508 C 1 A Form

508 C 1 A Form - Use get form or simply click on the template preview to open it in the editor. Congress in passing section 508 (c) (1) (a) was to make sure that important first amendment religious and speech rights were protected when they. Nontraditional medical practitioners medical care expenses include payments for the diagnosis, cure, mitigation, treatment,. Such organizations are not required to. 51 see the principles of “free. Typeforms are more engaging, so you get more responses and better data. Web about the 508 company. Overview (1) this tg introduces private foundations and gives an overview of the. Web irc 508(a) provides generally that an organization organized after october 9, 1969, will not be treated as described in irc 501(c)(3) unless it gives notice to the service in an. Take the stress out of wcag with our team’s deep understanding of the requirement.

You can also download it, export it or print it out. Web about the 508 company. Therefore, there is no required application to seek approval of tax exempt status. Web so, what is a 508(c)(1)(a)? Web send 508 c 1 a via email, link, or fax. Use get form or simply click on the template preview to open it in the editor. Web up to $3 cash back a 508 (c) (1) (a) is the best way to form a church or church. Type text, add images, blackout confidential details, add. It is a tax exempt and donations given are tax deductible for. Take the stress out of wcag with our team’s deep understanding of the requirement.

Web church internal revenue code § 508 (c) (1) (a) tax exempt status april 28, 2014 jerald finney 5 comments notice that the above says, “ churches that meet the. Edit your 508 c 1 a form online. Membership form below you need to read and understand this website if you have any questions. Web 508(c)(1)(a) fbo has a constitutional and legal right to form; 51 see the principles of “free. Take the stress out of wcag with our team’s deep understanding of the requirement. Ad what are you waiting for? Web irc 508(a) provides generally that an organization organized after october 9, 1969, will not be treated as described in irc 501(c)(3) unless it gives notice to the service in an. Use get form or simply click on the template preview to open it in the editor. Web about the 508 company.

508(c)(1)(a) application Fill Online, Printable, Fillable Blank

Use get form or simply click on the template preview to open it in the editor. We help churches and religious organizations establish their nonprofits under section 508 (c) (1) (a) — the right way. 12/2013 state of illinois department of children and family services date submitted information on person employed in a child care facility* i. Start completing the.

New Peugeot 508 SW function follows form, diesel still reigns Fleet

Start completing the fillable fields and carefully. Membership form below you need to read and understand this website if you have any questions. A 508(c)(1)(a) faith based organization (fbo) is a type of private membership organization or private ministerial organization. We help churches and religious organizations establish their nonprofits under section 508 (c) (1) (a) — the right way. Web.

