593 Tax Form

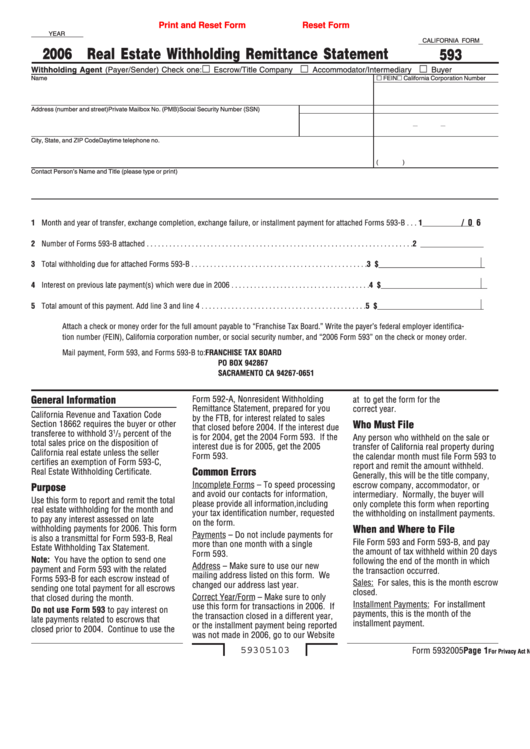

593 Tax Form - Web same tax year or are concurrently changing to the tax year that the corporation adopts, retains, or changes to per item f, part i, and that such tax year satisfies the requirement. _________________________ part i remitter information • reep • qualified intermediary buyer/transferee. Web file now with turbotax related california sales tax forms: Employers engaged in a trade or business who. Web you do not have to withhold tax if the ca real property is: Find your state tax return mailing addresses here. Complete part ii, seller/transferor information. Seller is a bank acting as a trustee; The 593 form is a california specific form used to determine whether or not there should be state tax withheld on a property sale by the seller (individual,. Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that.

The irs mailing addresses listed here are for irs federal tax returns only; Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that. Web file now with turbotax related california sales tax forms: Private delivery services should not deliver returns to irs offices other than. Complete part ii, seller/transferor information. Web form 3903 department of the treasury internal revenue service moving expenses go to www.irs.gov/form3903 for instructions and the latest information. The 593 form is a california specific form used to determine whether or not there should be state tax withheld on a property sale by the seller (individual,. Employers engaged in a trade or business who. Complete part iv, certifications, that may partially or fully. _________________________ part i remitter information • reep • qualified intermediary buyer/transferee.

Seller is a bank acting as a trustee; Web form 3903 department of the treasury internal revenue service moving expenses go to www.irs.gov/form3903 for instructions and the latest information. Employers engaged in a trade or business who. _________________________ part i remitter information • reep • qualified intermediary buyer/transferee. These addresses are to be used. Web california form 593 escrow or exchange no. Web 2019 form 593 real estate withholding tax statement form 53 2018 taxable year 2019 real estate withholding tax statement california form 593 business name. Return form 593 to remitter. Find your state tax return mailing addresses here. Web you must file a u.s.

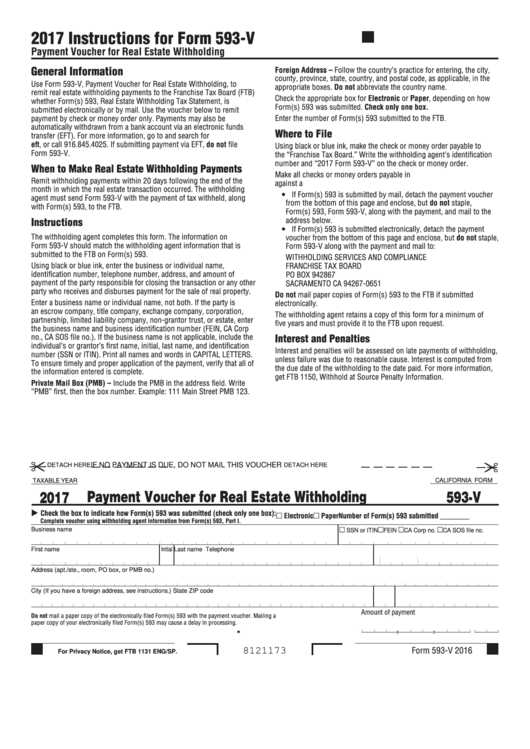

Fillable Form 593V Payment Voucher For Real Estate Withholding

Web form 3903 department of the treasury internal revenue service moving expenses go to www.irs.gov/form3903 for instructions and the latest information. Web you must file a u.s. Web file now with turbotax related california sales tax forms: _________________________ part i remitter information • reep • qualified intermediary buyer/transferee. The 593 form is a california specific form used to determine whether.

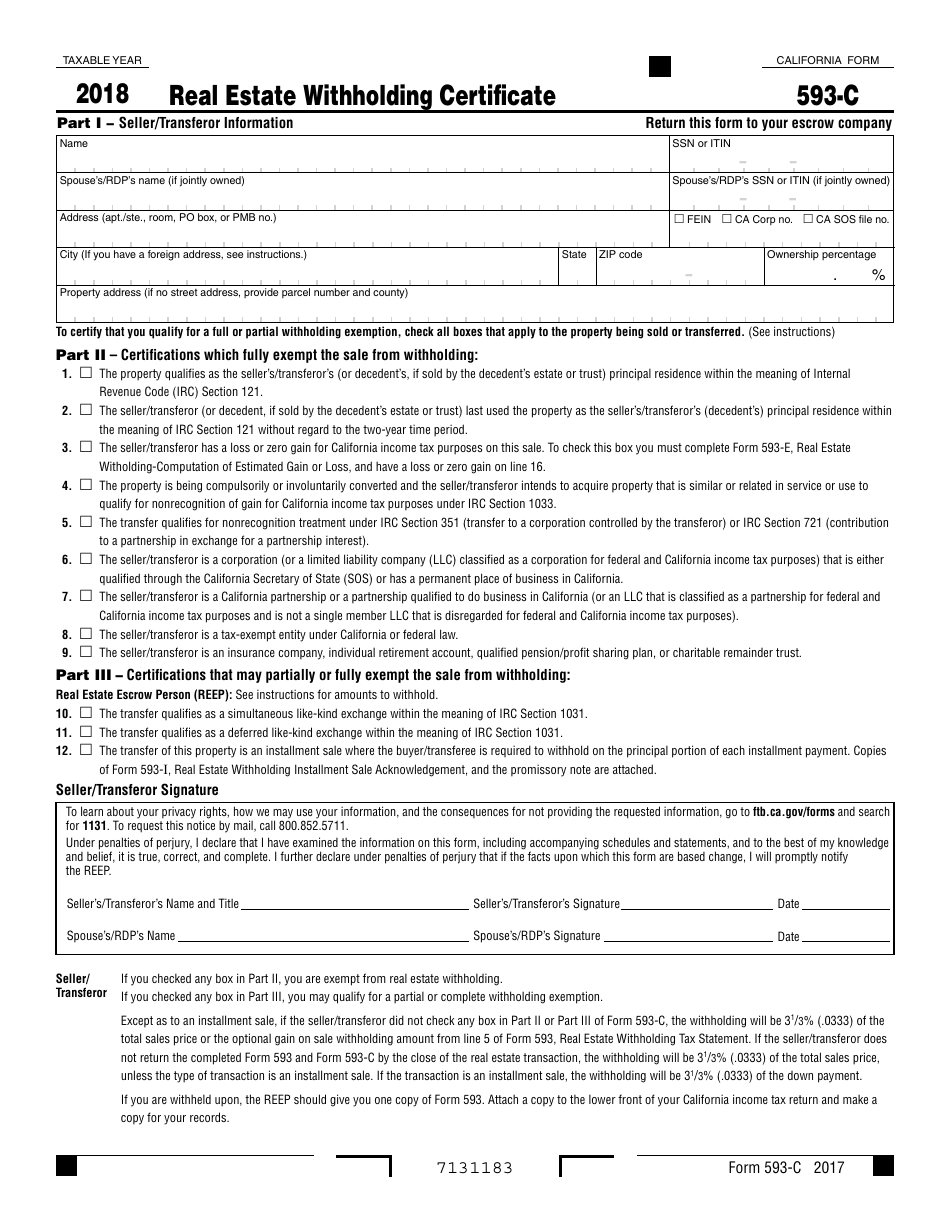

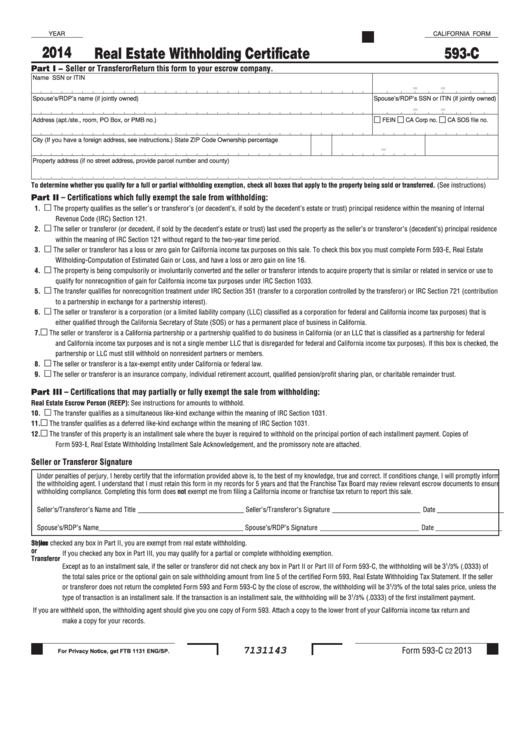

Form 593c Download Fillable PDF or Fill Online Real Estate Withholding

Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that. Web file now with turbotax related california sales tax forms: Web find irs addresses for private delivery of tax returns, extensions and payments. Find your state tax return mailing addresses here. Web the 593 form is.

Form 593V Franchise Tax Board Edit, Fill, Sign Online Handypdf

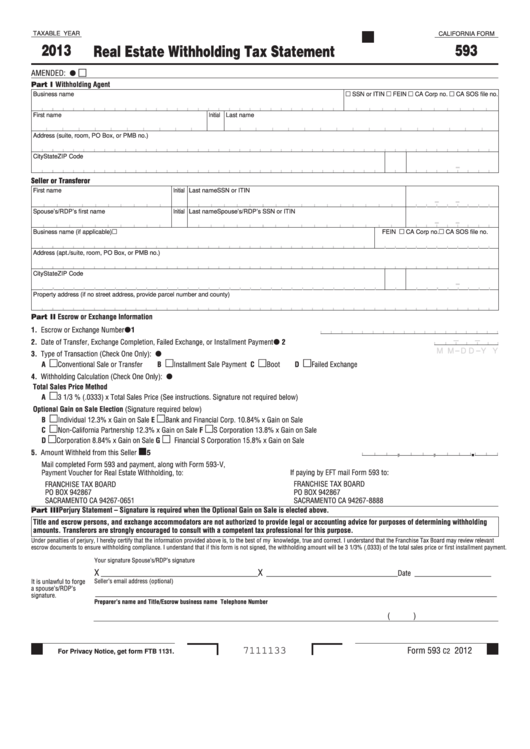

The 593 form is a california specific form used to determine whether or not there should be state tax withheld on a property sale by the seller (individual,. Find your state tax return mailing addresses here. Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or.

Fillable California Form 593 Real Estate Withholding Tax Statement

Web same tax year or are concurrently changing to the tax year that the corporation adopts, retains, or changes to per item f, part i, and that such tax year satisfies the requirement. Web file now with turbotax related california sales tax forms: Taxformfinder has an additional 174 california income tax forms that you may need, plus all federal income..

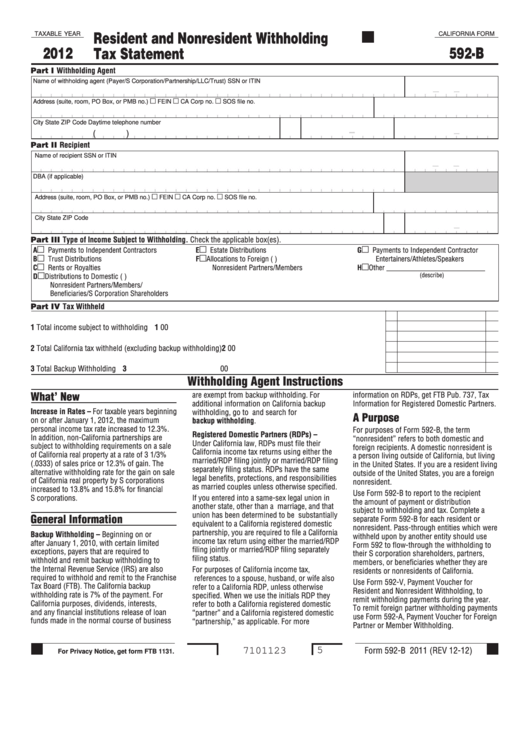

Fillable Form 592B Resident And Nonresident Withholding Tax

The 593 form is a california specific form used to determine whether or not there should be state tax withheld on a property sale by the seller (individual,. Find your state tax return mailing addresses here. Complete part iv, certifications, that may partially or fully. The irs mailing addresses listed here are for irs federal tax returns only; These addresses.

