8812 Form 2021

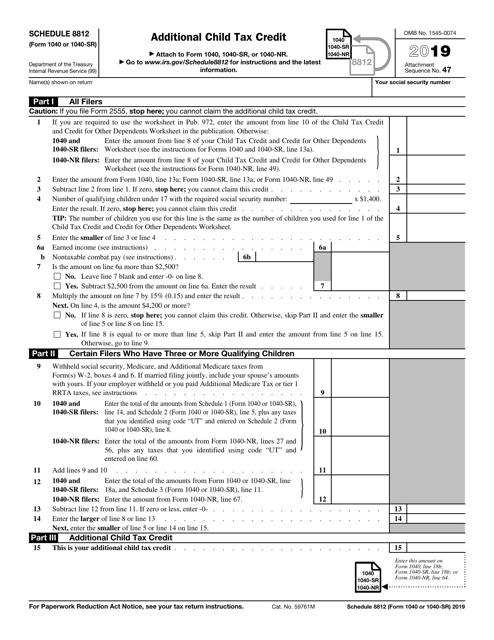

8812 Form 2021 - Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Web the expanded schedule 8812 is now three pages for 2021. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. But i do not have any dependents or children. Web families should hold onto the letter and use it to correctly reconcile the child tax credit when they file their 2021 taxes. Web turbotax 2021 is asking me to fill out the schedule 8812 form. Web published january 17, 2023 one of the most significant tax changes for 2022 applies to the child tax credit, which is claimed by tens of millions of parents each year:. Web based on the amount of qualifying dependents you claim on your tax return, the irs might require you to fill out form 8812. Should be completed by all filers to claim the basic. Web up to 10% cash back because of these changes to the credit, all worksheets for figuring the 2021 child credit have been moved from the form 1040 instructions, and are.

Why is it asking me to fill this out? You can download or print current or. From july 2021 to december 2021, taxpayers may. Web tax forms for irs and state income tax returns. The child tax credit is a partially refundable credit offered. For 2022, there are two parts to this form: Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. For example, if the amount. The ctc and odc are.

Irs form 8812 will need to be filed alongside your. Web the expanded schedule 8812 is now three pages for 2021. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. Web solved • by turbotax • 3264 • updated january 25, 2023. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). The ctc and odc are. Web you'll use form 8812 to calculate your additional child tax credit. For tax years 2020 and prior: The information will be helpful in filling out.

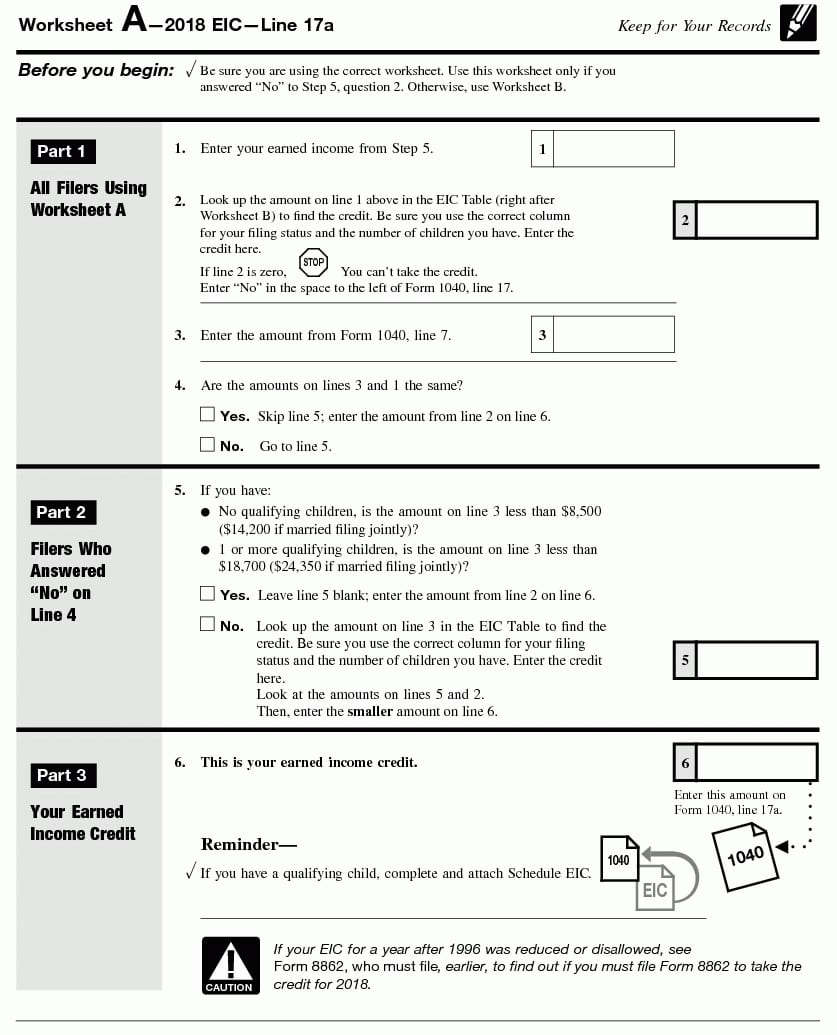

8812 Worksheet

Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web families should hold onto the letter and use it to correctly reconcile the child tax credit when they file their 2021 taxes. Web published january 17, 2023 one of the most significant tax changes for.

Schedule 8812 Instructions Fill Out and Sign Printable PDF Template

Web schedule 8812 (form 1040) is now used to calculate child tax credits and to report advance child tax credit payments received in 2021, and to figure any additional. Why is it asking me to fill this out? Web internal revenue service 2022 instructions for schedule 8812 credits for qualifying children and other dependents use schedule 8812 (form 1040) to.

Irs 8812 Instructions Fill Out and Sign Printable PDF Template signNow

Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. You can download or print current or. Web turbotax 2021 is asking me to fill out the schedule 8812 form. From july 2021 to december 2021, taxpayers may. For tax years 2020 and prior:

What Is A 1040sr Worksheet

Web the expanded schedule 8812 is now three pages for 2021. Web turbotax 2021 is asking me to fill out the schedule 8812 form. The ctc and odc are. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. Web schedule 8812 (form 1040) is now used to calculate child tax credits and.

Qualified Dividends And Capital Gains Worksheet 2018 —

Web tax forms for irs and state income tax returns. From july 2021 to december 2021, taxpayers may. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. The ctc and odc are. Irs form 8812 will need to be filed alongside your.

Form 8812 Line 5 Worksheet

Web you'll use form 8812 to calculate your additional child tax credit. The child tax credit is a partially refundable credit offered. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web up to 10% cash back because of these changes to the credit, all.

What Is The Credit Limit Worksheet A For Form 8812

From july 2021 to december 2021, taxpayers may. But i do not have any dependents or children. For 2022, there are two parts to this form: Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Why is it asking me to fill this out?

8812 Worksheet

Web published january 17, 2023 one of the most significant tax changes for 2022 applies to the child tax credit, which is claimed by tens of millions of parents each year:. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax..

Irs Child Tax Credit IRS Form 1040 Schedule 8812 Download Fillable

Web solved • by turbotax • 3264 • updated january 25, 2023. Irs form 8812 will need to be filed alongside your. Web published january 17, 2023 one of the most significant tax changes for 2022 applies to the child tax credit, which is claimed by tens of millions of parents each year:. Web for more information on the child.

️Form 8812 Worksheet 2013 Free Download Goodimg.co

Irs form 8812 will need to be filed alongside your. Web schedule 8812 (form 1040) is now used to calculate child tax credits and to report advance child tax credit payments received in 2021, and to figure any additional. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. Web we last updated.

Web Schedule 8812 (Form 1040) Is Now Used To Calculate Child Tax Credits And To Report Advance Child Tax Credit Payments Received In 2021, And To Figure Any Additional.

Web families should hold onto the letter and use it to correctly reconcile the child tax credit when they file their 2021 taxes. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax. You can download or print current or. The child tax credit is a partially refundable credit offered.

Web You'll Use Form 8812 To Calculate Your Additional Child Tax Credit.

The information will be helpful in filling out. Irs form 8812 will need to be filed alongside your. The ctc and odc are. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions.

From July 2021 To December 2021, Taxpayers May.

Web internal revenue service 2022 instructions for schedule 8812 credits for qualifying children and other dependents use schedule 8812 (form 1040) to figure your child tax. Web tax forms for irs and state income tax returns. Web up to 10% cash back because of these changes to the credit, all worksheets for figuring the 2021 child credit have been moved from the form 1040 instructions, and are. But i do not have any dependents or children.

Web Use Schedule 8812 (Form 1040) To Figure Your Child Tax Credit (Ctc), Credit For Other Dependents (Odc), And Additional Child Tax Credit (Actc).

For 2022, there are two parts to this form: Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Why is it asking me to fill this out?