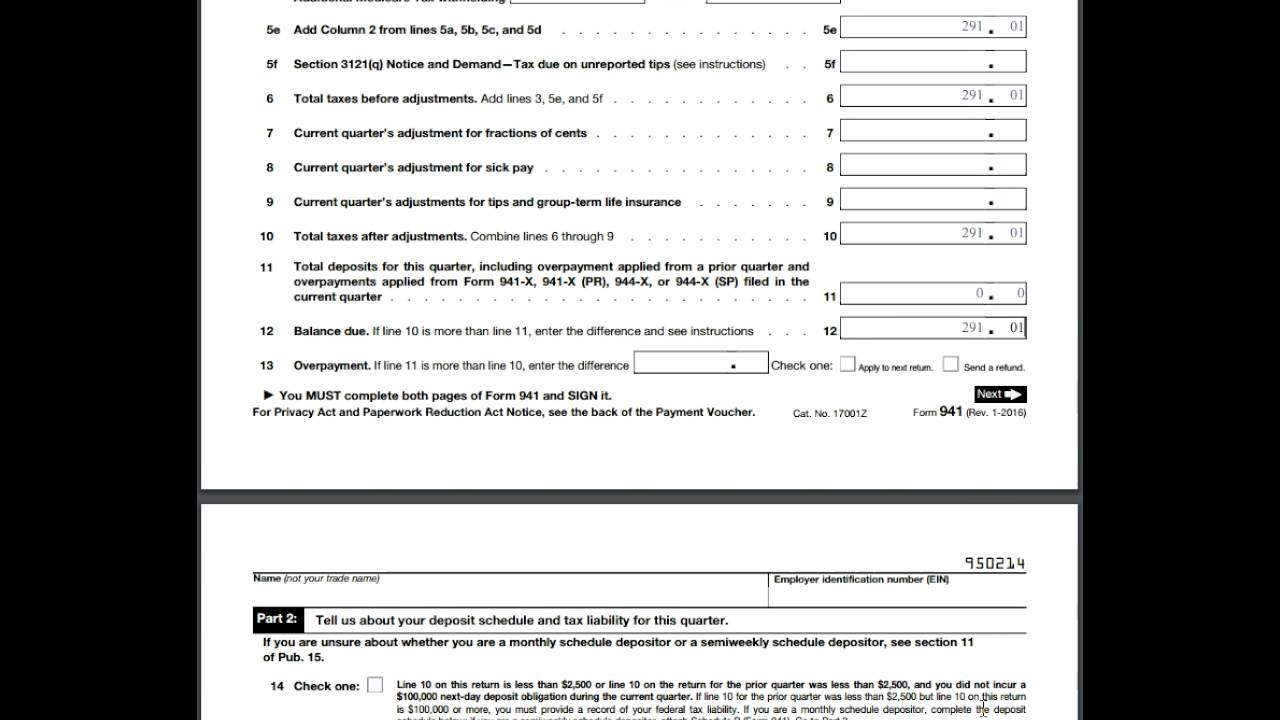

Form 941 Employer's Quarterly Federal Tax Return. Normal forms not due

Don't use an earlier revision to report taxes for 2023. Web finalized versions of the 2022 form 941, its instructions, and schedules were issued feb. Complete, edit or print tax forms instantly. Web we last updated federal form 941 from the internal revenue service in july 2022. Form 941 is used by employers.

IRS Form 941 Instructions for 2021 How to fill out Form 941

Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to. This form is for income earned in tax year 2022, with tax returns due in april 2023..

TX 2022 20112022 Fill and Sign Printable Template Online US Legal

Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. This form is for income earned in tax year 2022, with tax returns due in april 2023. Complete, edit or print tax forms instantly. Web february 28, 2022 · 9 minute read..

File Form 941 Online for 2023 Efile 941 at Just 5.95

Don't use an earlier revision to report taxes for 2023. 28 by the internal revenue service. Web we last updated federal form 941 from the internal revenue service in july 2022. Web form 941, employer’s quarterly federal tax return, is the tax form that reports wages paid to employees, tips they reported, and taxes withheld from their paychecks, including. Web.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

The irs has officially named this form as quarterly employer’s. At this time, the irs. Don't use an earlier revision to report taxes for 2023. Show sources > about the corporate income tax the irs and most states require. Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022.

Printable 941 Form Printable Form 2021

Show sources > about the corporate income tax the irs and most states require. At this time, the irs. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. The deadline is the last day of the month following the end of the quarter. March 2023) employer’s quarterly federal.

