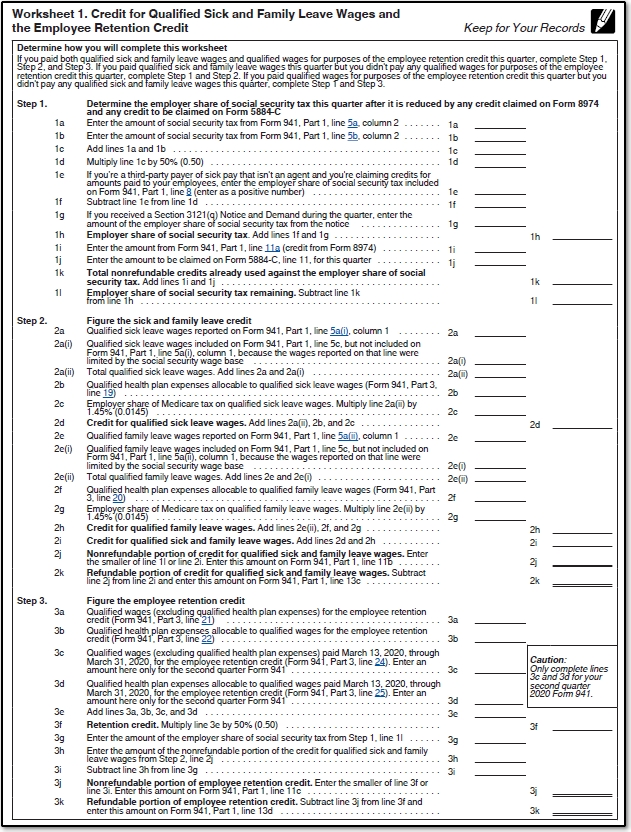

941-X Worksheet 1 Fillable Form

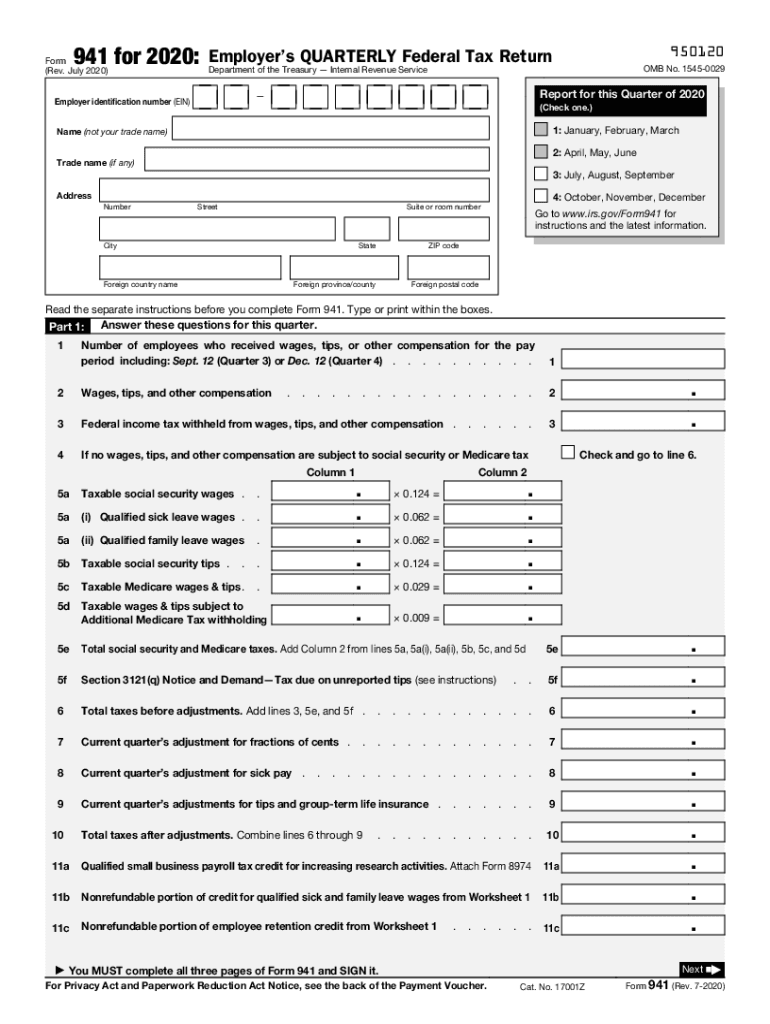

941-X Worksheet 1 Fillable Form - What are the new changes in form 941 worksheets for 2023? Adjusted employment tax return, claim certifications: For tax years beginning before january 1, 2023, a qualified small business may elect to claim up to $250,000 of its credit for increasing research activities as a payroll tax credit. Type or print within the boxes. Adjusted employer's quarterly federal tax return or claim for refund keywords: Form has the process of adjusted employment tax return or claim in part 1 page and part 2 page of form consists of certifications. You must complete all four pages. I pulled worksheet 1 from the irs website and filled it out, but the 941 won't let me override to fill in the appropriate line items. Web 941 x worksheet 1 fillable form use a 941 x worksheet 2 excel template to make your document workflow more streamlined. See the instructions for line 36.

