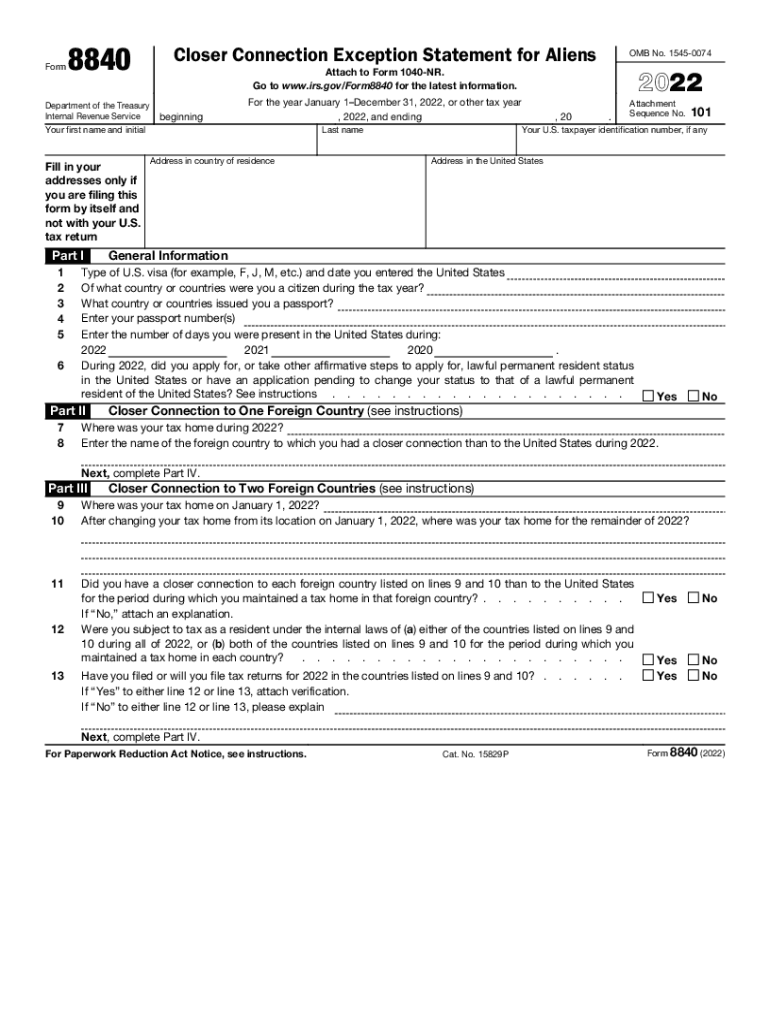

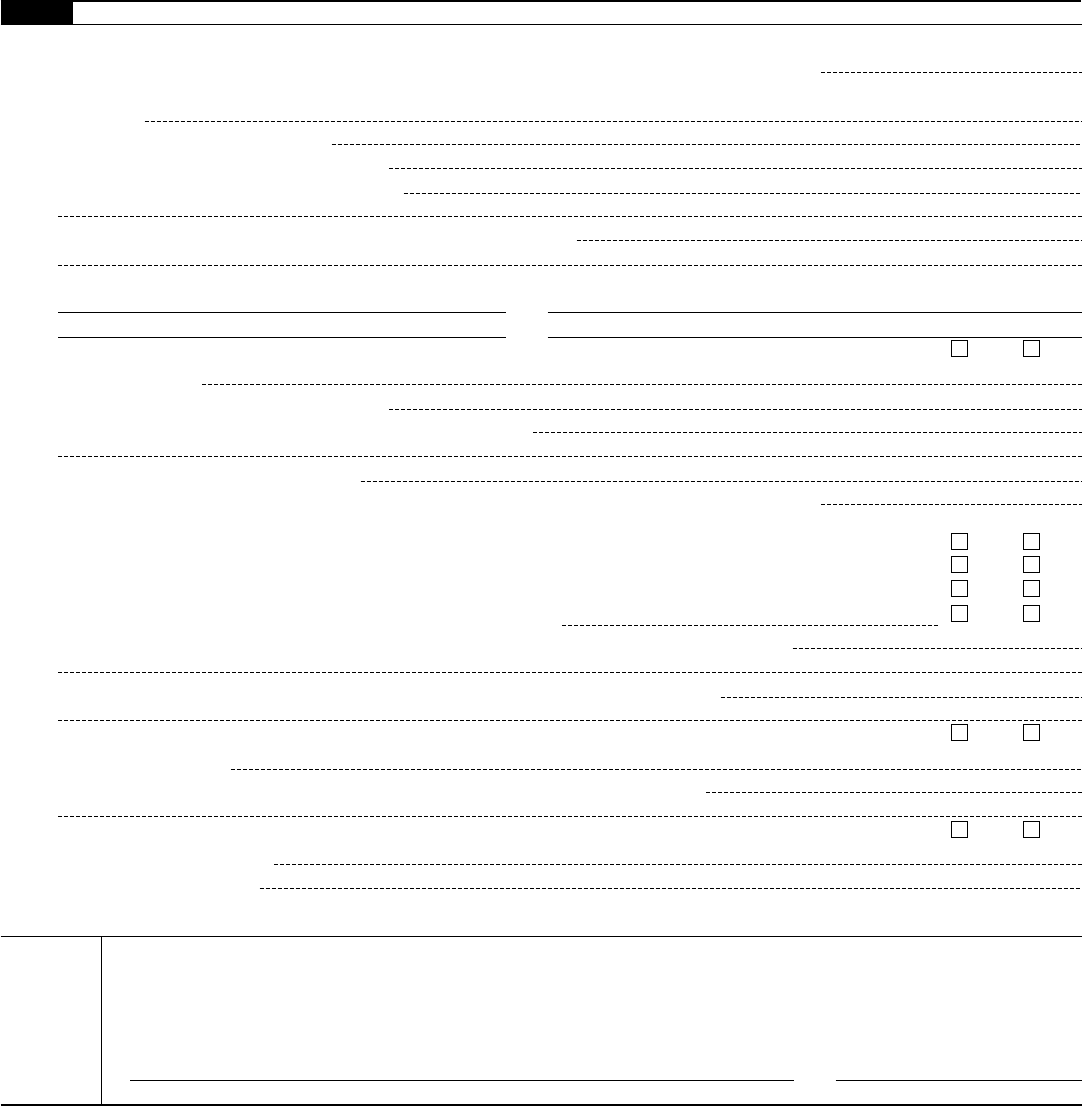

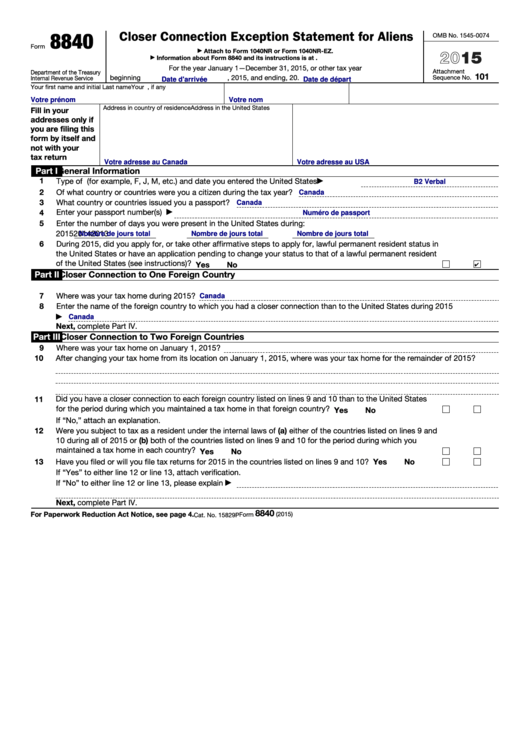

8840 Form For 2022

8840 Form For 2022 - Each alien individual must file a separate form 8840 to claim the closer connection exception. Web information about form 8840, closer connection exception statement for aliens, including recent updates, related forms, and instructions on how to file. Income tax if they exceed a specific number of days (based on a calculation on the form 8840) in the u.s. Beginning, 2022, and ending, 20.omb no. Add the date and place your electronic signature. However, filing form 8840 with the irs has no impact on your canadian income tax return. Canadian residents who winter in the u.s. Use form 8840 to claim the closer connection to a foreign country(ies) exception to. Pour enregistrer la déclaration, il suffit de la poster au: Web find the irs 8840 you require.

Concerned parties names, places of residence and numbers etc. However, filing form 8840 with the irs has no impact on your canadian income tax return. Each alien individual must file a separate form 8840 to claim the closer connection exception. Use the income tax package for the province or territory where you lived on the date you left canada. Canadian residents who winter in the u.s. Web you left canada permanently (emigrated) in 2022. Web you must file form 8840, closer connection exception statement for aliens, to claim the closer connection exception. Beginning, 2022, and ending, 20.omb no. Trip interfere with the more mundane elements of your canadian responsibilities. Change the blanks with unique fillable fields.

