Address For Form 7004

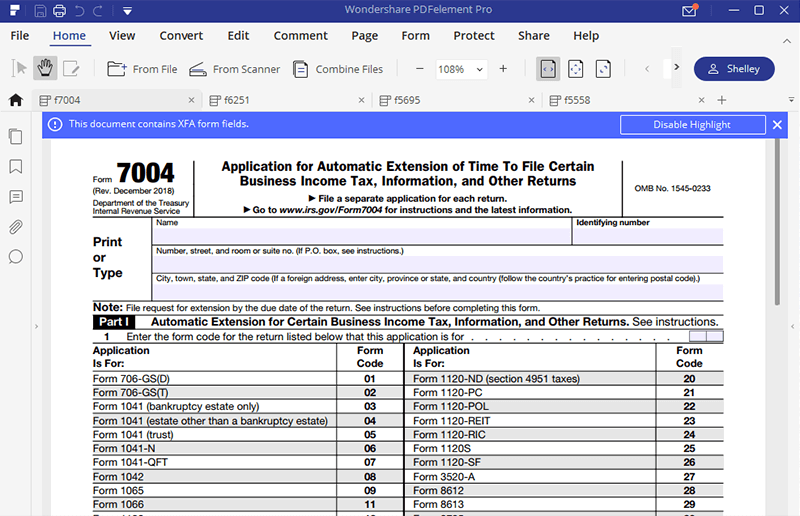

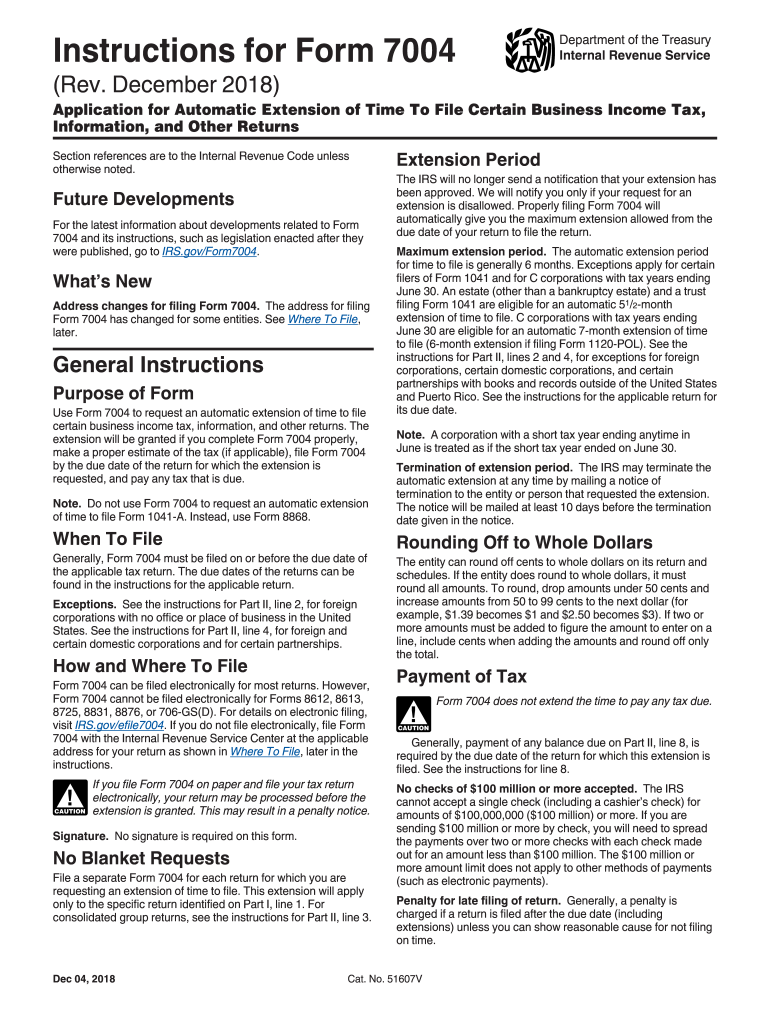

Address For Form 7004 - Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Web form 7004 is the extension form mainly used for form 1120s, the federal income tax return for s corporations. Where to mail the paper form? Web address changes for filing form 7004. Web address changes for filing form 7004. See where to file, later. The first step to finding out where to send your form 7004 to the. Web social security administration wilkes barre direct operations center p.o. Form 7004 is just one page long, and it’s broken into two sections. It'll also assist you with generating the.

