8863 Form 2020

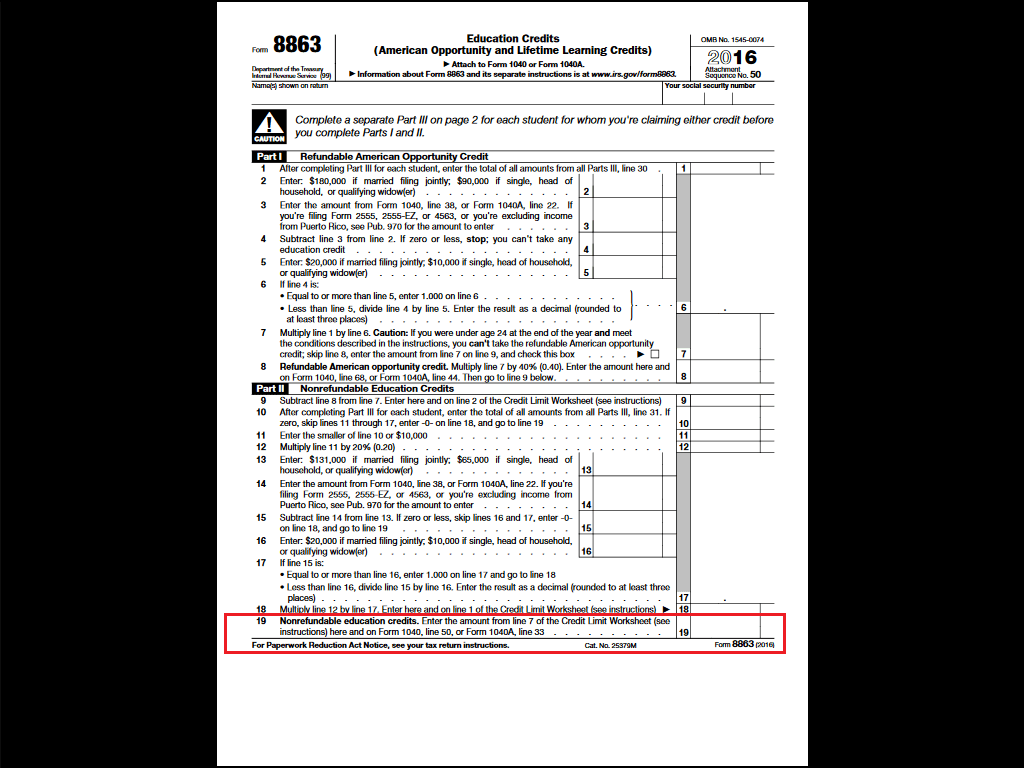

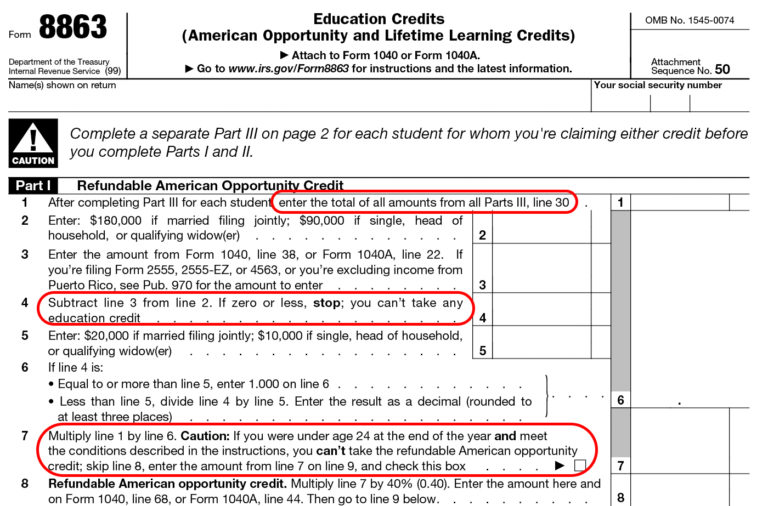

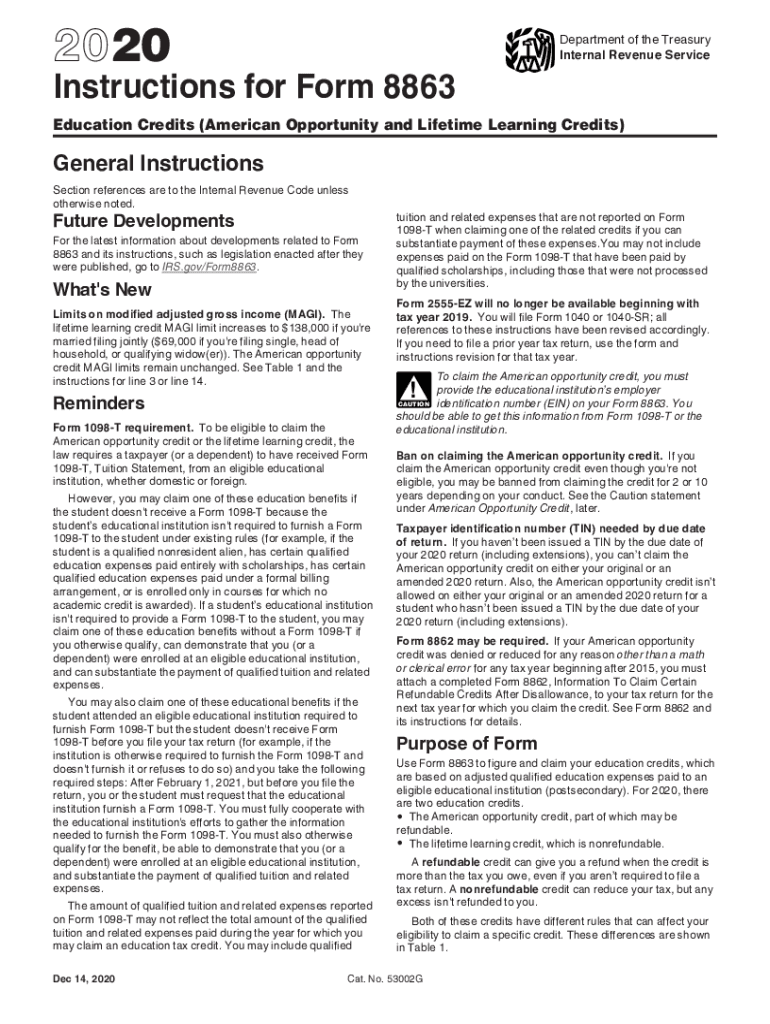

8863 Form 2020 - Web what is form 8863? Who can claim an education credit. You may be able to claim an education credit if you, your spouse, or a dependent you claim on your tax return was a student enrolled at or attending an eligible educational institution. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2020 form 8863: Web irs form 8863 is a two page form that entitles eligible tax payers for the american opportunity tax credit. Web • to compute the amount of your lifetime learning credit, enter the name, social security number, and qualified expenses of each applicable student on irs form 8863. The tax credit is calculated by applying 100 percent of the first $2,000 in expenses plus 25 percent of the excess. The irs offers a few educational tax credits students can take advantage of to help offset the high cost of education in the u.s. Go to www.irs.gov/form8863 for instructions and the latest information.

Web irs form 8863 is a two page form that entitles eligible tax payers for the american opportunity tax credit. Education credits (american opportunity and lifetime learning credits) 2019 inst 8863 Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2020 form 8863: Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). This includes the american opportunity credit (aotc) and the lifetime learning credit (llc). For 2020, the credits are based on the amount of Web identification number (ein) on your form 8863. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. The tax credit is calculated by applying 100 percent of the first $2,000 in expenses plus 25 percent of the excess. You may be able to claim an education credit if you, your spouse, or a dependent you claim on your tax return was a student enrolled at or attending an eligible educational institution.

Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2020 form 8863: Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). This includes the american opportunity credit (aotc) and the lifetime learning credit (llc). Web • to compute the amount of your lifetime learning credit, enter the name, social security number, and qualified expenses of each applicable student on irs form 8863. Web what is form 8863? Education credits (american opportunity and lifetime learning credits) 2019 inst 8863 Education credits (american opportunity and lifetime learning credits) 2020 inst 8863: For 2020, the credits are based on the amount of Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. You may be able to claim an education credit if you, your spouse, or a dependent you claim on your tax return was a student enrolled at or attending an eligible educational institution.

AOTC & LLC Two Higher Education Tax Benefits For US Taxpayers The

50 name(s) shown on return your social security number Web irs form 8863 is a two page form that entitles eligible tax payers for the american opportunity tax credit. • enter $10,000 or your actual expenses, whichever is smaller, then multiply this number by 20 percent. Enter the amount from form 8863, line 18. Web what is form 8863?

Fill Free fillable Form 8863 Education Credits 2019 PDF form

Education credits (american opportunity and lifetime learning credits) 2020 inst 8863: Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Form 8863 typically accompanies your 1040 form, and this particular document contains information on expenses paid for qualifying students, along with their name and social security number. Go to www.irs.gov/form8863.

Form 8863 Education Credits (American Opportunity and Lifetime

This includes the american opportunity credit (aotc) and the lifetime learning credit (llc). Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web identification number (ein) on your form 8863. • enter $10,000 or your actual expenses, whichever is smaller, then multiply this number by.

