4506-C Form Purpose

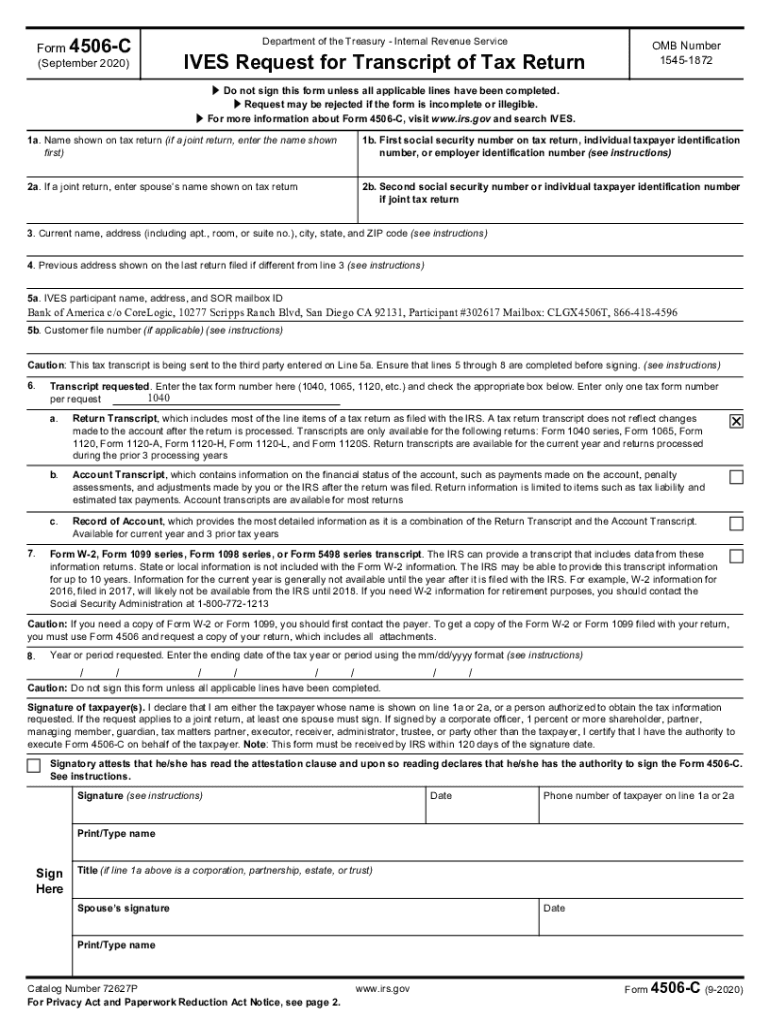

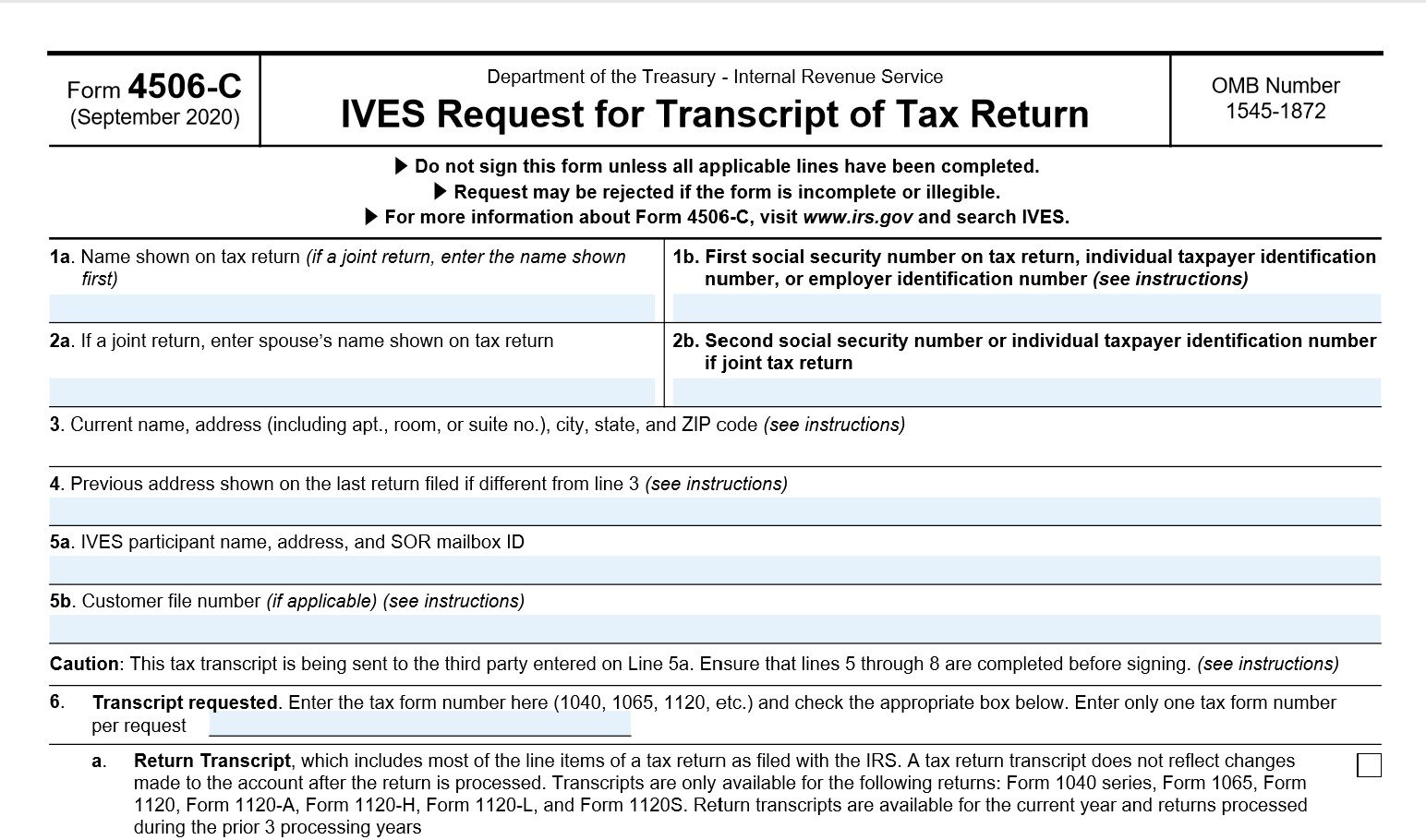

4506-C Form Purpose - Web 4506 request for copy of tax return (novmeber 2021) do not sign this form unless all applicable lines have been completed. With this file, you can choose which transcripts to. Securely download your document with other editable. Fill, sign, print and send online instantly. Request a copy of your tax return, or designate a third party. You will designate (on line 5a) a third party to receive the information. Web the purpose of this form is succinctly promulgated by the irs as follows: However, effective may 1, 2021,. New irs form 4506 for use by irs ives participants control no.: 1, the internal revenue service implemented an.

Request a copy of your tax return, or designate a third party. Web 1 to access the form, click on “click here to review and esign.” 2 enter your password, which is the last four digits of the social security number of the person named in the. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. With this file, you can choose which transcripts to. Web the purpose of this form is succinctly promulgated by the irs as follows: However, effective may 1, 2021,. Web the purpose of this notice is to inform all sba employees and sba lenders that the internal revenue service (irs) has released an updated version of irs form. Fill, sign, print and send online instantly. 1, the internal revenue service implemented an. New irs form 4506 for use by irs ives participants control no.:

Fill, sign, print and send online instantly. However, effective may 1, 2021,. The purpose of this form is to provide authorized third parties with the details about a taxpayer’s past tax returns directly from the irs,. Web the purpose of this notice is to inform all sba employees and sba lenders that the internal revenue service (irs) has released an updated version of irs form. December 11, 2020 the purpose of this notice is to inform all sba. You will designate (on line 5a) a third party to receive the information. With this file, you can choose which transcripts to. New irs form 4506 for use by irs ives participants control no.: Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. Web 4506 request for copy of tax return (novmeber 2021) do not sign this form unless all applicable lines have been completed.

