2023 Form 3522

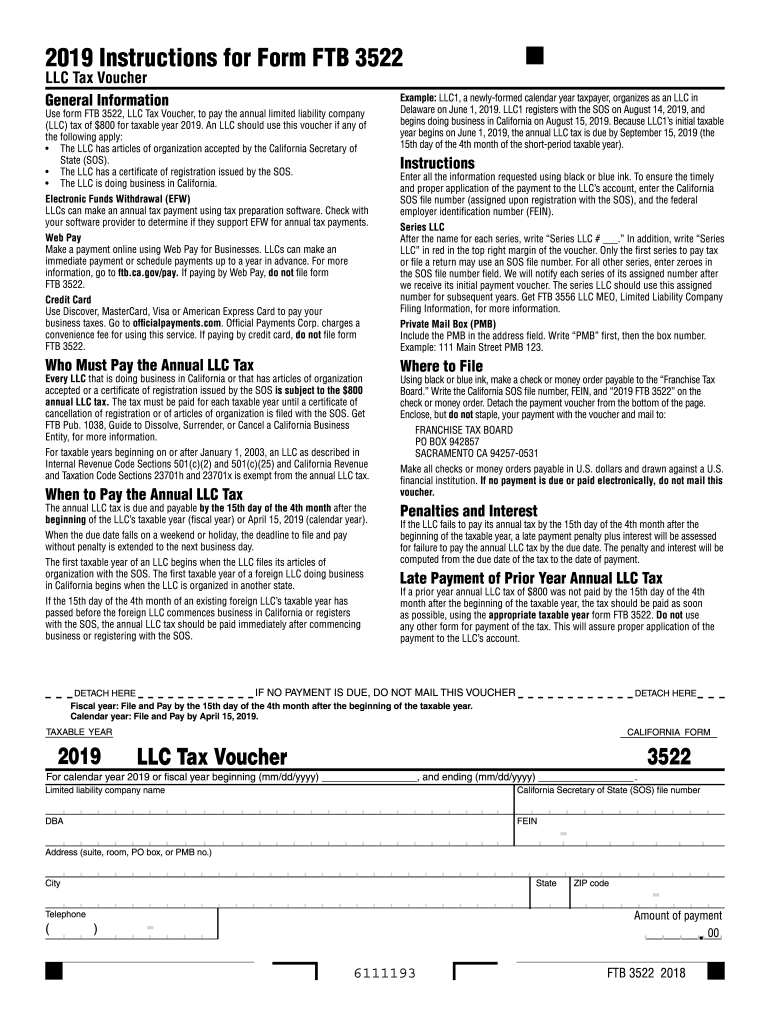

2023 Form 3522 - Select the document you want to sign and click upload. This annual tax amounts to about $800. Web how do i enter the amount paid with california forms 3522 and. Web we last updated the limited liability company tax voucher in january 2023, so this is the latest version of form 3522, fully updated for tax year 2022. Edit your form 3522 california 2022 online type text, add images, blackout confidential details, add comments, highlights and more. Show details we are not affiliated with any brand or entity on this form. Type text, add images, blackout confidential details, add comments, highlights and more. An llc should use this voucher if any of the following. Draw your signature, type it,. Web use a form 3522 2023 template to make your document workflow more streamlined.

The form 3522 is a tax voucher that llcs must use to pay yearly llc tax. Edit your form 3522 california 2022 online type text, add images, blackout confidential details, add comments, highlights and more. Web to pay the $800 that’s due by april 15, 2023, which version of form 3522 should i use: Web how do i enter the amount paid with california forms 3522 and. Who must pay the annual tax? Sign it in a few clicks. Sign it in a few clicks draw your. Web use a form 3522 2023 template to make your document workflow more streamlined. (a) requirements of petition.—a petition filed under section 321 may be considered only if—. An llc should use this voucher if any of the following.

Instead use the 2023 form ftb 3522, llc tax voucher. Web we last updated the limited liability company tax voucher in january 2023, so this is the latest version of form 3522, fully updated for tax year 2022. Every formed or registered llc that can do. Draw your signature, type it,. Web we last updated california form 3522 in january 2023 from the california franchise tax board. Web file form ftb 3536. An llc should use this voucher if any of the following. Web llc tax voucher general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Show details we are not affiliated with any brand or entity on this form. An llc should use this voucher if any of the following.

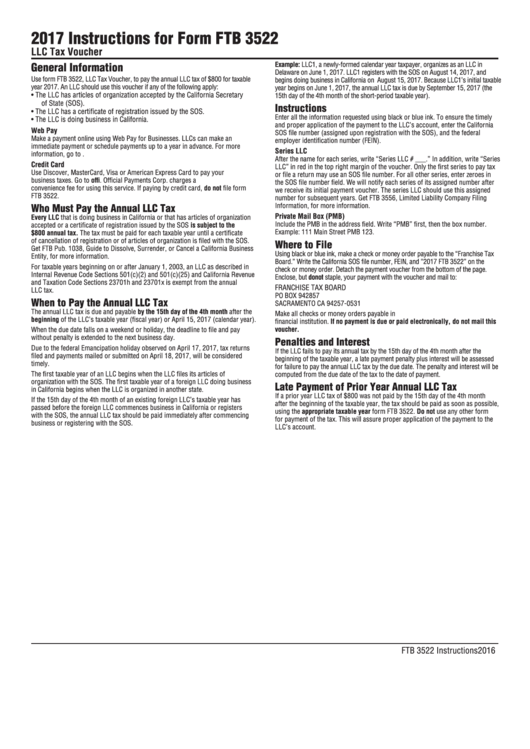

2017 Instructions For Form Ftb 3522 Llc Tax Voucher printable pdf

Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. You can download or print. Sign it in a few clicks draw your. Who must pay the annual tax? Web how do i enter the amount paid with california forms 3522 and.

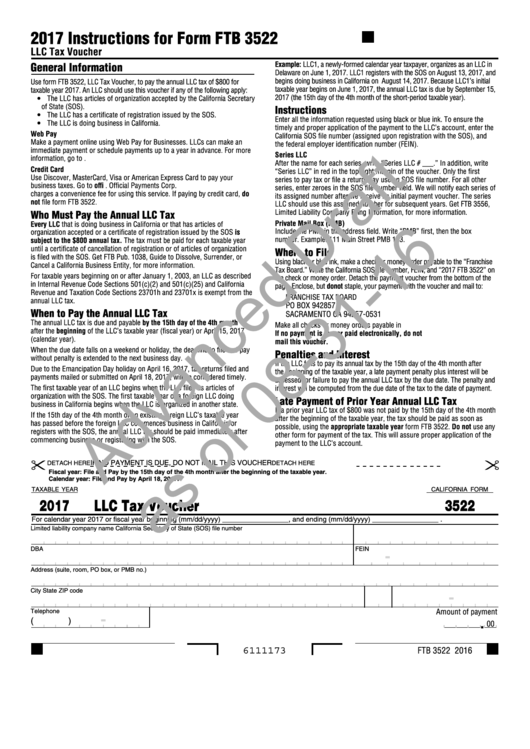

California Form 3522 (Draft) Llc Tax Voucher 2017 printable pdf

Taxable year 2022 or 2023? You can download or print. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Type text, add images, blackout confidential details, add comments, highlights and more. Web file form ftb 3536.

California Tax Form 3522 (Draft) Instructions For Form Ftb 3522 Llc

This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated the limited liability company tax voucher in january 2023, so this is the latest version of form 3522, fully updated for tax year 2022. Web llc tax voucher general information use form ftb 3522, llc tax voucher, to pay the.