Web — irsnews (@irsnews) april 17, 2023 irs form 7004 tax extension: The first step to finding out where to send your form 7004 to the. Use form 7004 to request an automatic 6. Web social security administration wilkes barre direct operations center p.o. As someone who’s in charge of an s corporation, make sure to file. Web how to file form 7004. See where to file, later. Web in this guide, we cover it all, including: Web what’s new address changes for filing form 7004. Web address changes for filing form 7004.

Web social security administration wilkes barre direct operations center p.o. Here’s how to fill out the form and file it with the irs: Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. General instructions purpose of form use. Use form 7004 to request an automatic 6. See where to file, later. The top of the form also has the address where you should mail the. The first step to finding out where to send your form 7004 to the. Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. Web this form contains instructions and filing addresses for [[form 7004]], application for automatic extension of time to file certain business income tax, information, and.

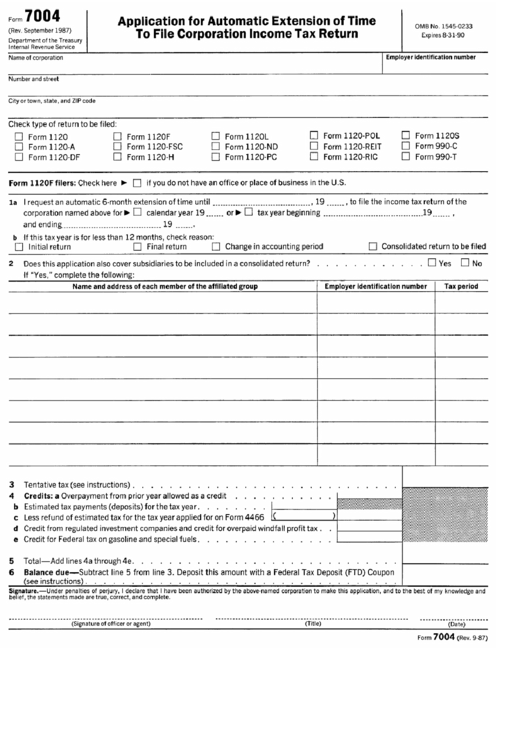

for How to Fill in IRS Form 7004

Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. Form 7004 is just one page long, and it’s broken into two sections. Web you may obtain a copy of this form in spanish, instead of english, if you would prefer. The top of the form also.

Form 7004 Where To Sign Fill Out and Sign Printable PDF Template

The top of the form also has the address where you should mail the. Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Web this form contains instructions and filing addresses for [[form 7004]], application for automatic extension of time to file certain business income tax, information, and. As.

How to file an LLC Tax extension Form 7004 Bette Hochberger, CPA, CGMA

Use form 7004 to request an automatic 6. Web this form contains instructions and filing addresses for [[form 7004]], application for automatic extension of time to file certain business income tax, information, and. Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. The address for filing.

File Form 1065 Extension Online Partnership Tax Extension

As someone who’s in charge of an s corporation, make sure to file. The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and. The first step to finding out where to send your form 7004 to the. You do not need to file. Web — irsnews (@irsnews) april 17, 2023 irs.

This Is Where You Need To Mail Your Form 7004 This Year Blog

General instructions purpose of form use. Irs form 7004 explained by jean murray updated on april 8, 2021 fact checked by hans. The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and. Web this form contains instructions and filing addresses for [[form 7004]], application for automatic extension of time to file.

Where to file Form 7004 Federal Tax TaxUni

The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and. It'll also assist you with generating the. The address for filing form 7004 has changed for some entities. Here’s how to fill out the form and file it with the irs: General instructions purpose of form use.

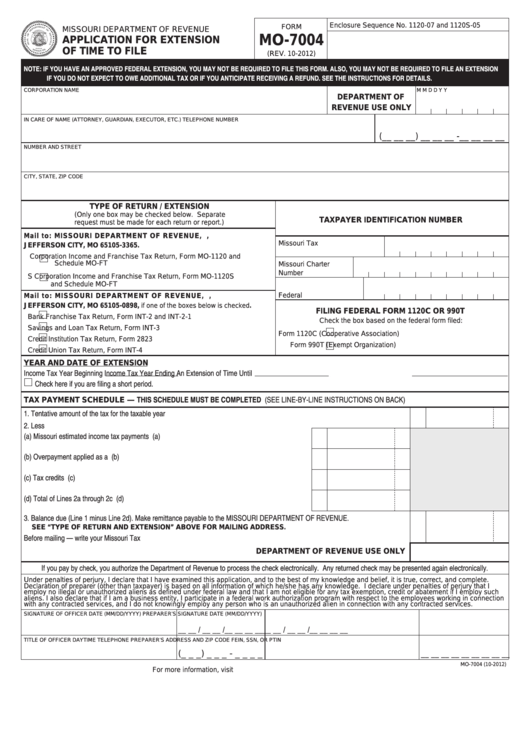

Fillable Form Mo7004 Application For Extension Of Time To File

See where to file, later. The address for filing form 7004 has changed for some entities. Web address changes for filing form 7004. Web you may obtain a copy of this form in spanish, instead of english, if you would prefer. Web address changes for filing form 7004.

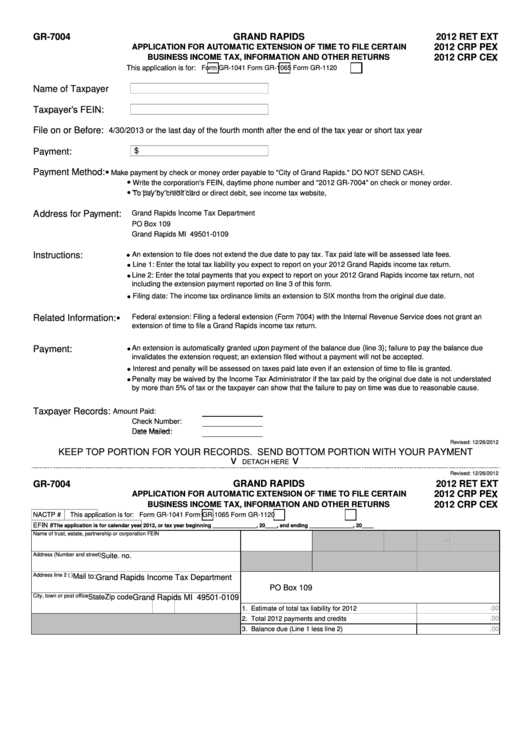

Form Gr7004 Application For Automatic Extension Of Time To File

General instructions purpose of form use. See where to file, later. Use form 7004 to request an automatic 6. Form 7004 is just one page long, and it’s broken into two sections. Web address changes for filing form 7004.

Last Minute Tips To Help You File Your Form 7004 Blog

It'll also assist you with generating the. General instructions purpose of form use. Web address changes for filing form 7004. Web what’s new address changes for filing form 7004. What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form.

Form 7004 Application For Automatic Extension Of Time To File

Here’s how to fill out the form and file it with the irs: Web see form 7004 instructions for exceptions pertaining to foreign corporations with no office or place of business in the united states, for foreign and certain domestic. Web address changes for filing form 7004. Web what’s new address changes for filing form 7004. Web in this guide,.

The Address For Filing Form 7004 Has Changed For Some Entities Located In Georgia, Illinois, Kentucky, Michigan, Tennessee, And.

As someone who’s in charge of an s corporation, make sure to file. Web address changes for filing form 7004. Web address changes for filing form 7004: See where to file, later.

Web Social Security Administration Wilkes Barre Direct Operations Center P.o.

The address for filing form 7004 has changed for some entities. Web what’s new address changes for filing form 7004. The top of the form also has the address where you should mail the. Web you may obtain a copy of this form in spanish, instead of english, if you would prefer.

The Address For Filing Form 7004 Has Changed For Some Entities.

Where to mail the paper form? Web this form contains instructions and filing addresses for [[form 7004]], application for automatic extension of time to file certain business income tax, information, and. The first step to finding out where to send your form 7004 to the. Web building your business business taxes what is irs form 7004?

General Instructions Purpose Of Form Use.

Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. It'll also assist you with generating the. The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and. See where to file, later.