8919 Tax Form

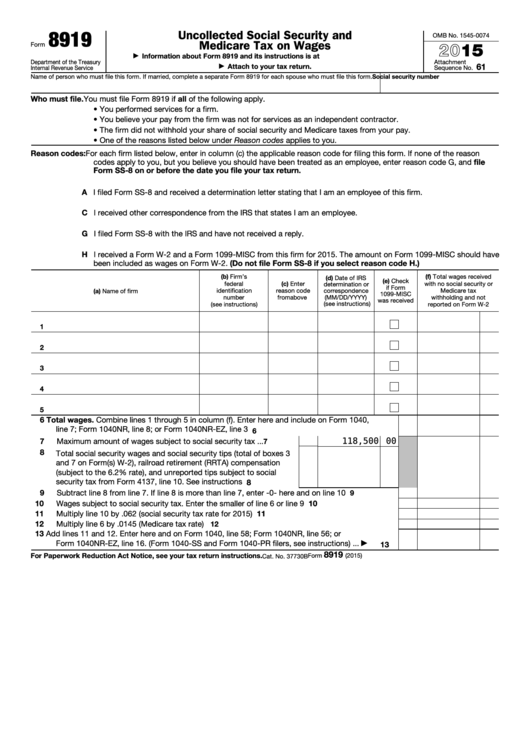

8919 Tax Form - You believe your pay from. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. You must file form 8919 if all of the following apply. Taxpayers can file form 8919 and pay their share of the social security and medicare tax with their 2007 form 1040, which has. Web business forms convenient and compatible forms to make your work easier & faster. Use form 8919 to figure and report your. Web view detailed information about property 8919 e independence ave, independence, mo 64053 including listing details, property photos, school and neighborhood data, and. Web form 8919 is available for use for the 2007 tax year. Attach to your tax return. Web compute the fica tax on the income, you must file form 1040x for the affected tax year(s) to compute the fica tax due on this income.

Taxpayers can file form 8919 and pay their share of the social security and medicare tax with their 2007 form 1040, which has. For tax years prior to 2007, use form 4137. Web in short, form 8919 is used to record the amount of unpaid social security and medicare payments owed to you as compensation if you were an employee, but. Web business forms convenient and compatible forms to make your work easier & faster. Form 8959, additional medicare tax. Web go to www.irs.gov/form8919 for the latest information. October 2018) department of the treasury internal revenue service. You believe your pay from. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest. Web view detailed information about property 8919 e independence ave, independence, mo 64053 including listing details, property photos, school and neighborhood data, and.

You must file form 8919 if all of the following apply. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. Web the irs form 8919, or uncollected social security and medicare tax on wages, is an important document utilized by employed individuals who were wrongly. Web in short, form 8919 is used to record the amount of unpaid social security and medicare payments owed to you as compensation if you were an employee, but. Attach to your tax return. Web compute the fica tax on the income, you must file form 1040x for the affected tax year(s) to compute the fica tax due on this income. Form 8959, additional medicare tax. Taxpayers can file form 8919 and pay their share of the social security and medicare tax with their 2007 form 1040, which has. A 0.9% additional medicare tax. Web view detailed information about property 8919 e independence ave, independence, mo 64053 including listing details, property photos, school and neighborhood data, and.

Form 945A Edit, Fill, Sign Online Handypdf

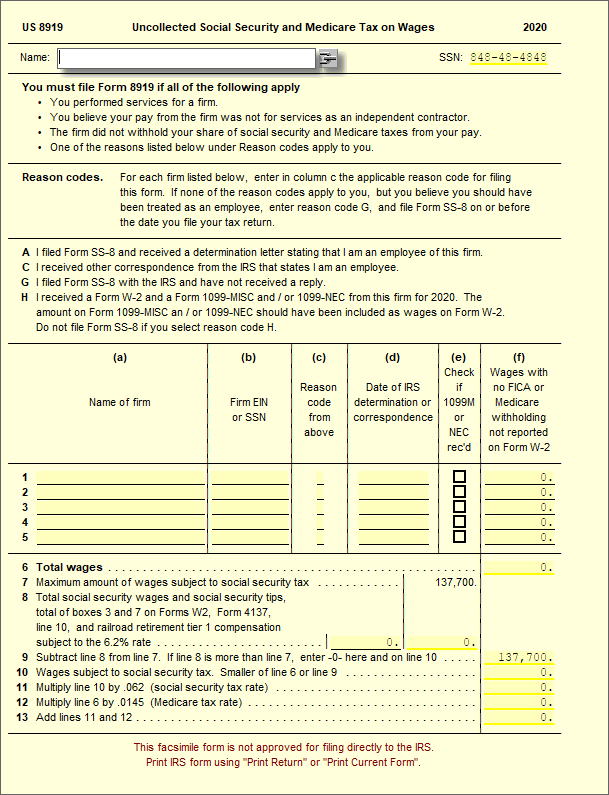

Web 4 weeks ago. Web in short, form 8919 is used to record the amount of unpaid social security and medicare payments owed to you as compensation if you were an employee, but. Web the date you file form 8919. Request for taxpayer identification number and certification. Web form 8919 department of the treasury internal revenue service uncollected social security.

Fill Free fillable F8919 Accessible 2019 Form 8919 PDF form

Request for taxpayer identification number and certification. 61 name of person who must file this form. Web answers to your questions. Attach to your tax return. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest.

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

Web go to www.irs.gov/form8919 for the latest information. Form 8959, additional medicare tax. Request for taxpayer identification number and certification. Web view detailed information about property 8919 e independence ave, independence, mo 64053 including listing details, property photos, school and neighborhood data, and. You must file form 8919 if all of the following apply.

8915 d form Fill out & sign online DocHub

Web the date you file form 8919. Taxpayers can file form 8919 and pay their share of the social security and medicare tax with their 2007 form 1040, which has. Web form 8919 is available for use for the 2007 tax year. Web answers to your questions. October 2018) department of the treasury internal revenue service.

9397 Toyota Corolla 1.8L Transmission Mount 5 Speed MT 6258 TOYOTA

Web the irs form 8919, or uncollected social security and medicare tax on wages, is an important document utilized by employed individuals who were wrongly. Use form 8919 to figure and report your. Web view detailed information about property 8919 e independence ave, independence, mo 64053 including listing details, property photos, school and neighborhood data, and. Taxpayers can file form.

Fillable Form 8919 Uncollected Social Security And Medicare Tax On

61 name of person who must file this form. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest. A 0.9% additional medicare tax. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. You performed services.

8919 Uncollected SS and Medicare Tax on Wages UltimateTax Solution

Web 4 weeks ago. Web form 8919 is available for use for the 2007 tax year. Web compute the fica tax on the income, you must file form 1040x for the affected tax year(s) to compute the fica tax due on this income. Taxpayers can file form 8919 and pay their share of the social security and medicare tax with.

About Lori DiMarco CPA, PLLC

Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. Web view detailed information about property 8919 e independence ave, independence, mo 64053 including listing details, property photos, school and neighborhood data, and. Web 4 weeks ago. 61 name of person who must file this form. Web compute the fica tax.

2020 Form IRS 8880 Fill Online, Printable, Fillable, Blank pdfFiller

October 2018) department of the treasury internal revenue service. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to.

how to fill out form 8919 Fill Online, Printable, Fillable Blank

Use form 8919 to figure and report your. You performed services for a firm. Web in short, form 8919 is used to record the amount of unpaid social security and medicare payments owed to you as compensation if you were an employee, but. Web answers to your questions. October 2018) department of the treasury internal revenue service.

Web Compute The Fica Tax On The Income, You Must File Form 1040X For The Affected Tax Year(S) To Compute The Fica Tax Due On This Income.

October 2018) department of the treasury internal revenue service. Web view detailed information about property 8919 e independence ave, independence, mo 64053 including listing details, property photos, school and neighborhood data, and. You believe your pay from. Web business forms convenient and compatible forms to make your work easier & faster.

Web Form 8919 Department Of The Treasury Internal Revenue Service Uncollected Social Security And Medicare Tax On Wages Go To Www.irs.gov/Form8919 For The Latest.

Web go to www.irs.gov/form8919 for the latest information. Web in short, form 8919 is used to record the amount of unpaid social security and medicare payments owed to you as compensation if you were an employee, but. Form 8959, additional medicare tax. Web the irs form 8919, or uncollected social security and medicare tax on wages, is an important document utilized by employed individuals who were wrongly.

You Performed Services For A Firm.

61 name of person who must file this form. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. Web answers to your questions. Taxpayers can file form 8919 and pay their share of the social security and medicare tax with their 2007 form 1040, which has.

Web Form 8919 Is Available For Use For The 2007 Tax Year.

Use form 8919 to figure and report your. For tax years prior to 2007, use form 4137. Request for taxpayer identification number and certification. Web the date you file form 8919.