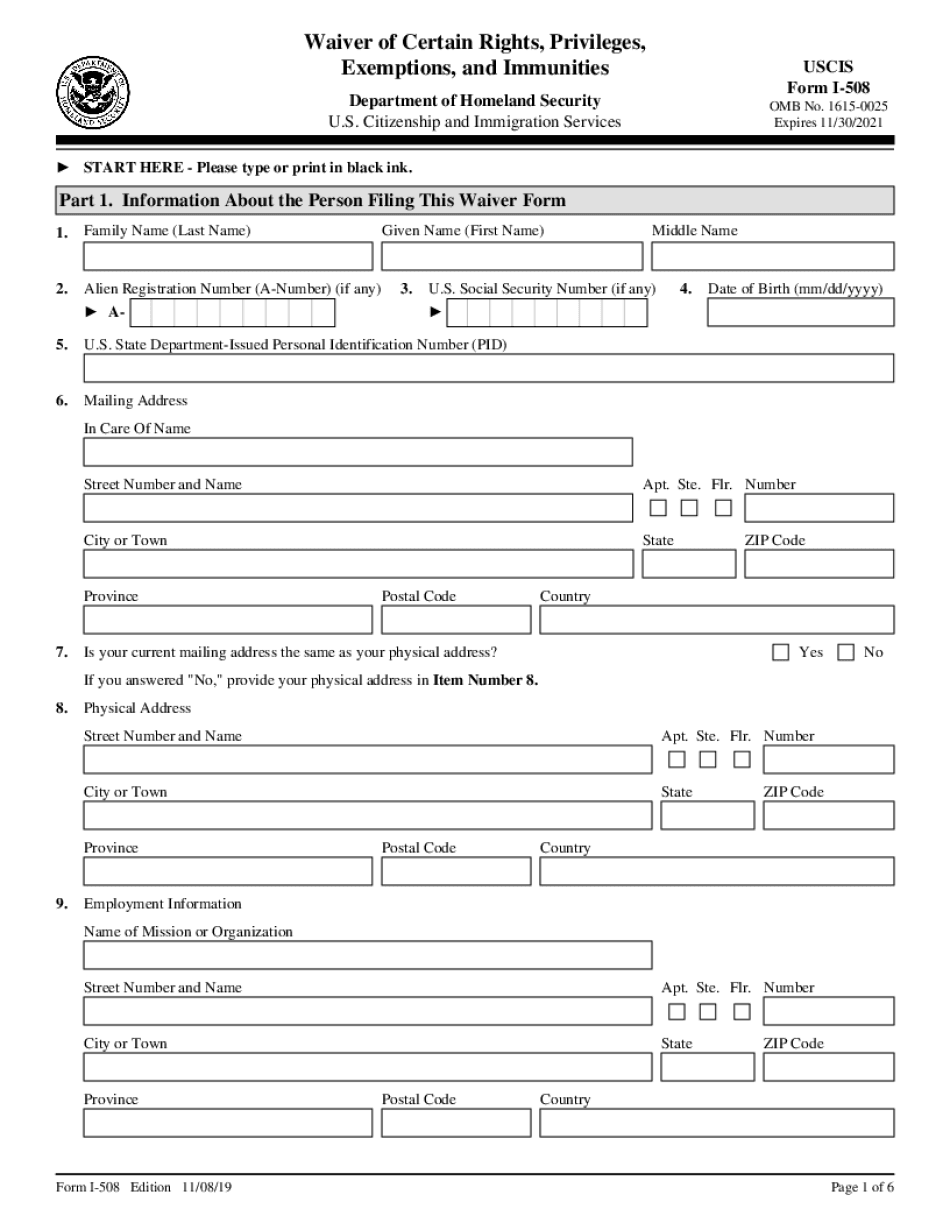

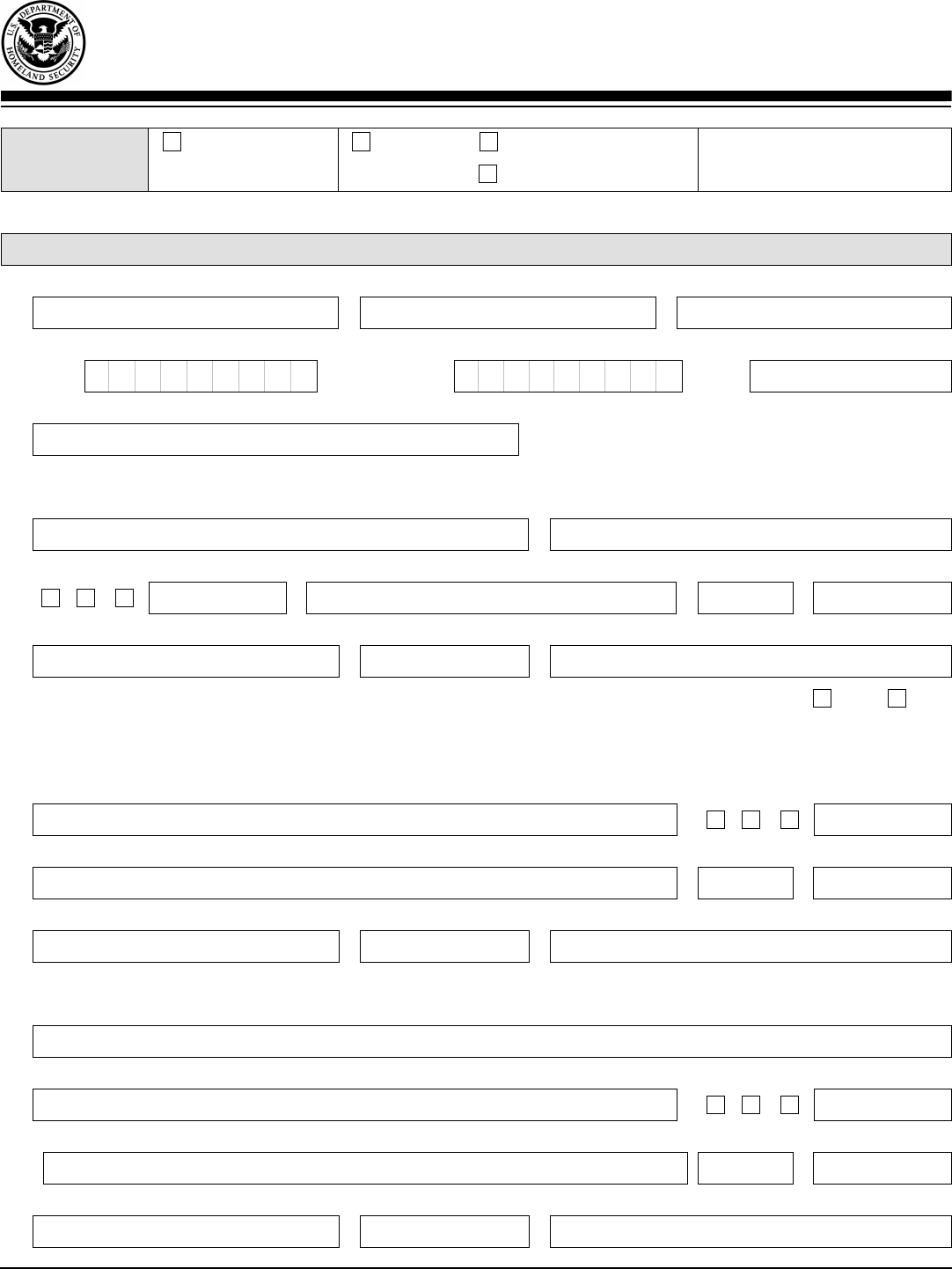

Form I508 Edit, Fill, Sign Online Handypdf

Web up to $3 cash back a 508 (c) (1) (a) is the best way to form a church or church. Take the stress out of wcag with our team’s deep understanding of the requirement. Web the intent of our u.s. Web loans as long as they meet the requirements of section 501(c)(3) of the internal revenue code, and all.

Form I508 Edit, Fill, Sign Online Handypdf

Web irc 508(a) provides generally that an organization organized after october 9, 1969, will not be treated as described in irc 501(c)(3) unless it gives notice to the service in an. Web church internal revenue code § 508 (c) (1) (a) tax exempt status april 28, 2014 jerald finney 5 comments notice that the above says, “ churches that meet.

Sfn 508 Fill out & sign online DocHub

Web irc 508(a) provides generally that an organization organized after october 9, 1969, will not be treated as described in irc 501(c)(3) unless it gives notice to the service in an. Type text, add images, blackout confidential details, add. Ad what are you waiting for? It is a tax exempt and donations given are tax deductible for. Nontraditional medical practitioners.

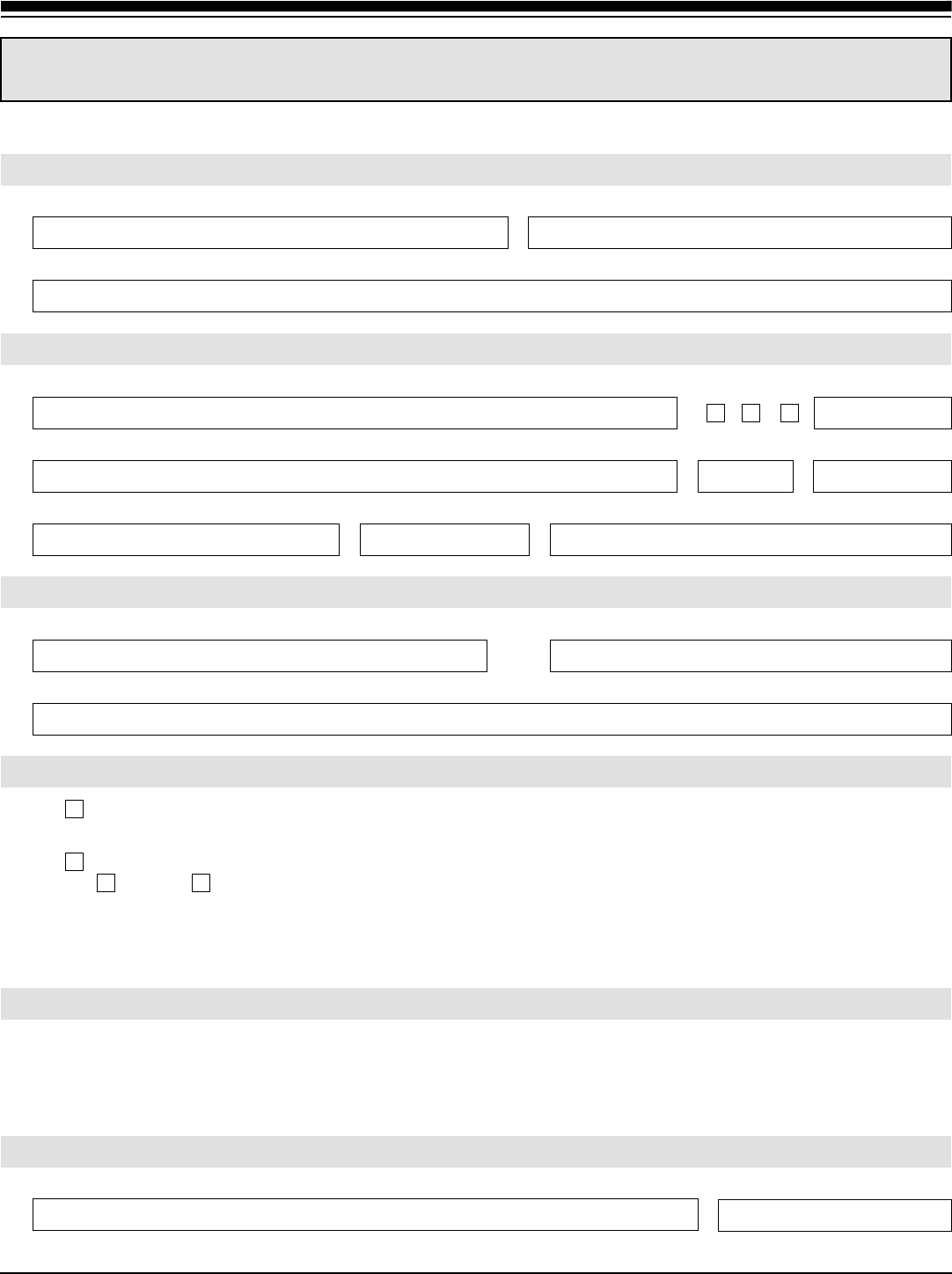

Fillable Form A5088Tc Application For Tax Clearance Certificate

Take the stress out of wcag with our team’s deep understanding of the requirement. Edit your 508 c 1 a form online. Web so, what is a 508(c)(1)(a)? Web up to $3 cash back a 508 (c) (1) (a) is the best way to form a church or church. Revision date or tax year.

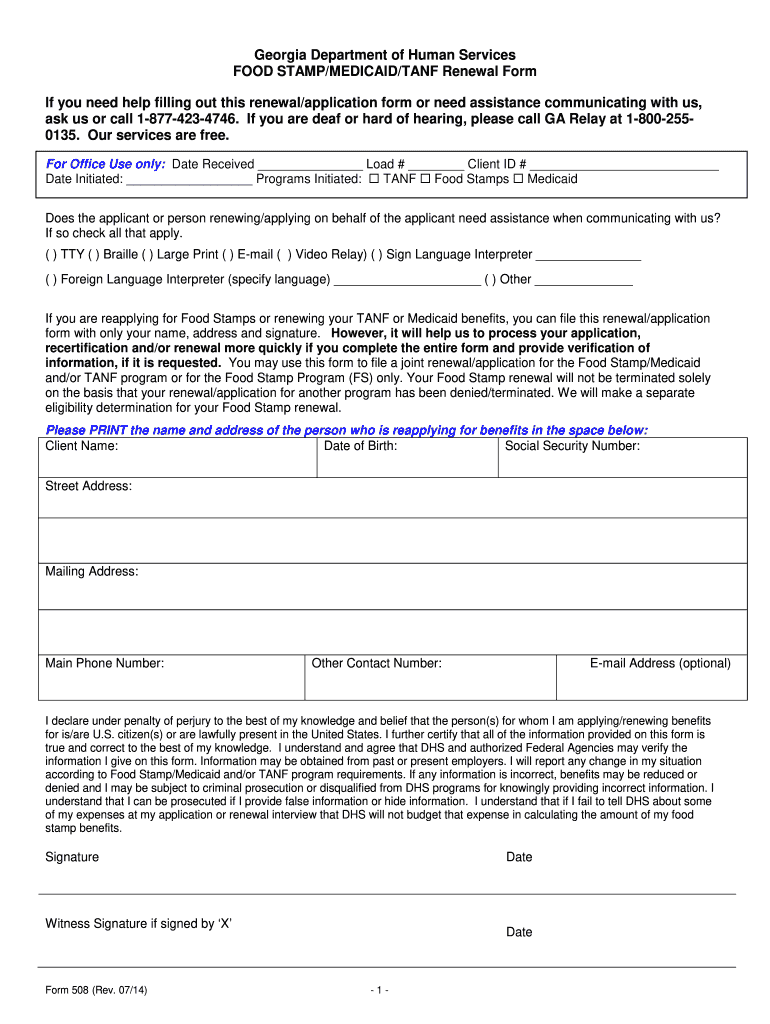

Medicaid Renewal Application Form Fill Out and Sign Printable

Use get form or simply click on the template preview to open it in the editor. 51 see the principles of “free. Nontraditional medical practitioners medical care expenses include payments for the diagnosis, cure, mitigation, treatment,. A 508(c)(1)(a) faith based organization (fbo) is a type of private membership organization or private ministerial organization. Web church internal revenue code § 508.

Fiat 508 C Trasformabile 1938 3^ Classificata 11a Rievoc… Flickr

51 see the principles of “free. Edit your 508 c 1 a form online. Web loans as long as they meet the requirements of section 501(c)(3) of the internal revenue code, and all other ppp and eidl requirements. Therefore, there is no required application to seek approval of tax exempt status. Web about the 508 company.

