592-B Form

592-B Form - Resident and nonresident withholding statement created date: We assess a penalty for failure to file complete, correct, and timely information returns. Do not use form 592 if: I was able to enter total california tax withheld for both the federal and california returns, but i am not sure where to enter total income subject to withholding on the federal return. Web file form 592 to report withholding on domestic nonresident individuals. Web 2022 form 592 resident and nonresident withholding statement author: 2022, form 592, resident and nonresident withholding statement keywords: Go to the california > california individual (form 540/540nr) > general worksheet. For more information go to ftb.ca.gov and You are reporting withholding as a pass through entity.

Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, etc. Do not use form 592 if: I was able to enter total california tax withheld for both the federal and california returns, but i am not sure where to enter total income subject to withholding on the federal return. With their state tax return. Resident and nonresident withholding statement created date: This form can be provided to the payee electronically. You are reporting withholding as a pass through entity. Web 2022 form 592 resident and nonresident withholding statement author: For more information go to ftb.ca.gov and We assess a penalty for failure to file complete, correct, and timely information returns.

Do not use form 592 if: With their state tax return. Resident and nonresident withholding statement created date: Web 2022 form 592 resident and nonresident withholding statement author: Web 2022 ca form 592, resident and nonresident withholding statement. You are reporting withholding as a pass through entity. Instead, you withheld an amount to help pay taxes when you do your california return. We assess a penalty for failure to file complete, correct, and timely information returns. 2022, form 592, resident and nonresident withholding statement keywords: Go to the california > california individual (form 540/540nr) > general worksheet.

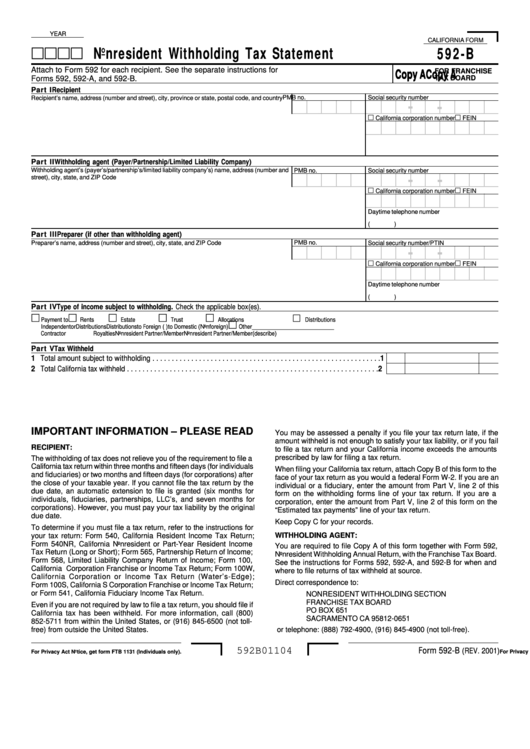

Form 592B Nonresident Withholding Tax Statement 2001 printable pdf

With their state tax return. This form can be provided to the payee electronically. Resident and nonresident withholding statement created date: Web 2022 ca form 592, resident and nonresident withholding statement. Web 2022 form 592 resident and nonresident withholding statement author:

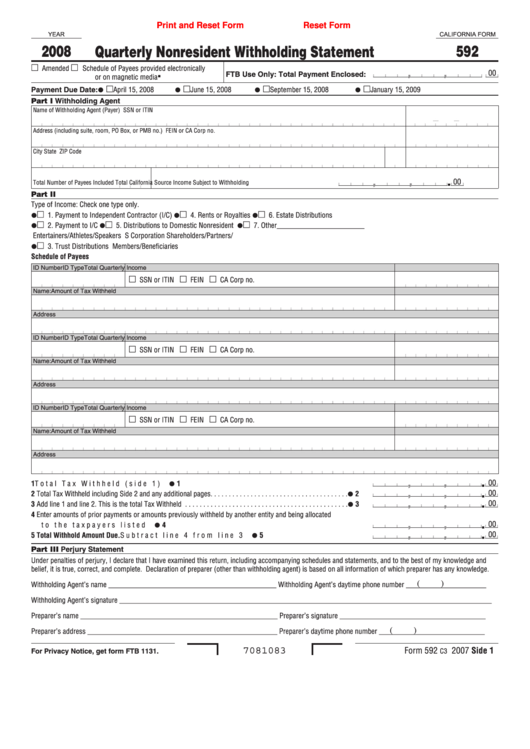

2013 Form CA FTB 592 Fill Online, Printable, Fillable, Blank pdfFiller

Instead, you withheld an amount to help pay taxes when you do your california return. Do not use form 592 if: Web 2022 ca form 592, resident and nonresident withholding statement. We assess a penalty for failure to file complete, correct, and timely information returns. Items of income that are subject to withholding are payments to independent contractors, recipients of.

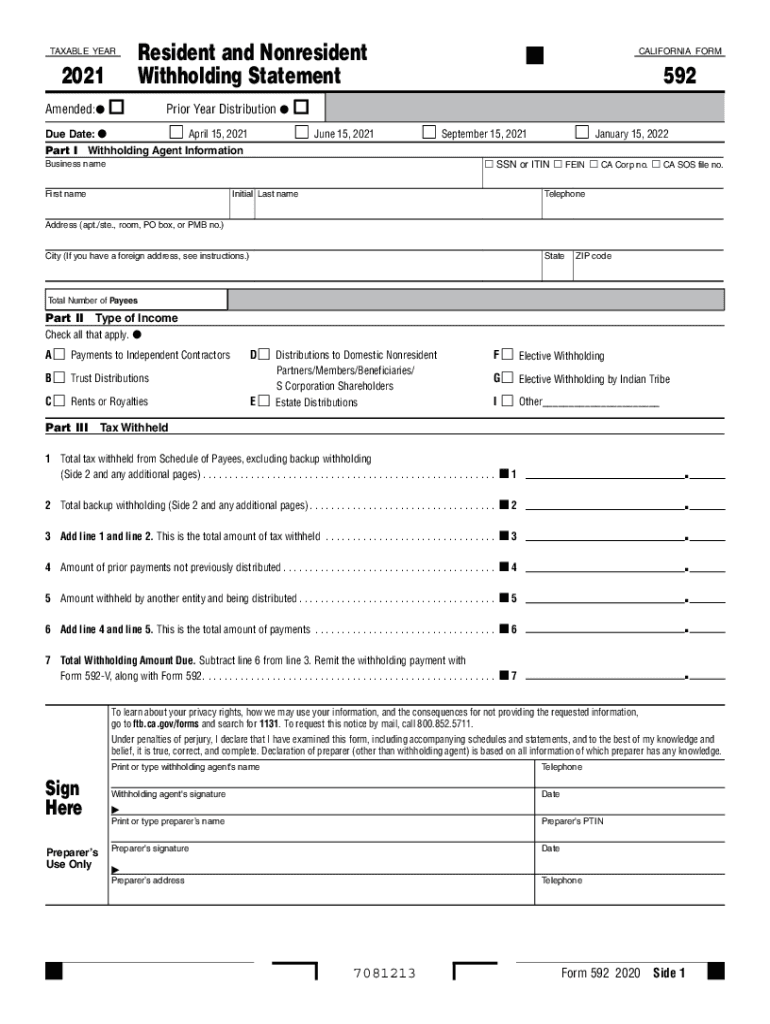

CA FTB 592 20212022 Fill out Tax Template Online US Legal Forms

Instead, you withheld an amount to help pay taxes when you do your california return. For more information go to ftb.ca.gov and I was able to enter total california tax withheld for both the federal and california returns, but i am not sure where to enter total income subject to withholding on the federal return. You are reporting withholding as.

48 Form 592 Templates free to download in PDF

Instead, you withheld an amount to help pay taxes when you do your california return. I was able to enter total california tax withheld for both the federal and california returns, but i am not sure where to enter total income subject to withholding on the federal return. Resident and nonresident withholding statement created date: Web 2022 form 592 resident.