Form 8863Education Credits

Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2020 form 8863: • enter $10,000 or your actual expenses, whichever is smaller, then multiply this number by 20 percent. Enter the amount from form 8863, line 18. The irs offers a few educational tax credits students can take advantage of to help offset the high cost of.

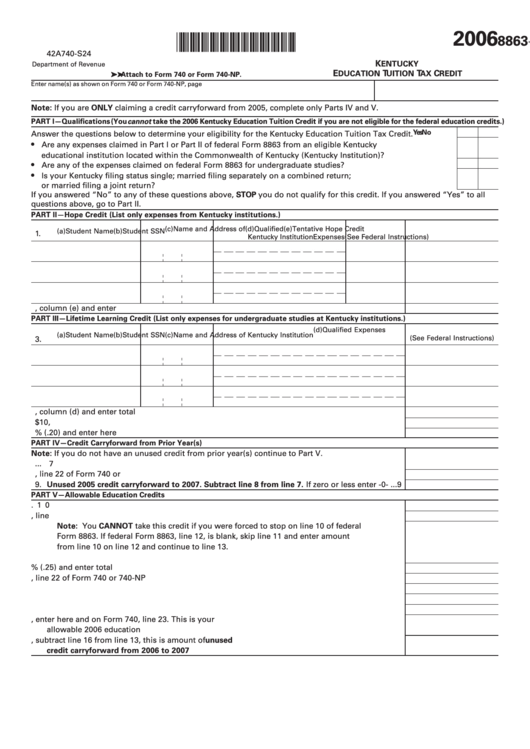

Form 8863K Education Tuition Tax Credit printable pdf download

The irs offers a few educational tax credits students can take advantage of to help offset the high cost of education in the u.s. Web • to compute the amount of your lifetime learning credit, enter the name, social security number, and qualified expenses of each applicable student on irs form 8863. This includes the american opportunity credit (aotc) and.

IRS 8863 Line 23 Fill and Sign Printable Template Online US Legal Forms

Go to www.irs.gov/form8863 for instructions and the latest information. • enter $10,000 or your actual expenses, whichever is smaller, then multiply this number by 20 percent. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Web identification number (ein) on your form 8863. Enter the amount from form 8863, line.

NS 8863

Web identification number (ein) on your form 8863. Enter the amount from form 8863, line 18. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Who can claim an education credit. Education credits (american opportunity and lifetime learning credits) 2019 inst 8863

Form 8863 Instructions Information On The Education 1040 Form Printable

This includes the american opportunity credit (aotc) and the lifetime learning credit (llc). The irs offers a few educational tax credits students can take advantage of to help offset the high cost of education in the u.s. Web irs form 8863 is a two page form that entitles eligible tax payers for the american opportunity tax credit. Who can claim.

2020 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

The tax credit is calculated by applying 100 percent of the first $2,000 in expenses plus 25 percent of the excess. Enter the amount from form 8863, line 18. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). This includes the american opportunity credit (aotc) and the lifetime learning credit.

IRS Form8863 Foster Blog

Web • to compute the amount of your lifetime learning credit, enter the name, social security number, and qualified expenses of each applicable student on irs form 8863. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Who can claim an education.

Education Credits (American Opportunity And Lifetime Learning Credits) 2020 Inst 8863:

Form 8863 typically accompanies your 1040 form, and this particular document contains information on expenses paid for qualifying students, along with their name and social security number. Web identification number (ein) on your form 8863. Go to www.irs.gov/form8863 for instructions and the latest information. Web irs form 8863 is a two page form that entitles eligible tax payers for the american opportunity tax credit.

Education Credits (American Opportunity And Lifetime Learning Credits) 2019 Inst 8863

50 name(s) shown on return your social security number For 2020, the credits are based on the amount of Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). • enter $10,000 or your actual expenses, whichever is smaller, then multiply this number by 20 percent.

Instructions For Form 8863, Education Credits (American Opportunity And Lifetime Learning Credits) 2020 Form 8863:

Web • to compute the amount of your lifetime learning credit, enter the name, social security number, and qualified expenses of each applicable student on irs form 8863. The tax credit is calculated by applying 100 percent of the first $2,000 in expenses plus 25 percent of the excess. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. This includes the american opportunity credit (aotc) and the lifetime learning credit (llc).

You May Be Able To Claim An Education Credit If You, Your Spouse, Or A Dependent You Claim On Your Tax Return Was A Student Enrolled At Or Attending An Eligible Educational Institution.

Who can claim an education credit. Enter the amount from form 8863, line 18. Web what is form 8863? Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution.