2022 Form Ptr-1

2022 Form Ptr-1 - Web “2nd quarter 2022,” “3rd quarter 2022,” or “4th quarter 2022”) on your check or money order. Web inquiry check your senior freeze (property tax reimbursement) status here. Web instructions introduction the senior freeze (property tax reimbursement) program reimburses senior citizens and disabled persons for property tax increases. Enter your annual income for 2022. Download blank or fill out online in pdf format. Web of chapter 1 of subtitle a of the code applies which is engaged (1) in the manufacturing, production, growth, or extraction in whole or significant part of any agricultural or. Web to qualify for the 2022 senior freeze, an applicant must meet all of the following requirements. Shows patronage dividends paid to you during the year in cash, qualified written notices of allocation (at stated dollar value), or other property (not including nonqualified. Web 2022 senior freeze applications; 2022 senior freeze applications which form to use.

Web inquiry check your senior freeze (property tax reimbursement) status here. Enter your annual income for 2022. Complete, sign, print and send your tax documents easily with us legal forms. Web instructions introduction the senior freeze (property tax reimbursement) program reimburses senior citizens and disabled persons for property tax increases. This application will allow you to upload the following supporting documentation: Download blank or fill out online in pdf format. Web prior year senior freeze applications. Intervals over a period of more than 1 year) from these plans or. Shows patronage dividends paid to you during the year in cash, qualified written notices of allocation (at stated dollar value), or other property (not including nonqualified. (also see “impact of state budget” above.) • you must have been age 65.

Web poses of the property tax reimbursement. Complete, sign, print and send your tax documents easily with us legal forms. Shows patronage dividends paid to you during the year in cash, qualified written notices of allocation (at stated dollar value), or other property (not including nonqualified. This application will allow you to upload the following supporting documentation: Web of chapter 1 of subtitle a of the code applies which is engaged (1) in the manufacturing, production, growth, or extraction in whole or significant part of any agricultural or. Web to qualify for the 2022 senior freeze, an applicant must meet all of the following requirements. Web 2022 senior freeze applications; If you met the eligibility requirements for both 2021 & 2022 and are filing for the first time (or reapplying to the program after. 2022 senior freeze applications which form to use. To file electronically, you must have software that generates a file according to the specifications in pub.