However, filing form 8840 with the irs has no impact on your canadian income tax return. If you are filing a u.s. Go to www.irs.gov/form8840 for the latest information. Concerned parties names, places of residence and numbers etc. That said, don't let your u.s. Use form 8840 to claim the closer connection to a foreign country(ies) exception to. Pour enregistrer la déclaration, il suffit de la poster au: Beginning, 2022, and ending, 20.omb no. Web form 8840 allows canadians to declare their closer connection to canada—and thus avoid u.s. Trip interfere with the more mundane elements of your canadian responsibilities.

IRS Form 8840 How to Fill it Right and Easily

Concerned parties names, places of residence and numbers etc. Use form 8840 to claim the closer connection to a foreign country(ies) exception to. Open it using the online editor and start editing. Federal income tax return, please attach form 8840 to the income tax return. Each alien individual must file a separate form 8840 to claim the closer connection exception.

2022 Form IRS 8840 Fill Online, Printable, Fillable, Blank pdfFiller

Use form 8840 to claim the closer connection to a foreign country(ies) exception to. Change the blanks with unique fillable fields. Go to www.irs.gov/form8840 for the latest information. Pour enregistrer la déclaration, il suffit de la poster au: Concerned parties names, places of residence and numbers etc.

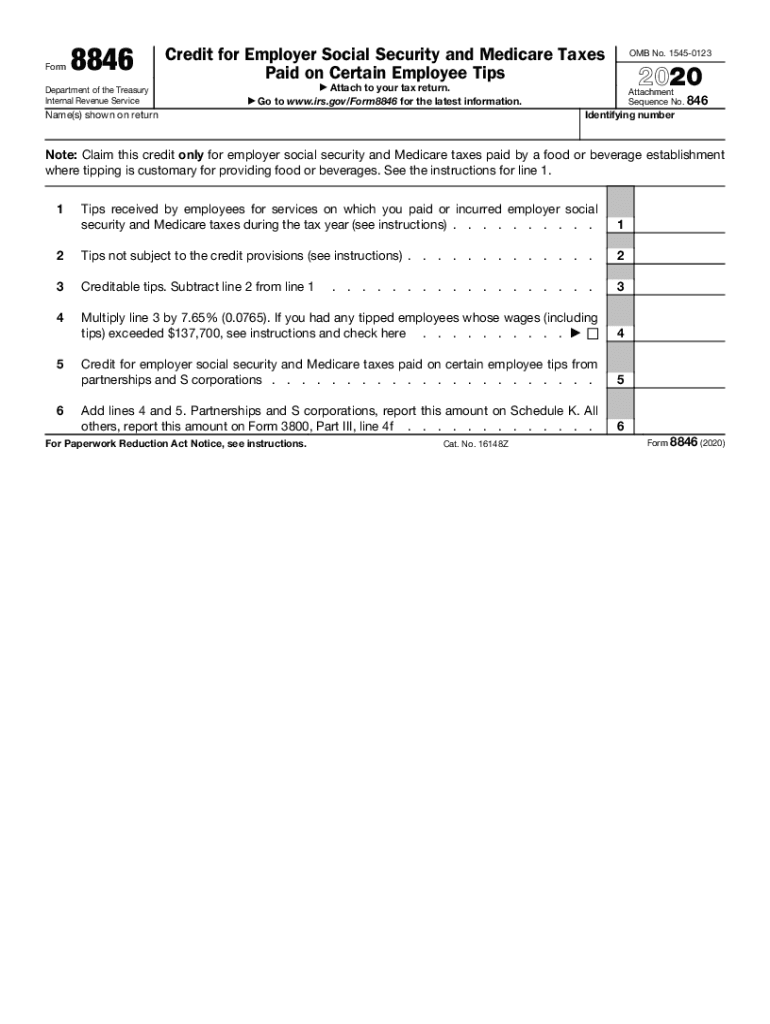

8846 Fill Out and Sign Printable PDF Template signNow

Pour enregistrer la déclaration, il suffit de la poster au: Web find the irs 8840 you require. Web form 8840 allows canadians to declare their closer connection to canada—and thus avoid u.s. Your social security number ! Income tax if they exceed a specific number of days (based on a calculation on the form 8840) in the u.s.