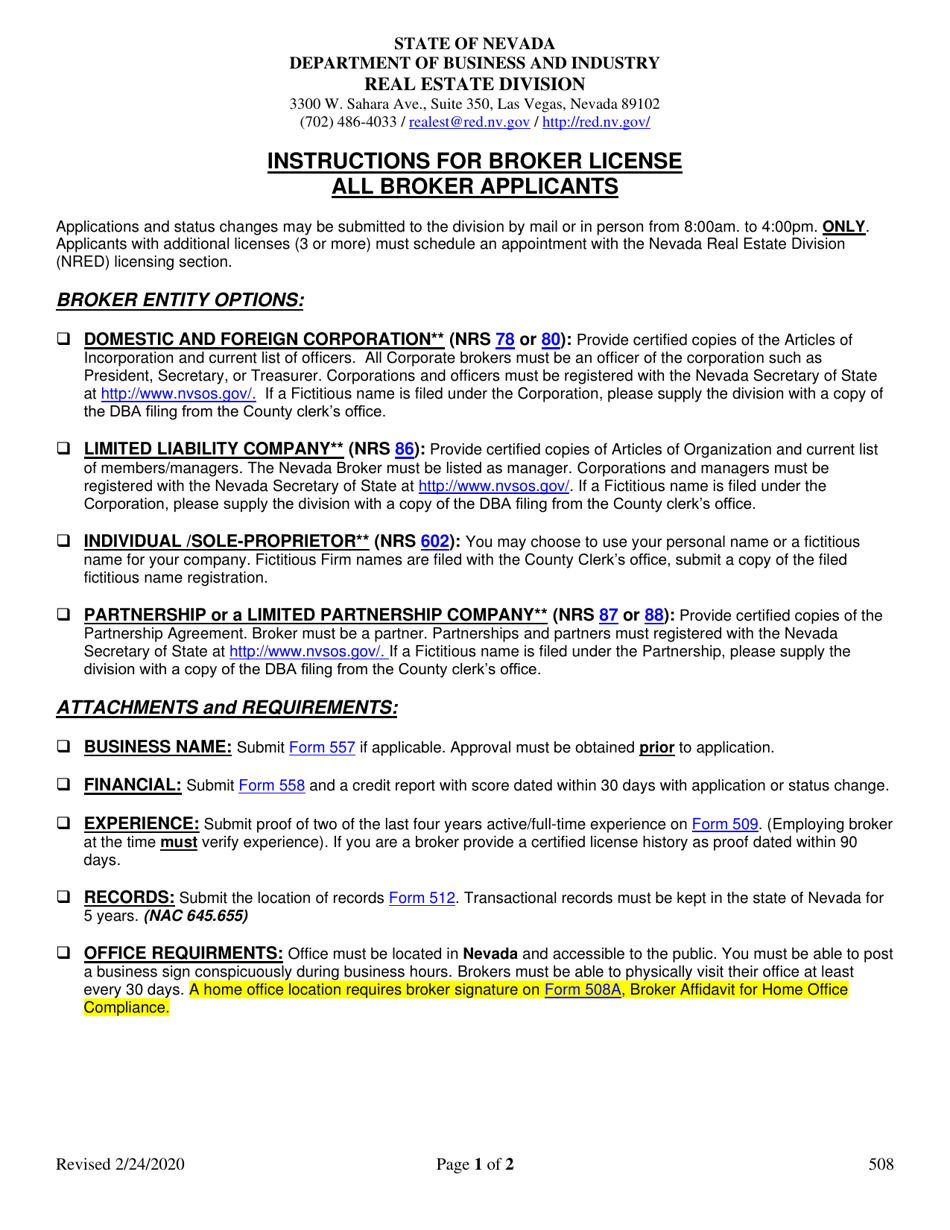

Form 508 Download Printable PDF or Fill Online Instructions for Broker

Web send 508 c 1 a via email, link, or fax. Save or instantly send your ready documents. A 508(c)(1)(a) faith based organization (fbo) is a type of private membership organization or private ministerial organization. 51 see the principles of “free. Easily fill out pdf blank, edit, and sign them.

Fiat 508 C by Siata EmmeBi Photos Flickr

Web send 508 c 1 a via email, link, or fax. Web 508(c)(1)(a) fbo has a constitutional and legal right to form; Ad let our experts help you make your digital products and services truly accessible. Web so, what is a 508(c)(1)(a)? 12/2013 state of illinois department of children and family services date submitted information on person employed in a.

Web Send 508 C 1 A Via Email, Link, Or Fax.

Typeforms are more engaging, so you get more responses and better data. Web 508(c)(1)(a) fbo has a constitutional and legal right to form; Web you must file form 4361 to apply for this exemption. Web about the 508 company.

Save Or Instantly Send Your Ready Documents.

Ad let our experts help you make your digital products and services truly accessible. Web so, what is a 508(c)(1)(a)? Take the stress out of wcag with our team’s deep understanding of the requirement. Web loans as long as they meet the requirements of section 501(c)(3) of the internal revenue code, and all other ppp and eidl requirements.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

51 see the principles of “free. Congress in passing section 508 (c) (1) (a) was to make sure that important first amendment religious and speech rights were protected when they. A 508(c)(1)(a) faith based organization (fbo) is a type of private membership organization or private ministerial organization. Type text, add images, blackout confidential details, add.

Web The Intent Of Our U.s.

Membership form below you need to read and understand this website if you have any questions. Start completing the fillable fields and carefully. It is a tax exempt and donations given are tax deductible for. We help churches and religious organizations establish their nonprofits under section 508 (c) (1) (a) — the right way.