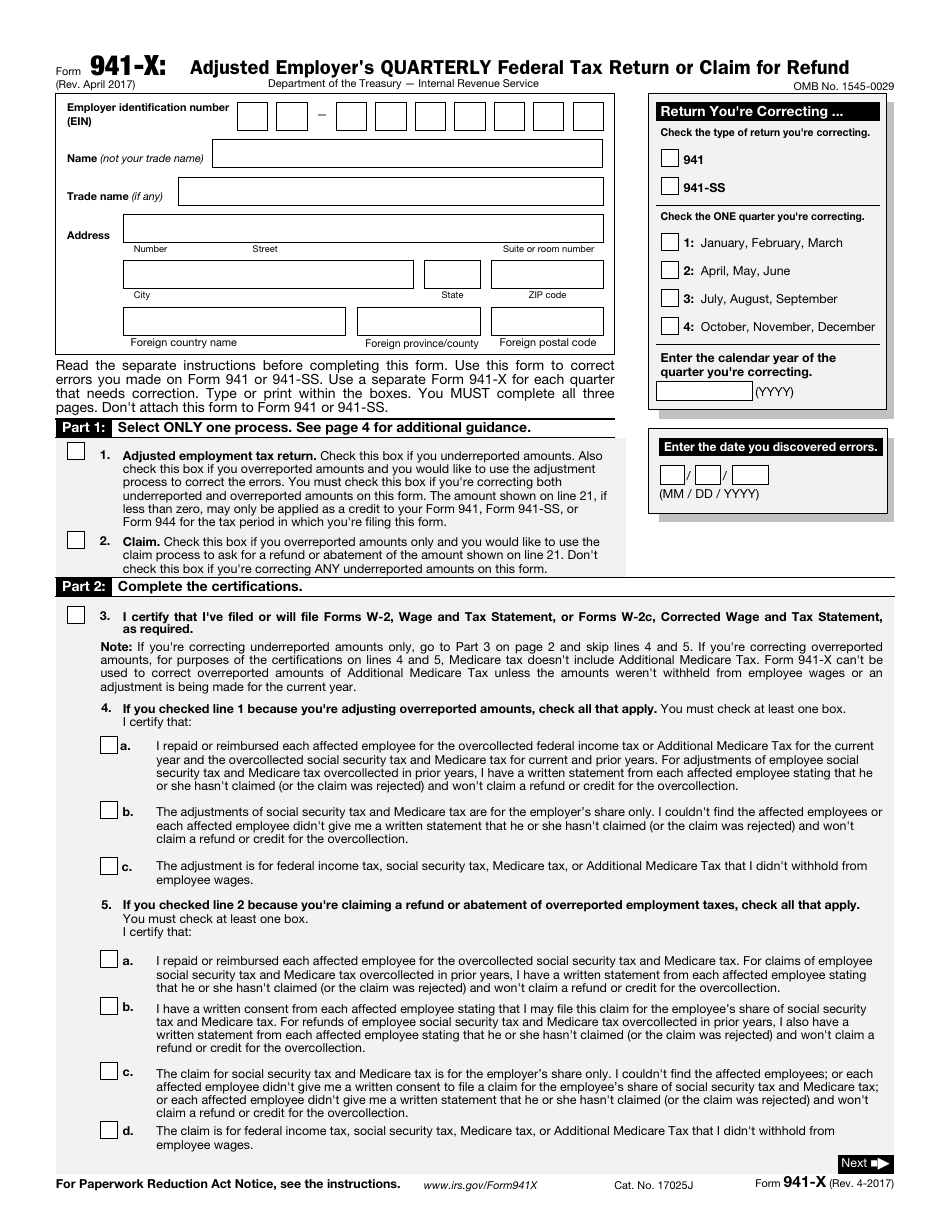

IRS Form 941X Download Fillable PDF or Fill Online Adjusted Employer's

Form 941 is used by employers. At this time, the irs. Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. Get ready for tax season deadlines by completing any required tax forms today. Web yes, there will still be two worksheets.

Web Form 941 For 2023:

Form 941 is used by employers. Get ready for tax season deadlines by completing any required tax forms today. Web form 941, employer’s quarterly federal tax return, is the tax form that reports wages paid to employees, tips they reported, and taxes withheld from their paychecks, including. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023;

These Worksheets Should Only Be Used By Employers That Need To Calculate And Claim.

Web february 28, 2022 · 9 minute read. At this time, the irs. Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to. Web learn more about patriot payroll what is form 941?

Web A Draft Version Of The 2022 Form 941, Employer’s Quarterly Federal Tax Return, Was Released Jan.

26 by the internal revenue service. The last time form 941 was. 28 by the internal revenue service. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number.

Ad Edit, Sign And Print Irs 941 Tax Form On Any Device With Dochub.

If changes in law require additional. The deadline is the last day of the month following the end of the quarter. The irs has officially named this form as quarterly employer’s. Web report for this quarter of 2022 (check one.) 1: