Arizona Tax Extension Form

Arizona Tax Extension Form - Web form is used by a fiduciary to request an extension of time to file the estate or trust's income tax return (form 141az). If you do not owe arizona income taxes by the tax deadline of april 18, 2023, you do not have to prepare and file a az tax extension. Phoenix, az— the arizona department of revenue and the arizona association of. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Application for automatic extension of time to file corporation, partnership, and. Web the completed extension form must be filed by april 18, 2023. Web purpose of form 204 use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. Web • the extension request can be made by filing an arizona extension request, arizona form 120/165ext, or by filing a federal extension. Income tax return (for u.s. The state of arizona requires individuals to file a federal form 4868 rather than requesting a.

If you do not owe arizona income taxes by the tax deadline of april 18, 2023, you do not have to prepare and file a az tax extension. • the department will also accept a. For individuals who filed a timely arizona form 204 for an automatic extension to file, the due date for an arizona. A change to a business name typically indicates a change in. To apply for a state extension, file arizona form 204 by april 15,. Phoenix, az— the arizona department of revenue and the arizona association of. Application for automatic extension of time to file corporation, partnership, and. Web 26 rows individual income tax forms. Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr, 140py, 140ptc or 140et. Application for filing extension for fiduciary.

Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr, 140py, 140ptc or 140et. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. To apply for a state extension, file arizona form 204 by april 15,. Web arizona filing due date: Application for filing extension for fiduciary. Web 26 rows application for automatic extension of time to file corporation, partnership,. Income tax return (for u.s. Web form 2350, application for extension of time to file u.s. The arizona department of revenue will follow. Web 26 rows individual income tax forms.

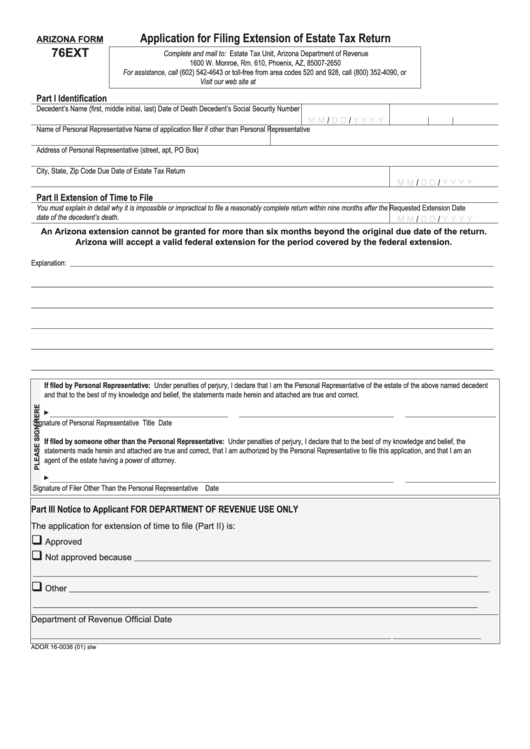

Form 76ext Application For Filing Extension Of Estate Tax Return

Web this form is being used to transmit the arizona extension payment. For individuals who filed a timely arizona form 204 for an automatic extension to file, the due date for an arizona. To apply for a state extension, file arizona form 204 by april 15,. In case you expect a az tax refund,. Web the completed extension form must.

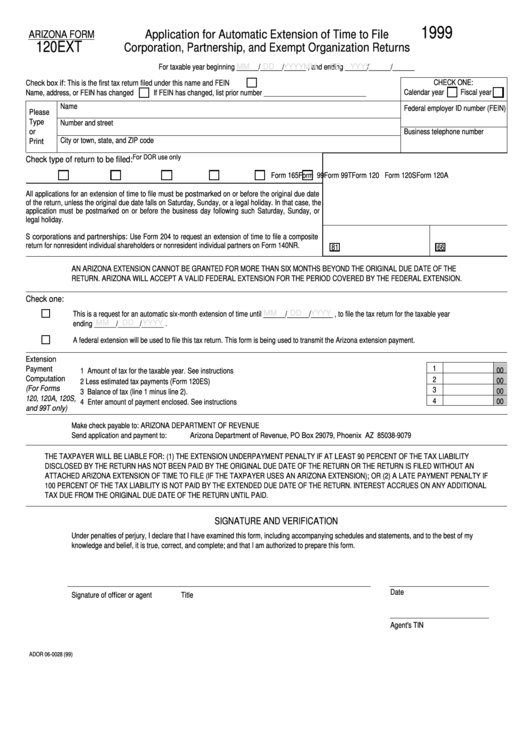

Arizona Form 120ext Application For Automatic Extension Of Time To

The arizona department of revenue will follow. Web does arizona support tax extension for personal income tax returns? The state of arizona requires individuals to file a federal form 4868 rather than requesting a. Web file this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. Income tax return (for u.s.

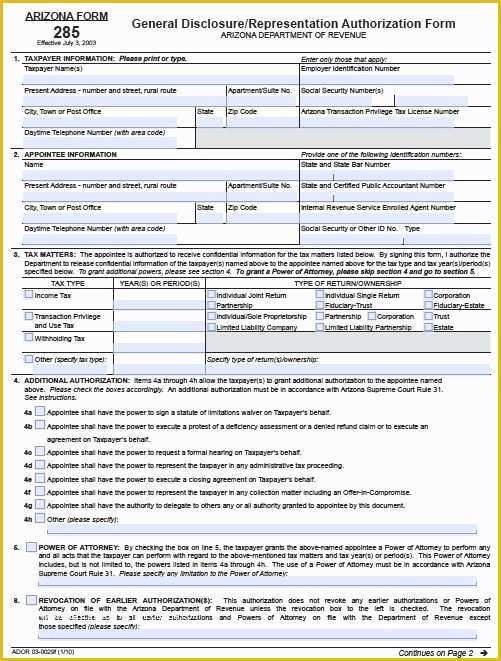

Free Will Template Arizona Of Free Tax Power Of attorney Arizona form

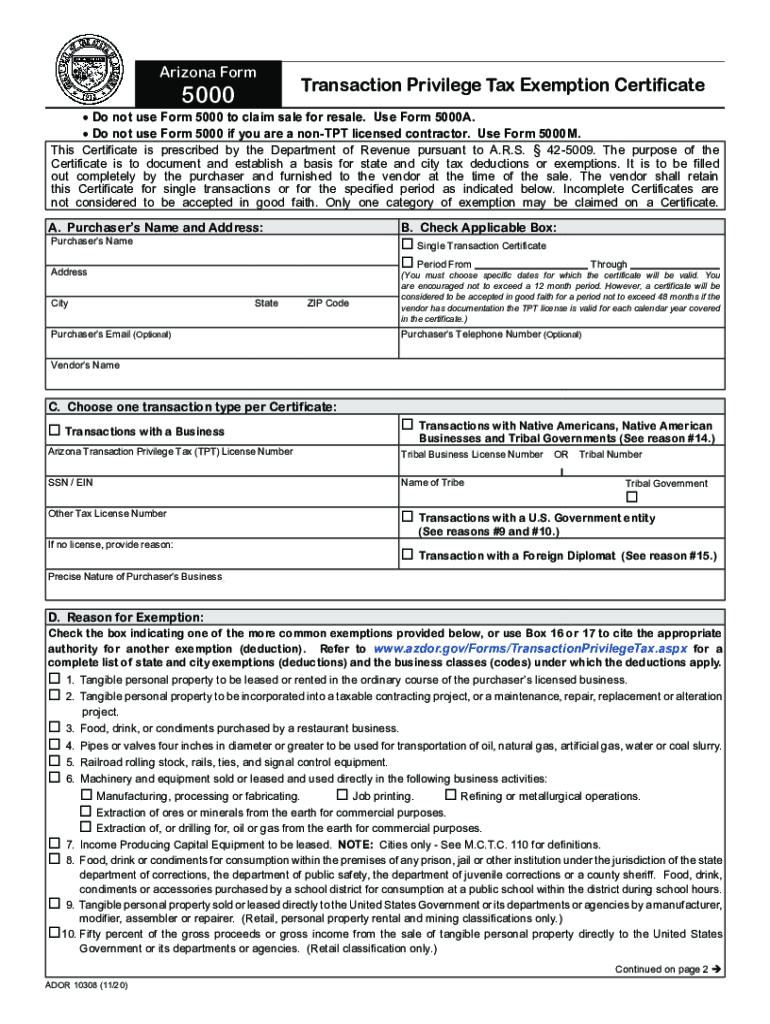

Web the update form is available in the forms section for transaction privilege tax (tpt) on www.azdor.gov note: Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr, 140py, 140ptc or 140et. An arizona extension will give you until october 15, 2021 to. Web • the extension request can be made by filing an arizona extension.

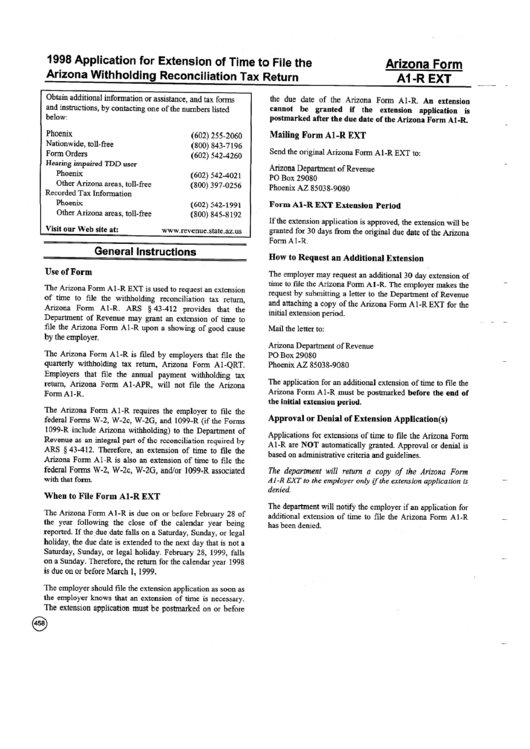

Form A1R Ext 1998 Application For Extension Of Time To File The

An arizona extension will give you until october 15, 2021 to. Income tax return (for u.s. Web 26 rows application for automatic extension of time to file corporation, partnership,. The arizona department of revenue will follow. Web if filing under extension arizona form 140 resident personal income tax return for calendar year 2021 or fiscal year beginning m m d.

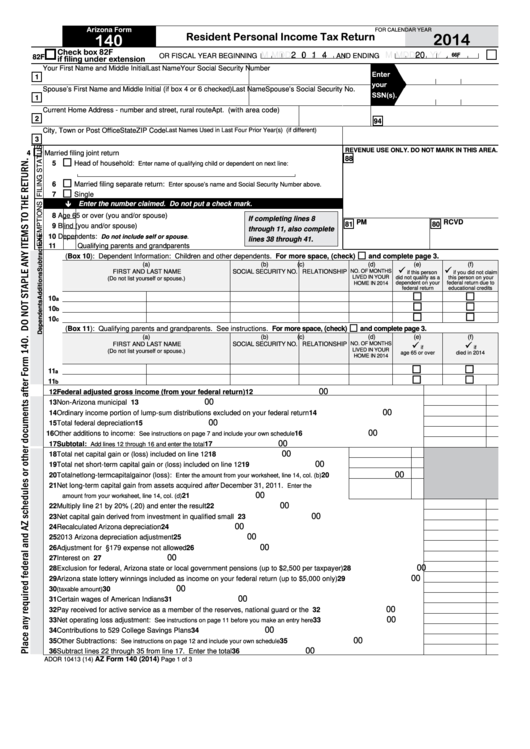

Fillable Arizona Form 140 Resident Personal Tax Return 2014

The arizona department of revenue will follow. Web make an individual or small business income payment individual payment type options include: To apply for a state extension, file arizona form 204 by april 15,. Web does arizona support tax extension for personal income tax returns? Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr, 140py,.

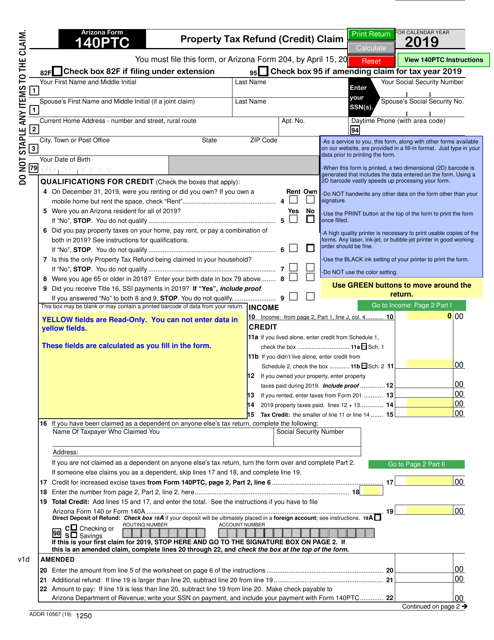

Arizona Form 140PTC (ADOR10567) Download Fillable PDF or Fill Online

Application for filing extension for fiduciary. The state of arizona requires individuals to file a federal form 4868 rather than requesting a. Application for automatic extension of time to file corporation, partnership, and. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web this form is being used to transmit the arizona.

Form 4868 Application for Automatic Extension of Time to File U.S

• the department will also accept a. Web purpose of form 204 use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. Application for automatic extension of time to file corporation, partnership, and. Application for filing extension for fiduciary. Web • the extension request can be made.

Arizona Lawmakers Deliver Tax Cuts and Federal Conformity

Web form is used by a fiduciary to request an extension of time to file the estate or trust's income tax return (form 141az). Web july 26, 2023. Web the completed extension form must be filed by april 18, 2023. In case you expect a az tax refund,. To apply for a state extension, file arizona form 204 by april.

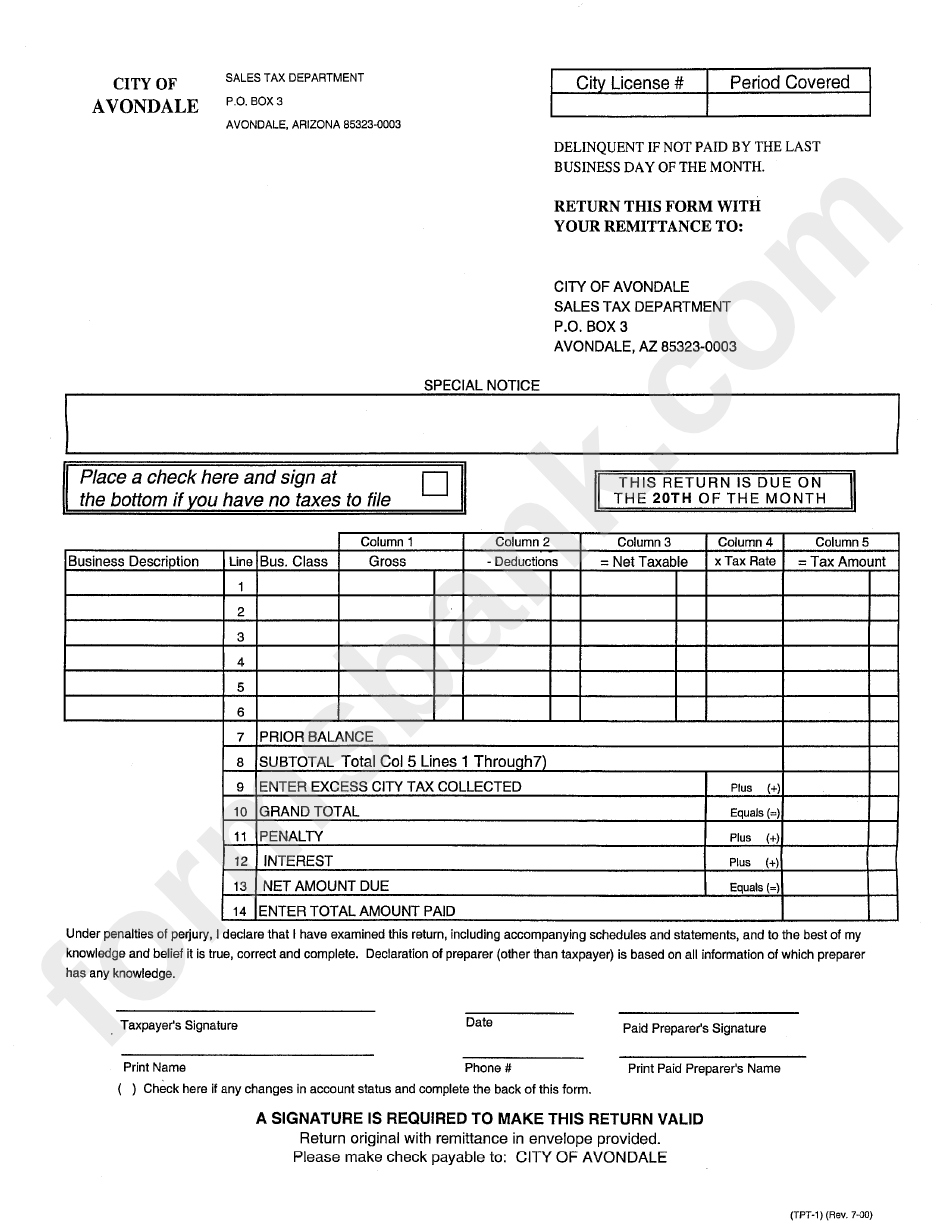

Sales Tax Department Form State Of Arizona printable pdf download

Web this form is being used to transmit the arizona extension payment. Web arizona income tax forms arizona printable income tax forms 96 pdfs arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the. Application for filing extension for fiduciary. • the department will also accept a. Web if filing under extension.

2020 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank pdfFiller

Individual income tax returns are due by april 15, in most years — or by the 15th day of the 4th month following the end of the taxable year (for fiscal year. Citizens and resident aliens abroad who expect to qualify for special. If you only require a state tax extension, go ahead and apply for a state extension using.

Web • The Extension Request Can Be Made By Filing An Arizona Extension Request, Arizona Form 120/165Ext, Or By Filing A Federal Extension.

Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr, 140py, 140ptc or 140et. Web make an individual or small business income payment individual payment type options include: In case you expect a az tax refund,. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes.

To Apply For A State Extension, File Arizona Form 204 By April 15,.

Individual income tax returns are due by april 15, in most years — or by the 15th day of the 4th month following the end of the taxable year (for fiscal year. A change to a business name typically indicates a change in. The arizona department of revenue will follow. Web july 26, 2023.

Web 26 Rows Individual Income Tax Forms.

Web if filing under extension arizona form 140 resident personal income tax return for calendar year 2021 or fiscal year beginning m m d d 2 0 2 1 and ending. • the department will also accept a. For individuals who filed a timely arizona form 204 for an automatic extension to file, the due date for an arizona. Citizens and resident aliens abroad who expect to qualify for special.

If You Only Require A State Tax Extension, Go Ahead And Apply For A State Extension Using Arizona Form 204.

The state of arizona requires individuals to file a federal form 4868 rather than requesting a. Phoenix, az— the arizona department of revenue and the arizona association of. Web does arizona support tax extension for personal income tax returns? Application for automatic extension of time to file corporation, partnership, and.