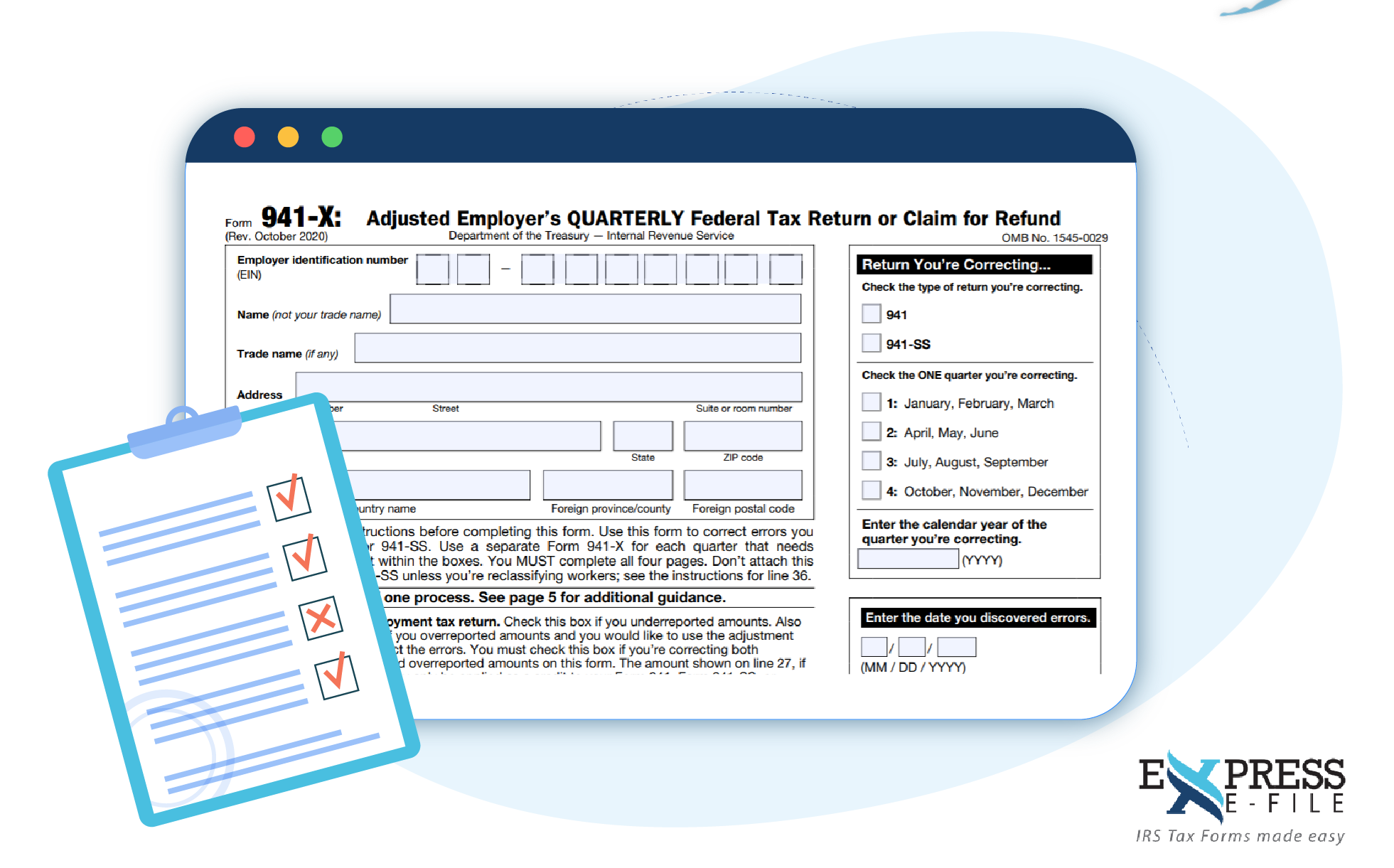

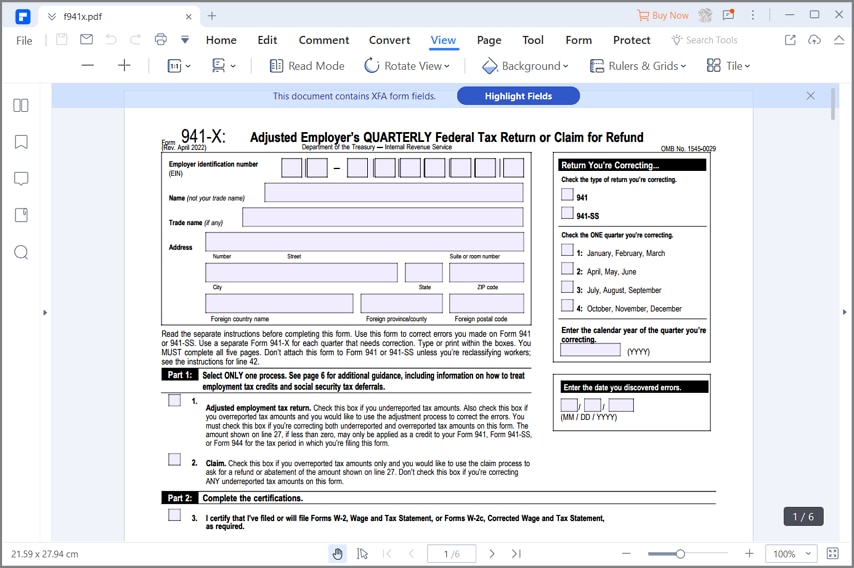

941-X Form

941-X Form - See the instructions for line 42. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Employer identification number (ein) — name (not your trade name) trade name (if. This form will be used to correct the number of employees reported. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Type or print within the boxes. April 2017) adjusted employer's quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. Choose either process to correct the overreported amounts. For all quarters you qualify for, get your original 941, a.

Choose the adjustment process if you want the amount shown on line 21 credited to your form 941, Choose either process to correct the overreported amounts. Type or print within the boxes. Determine which payroll quarters in 2020 and 2021 your business qualifies for. If you are located in. This form will be used to correct the number of employees reported. For all quarters you qualify for, get your original 941, a. Amend your 941 form for free. For more information, see the instructions for form 8974 and go to irs.gov/ researchpayrolltc. These instructions have been updated for changes under the american rescue plan act of 2021 (the arp).

These instructions have been updated for changes under the american rescue plan act of 2021 (the arp). For more information, see the instructions for form 8974 and go to irs.gov/ researchpayrolltc. Determine which payroll quarters in 2020 and 2021 your business qualifies for. This form will be used to correct the number of employees reported. If you're correcting a quarter that began Amend your 941 form for free. April 2017) adjusted employer's quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. See the instructions for line 42. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. For all quarters you qualify for, get your original 941, a.

What You Need to Know About Just Released IRS Form 941X Blog

You must complete all five pages. See the instructions for line 42. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to.

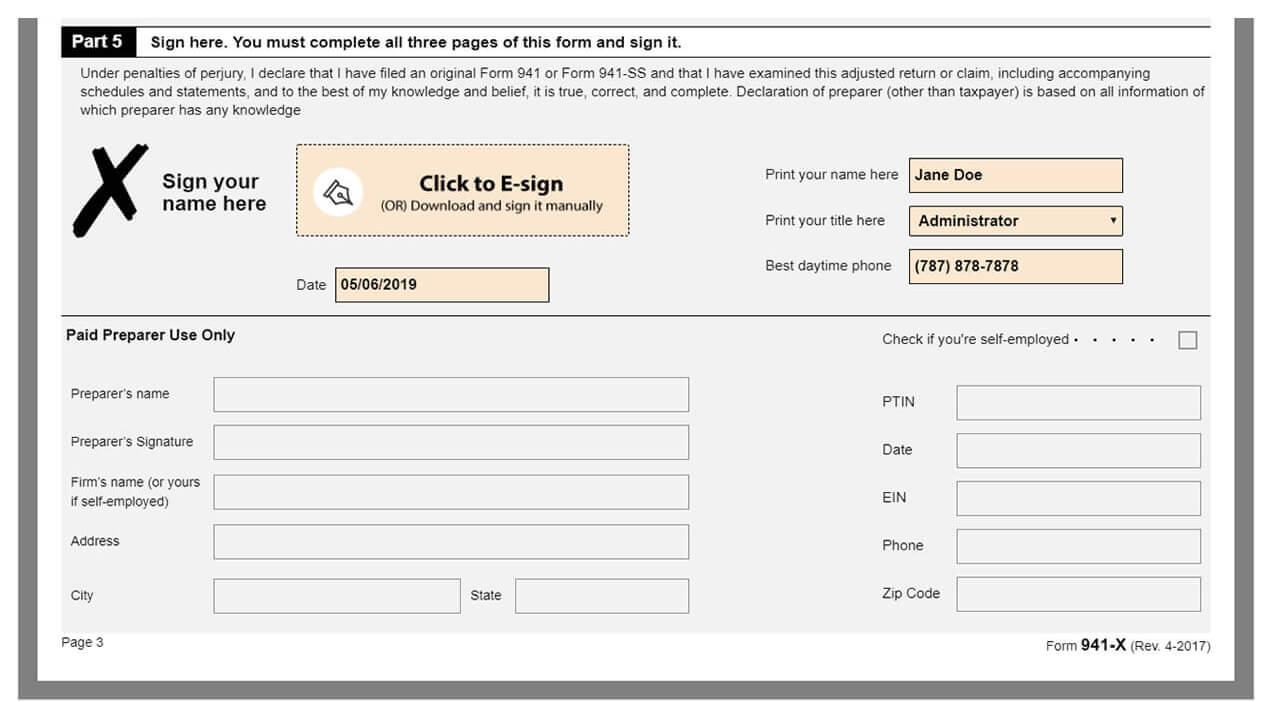

Form 941X Edit, Fill, Sign Online Handypdf

April 2017) adjusted employer's quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Employer identification number (ein) — name (not your trade name) trade name (if. These instructions have been updated for changes under the american rescue plan act of 2021 (the arp). Employee wages, income tax withheld from wages, taxable.

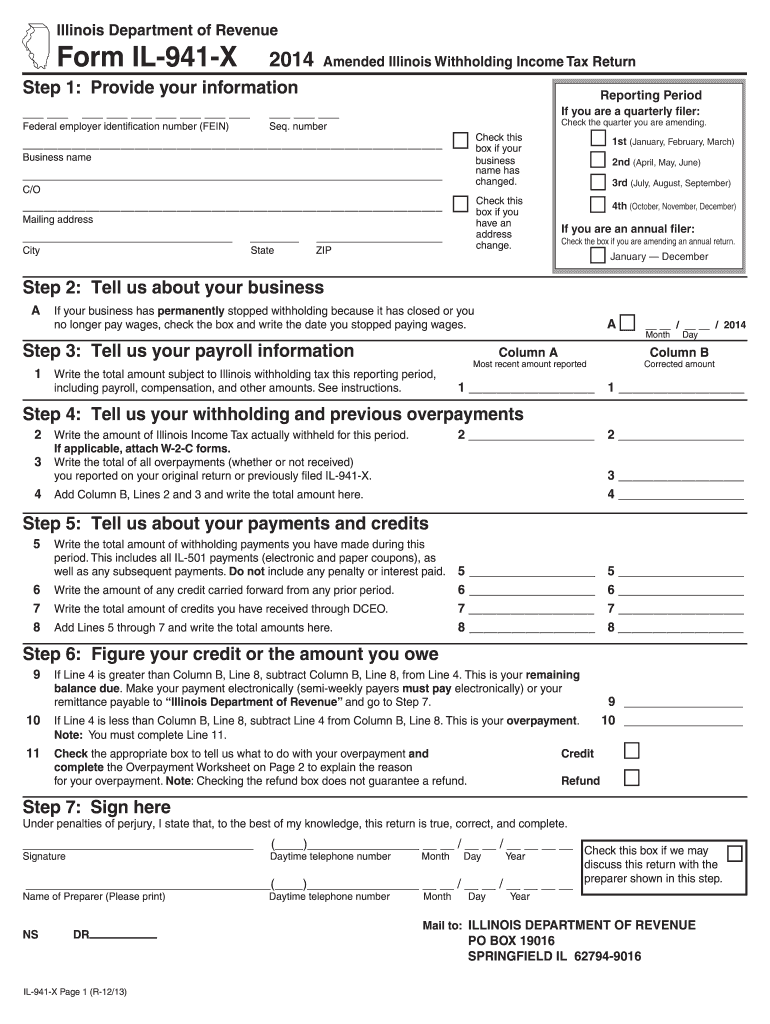

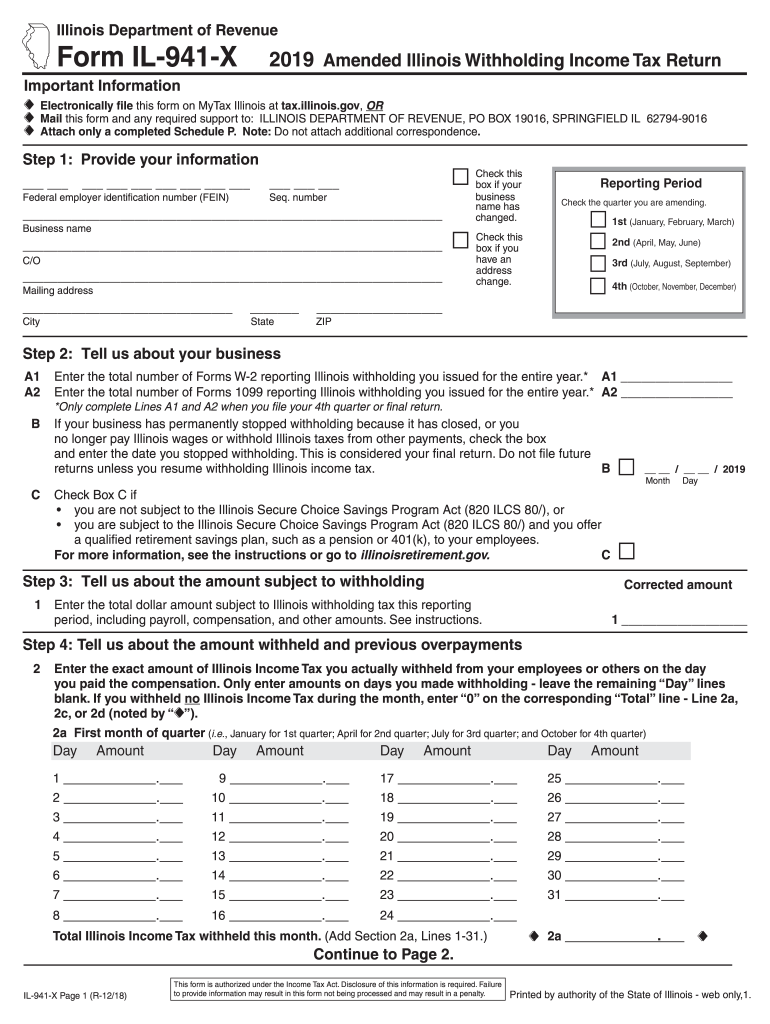

2016 Form IL DoR IL941X Fill Online, Printable, Fillable, Blank

Amend your 941 form for free. Web endobj 1396 0 obj >/filter/flatedecode/id[]/index[1328 126]/info 1327 0 r/length 120/prev 131553/root 1329 0 r/size 1454/type/xref/w[1 2 1]>>stream hþbbd ``b`y $ [ad. Complete and get your 941x online easily with taxbandits. If you're correcting a quarter that began For more information, see the instructions for form 8974 and go to irs.gov/ researchpayrolltc.

Il 941 X Form Fill Out and Sign Printable PDF Template signNow

Employer identification number (ein) — name (not your trade name) trade name (if. This form will be used to correct the number of employees reported. Amend your 941 form for free. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax.

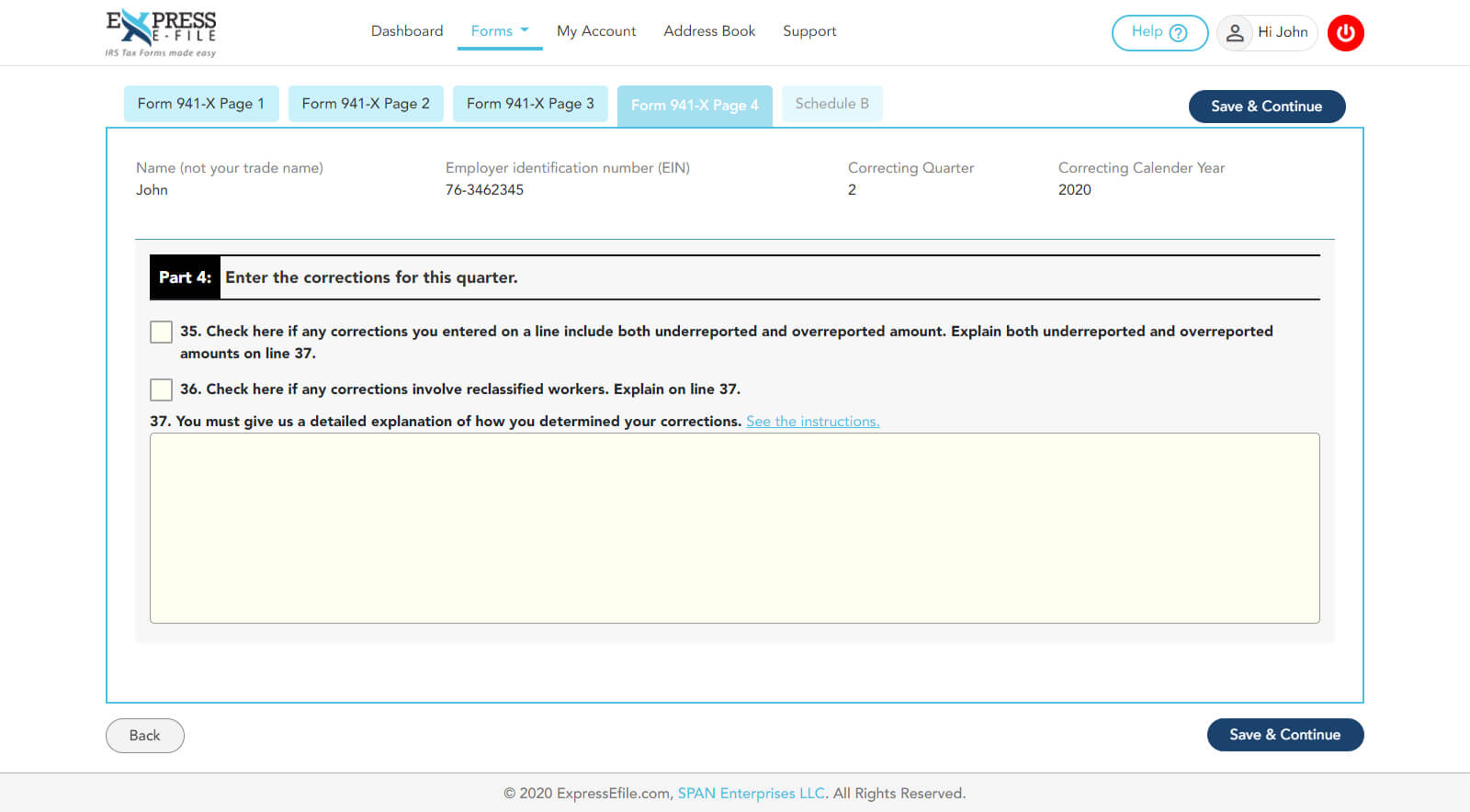

How to Complete & Download Form 941X (Amended Form 941)?

You must complete all five pages. Choose the adjustment process if you want the amount shown on line 21 credited to your form 941, July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Employer identification number (ein) — name (not your trade name) trade name (if. Type.

Form Il 941 X Fill Out and Sign Printable PDF Template signNow

See the instructions for line 42. For all quarters you qualify for, get your original 941, a. Amend your 941 form for free. If you're correcting a quarter that began Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding.

IRS Form 941X Complete & Print 941X for 2021

Amend your 941 form for free. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Complete and get your 941x online easily with taxbandits. The amount filed for line 1, number of employees, was filed incorrectly on the 941.

Form 941 X 2023 Fill online, Printable, Fillable Blank

Determine which payroll quarters in 2020 and 2021 your business qualifies for. Web endobj 1396 0 obj >/filter/flatedecode/id[]/index[1328 126]/info 1327 0 r/length 120/prev 131553/root 1329 0 r/size 1454/type/xref/w[1 2 1]>>stream hþbbd ``b`y $ [ad. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. You must complete all.

IRS Form 941X Learn How to Fill it Easily

Employer identification number (ein) — name (not your trade name) trade name (if. Choose either process to correct the overreported amounts. April 2017) adjusted employer's quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Employer identification number (ein) — name (not your trade name) trade name (if. See the instructions for.

How to Complete & Download Form 941X (Amended Form 941)?

July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. You must complete all five pages. The amount filed for line 1, number of employees, was filed incorrectly on the 941 form. Determine which payroll quarters in 2020 and 2021 your business qualifies for. These instructions have been.

You Must Complete All Five Pages.

Amend your 941 form for free. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. If you're correcting a quarter that began Complete and get your 941x online easily with taxbandits.

Employer Identification Number (Ein) — Name (Not Your Trade Name) Trade Name (If.

Choose the adjustment process if you want the amount shown on line 21 credited to your form 941, Determine which payroll quarters in 2020 and 2021 your business qualifies for. If you are located in. For more information, see the instructions for form 8974 and go to irs.gov/ researchpayrolltc.

April 2017) Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Department Of The Treasury — Internal Revenue Service Omb No.

These instructions have been updated for changes under the american rescue plan act of 2021 (the arp). Choose either process to correct the overreported amounts. Check here if you’re eligible for the employee retention credit in the third or. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,.

This Form Will Be Used To Correct The Number Of Employees Reported.

The amount filed for line 1, number of employees, was filed incorrectly on the 941 form. See the instructions for line 42. For all quarters you qualify for, get your original 941, a. Type or print within the boxes.