Now that you’re allowed to have both your ppp loans and ertcs, you will need to revise your 941s that you filed with the irs in previous quarters. Adjusted employer's quarterly federal tax return or claim for refund keywords: Add and customize text, images, and fillable areas, whiteout unneeded details, highlight the important ones, and provide comments on your updates. Type or print within the boxes. You must complete all four pages. I pulled worksheet 1 from the irs website and filled it out, but the 941 won't let me override to fill in the appropriate line items. Before you begin to complete worksheet 1, you should know how you paid your employees for the reporting quarter. Show details we are not affiliated with any brand or entity on this form. How it works browse for the 941 x worksheet 2 customize and esign 941x worksheet 2 send out signed worksheet 2 941x or print it rate the 941x. To make sure the worksheet 1 will populate when opening.

Before you begin to complete worksheet 1, you should know how you paid your employees for the reporting quarter. Web the 941 form mentions worksheet 1 and line items that will come from worksheet 1, but it's not included when filling out the 941. Type or print within the boxes. The irs has updated the first step of worksheet 1 and reintroduced worksheet 2. Now that you’re allowed to have both your ppp loans and ertcs, you will need to revise your 941s that you filed with the irs in previous quarters. Adjusted employer's quarterly federal tax return or claim for refund keywords: Web basically, form 941 worksheet 1 consists of 3 steps. How it works browse for the 941 x worksheet 2 customize and esign 941x worksheet 2 send out signed worksheet 2 941x or print it rate the 941x. See the instructions for line 42. Thus, any employer who files the quarterly employment tax form to the irs under cares act and employees retention credit should use this worksheet.

2020 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. Type or print within the boxes. The irs has updated the first step of worksheet 1 and reintroduced worksheet 2. Adjusted employment tax return, claim certifications: Add and customize text, images, and fillable areas, whiteout unneeded details, highlight the important ones, and provide comments on.

941x Worksheet 2 Excel

See the instructions for line 36. Before you begin to complete worksheet 1, you should know how you paid your employees for the reporting quarter. Web the 941 form mentions worksheet 1 and line items that will come from worksheet 1, but it's not included when filling out the 941. Now that you’re allowed to have both your ppp loans.

941 Form Printable & Fillable Sample in PDF

Type or print within the boxes. Use worksheet 3 to figure the credit for leave taken after march 31, 2021, and before october 1, 2021. What are the new changes in form 941 worksheets for 2023? You must complete all five pages. Before you begin to complete worksheet 1, you should know how you paid your employees for the reporting.

941x Worksheet 1 Excel

Type or print within the boxes. Adjusted employer's quarterly federal tax return or claim for refund keywords: For a description of changes made under the arp, see the june 2021 revision of. Adjusted employment tax return, claim certifications: To make sure the worksheet 1 will populate when opening.

941x Worksheet 2 Excel

See the instructions for line 36. Thus, any employer who files the quarterly employment tax form to the irs under cares act and employees retention credit should use this worksheet. For a description of changes made under the arp, see the june 2021 revision of. Adjusted employment tax return, claim certifications: April, may, june read the separate instructions before completing.

What Is The Nonrefundable Portion Of Employee Retention Credit 2021

How it works browse for the 941 x worksheet 2 customize and esign 941x worksheet 2 send out signed worksheet 2 941x or print it rate the 941x. Adjusted employment tax return, claim certifications: Web basically, form 941 worksheet 1 consists of 3 steps. Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. See.

941x Worksheet 2 Excel

Before you begin to complete worksheet 1, you should know how you paid your employees for the reporting quarter. Much like with your form 941, completing worksheet 1 electronically will help you avoid errors. Web how it works browse for the 941 x worksheet 2 excel customize and esign 941x worksheet 1 send out signed 941 x worksheet 1 fillable.

941x Worksheet 1 Excel

Type or print within the boxes. Use worksheet 3 to figure the credit for leave taken after march 31, 2021, and before october 1, 2021. April, may, june read the separate instructions before completing this form. You must complete all four pages. Adjusted employer's quarterly federal tax return or claim for refund keywords:

Worksheet 1 941x

Web basically, form 941 worksheet 1 consists of 3 steps. For a description of changes made under the arp, see the june 2021 revision of. Much like with your form 941, completing worksheet 1 electronically will help you avoid errors. See the instructions for line 36. Use worksheet 3 to figure the credit for leave taken after march 31, 2021,.

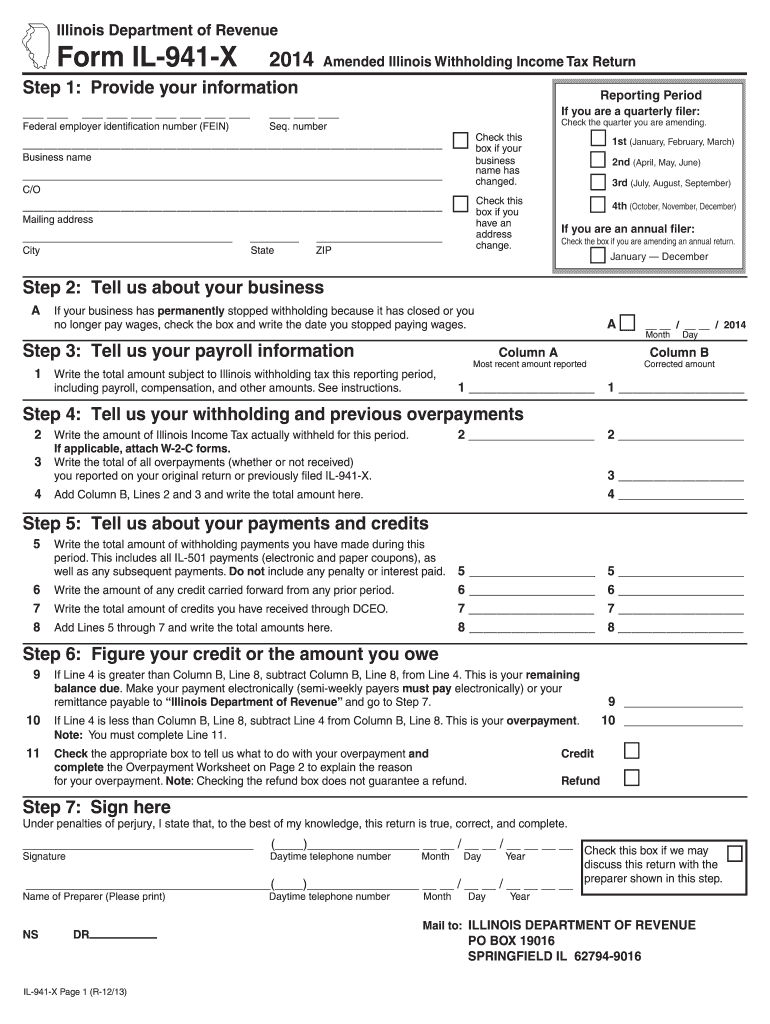

IL DoR IL941X 2014 Fill out Tax Template Online US Legal Forms

You must complete all five pages. What are the new changes in form 941 worksheets for 2023? April, may, june read the separate instructions before completing this form. How it works browse for the 941 x worksheet 2 customize and esign 941x worksheet 2 send out signed worksheet 2 941x or print it rate the 941x. These changes are based.

I Pulled Worksheet 1 From The Irs Website And Filled It Out, But The 941 Won't Let Me Override To Fill In The Appropriate Line Items.

Much like with your form 941, completing worksheet 1 electronically will help you avoid errors. For more information about the credit for qualified sick and family leave wages, go to irs.gov/plc. Show details we are not affiliated with any brand or entity on this form. Type or print within the boxes.

Adjusted Employment Tax Return, Claim Certifications:

Web 941 x worksheet 1 fillable form use a 941 x worksheet 2 excel template to make your document workflow more streamlined. See the instructions for line 42. Use worksheet 3 to figure the credit for leave taken after march 31, 2021, and before october 1, 2021. Now that you’re allowed to have both your ppp loans and ertcs, you will need to revise your 941s that you filed with the irs in previous quarters.

For Tax Years Beginning Before January 1, 2023, A Qualified Small Business May Elect To Claim Up To $250,000 Of Its Credit For Increasing Research Activities As A Payroll Tax Credit.

You must complete all five pages. These changes are based on form 8974 changes for the first quarter of 2023. Adjusted employer's quarterly federal tax return or claim for refund keywords: Type or print within the boxes.

Type Or Print Within The Boxes.

Web basically, form 941 worksheet 1 consists of 3 steps. Add and customize text, images, and fillable areas, whiteout unneeded details, highlight the important ones, and provide comments on your updates. Type or print within the boxes. See the instructions for line 36.

.jpg)