5329 Form 2021

5329 Form 2021 - Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. I have tt desktop edition and have successfully filled out form 5329 and the waiver explanation. Web form 5329 (2022) page. Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329. Individual income tax return, line 6 for additional tax on iras, other qualified retirement plans, etc. Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly , each spouse must complete their own form. My question is will the waiver explanation efile with my return or do i have print and mail? If you file form 5329 by itself, 2 part v additional tax on excess contributions to coverdell esas. These distributions must be for your life or life expectancy, or the joint lives or joint life expectancies of you and your beneficiary.

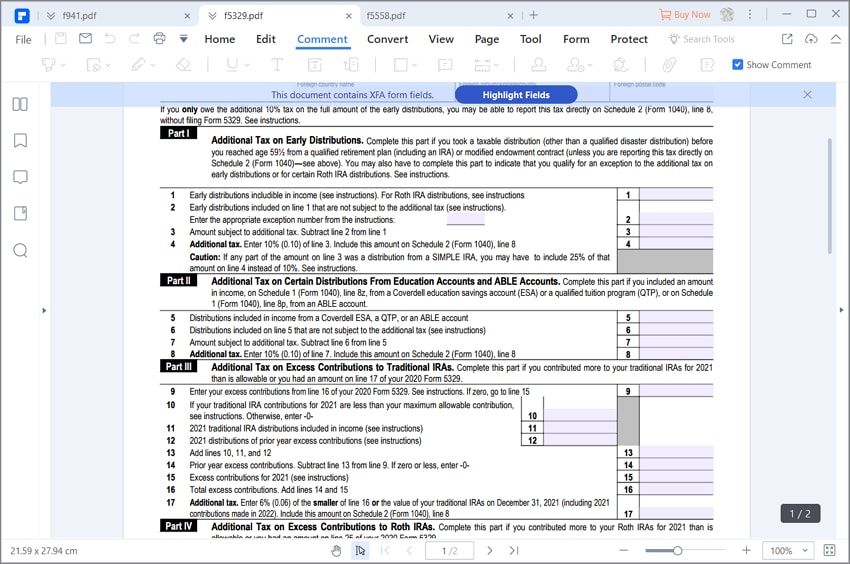

Enter the excess contributions from line 32 of your 2021 form 5329. Complete this part if the contributions to your coverdell esas for 2022 were more than is allowable or you had an amount on line 33 of your 2021 form 5329. I have tt desktop edition and have successfully filled out form 5329 and the waiver explanation. Web form 5329 (2022) page. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. 2 part v additional tax on excess contributions to coverdell esas. These distributions must be for your life or life expectancy, or the joint lives or joint life expectancies of you and your beneficiary. Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329. Web you can claim an exemption on ira withdrawals with form 5329, but how do you know if you're eligible? Web form 5329 is the tax form used to calculate possibly irs penalties from the situations listed above and possibly request a penalty waiver.

Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly , each spouse must complete their own form. My question is will the waiver explanation efile with my return or do i have print and mail? Individual income tax return, line 6 for additional tax on iras, other qualified retirement plans, etc. Get tax answers at h&r block. Web form 5329 (2022) page. I have tt desktop edition and have successfully filled out form 5329 and the waiver explanation. If you file form 5329 by itself, Web you can claim an exemption on ira withdrawals with form 5329, but how do you know if you're eligible? 2 part v additional tax on excess contributions to coverdell esas.

Form 5329 Edit, Fill, Sign Online Handypdf

These distributions must be for your life or life expectancy, or the joint lives or joint life expectancies of you and your beneficiary. Web you can claim an exemption on ira withdrawals with form 5329, but how do you know if you're eligible? If you file form 5329 by itself, 2 part v additional tax on excess contributions to coverdell.

2012 form 5329 Fill out & sign online DocHub

Enter the excess contributions from line 32 of your 2021 form 5329. Web form 5329 is the tax form used to calculate possibly irs penalties from the situations listed above and possibly request a penalty waiver. Get tax answers at h&r block. Complete this part if the contributions to your coverdell esas for 2022 were more than is allowable or.