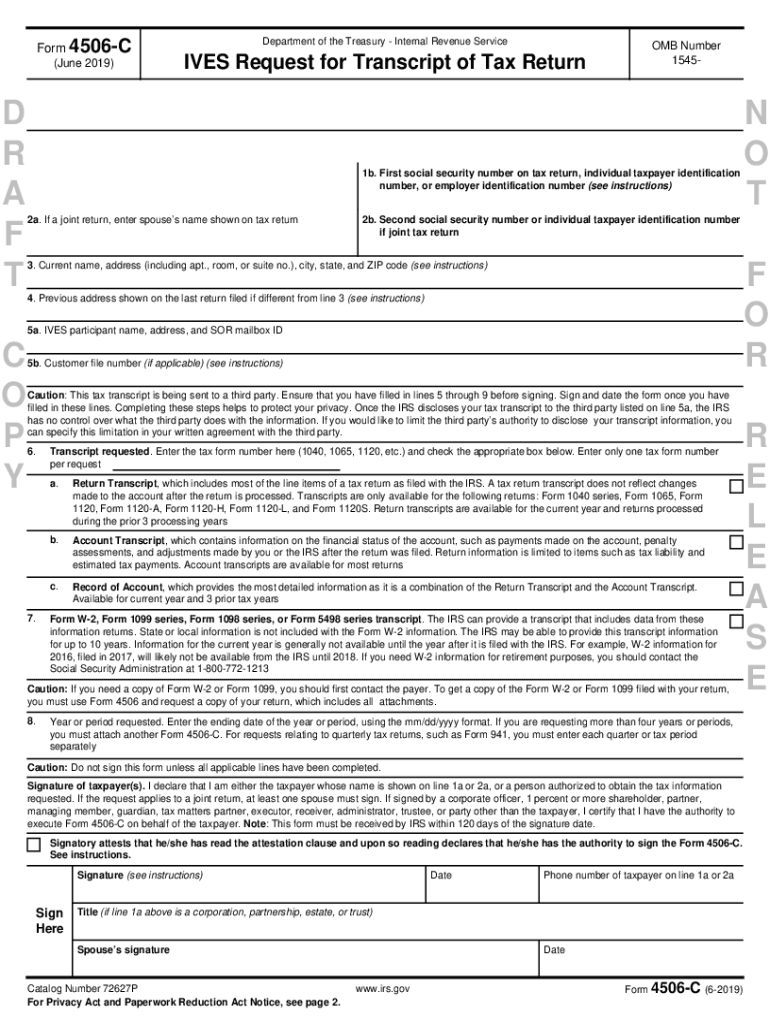

4506 C Pdf Fill and Sign Printable Template Online US Legal Forms

New irs form 4506 for use by irs ives participants control no.: Request a copy of your tax return, or designate a third party. December 11, 2020 the purpose of this notice is to inform all sba. The purpose of this form is to provide authorized third parties with the details about a taxpayer’s past tax returns directly from the.

Form 4506t Edit, Fill, Sign Online Handypdf

New irs form 4506 for use by irs ives participants control no.: Web 4506 request for copy of tax return (novmeber 2021) do not sign this form unless all applicable lines have been completed. With this file, you can choose which transcripts to. The purpose of this form is to provide authorized third parties with the details about a taxpayer’s.

Information of form 4506 T YouTube

Web the purpose of this notice is to inform all sba employees and sba lenders that the internal revenue service (irs) has released an updated version of irs form. The purpose of this form is to provide authorized third parties with the details about a taxpayer’s past tax returns directly from the irs,. December 11, 2020 the purpose of this.

Form 4506T YouTube

Request a copy of your tax return, or designate a third party. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. New irs form 4506 for use by irs ives participants control no.: Web 4506 request for copy of tax return (novmeber 2021) do not sign this form unless all applicable lines.