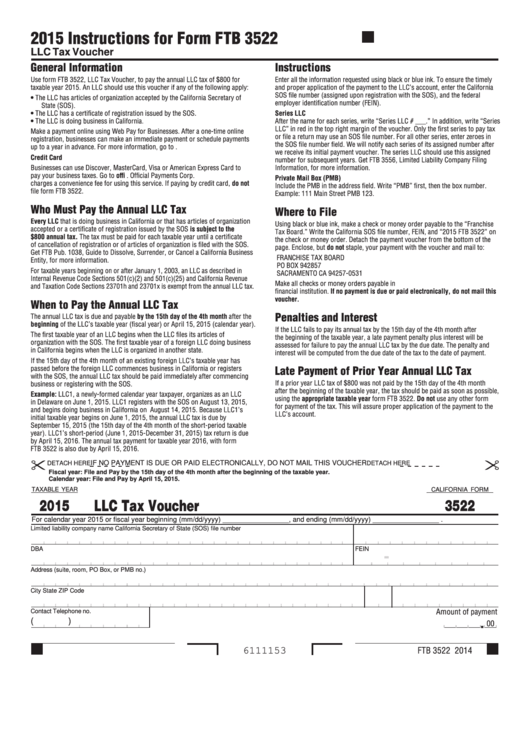

California Form 3522 Llc Tax Voucher 2015 printable pdf download

An llc should use this voucher if any of the following. Web what is form 3522? This annual tax amounts to about $800. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Enjoy smart fillable fields and interactivity.

What is Form 3522?

Draw your signature, type it,. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Select the document you want to sign and click upload. Type text, add images, blackout confidential details, add comments, highlights and more. Who must pay the annual tax?

공장등록증명(신청)서(자가공장, 임대공장) 샘플, 양식 다운로드

An llc should use this voucher if any of the following. Who must pay the annual tax? Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Sign it in a few clicks draw your. Type text, add images, blackout confidential details, add comments, highlights and more.

Ftb 3522 Fill Out and Sign Printable PDF Template signNow

Who must pay the annual tax? Type text, add images, blackout confidential details, add comments, highlights and more. An llc should use this voucher if any of the following. Select the document you want to sign and click upload. Sign it in a few clicks.

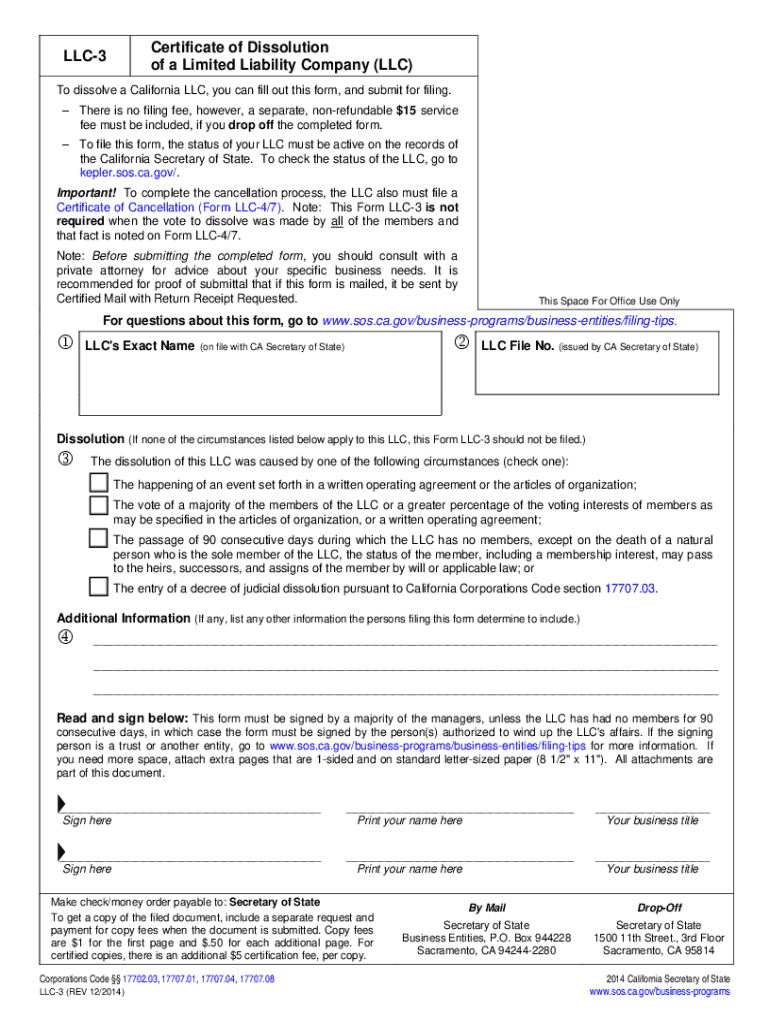

Form LLC4/7 California Secretary of State State of California

Select the document you want to sign and click upload. I’m a little confused because i didn’t need to. The form 3522 is a tax voucher that llcs must use to pay yearly llc tax. Web you need to submit form 3522 with the california ftb yearly, but you can also do it any time before the june 30 due.

2020 Form CA FTB 540 Fill Online, Printable, Fillable, Blank pdfFiller

An llc should use this voucher if any of the following. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Web llc tax voucher general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable.

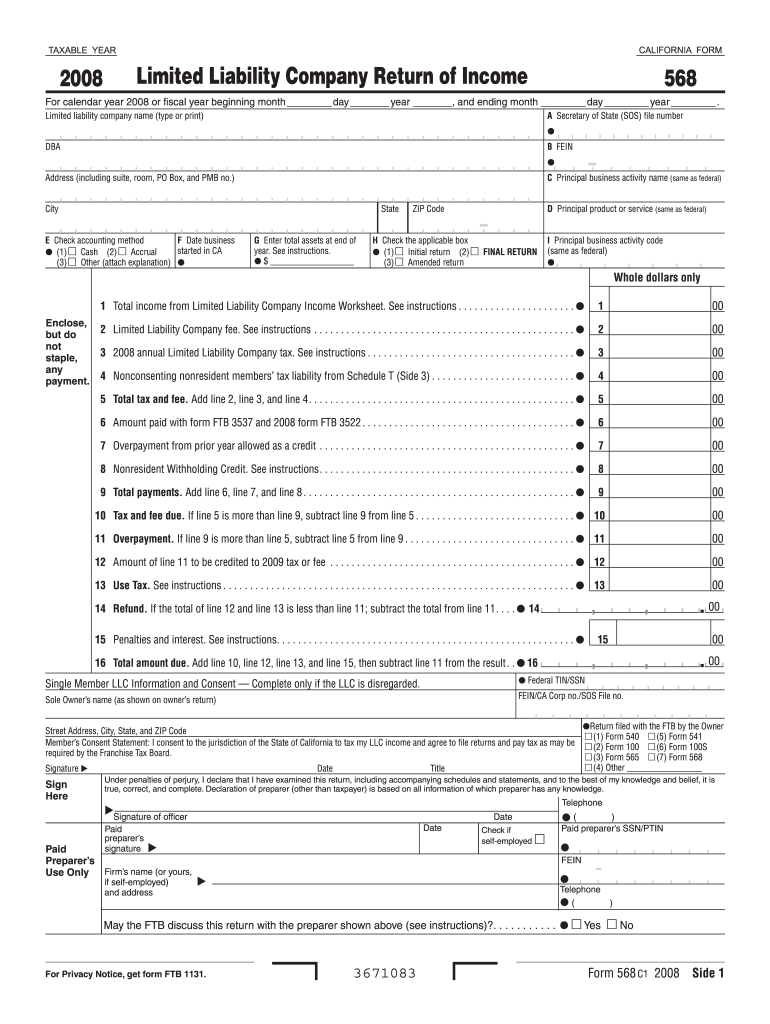

2008 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Get your online template and fill it in using progressive features. Web we last updated california form 3522 in january 2023 from the california franchise tax board. An llc should use this voucher if any of the following. Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income.

Edit Your Ftb 3522 Online.

An llc should use this voucher if any of the following. How it works open the. The form 3522 is a tax voucher that llcs must use to pay yearly llc tax. Web use a form 3522 2023 template to make your document workflow more streamlined.

Select The Document You Want To Sign And Click Upload.

Web file form ftb 3536. Web llc tax voucher general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. An llc should use this voucher if any of the following. Type text, add images, blackout confidential details, add comments, highlights and more.

An Llc Should Use This Voucher If Any Of The Following.

Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Edit your form 3522 california 2022 online type text, add images, blackout confidential details, add comments, highlights and more. Enjoy smart fillable fields and interactivity. Web how to fill out and sign form 3522 2023 online?

Who Must Pay The Annual Tax?

Every formed or registered llc that can do. Use form ftb 3536 if you are paying the 2023 $800 annual llc tax. Web what is form 3522? This annual tax amounts to about $800.