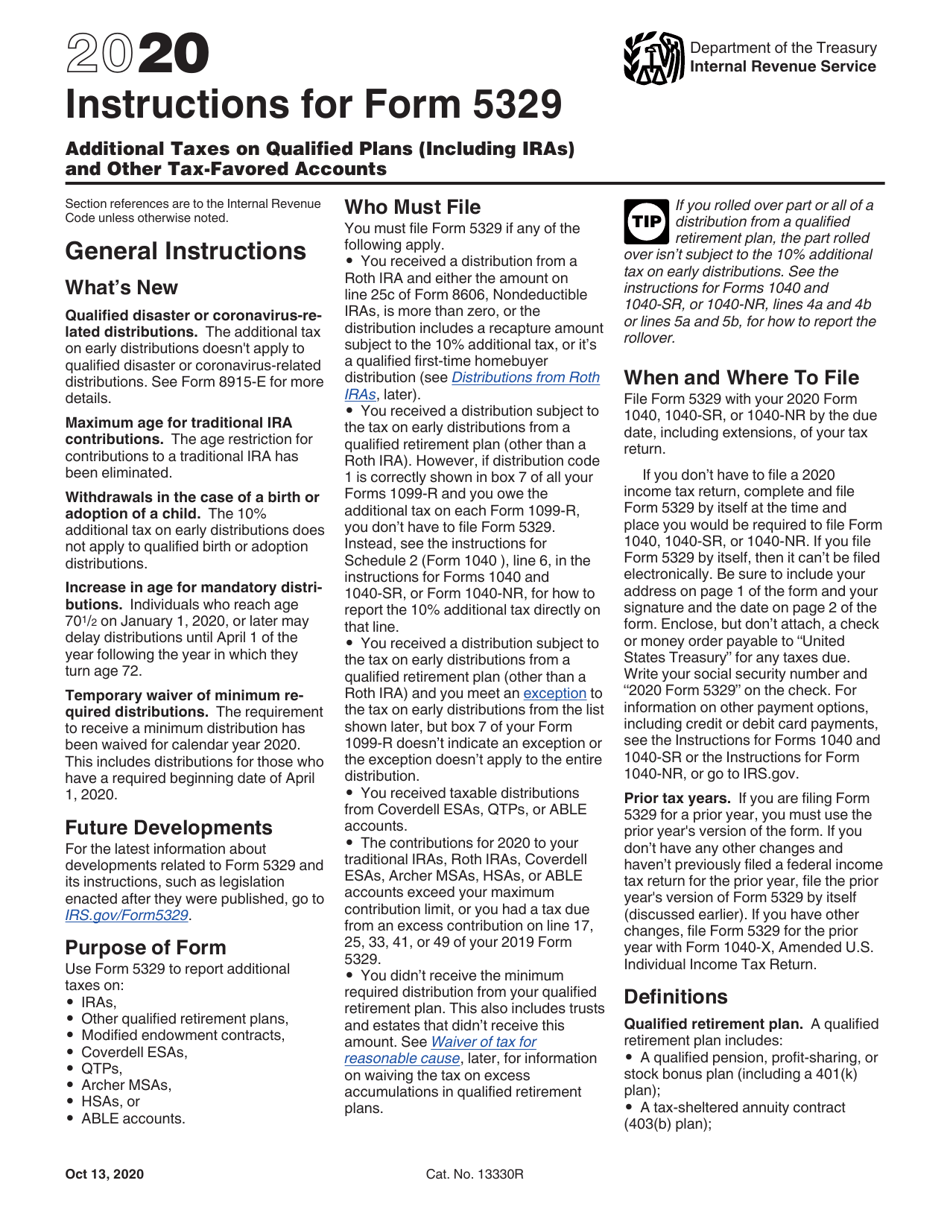

Form 5329 Instructions & Exception Information for IRS Form 5329

Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Individual income tax return, line 6 for additional tax on iras, other qualified retirement plans, etc. Get tax answers at h&r block. Complete this part if the contributions to your coverdell esas for 2022 were more.

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Web form 5329 (2022) page. Individual income tax return, line 6 for additional tax on iras, other qualified retirement plans, etc. If you file form 5329 by itself, Enter the excess contributions from line 32 of your 2021 form 5329. Go to www.irs.gov/form5329 for instructions and the latest information.

IRS Form 5329 [For Retirement Savings And More] Tax Relief Center

Web you can claim an exemption on ira withdrawals with form 5329, but how do you know if you're eligible? Get tax answers at h&r block. These distributions must be for your life or life expectancy, or the joint lives or joint life expectancies of you and your beneficiary. My question is will the waiver explanation efile with my return.

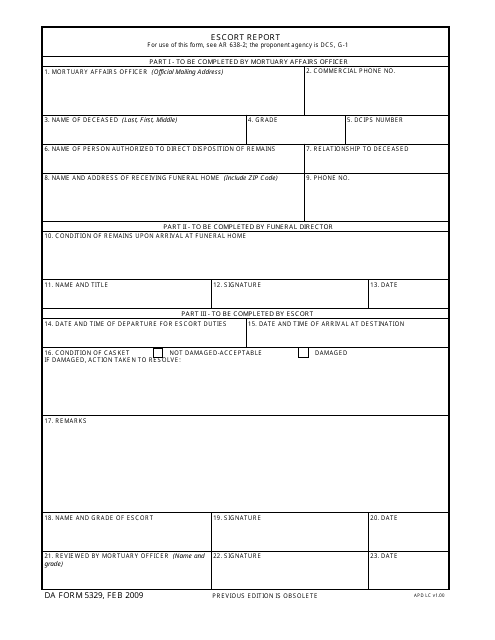

DA Form 5329 Download Fillable PDF or Fill Online Escort Report

2 part v additional tax on excess contributions to coverdell esas. If you file form 5329 by itself, My question is will the waiver explanation efile with my return or do i have print and mail? Enter the excess contributions from line 32 of your 2021 form 5329. Web form 5329 (2022) page.

How to Fill in IRS Form 5329

Individual income tax return, line 6 for additional tax on iras, other qualified retirement plans, etc. Web you can claim an exemption on ira withdrawals with form 5329, but how do you know if you're eligible? If you file form 5329 by itself, 2 part v additional tax on excess contributions to coverdell esas. My question is will the waiver.

Download Instructions for IRS Form 5329 Additional Taxes on Qualified

Web you can claim an exemption on ira withdrawals with form 5329, but how do you know if you're eligible? Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329. Individual income tax return, line 6 for additional tax on iras, other qualified retirement plans, etc. If you.

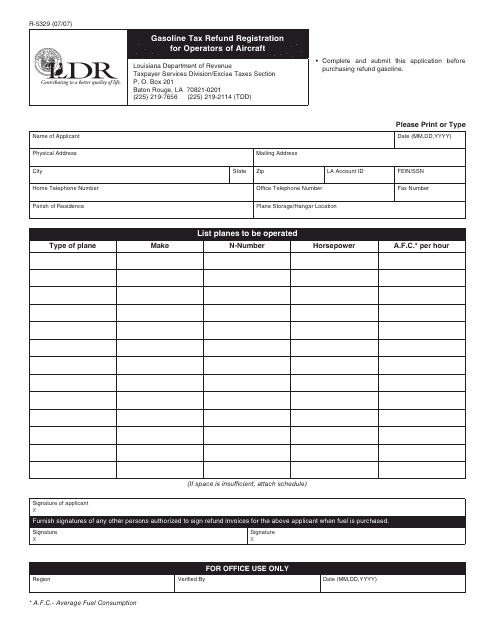

Form R5329 Download Printable PDF or Fill Online Gasoline Tax Refund

Get tax answers at h&r block. Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly , each spouse must complete their own form. Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329. My question is will the waiver explanation.

I9 Form 2021 I9 Forms intended for Form I9 2021 Printable

Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Enter the excess contributions from line 32 of your 2021 form 5329. Get tax answers at h&r block. Web you can claim an exemption on ira withdrawals with form 5329, but how do you know if.

Individual Income Tax Return, Line 6 For Additional Tax On Iras, Other Qualified Retirement Plans, Etc.

Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly , each spouse must complete their own form. These distributions must be for your life or life expectancy, or the joint lives or joint life expectancies of you and your beneficiary. 2 part v additional tax on excess contributions to coverdell esas. Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329.

Web Form 5329 Is The Tax Form Used To Calculate Possibly Irs Penalties From The Situations Listed Above And Possibly Request A Penalty Waiver.

Go to www.irs.gov/form5329 for instructions and the latest information. If you file form 5329 by itself, Web form 5329 (2022) page. Web you can claim an exemption on ira withdrawals with form 5329, but how do you know if you're eligible?

I Have Tt Desktop Edition And Have Successfully Filled Out Form 5329 And The Waiver Explanation.

Enter the excess contributions from line 32 of your 2021 form 5329. Get tax answers at h&r block. My question is will the waiver explanation efile with my return or do i have print and mail? Complete this part if the contributions to your coverdell esas for 2022 were more than is allowable or you had an amount on line 33 of your 2021 form 5329.

![IRS Form 5329 [For Retirement Savings And More] Tax Relief Center](https://help.taxreliefcenter.org/wp-content/uploads/2018/04/businessman-on-meeting-commenting-document-form-5329-ss-1024x683.jpg)