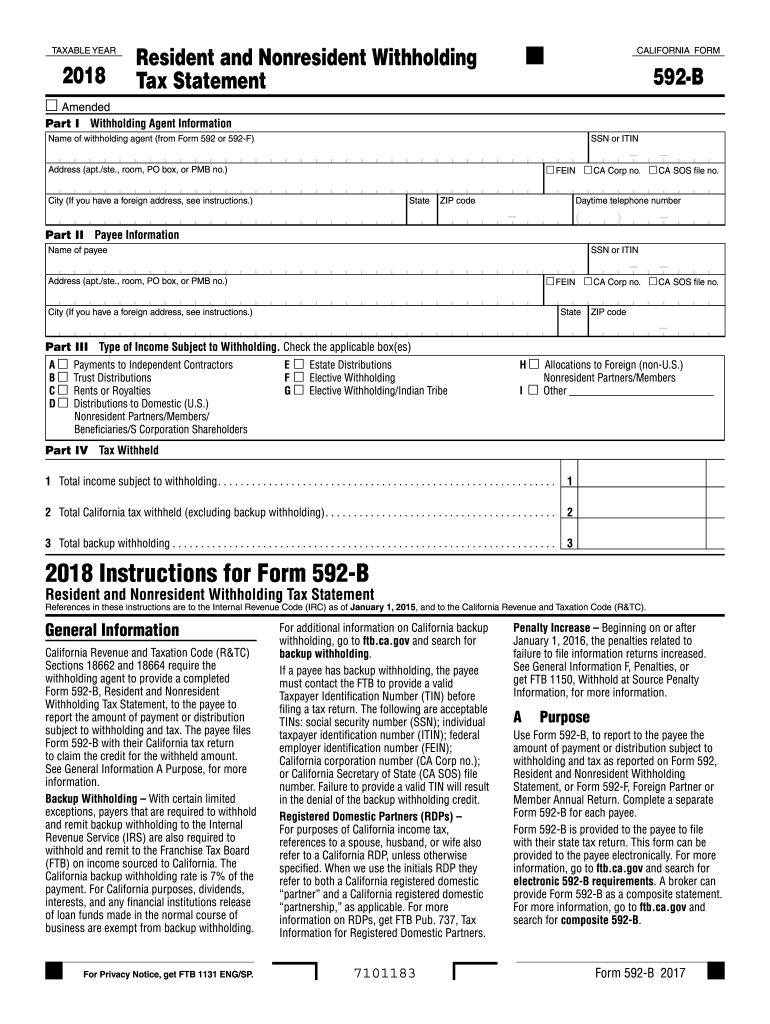

2018 Form CA FTB 592B Fill Online, Printable, Fillable, Blank pdfFiller

Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, etc. We assess a penalty for failure to file complete, correct, and timely information returns. Resident and nonresident withholding statement created date: Do not use form 592 if: Web file form 592 to report withholding on domestic nonresident individuals.

Form 592 B ≡ Fill Out Printable PDF Forms Online

2022, form 592, resident and nonresident withholding statement keywords: For more information go to ftb.ca.gov and Web 2022 form 592 resident and nonresident withholding statement author: Do not use form 592 if: Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, etc.

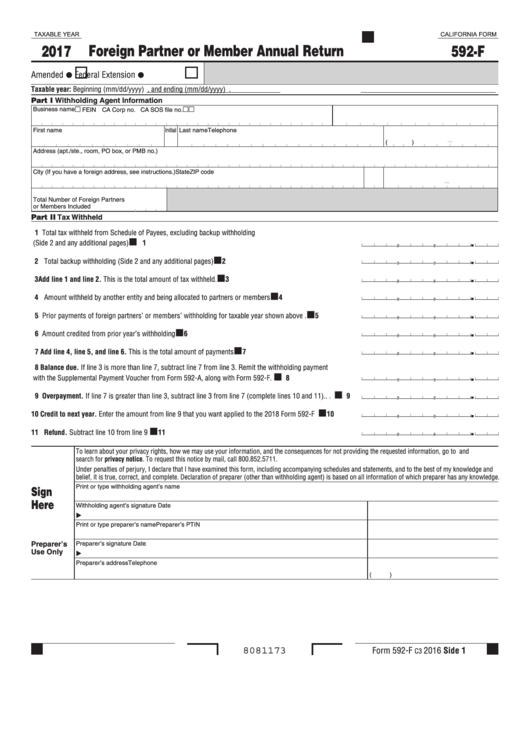

Fillable California Form 592F Foreign Partner Or Member Annual

I was able to enter total california tax withheld for both the federal and california returns, but i am not sure where to enter total income subject to withholding on the federal return. 2022, form 592, resident and nonresident withholding statement keywords: Do not use form 592 if: We assess a penalty for failure to file complete, correct, and timely.

ponderorb Pair of earrings in the form of vines, enameled gold mounted

You are reporting withholding as a pass through entity. I was able to enter total california tax withheld for both the federal and california returns, but i am not sure where to enter total income subject to withholding on the federal return. Do not use form 592 if: With their state tax return. Resident and nonresident withholding statement created date:

ftb.ca.gov forms 09_592v

For more information go to ftb.ca.gov and Instead, you withheld an amount to help pay taxes when you do your california return. You are reporting withholding as a pass through entity. This form can be provided to the payee electronically. Do not use form 592 if:

592B Form Franchise Tax Board Edit, Fill, Sign Online Handypdf

Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, etc. We assess a penalty for failure to file complete, correct, and timely information returns. Web 2022 ca form 592, resident and nonresident withholding statement. Web 2022 form 592 resident and nonresident withholding statement author: This form can be provided to.

I Was Able To Enter Total California Tax Withheld For Both The Federal And California Returns, But I Am Not Sure Where To Enter Total Income Subject To Withholding On The Federal Return.

Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, etc. Web 2022 ca form 592, resident and nonresident withholding statement. You are reporting withholding as a pass through entity. Web file form 592 to report withholding on domestic nonresident individuals.

Web 2022 Form 592 Resident And Nonresident Withholding Statement Author:

Instead, you withheld an amount to help pay taxes when you do your california return. For more information go to ftb.ca.gov and Resident and nonresident withholding statement created date: This form can be provided to the payee electronically.

Go To The California > California Individual (Form 540/540Nr) > General Worksheet.

We assess a penalty for failure to file complete, correct, and timely information returns. With their state tax return. 2022, form 592, resident and nonresident withholding statement keywords: Do not use form 592 if: