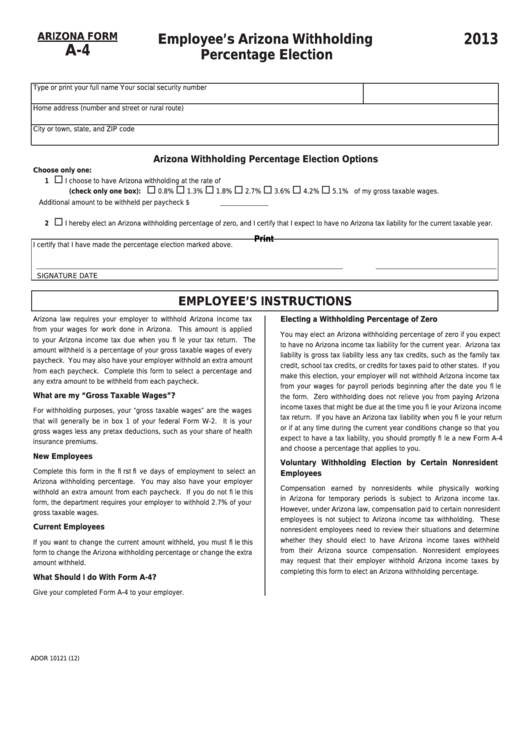

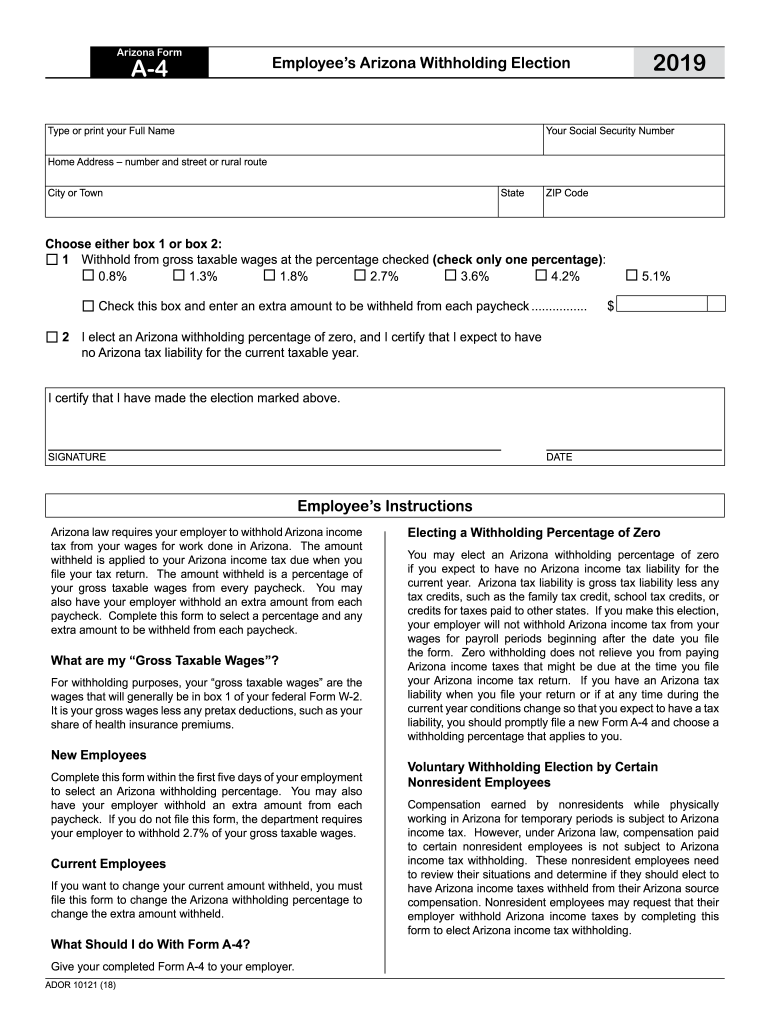

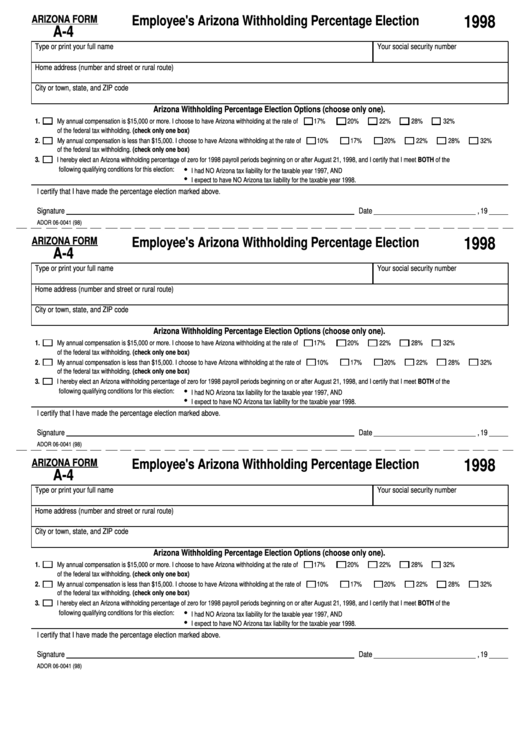

Arizona Tax Form A-4

Arizona Tax Form A-4 - The rates used on the form continue to range from 0.8% to 5.1%. You can use your results from the formula to help you complete the form and adjust your income tax withholding. I think rates are likely to remain relatively flat. Web arizona corporate or partnership income tax payment voucher: Voluntary withholding request for arizona resident employed outside of arizona | arizona department of revenue Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Web arizona withholding percentage: Tax credits forms, individual : Duration of voluntary arizona withholding election the payor of your pension or annuity will withhold arizona income tax from your payments until you notify the payor to change or terminate arizona withholding. Zero withholding does not relieve you from paying arizona income taxes that might be due at the time you file your arizona income tax return.

Voluntary withholding request for arizona resident employed outside of arizona | arizona department of revenue Web chances are good that mortgage rates won't increase much more this year, even if they don't actually start lowering until late 2023 or 2024. 9 by the state revenue department. This form is for income earned in tax year 2022, with tax returns due in april 2023. This form is submitted to the employer, not the department. Web july 26, 2023. The date of the employee's election. I think rates are likely to remain relatively flat. Arizona corporation income tax return (short form) corporate tax forms : Tax credits forms, individual :

Web chances are good that mortgage rates won't increase much more this year, even if they don't actually start lowering until late 2023 or 2024. You can use your results from the formula to help you complete the form and adjust your income tax withholding. Arizona corporation income tax return (short form) corporate tax forms : Annuitant's request for voluntary arizona income tax. Web what is the normal arizona withholding percentage? Web when the federal government recently announced it had stopped 10,000 pounds of fentanyl from entering arizona and southern california from mexico, the special name attached to the counternarcotics. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. This form is submitted to the employer, not the department. This form is for income earned in tax year 2022, with tax returns due in april 2023. Thursday, december 9th, 2021 if your small business staff includes hired employees, your financial responsibilities will include adjusting their paychecks for income tax withholding.

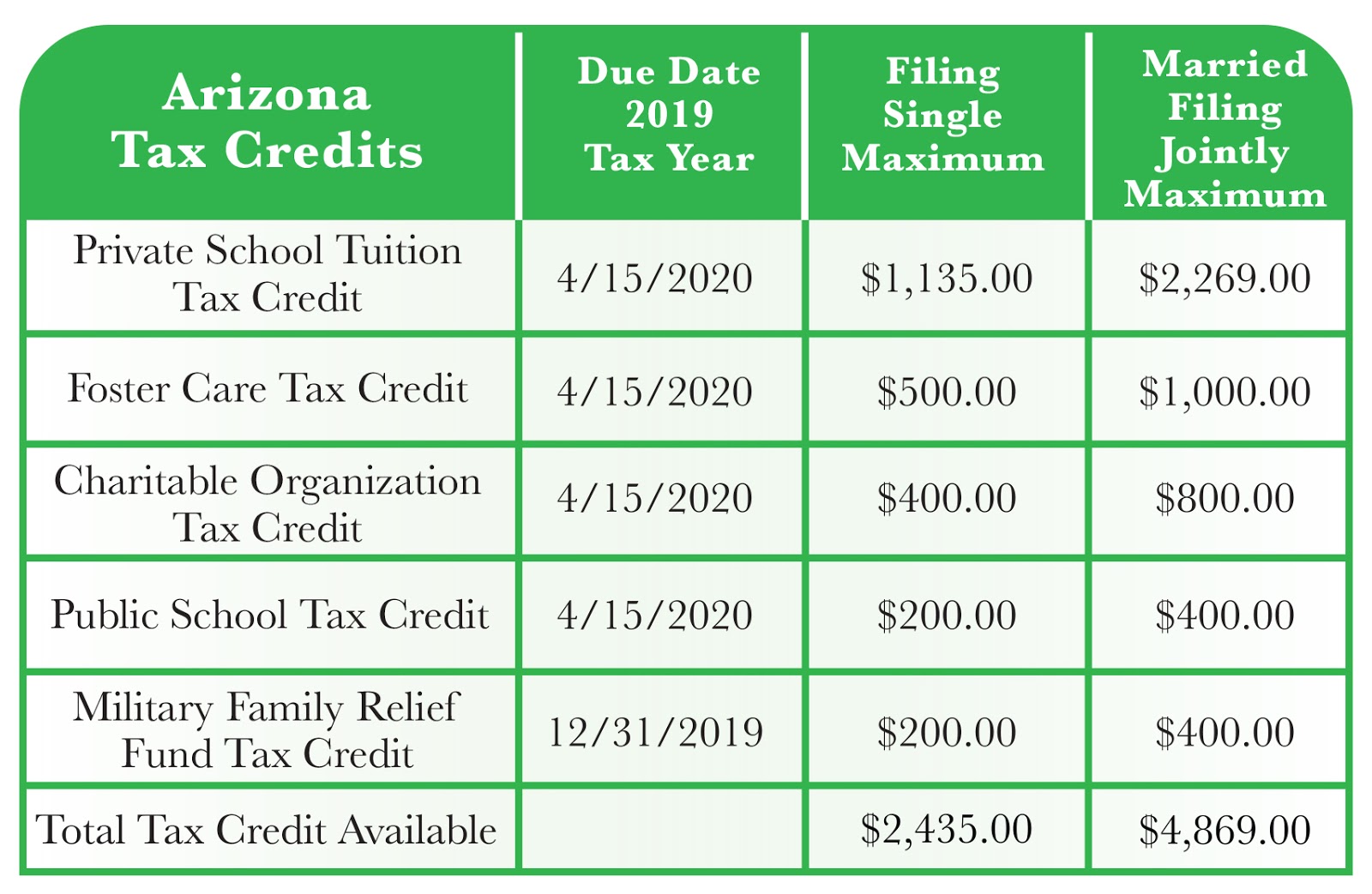

IBE Scholarships Arizona Offers Five Different Tax Credits

Web arizona withholding percentage: Web arizona corporate or partnership income tax payment voucher: Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. The date of the employee's election. Electing a withholding percentage of zero you may elect.

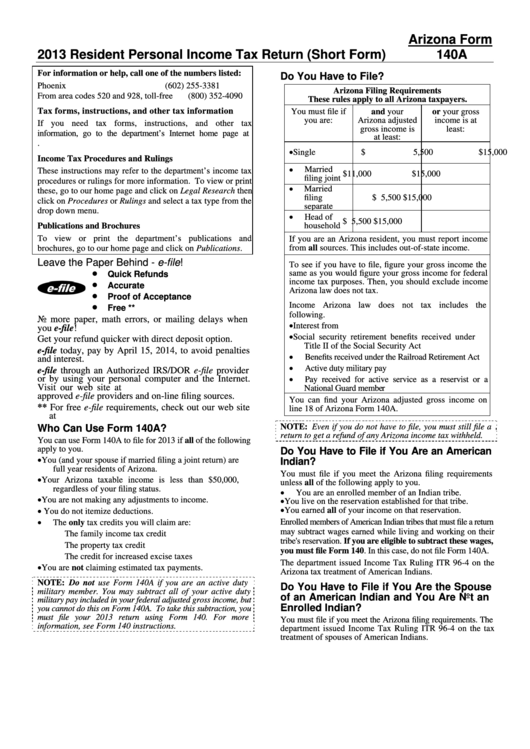

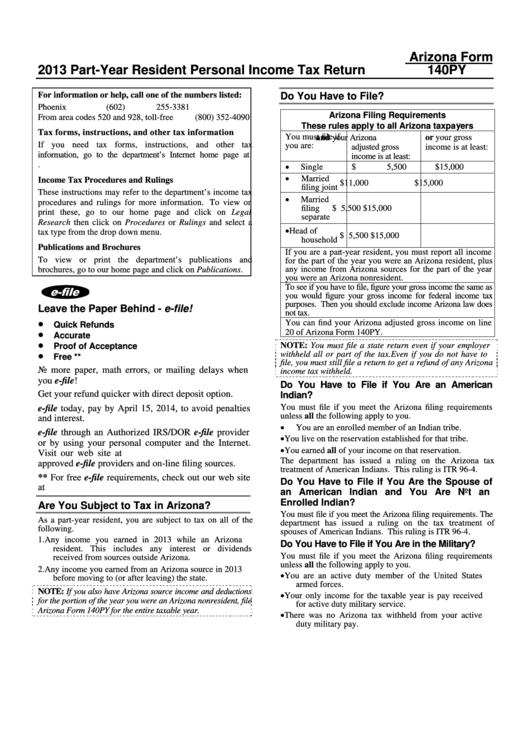

Instructions For Arizona Form 140a Resident Personal Tax

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web july 26, 2023. Web chances are good that mortgage rates won't increase much more this year, even if they don't actually start lowering until late 2023 or 2024. Arizona tax liability is gross tax liability less any Arizona corporation income tax return.

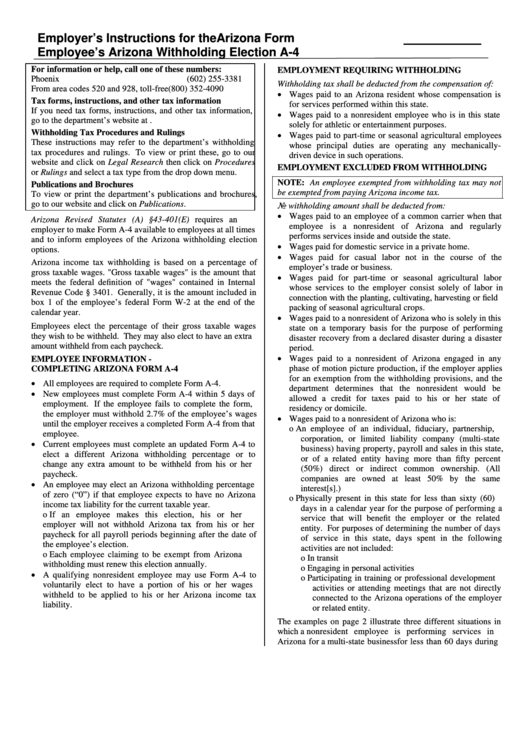

Arizona Form A4 Employer'S Instructions For The Employee'S Arizona

Annuitant's request for voluntary arizona income tax. Arizona corporation income tax return (short form) corporate tax forms : Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Web arizona withholding percentage: Zero withholding does not relieve you.

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Web when the federal government recently announced it had stopped 10,000 pounds of fentanyl from entering arizona and southern california from mexico, the special name attached to the counternarcotics. We will update this page with a new version of the form for 2024 as soon as it is made available by the arizona government. Voluntary withholding request for arizona resident.