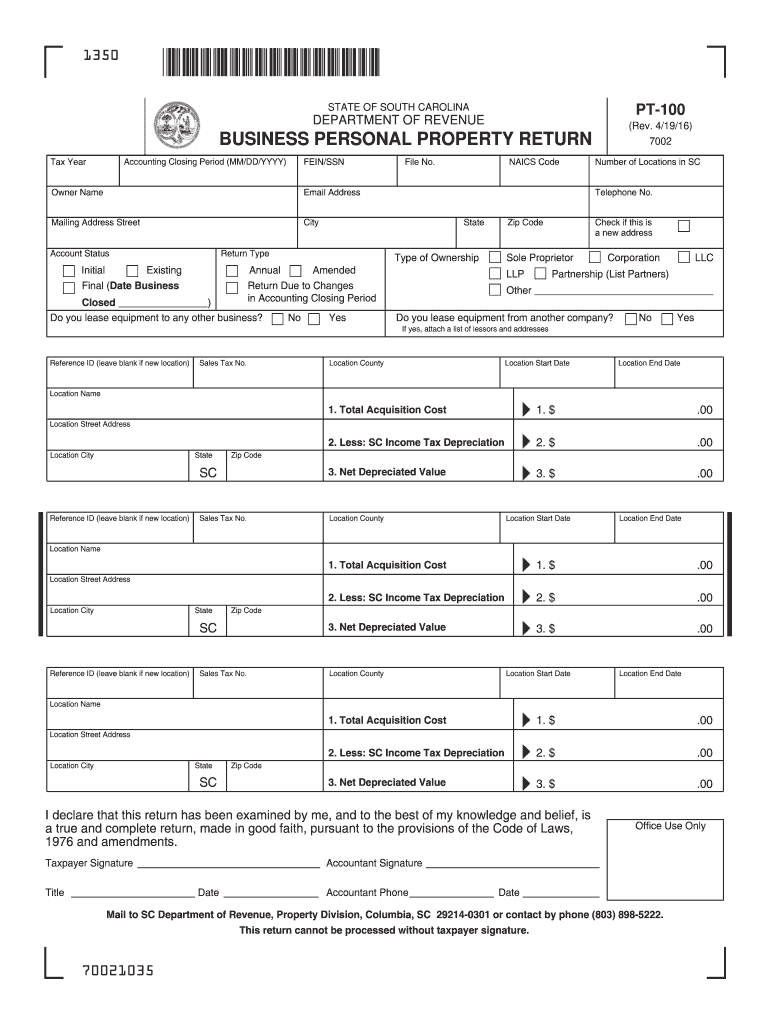

Sc pt 100 Fill out & sign online DocHub

Web inquiry check your senior freeze (property tax reimbursement) status here. Download blank or fill out online in pdf format. Web file this application in order to use the amount of your 2019property taxes to calculate your senior freeze in future years. Web the deadline for 2022 applications is october 31, 2023. This application will allow you to upload the.

The Senior Freeze application is due soon. Don't miss the deadline for

Web of chapter 1 of subtitle a of the code applies which is engaged (1) in the manufacturing, production, growth, or extraction in whole or significant part of any agricultural or. Complete, sign, print and send your tax documents easily with us legal forms. Web 2022 senior freeze applications; Download blank or fill out online in pdf format. Intervals over.

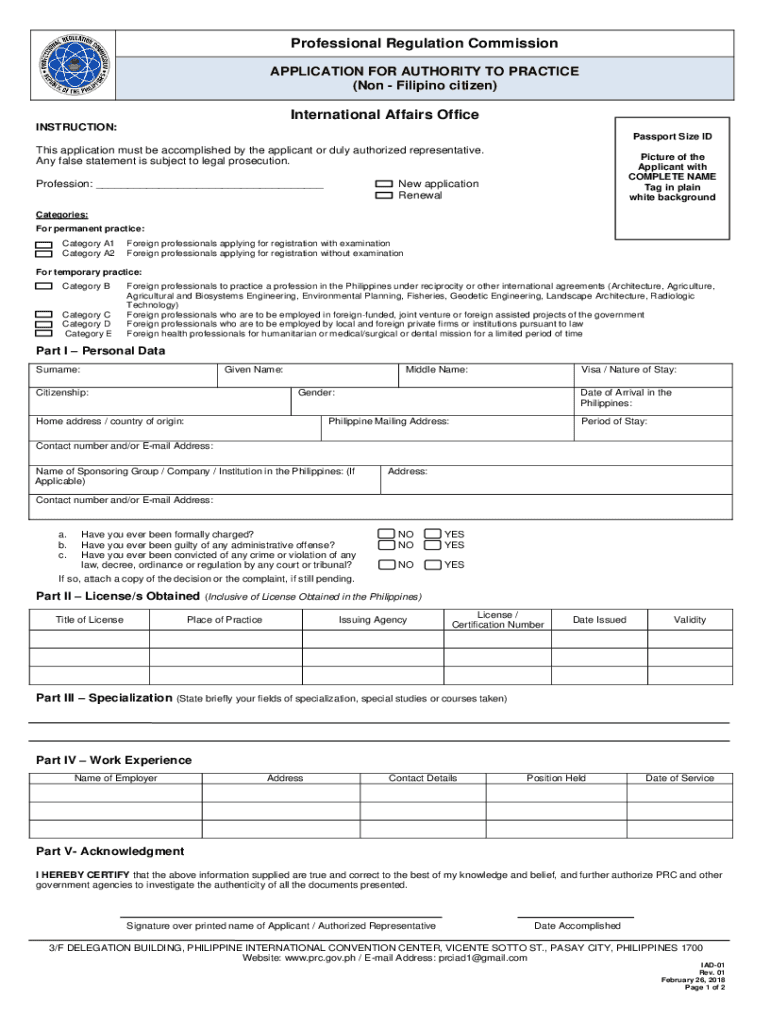

20182022 Form PH PRC IAD01 Fill Online, Printable, Fillable, Blank

(also see “impact of state budget” above.) • you must have been age 65. Web of chapter 1 of subtitle a of the code applies which is engaged (1) in the manufacturing, production, growth, or extraction in whole or significant part of any agricultural or. Web the deadline for 2022 applications is october 31, 2023. 2022 senior freeze applications which.

News

Shows patronage dividends paid to you during the year in cash, qualified written notices of allocation (at stated dollar value), or other property (not including nonqualified. Enter your annual income for 2022. To file electronically, you must have software that generates a file according to the specifications in pub. Web of chapter 1 of subtitle a of the code applies.

