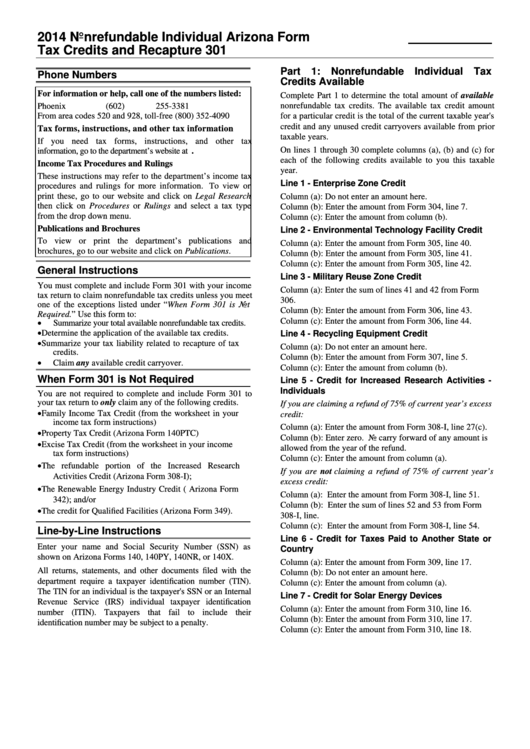

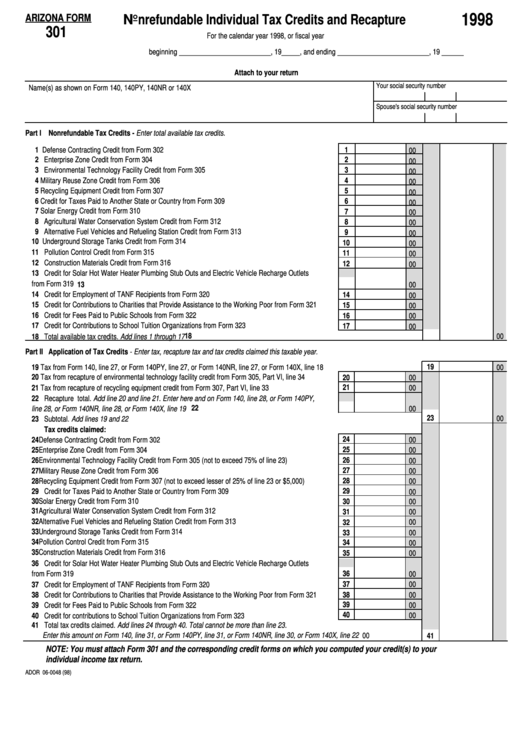

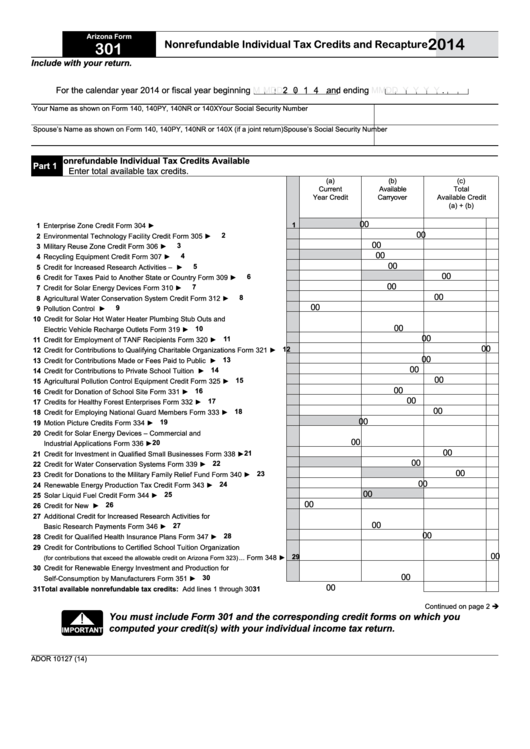

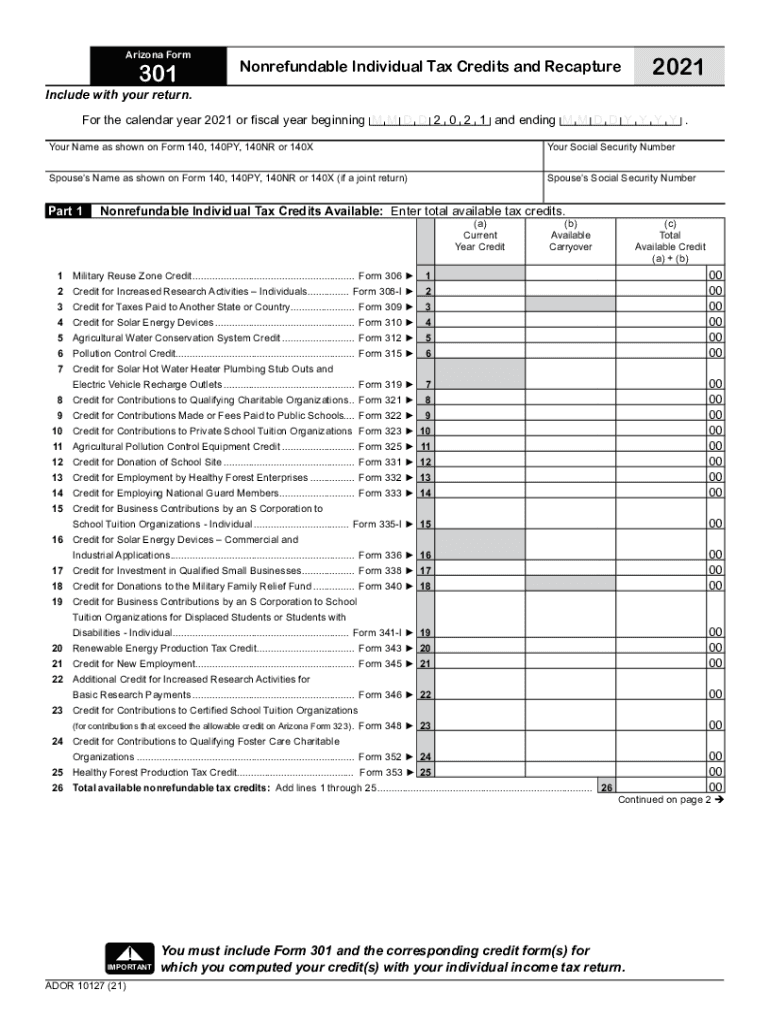

Arizona Tax Form 301

Arizona Tax Form 301 - Web arizona state income tax forms 301, 323, and 348 are used for claiming the original and plus/overflow tuition tax credits. Web 26 rows tax credits forms : Web you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return.! It acts as a summary to include all the. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Nonrefundable individual tax credits and. Web we last updated the nonrefundable individual tax credits and recapture in february 2023, so this is the latest version of form 301, fully updated for tax year 2022. Edit, sign and print tax forms on any device with pdffiller. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web arizona form 301 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax.

Web arizona state income tax forms 301, 323, and 348 are used for claiming the original and plus/overflow tuition tax credits. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Nonrefundable individual tax credits and recapture keywords: Web the az form 301 is a summary form for all the arizona credits on your return, and the form 310 is the solar energy credit, which cannot exceed $1,000 per. Edit your arizona 301 tax online type text, add images, blackout confidential details, add comments, highlights and more. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Web we last updated arizona form 301 in february 2023 from the arizona department of revenue. Arizona department of revenue subject: Web 26 rows tax credits forms : Edit, sign and print tax forms on any device with pdffiller.

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Mary’s 2020 tax is $250. Sign it in a few clicks draw your signature, type it,. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Web generalinstructions you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless. Web you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return.! Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Mary can apply $250 of the credit to her 2020 tax liability and carryover $150 of the unused $400. Web for 2020, mary is allowed a maximum credit of $400. Web arizona form 301 author:

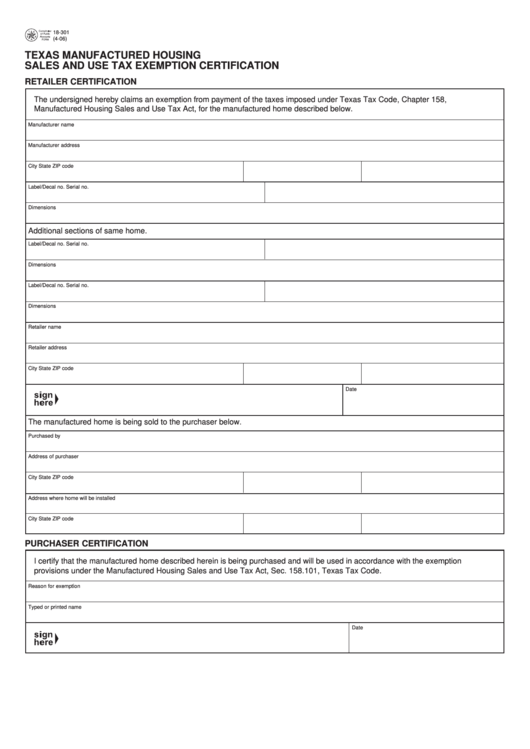

Fillable Form 18301 Texas Manufactured Housing Sales And Use Tax

Mary can apply $250 of the credit to her 2020 tax liability and carryover $150 of the unused $400. Arizona department of revenue subject: Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Edit, sign and print tax forms on any device with pdffiller. It acts as a summary to include all.

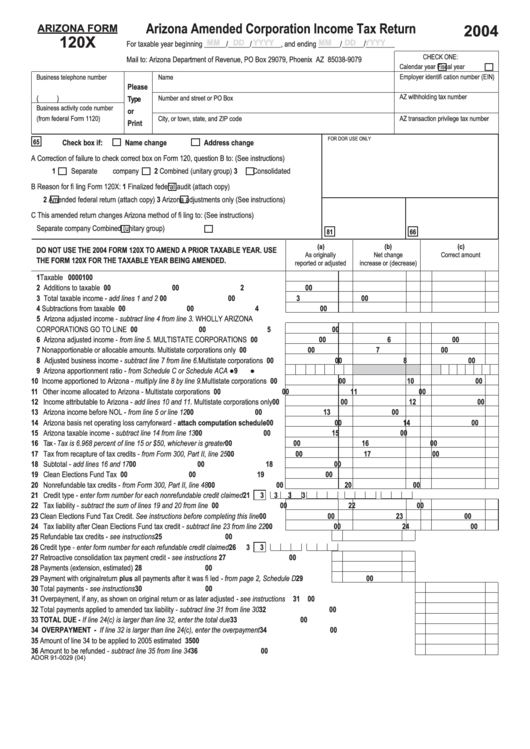

Arizona Form 120x Arizona Amended Corporation Tax Return

Nonrefundable individual tax credits and recapture keywords: Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Web general instructions you must complete.

Arizona Form 301 Nonrefundable Individual Tax Credits And Recapture

Edit your arizona 301 tax online type text, add images, blackout confidential details, add comments, highlights and more. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless.

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the..

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Web the az form 301 is a summary form for all the arizona credits on your return, and the form 310 is the solar energy credit, which cannot exceed $1,000 per. Web arizona form 301 author: It acts as a summary to include all the. Nonrefundable individual tax credits and recapture keywords: Web you must complete and include arizona form.

Download Instructions for Arizona Form 120 Arizona Corporation

Web generalinstructions you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Web the az form 301 is a summary form for all the arizona credits on your return,.

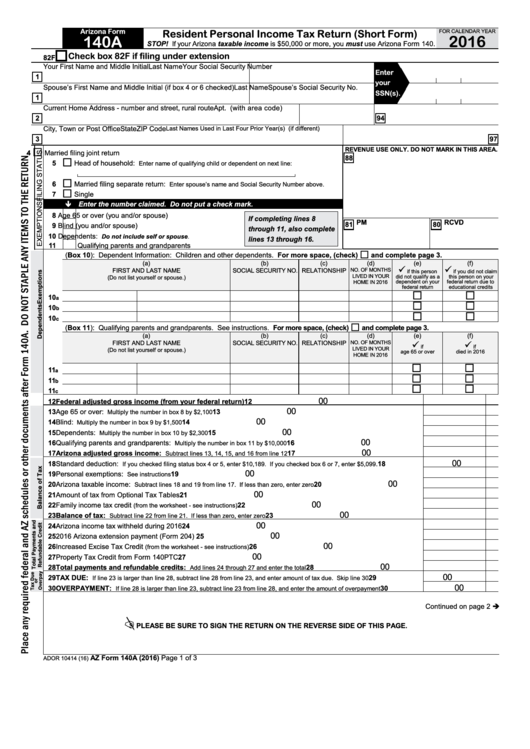

Arizona Form 140a Resident Personal Tax Return 2016

Web we last updated arizona form 301 in february 2023 from the arizona department of revenue. Nonrefundable individual tax credits and. Web for 2020, mary is allowed a maximum credit of $400. Web arizona form 301 author: Edit, sign and print tax forms on any device with pdffiller.

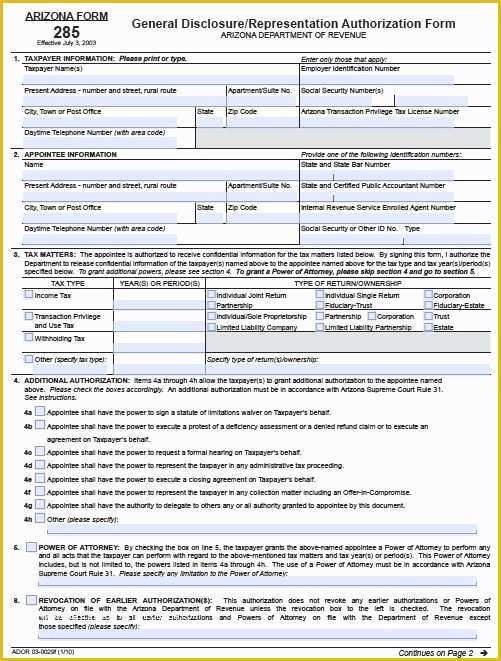

Free Will Template Arizona Of Free Tax Power Of attorney Arizona form

Arizona department of revenue subject: Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web 26 rows arizona corporate or partnership income tax payment voucher: Web for 2020, mary is allowed a maximum credit of $400. Web we last.

2021 AZ DoR Form 301 Fill Online, Printable, Fillable, Blank pdfFiller

Mary can apply $250 of the credit to her 2020 tax liability and carryover $150 of the unused $400. Web 26 rows arizona corporate or partnership income tax payment voucher: Web you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return.! Sign it in a few clicks.

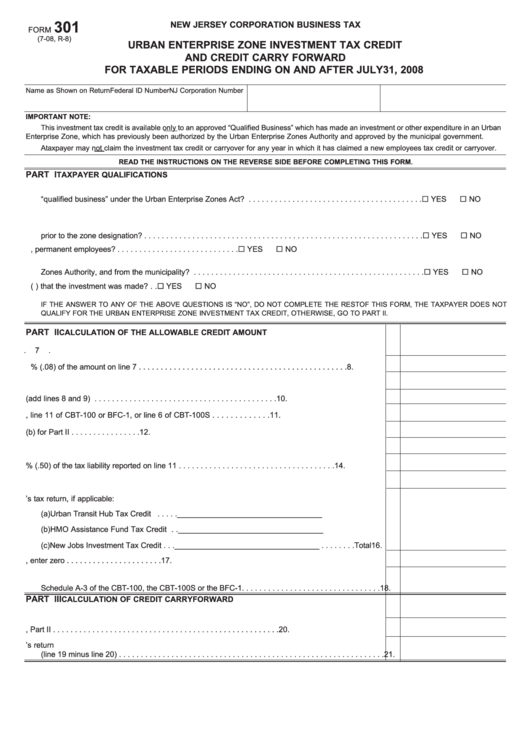

Fillable Form 301 Urban Enterprise Zone Investment Tax Credit And

Web for 2020, mary is allowed a maximum credit of $400. Web the az form 301 is a summary form for all the arizona credits on your return, and the form 310 is the solar energy credit, which cannot exceed $1,000 per. Web we last updated arizona form 301 in february 2023 from the arizona department of revenue. Web arizona.

It Acts As A Summary To Include All The.

Edit, sign and print tax forms on any device with pdffiller. Web arizona form 301 author: Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Edit, sign and print tax forms on any device with signnow.

Web Arizona Form 301 Is The Initial Document That Needs To Be Prepared By Taxpayers In Arizona Who Intend To Claim One Or Multiple Tax Credits.

Web arizona form 301 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax. Mary’s 2020 tax is $250. Mary can apply $250 of the credit to her 2020 tax liability and carryover $150 of the unused $400. Web arizona state income tax forms 301, 323, and 348 are used for claiming the original and plus/overflow tuition tax credits.

Web For 2020, Mary Is Allowed A Maximum Credit Of $400.

Web 26 rows arizona corporate or partnership income tax payment voucher: Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Sign it in a few clicks draw your signature, type it,. Web generalinstructions you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless.

For Each Credit, Part 1 Displays In Three Columns:.

Web you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return.! Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Nonrefundable individual tax credits and recapture keywords: Web the az form 301 is a summary form for all the arizona credits on your return, and the form 310 is the solar energy credit, which cannot exceed $1,000 per.