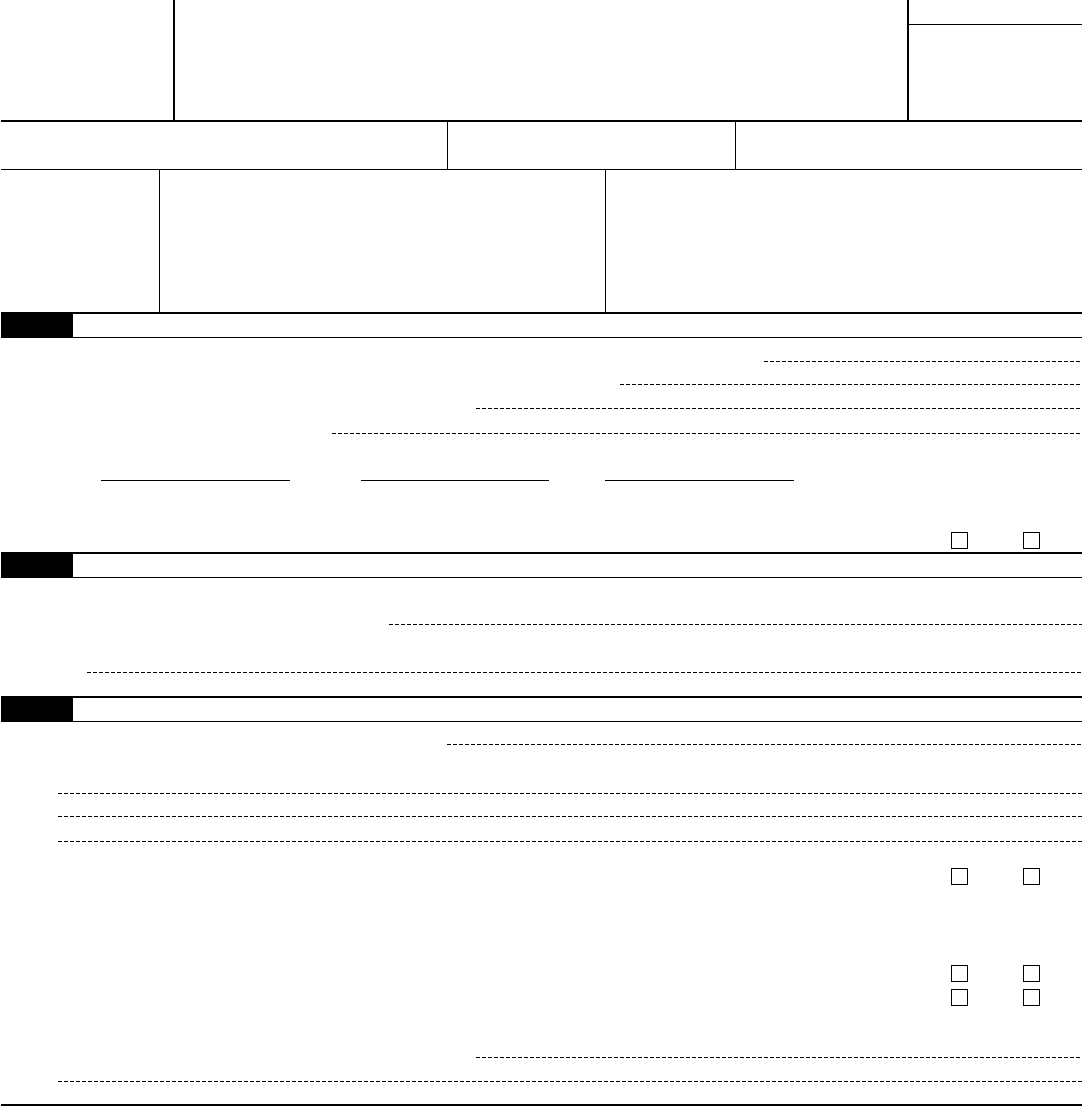

Form 8840 Edit, Fill, Sign Online Handypdf

For more details on the substantial presence test and the closer connection exception, see pub. Income tax if they exceed a specific number of days (based on a calculation on the form 8840) in the u.s. Federal income tax return, please attach form 8840 to the income tax return. Web form 8840 allows canadians to declare their closer connection to.

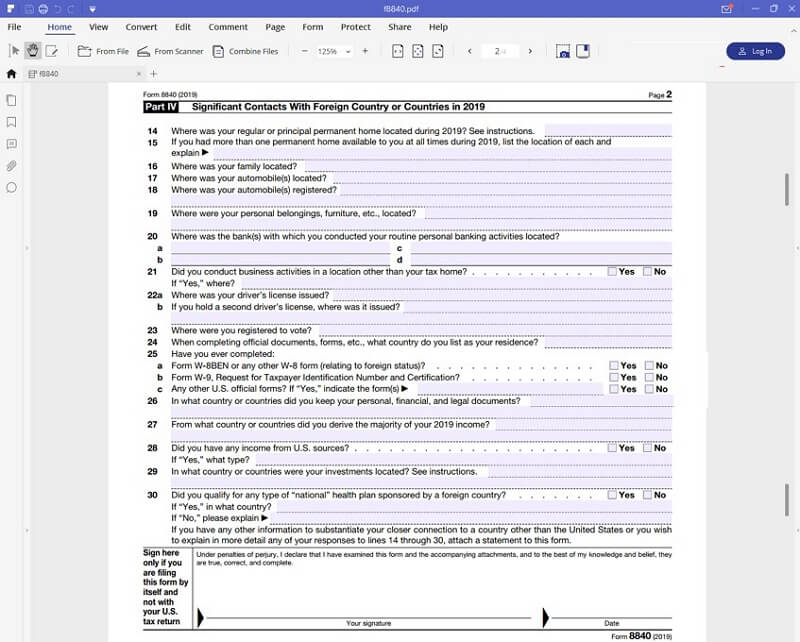

2017 Form 8840 Edit, Fill, Sign Online Handypdf

Beginning, 2022, and ending, 20.omb no. Change the blanks with unique fillable fields. However, filing form 8840 with the irs has no impact on your canadian income tax return. If you are filing a u.s. Use form 8840 to claim the closer connection to a foreign country(ies) exception to.

Fillable Closer Connection Exception Statement For Aliens printable pdf

Canadian residents who winter in the u.s. Change the blanks with unique fillable fields. If you are filing a u.s. Federal income tax return, please attach form 8840 to the income tax return. Add the date and place your electronic signature.

IRS Form 8840 Download Fillable PDF Or Fill Online Closer Printable

Concerned parties names, places of residence and numbers etc. For more details on the substantial presence test and the closer connection exception, see pub. However, filing form 8840 with the irs has no impact on your canadian income tax return. Add the date and place your electronic signature. Go to www.irs.gov/form8840 for the latest information.

Form 8840, Closer Connection Exception Statement for Aliens IRS.gov

Web find the irs 8840 you require. Federal income tax return, please attach form 8840 to the income tax return. Open it using the online editor and start editing. Web you left canada permanently (emigrated) in 2022. Web form 8840 allows canadians to declare their closer connection to canada—and thus avoid u.s.

Form 8840 IRS Closer Connection Exception Statement

Are technically subject to u.s. Open it using the online editor and start editing. Add the date and place your electronic signature. Use form 8840 to claim the closer connection to a foreign country(ies) exception to. Web form 8840 allows canadians to declare their closer connection to canada—and thus avoid u.s.

How Tax Form 8840 Exception to Substantial Presence Works

Leaving canada (emigrants) you have residential ties in more than one province or territory on december 31, 2022. Go to www.irs.gov/form8840 for the latest information. Canadian residents who winter in the u.s. Add the date and place your electronic signature. Concerned parties names, places of residence and numbers etc.

Trip Interfere With The More Mundane Elements Of Your Canadian Responsibilities.

Federal income tax return, please attach form 8840 to the income tax return. Web information about form 8840, closer connection exception statement for aliens, including recent updates, related forms, and instructions on how to file. Each alien individual must file a separate form 8840 to claim the closer connection exception. Concerned parties names, places of residence and numbers etc.

Go To Www.irs.gov/Form8840 For The Latest Information.

Change the blanks with unique fillable fields. Use form 8840 to claim the closer connection to a foreign country(ies) exception to. Web form 8840 allows canadians to declare their closer connection to canada—and thus avoid u.s. Web find the irs 8840 you require.

Pour Enregistrer La Déclaration, Il Suffit De La Poster Au:

Go to www.irs.gov/form8880 for the latest information. Income tax if they exceed a specific number of days (based on a calculation on the form 8840) in the u.s. Leaving canada (emigrants) you have residential ties in more than one province or territory on december 31, 2022. Web you left canada permanently (emigrated) in 2022.

Open It Using The Online Editor And Start Editing.

Web file form 8840 with the irs to establish your claim that you are a nonresident of the united states by reason of that exception. Add the date and place your electronic signature. Web you must file form 8840, closer connection exception statement for aliens, to claim the closer connection exception. However, filing form 8840 with the irs has no impact on your canadian income tax return.