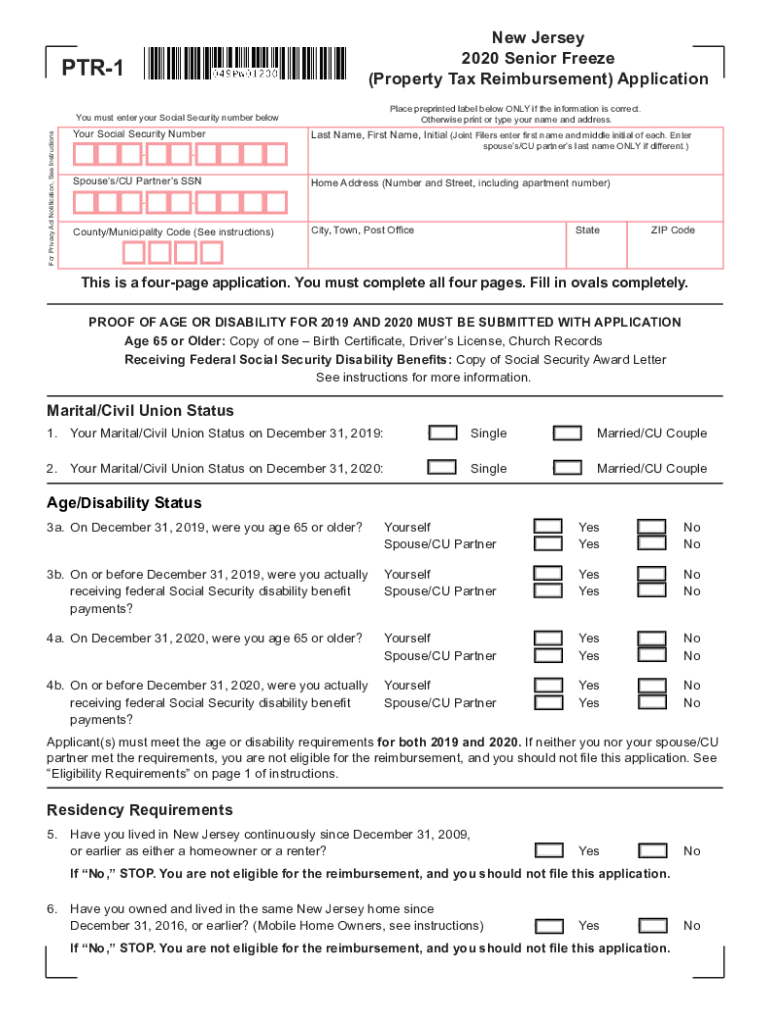

NJ Form PTR1 20202022 Fill out Tax Template Online US Legal Forms

2022 senior freeze applications which form to use. • enter numbers within the boundaries of each box. Web to qualify for the 2022 senior freeze, an applicant must meet all of the following requirements. Web “2nd quarter 2022,” “3rd quarter 2022,” or “4th quarter 2022”) on your check or money order. Web 2022 senior freeze applications;