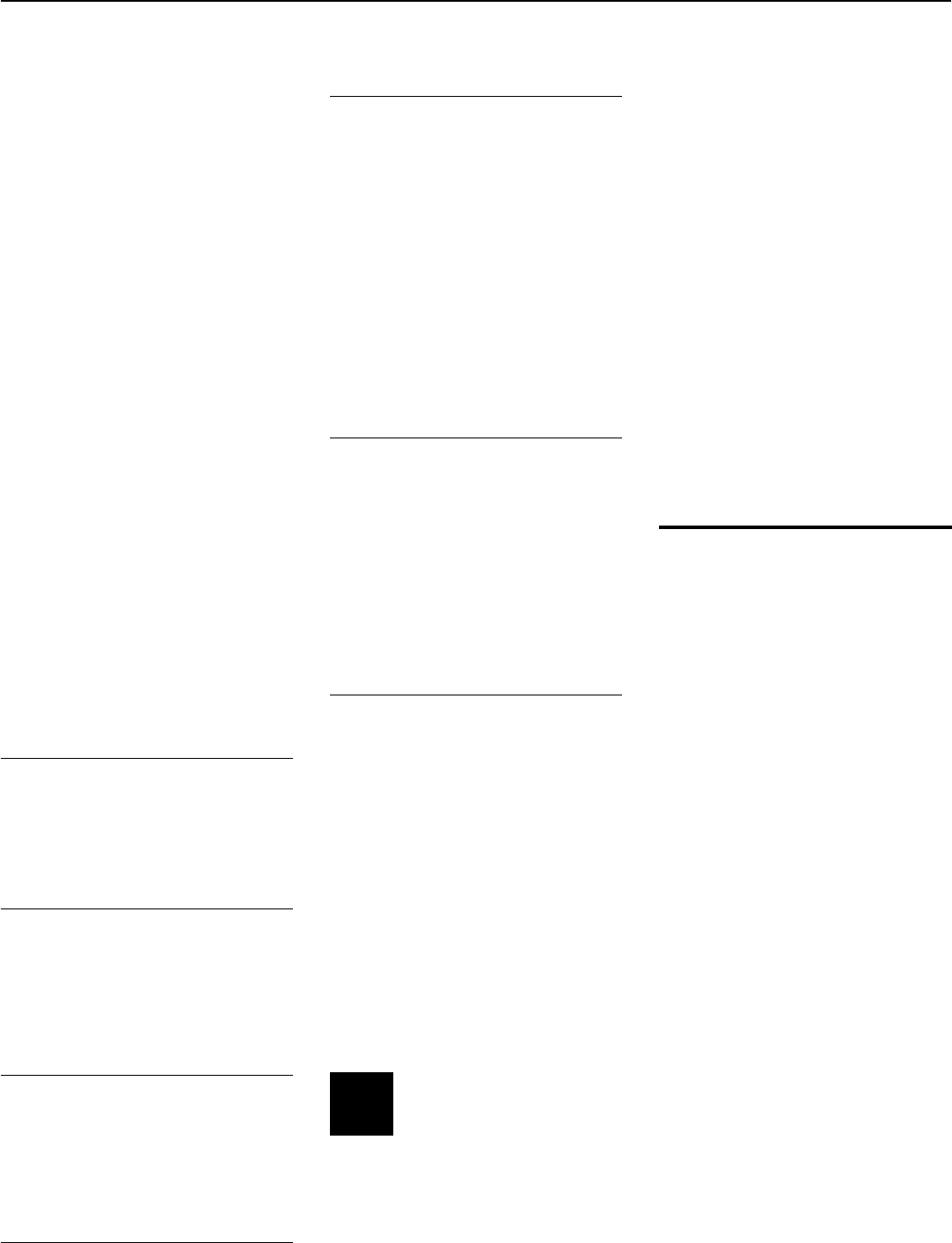

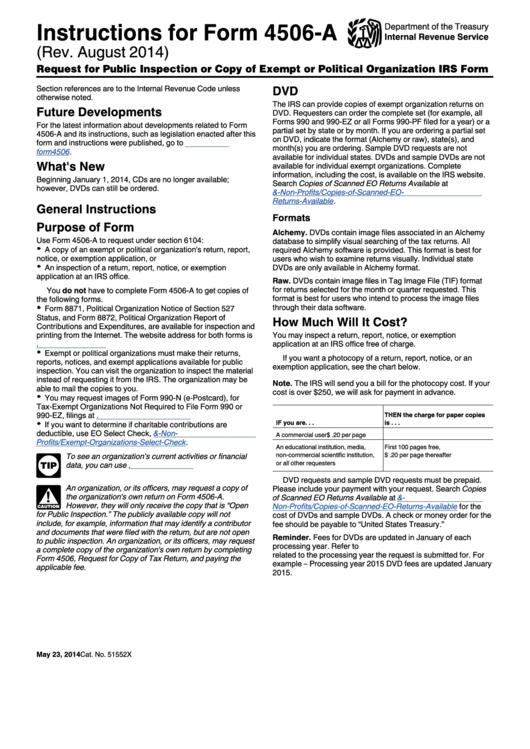

Form 4506A Request For Public Inspection Or Copy Of Exempt

Fill, sign, print and send online instantly. With this file, you can choose which transcripts to. Securely download your document with other editable. New irs form 4506 for use by irs ives participants control no.: Web form 4506 is used by taxpayers to request copies of their tax returns for a fee.

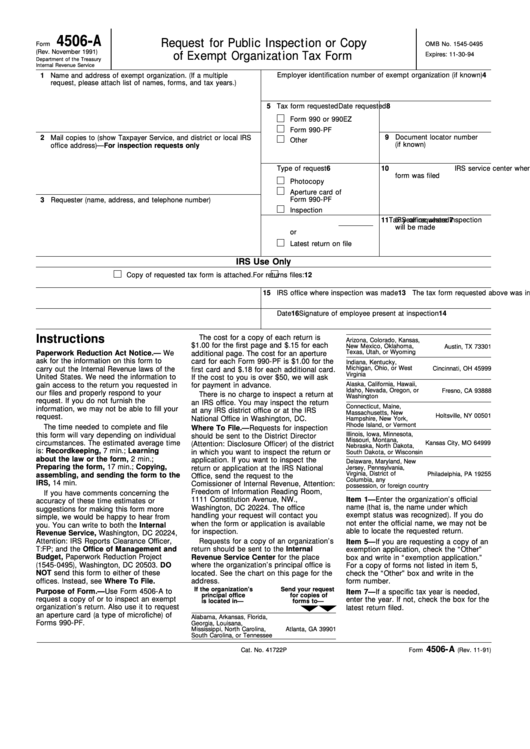

Form M4506 Request For Copy Of Tax Form printable pdf download

New irs form 4506 for use by irs ives participants control no.: With this file, you can choose which transcripts to. Request a copy of your tax return, or designate a third party. Web 4506 request for copy of tax return (novmeber 2021) do not sign this form unless all applicable lines have been completed. 1, the internal revenue service.

4506 C Fillable Form Fill and Sign Printable Template Online US

Fill, sign, print and send online instantly. The purpose of this form is to provide authorized third parties with the details about a taxpayer’s past tax returns directly from the irs,. New irs form 4506 for use by irs ives participants control no.: With this file, you can choose which transcripts to. Web the purpose of this notice is to.

The IRS to replace Form 4506T/TEZ, now extended 60 days.

Fill, sign, print and send online instantly. Web 4506 request for copy of tax return (novmeber 2021) do not sign this form unless all applicable lines have been completed. Web the purpose of this notice is to inform all sba employees and sba lenders that the internal revenue service (irs) has released an updated version of irs form. Securely download.

DocMagic Blog Mortgage news to keep you compliant IRS

Web 4506 request for copy of tax return (novmeber 2021) do not sign this form unless all applicable lines have been completed. With this file, you can choose which transcripts to. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. December 11, 2020 the purpose of this notice is to inform all.

Instructions For Form 4506A (Rev. August 2014) printable pdf download

1, the internal revenue service implemented an. Web the purpose of this notice is to inform all sba employees and sba lenders that the internal revenue service (irs) has released an updated version of irs form. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. December 11, 2020 the purpose of this.

Fill, Sign, Print And Send Online Instantly.

New irs form 4506 for use by irs ives participants control no.: You will designate (on line 5a) a third party to receive the information. 1, the internal revenue service implemented an. However, effective may 1, 2021,.

Web Form 4506 Is Used By Taxpayers To Request Copies Of Their Tax Returns For A Fee.

Web the purpose of this notice is to inform all sba employees and sba lenders that the internal revenue service (irs) has released an updated version of irs form. With this file, you can choose which transcripts to. Web 4506 request for copy of tax return (novmeber 2021) do not sign this form unless all applicable lines have been completed. Web 1 to access the form, click on “click here to review and esign.” 2 enter your password, which is the last four digits of the social security number of the person named in the.

Request A Copy Of Your Tax Return, Or Designate A Third Party.

Securely download your document with other editable. December 11, 2020 the purpose of this notice is to inform all sba. The purpose of this form is to provide authorized third parties with the details about a taxpayer’s past tax returns directly from the irs,. Web the purpose of this form is succinctly promulgated by the irs as follows: