645 Election Form

645 Election Form - A form 706 is not required to be filed as a result of a 's death. A qrt is a grantor trust. The executor of a 's estate and the trustee of trust, an electing trust, made a section 645 election. Web trust making section 645 election, inability to tick both decedent's estate and trust type on 1041 united states (spanish) canada (english) canada (french) tax forms. Additionally, on the first filed fiduciary. Web 645 election termination form: Web the §645 election itself is made by filing irs form 8855, election to treat a qualified revocable trust as part of an estate. Web died on october 20, 2002. 645 allows for an election to treat a qualified revocable trust (qrt) as part of a decedent’s estate for federal income tax purposes. On the site with all the document, click on begin immediately along with complete for the editor.

Use your indications to submit. 645 allows for an election to treat a qualified revocable trust (qrt) as part of a decedent’s estate for federal income tax purposes. A qrt is a grantor trust. Web the general rule provides that grantor trusts must file an abbreviated form 1041, u.s. The final treasury regulations states that the requirement that a “qualified. On the site with all the document, click on begin immediately along with complete for the editor. A form 706 is not required to be filed as a result of a. Additionally, on the first filed fiduciary. Web the §645 election must be made on form 8855, election to treat a qualified revocable trust as part of an estate, by the due date, including extensions, of the estate’s initial. Web how do i make a 645 election on a 1041?

Use your indications to submit. Web died on october 20, 2002. Web the §645 election itself is made by filing irs form 8855, election to treat a qualified revocable trust as part of an estate. Web if an executor for the related estate isn't appointed until after the trustee has made a valid section 645 election, the executor must agree to the trustee's election and they must. Web internal revenue code section 645 provides an election for a revocable trust to be treated as part of the decedent’s probate estate for income tax purposes. For this reason, i recommend that a trust be kept separate from one's corporation. Web 645 election termination form: Department of the treasury—internal revenue service. Web the §645 election must be made on form 8855, election to treat a qualified revocable trust as part of an estate, by the due date, including extensions, of the estate’s initial. Web the general rule provides that grantor trusts must file an abbreviated form 1041, u.s.

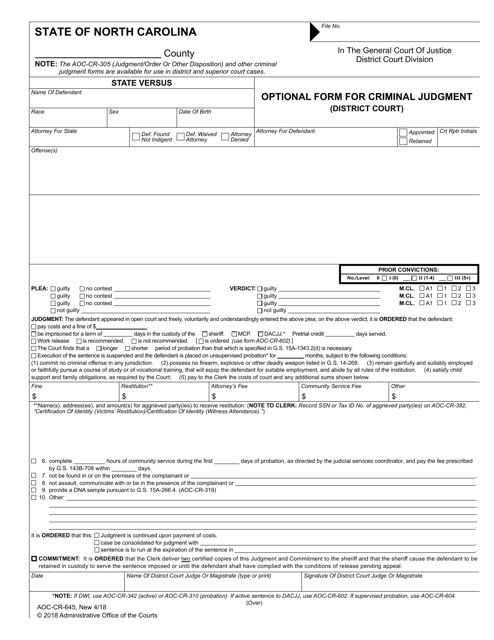

Form AOCCR645 Download Fillable PDF or Fill Online Optional Form for

A form 706 is not required to be filed as a result of a. Web in simplified terms, a §645 election can be used to combine the trust and estate into one entity for tax purposes, so only one irs form 1041 needs to be filed. 645 election allows the trustee and the executor to effectively combine a qrt and.

Form 8855 Election to Treat a Qualified Revocable Trust as Part of an

645 election allows the trustee and the executor to effectively combine a qrt and an estate into one tax return,. A qrt is a grantor trust. On the site with all the document, click on begin immediately along with complete for the editor. Department of the treasury—internal revenue service. Web trust making section 645 election, inability to tick both decedent's.

Election Out of Qualified Economic Stimulus PropertyTax...

645 election allows the trustee and the executor to effectively combine a qrt and an estate into one tax return,. Additionally, on the first filed fiduciary. A form 706 is not required to be filed as a result of a 's death. A form 706 is not required to be filed as a result of a. This form identifies the.

Form 8855 Election to Treat a Qualified Revocable Trust as Part of an

This form identifies the qrt making. On the site with all the document, click on begin immediately along with complete for the editor. Web the executor of a 's estate and the trustee of trust, an electing trust, made a section 645 election. Use your indications to submit. The final treasury regulations states that the requirement that a “qualified.

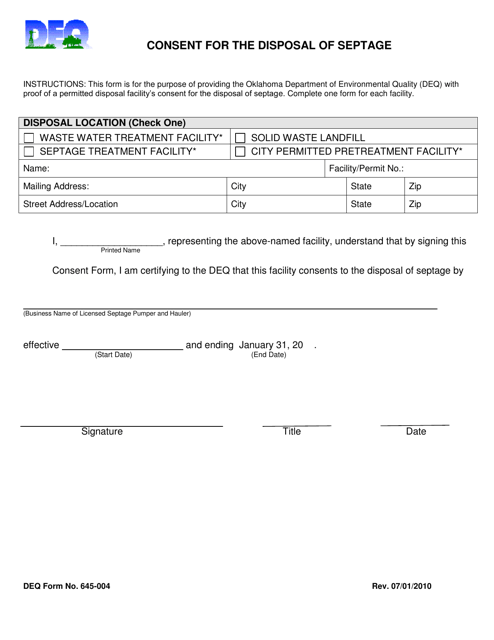

DEQ Form 645004 Download Printable PDF or Fill Online Consent for the

Web trust making section 645 election, inability to tick both decedent's estate and trust type on 1041 united states (spanish) canada (english) canada (french) tax forms. Web died on october 20, 2002. Web if an executor for the related estate isn't appointed until after the trustee has made a valid section 645 election, the executor must agree to the trustee's.

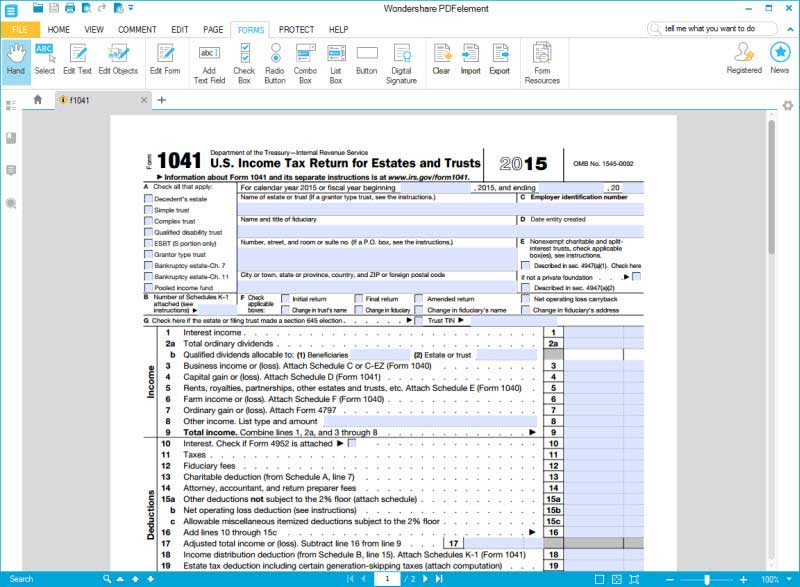

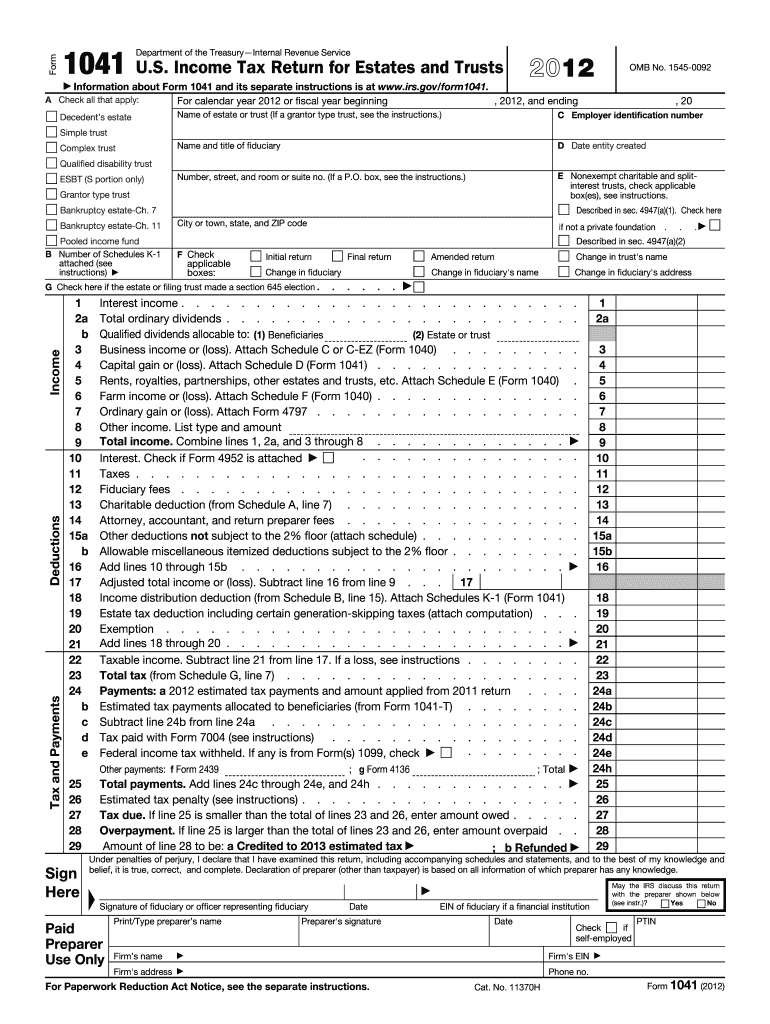

Guide for How to Fill in IRS Form 1041

Web died on october 20, 2002. Income tax return for estates and trusts. The final treasury regulations states that the requirement that a “qualified. Web the general rule provides that grantor trusts must file an abbreviated form 1041, u.s. A form 706 is not required to be filed as a result of a 's death.

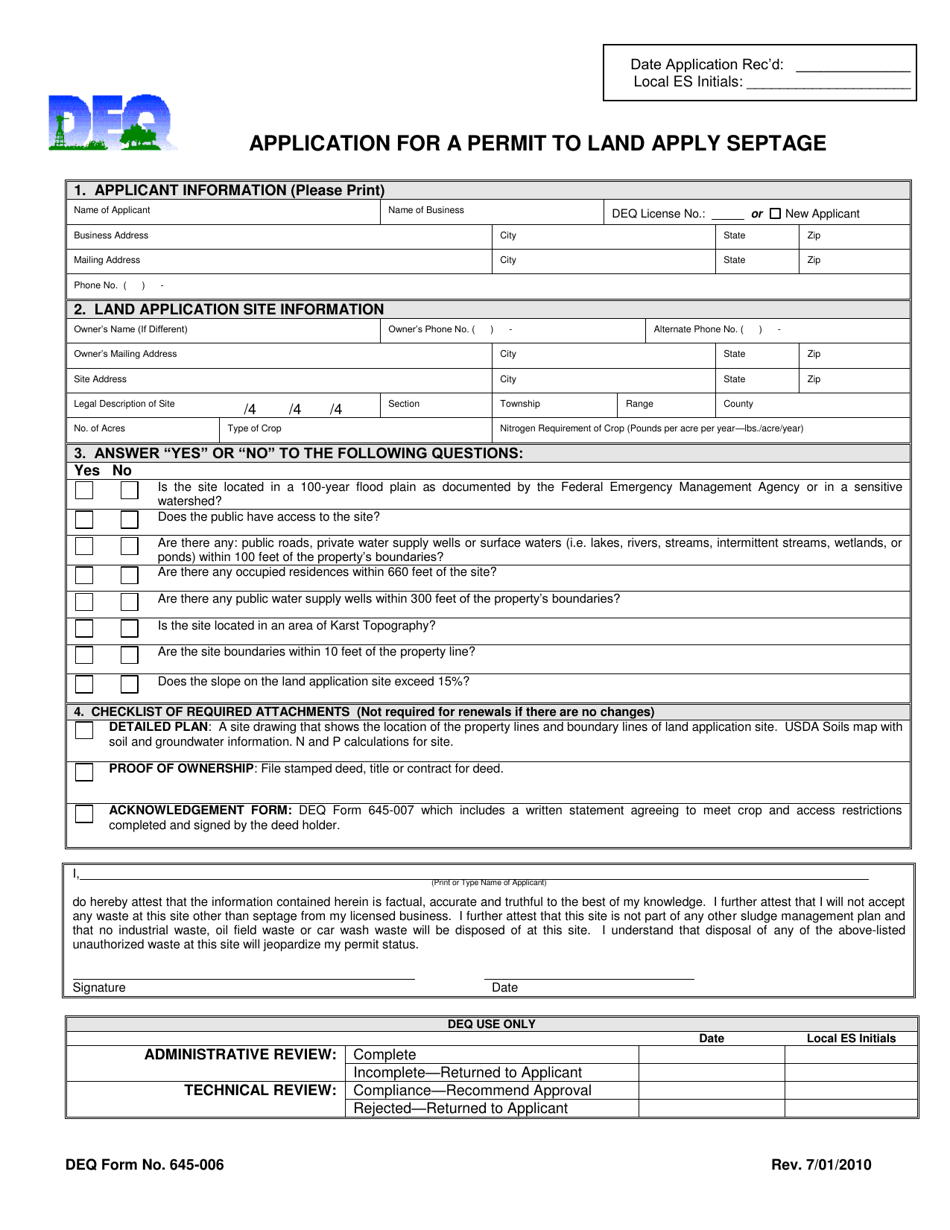

DEQ Form 645006 Download Printable PDF or Fill Online Application for

A form 706 is not required to be filed as a result of a 's death. A qrt is a grantor trust. Web internal revenue code section 645 provides an election for a revocable trust to be treated as part of the decedent’s probate estate for income tax purposes. 645 election allows the trustee and the executor to effectively combine.