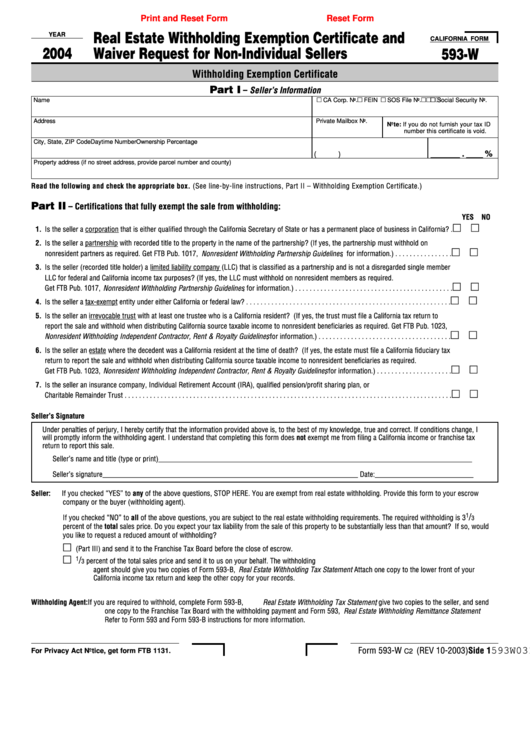

Fillable California Form 593W Real Estate Withholding Exemption

Web 2019 form 593 real estate withholding tax statement form 53 2018 taxable year 2019 real estate withholding tax statement california form 593 business name. Web the 593 form is a california specific form used to determine whether or not there should be state tax withheld on a property sale by the seller (individual, business entity, trust,. Return form 593.

Ca Form 593 slidesharetrick

Web you must file a u.s. Web california form 593 escrow or exchange no. Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. Web same tax year or are concurrently changing to the tax year that the corporation adopts, retains, or changes to per item f, part i, and that such tax.

Fillable California Form 593C Real Estate Withholding Certificate

Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that. Web find irs addresses for private delivery of tax returns, extensions and payments. Complete part ii, seller/transferor information. Employers engaged in a trade or business who. Return form 593 to remitter.

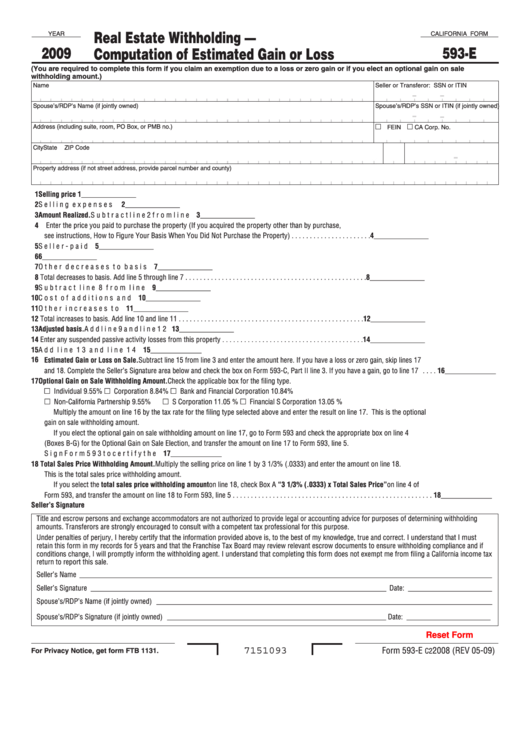

Fillable California Form 593E Real Estate Withholding Computation

Web you do not have to withhold tax if the ca real property is: Web you must file a u.s. Web find irs addresses for private delivery of tax returns, extensions and payments. See form 593, part iii for a. Employee's withholding certificate form 941;

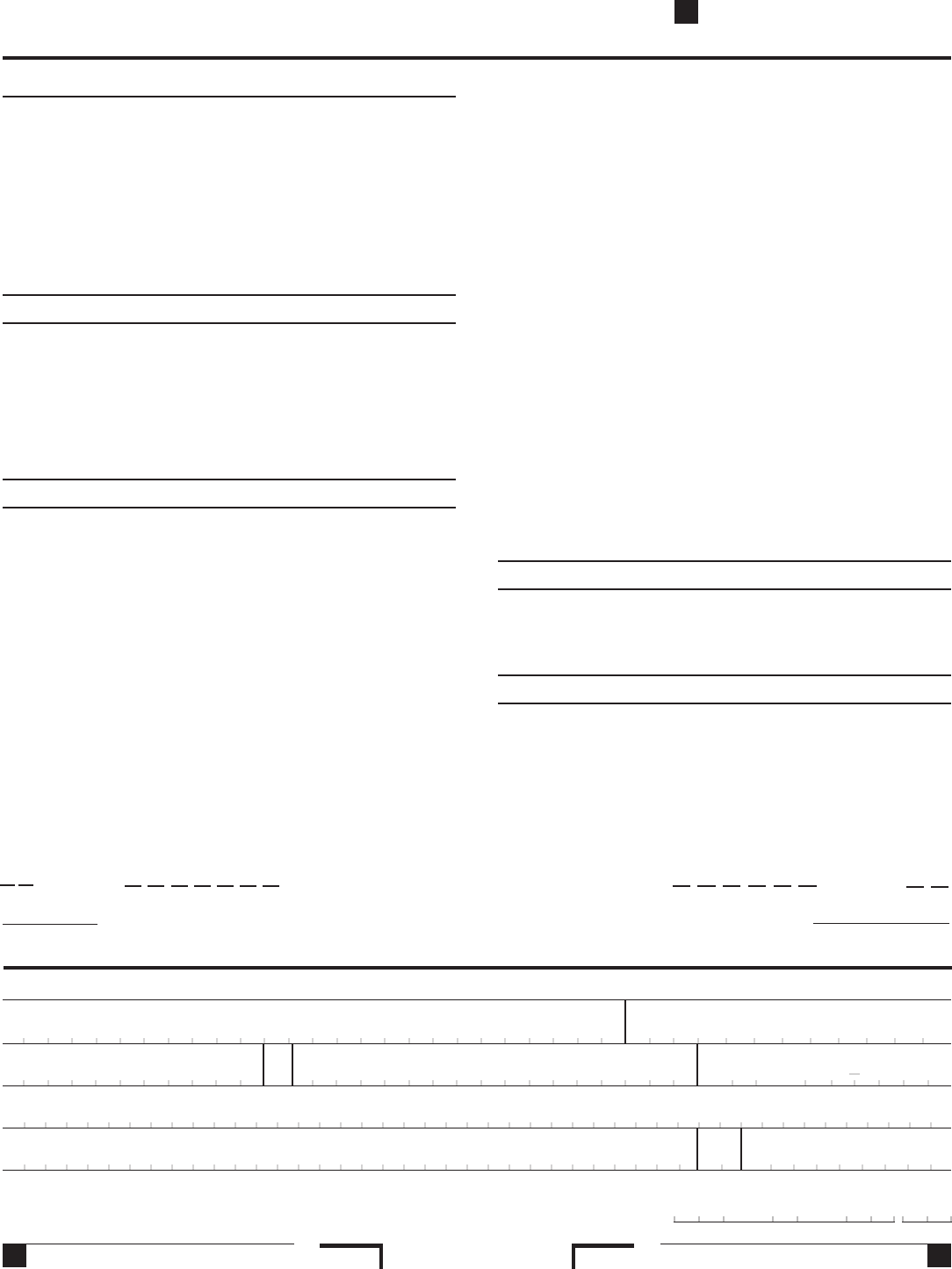

Fillable California Form 593 Real Estate Withholding Remittance

Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or exchanges. Web find irs addresses for private delivery of tax returns, extensions and payments. Employee's withholding certificate form 941; These addresses are to be used. Seller is a bank acting as a trustee;

Web 2019 Form 593 Real Estate Withholding Tax Statement Form 53 2018 Taxable Year 2019 Real Estate Withholding Tax Statement California Form 593 Business Name.

Seller is a bank acting as a trustee; Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. Employee's withholding certificate form 941; The 593 form is a california specific form used to determine whether or not there should be state tax withheld on a property sale by the seller (individual,.

Web Form 3903 Department Of The Treasury Internal Revenue Service Moving Expenses Go To Www.irs.gov/Form3903 For Instructions And The Latest Information.

Complete part iv, certifications, that may partially or fully. Web the 593 form is a california specific form used to determine whether or not there should be state tax withheld on a property sale by the seller (individual, business entity, trust,. Web file now with turbotax related california sales tax forms: Find your state tax return mailing addresses here.

Web Same Tax Year Or Are Concurrently Changing To The Tax Year That The Corporation Adopts, Retains, Or Changes To Per Item F, Part I, And That Such Tax Year Satisfies The Requirement.

Web you must file a u.s. Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or exchanges. Web verify form 593 is complete and accurate. Web you do not have to withhold tax if the ca real property is:

Private Delivery Services Should Not Deliver Returns To Irs Offices Other Than.

_________________________ part i remitter information • reep • qualified intermediary buyer/transferee. Complete part ii, seller/transferor information. These addresses are to be used. See form 593, part iii for a.