Arizona Form 140py PartYear Resident Personal Tax Return

Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. You can use your results from the formula to help you complete the form and adjust your income tax withholding. Arizona s corporation income tax return: Web july 26, 2023. Thursday, december 9th, 2021 if your small business staff.

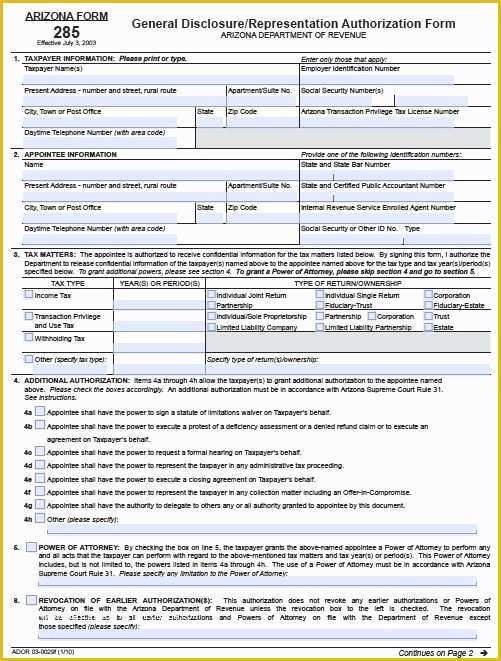

Free Will Template Arizona Of Free Tax Power Of attorney Arizona form

Zero withholding does not relieve you from paying arizona income taxes that might be due at the time you file your arizona income tax return. 9 by the state revenue department. Web what is the normal arizona withholding percentage? Arizona tax liability is gross tax liability less any The rates used on the form continue to range from 0.8% to.

2019 Form AZ DoR A4 Fill Online, Printable, Fillable, Blank PDFfiller

Arizona corporation income tax return (short form) corporate tax forms : I think rates are likely to remain relatively flat. You can use your results from the formula to help you complete the form and adjust your income tax withholding. For more information about this withholding law change, visit our website at www.azdor.gov. If you have an arizona tax liability.

Arizona to begin printing tax forms with revisions Legislature has yet

This form is submitted to the employer, not the department. I think rates are likely to remain relatively flat. Individual estimated tax payment form: Arizona corporation income tax return (short form) corporate tax forms : Annuitant's request for voluntary arizona income tax.

Download Arizona Form A4 (2013) for Free FormTemplate

Web arizona withholding percentage: Voluntary withholding request for arizona resident employed outside of arizona | arizona department of revenue 9 by the state revenue department. Web july 26, 2023. Web what is the normal arizona withholding percentage?

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Web july 26, 2023. Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Tax credits forms, individual : Web what is the normal arizona withholding percentage? For more information about this withholding law change, visit our website.

Annuitant's Request For Voluntary Arizona Income Tax.

You can use your results from the formula to help you complete the form and adjust your income tax withholding. For more information about this withholding law change, visit our website at www.azdor.gov. Web arizona withholding percentage: Arizona corporation income tax return (short form) corporate tax forms :

Duration Of Voluntary Arizona Withholding Election The Payor Of Your Pension Or Annuity Will Withhold Arizona Income Tax From Your Payments Until You Notify The Payor To Change Or Terminate Arizona Withholding.

Web when the federal government recently announced it had stopped 10,000 pounds of fentanyl from entering arizona and southern california from mexico, the special name attached to the counternarcotics. Arizona s corporation income tax return: We will update this page with a new version of the form for 2024 as soon as it is made available by the arizona government. Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year.

Web Chances Are Good That Mortgage Rates Won't Increase Much More This Year, Even If They Don't Actually Start Lowering Until Late 2023 Or 2024.

Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. I think rates are likely to remain relatively flat. Individual estimated tax payment form: Electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year.

9 By The State Revenue Department.

The date of the employee's election. If you have an arizona tax liability. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. This form is for income earned in tax year 2022, with tax returns due in april 2023.