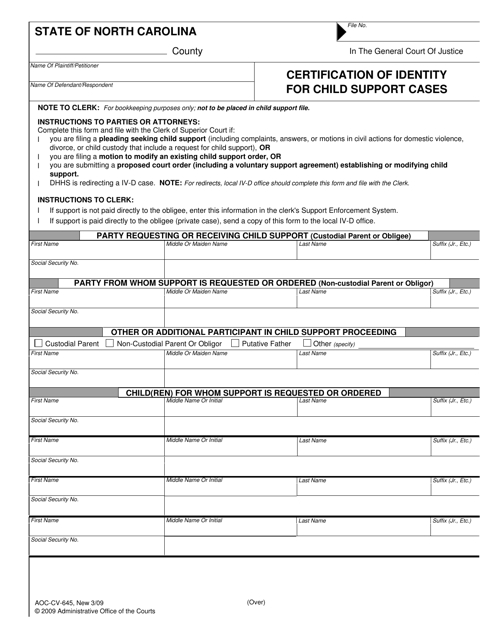

Form AOCCV645 Download Fillable PDF or Fill Online Certification of

Web a section 645 election can be used to combine the trust and estate into one entity for tax purposes, allowing only one form 1041 to be filed. 645 allows for an election to treat a qualified revocable trust (qrt) as part of a decedent’s estate for federal income tax purposes. The executor of a 's estate and the trustee.

2012 Form IRS 1041 Fill Online, Printable, Fillable, Blank pdfFiller

Web died on october 20, 2002. Income tax return for estates and trusts. Web if an executor for the related estate isn't appointed until after the trustee has made a valid section 645 election, the executor must agree to the trustee's election and they must. On the site with all the document, click on begin immediately along with complete for.

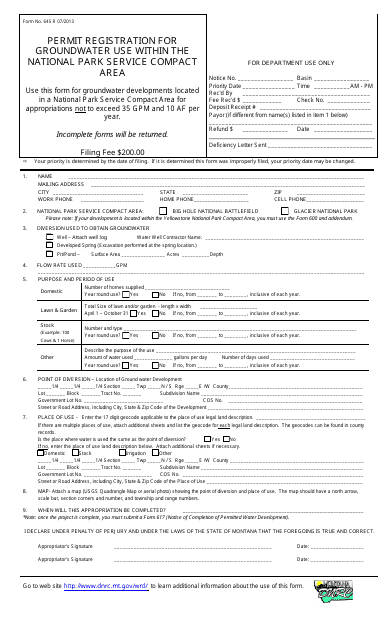

Form 645 Download Fillable PDF or Fill Online Permit Registration for

Web the general rule provides that grantor trusts must file an abbreviated form 1041, u.s. Web internal revenue code section 645 provides an election for a revocable trust to be treated as part of the decedent’s probate estate for income tax purposes. 645 election allows the trustee and the executor to effectively combine a qrt and an estate into one.

The Final Treasury Regulations States That The Requirement That A “Qualified.

Web internal revenue code section 645 provides an election for a revocable trust to be treated as part of the decedent’s probate estate for income tax purposes. Web died on october 20, 2002. The executor of a 's estate and the trustee of trust, an electing trust, made a section 645 election. A form 706 is not required to be filed as a result of a.

Web How Do I Make A 645 Election On A 1041?

Web when the decedent has both a qrt and a probate estate, the sec. For this reason, i recommend that a trust be kept separate from one's corporation. Income tax return for estates and trusts, that includes the trust's name,. Additionally, on the first filed fiduciary.

A Form 706 Is Not Required To Be Filed As A Result Of A 'S Death.

Department of the treasury—internal revenue service. Web the §645 election itself is made by filing irs form 8855, election to treat a qualified revocable trust as part of an estate. Web 645 election termination form: 645 allows for an election to treat a qualified revocable trust (qrt) as part of a decedent’s estate for federal income tax purposes.

Income Tax Return For Estates And Trusts.

Web the §645 election must be made on form 8855, election to treat a qualified revocable trust as part of an estate, by the due date, including extensions, of the estate’s initial. Web trust making section 645 election, inability to tick both decedent's estate and trust type on 1041 united states (spanish) canada (english) canada (french) tax forms. A qrt is a grantor trust. Web in simplified terms, a §645 election can be used to combine the trust and estate into one entity for tax purposes, so only one irs form 1041 needs to be filed.