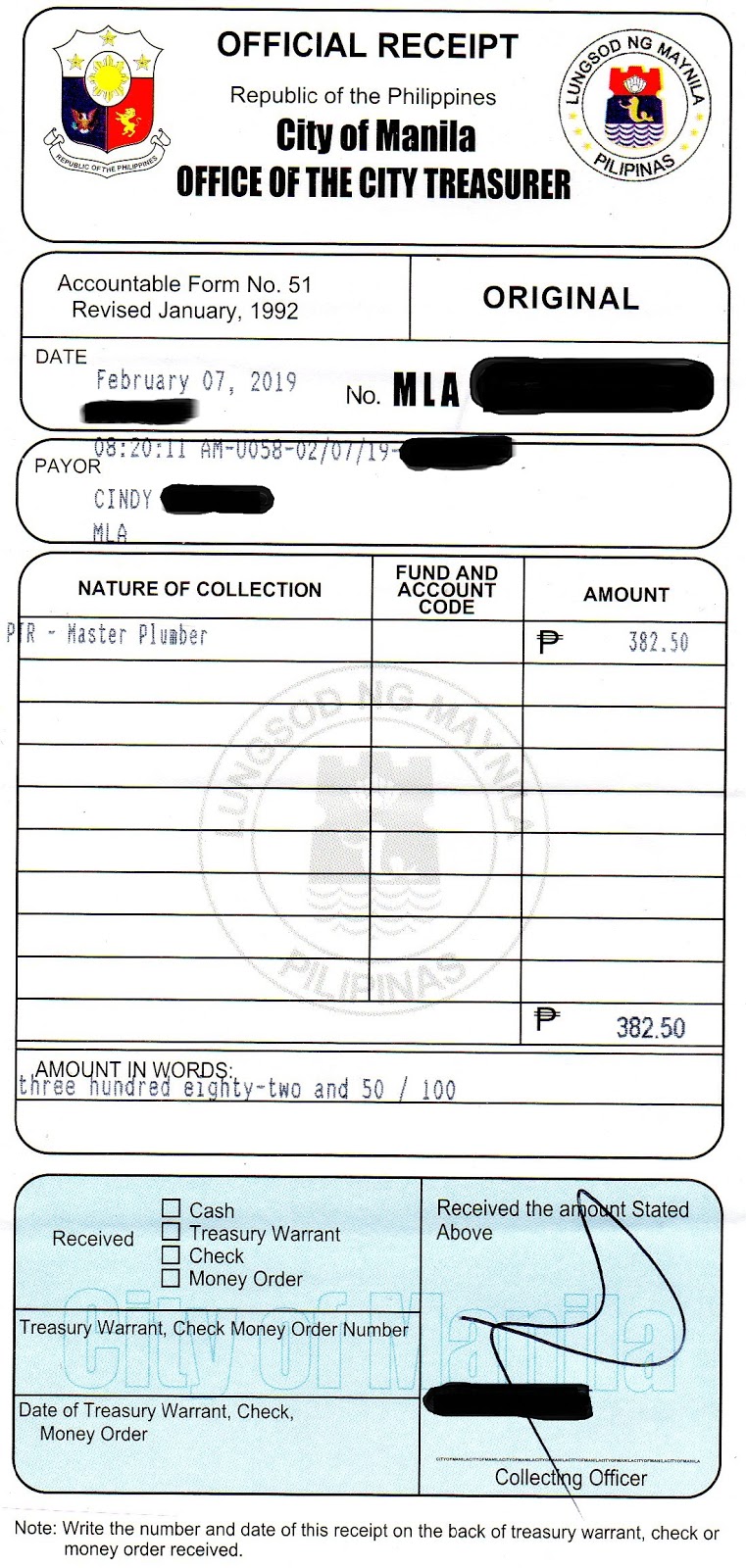

What is a Professional Tax Receipt (PTR) and how to obtain it?

Web poses of the property tax reimbursement. Print or type your name (last name first). Web file this application in order to use the amount of your 2019property taxes to calculate your senior freeze in future years. Web “2nd quarter 2022,” “3rd quarter 2022,” or “4th quarter 2022”) on your check or money order. This application will allow you to.

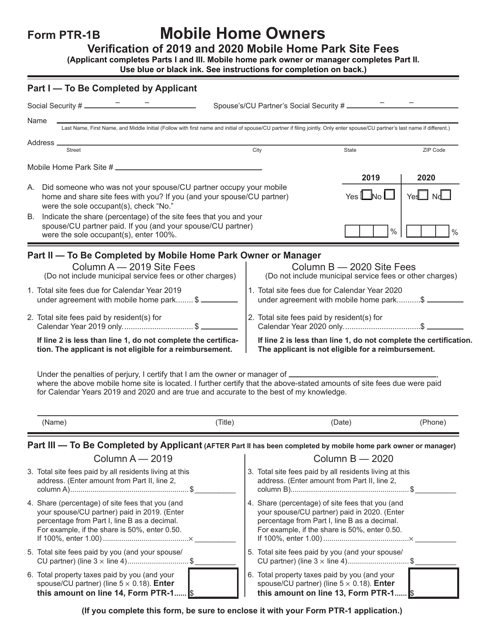

Form PTR1B Download Fillable PDF or Fill Online Mobile Home Owners

Web “2nd quarter 2022,” “3rd quarter 2022,” or “4th quarter 2022”) on your check or money order. Intervals over a period of more than 1 year) from these plans or. Print or type your name (last name first). Web 2022 senior freeze applications; Web of chapter 1 of subtitle a of the code applies which is engaged (1) in the.

Fill Free fillable PTR1 New Jersey 2019 Senior Freeze (Property Tax

(also see “impact of state budget” above.) • you must have been age 65. Shows patronage dividends paid to you during the year in cash, qualified written notices of allocation (at stated dollar value), or other property (not including nonqualified. Intervals over a period of more than 1 year) from these plans or. Web 2022 senior freeze applications; Print or.

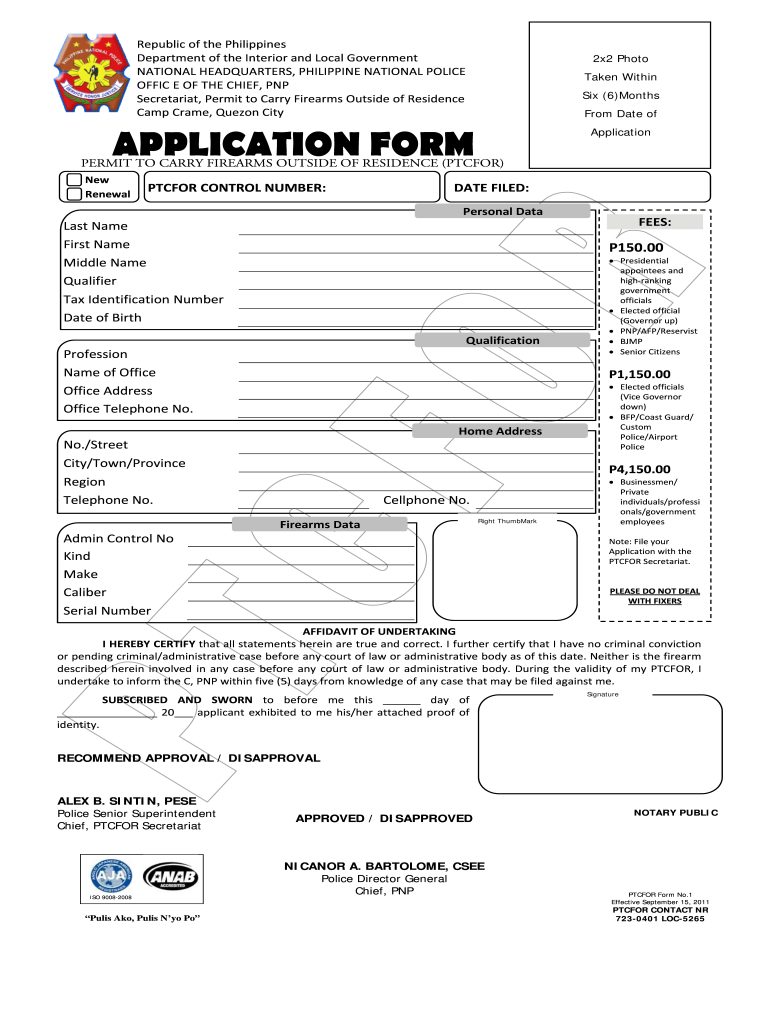

Ptcfor Online Application 2022 Fill Online, Printable, Fillable

Web file this application in order to use the amount of your 2019property taxes to calculate your senior freeze in future years. Enter your annual income for 2022. To file electronically, you must have software that generates a file according to the specifications in pub. Web the deadline for 2022 applications is october 31, 2023. Web prior year senior freeze.

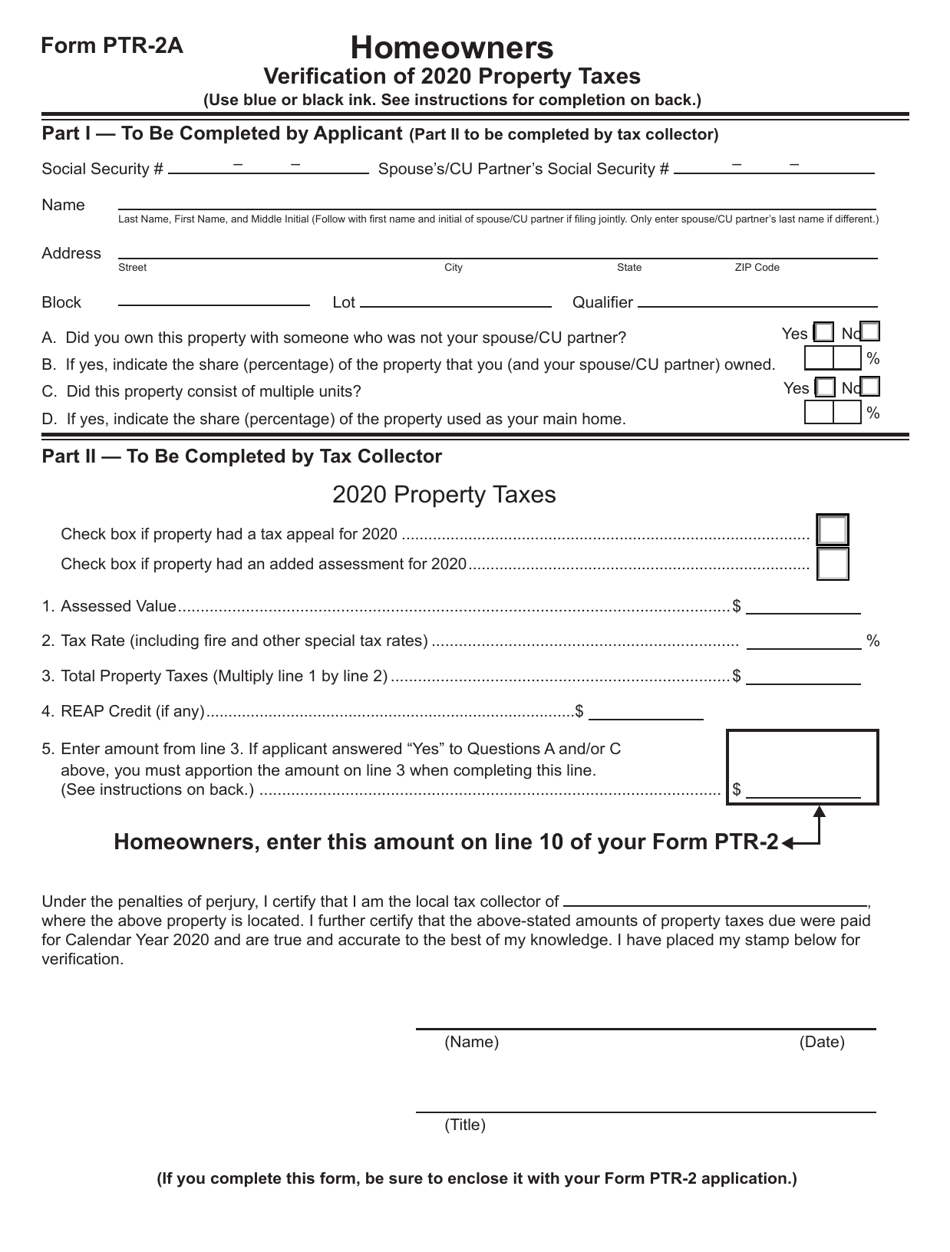

Form PTR2A Download Fillable PDF or Fill Online Homeowners

Web prior year senior freeze applications. Web poses of the property tax reimbursement. Web the deadline for 2022 applications is october 31, 2023. (also see “impact of state budget” above.) • you must have been age 65. Web to qualify for the 2022 senior freeze, an applicant must meet all of the following requirements.

Web The Deadline For 2022 Applications Is October 31, 2023.

To file electronically, you must have software that generates a file according to the specifications in pub. Web instructions introduction the senior freeze (property tax reimbursement) program reimburses senior citizens and disabled persons for property tax increases. Web “2nd quarter 2022,” “3rd quarter 2022,” or “4th quarter 2022”) on your check or money order. Web poses of the property tax reimbursement.

If You Met The Eligibility Requirements For Both 2021 & 2022 And Are Filing For The First Time (Or Reapplying To The Program After.

Web of chapter 1 of subtitle a of the code applies which is engaged (1) in the manufacturing, production, growth, or extraction in whole or significant part of any agricultural or. Web file this application in order to use the amount of your 2019property taxes to calculate your senior freeze in future years. Web to qualify for the 2022 senior freeze, an applicant must meet all of the following requirements. (also see “impact of state budget” above.) • you must have been age 65.

Intervals Over A Period Of More Than 1 Year) From These Plans Or.

Web 2022 senior freeze applications; Complete, sign, print and send your tax documents easily with us legal forms. 2022 senior freeze applications which form to use. Enter your annual income for 2022.

Web Inquiry Check Your Senior Freeze (Property Tax Reimbursement) Status Here.

Print or type your name (last name first). • enter numbers within the boundaries of each box. Web prior year senior freeze applications. Shows patronage dividends paid to you during the year in cash, qualified written notices of allocation (at stated dollar value), or other property (not including nonqualified.