Arkansas W4 Form 2022

Arkansas W4 Form 2022 - File this form with your employer. A single ticket won in california. Ar1023ct application for income tax exempt status. Enter the amount paid for this monthly reporting period only. The top individual tax rate is now. Web file this form with your employer. What are the top 10 largest mega millions jackpots ever? Web $5 (& 67$7( 2) $5.$16$6 (psor\hh·v :lwkkroglqj ([hpswlrq &huwlilfdwh 3ulqw )xoo 1dph 6rfldo 6hfxulw\ 1xpehu 3ulqw +rph $gguhvv &lw\ 6wdwh =ls (psor\hh Web 42 rows arkansas efile; Ar1100esct corporation estimated tax vouchers.

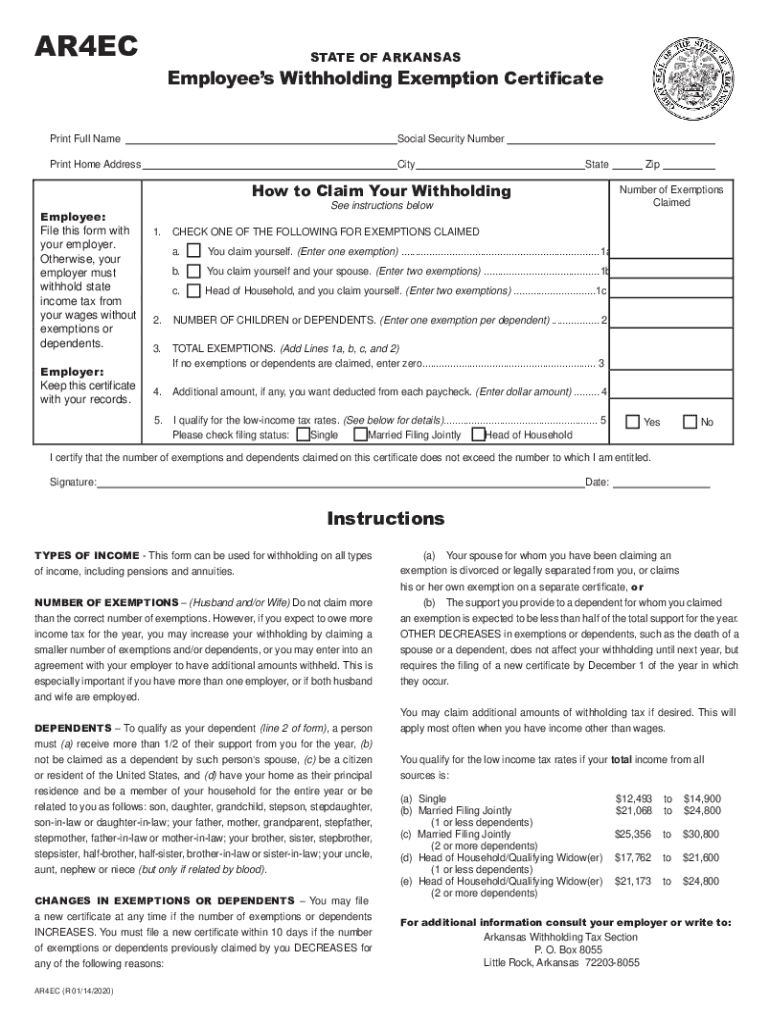

Web file this form with your employer. Web how to claim your withholding state zip number of exemptions employee: According to its website , here are. What are the top 10 largest mega millions jackpots ever? If too little is withheld, you will generally owe tax when you file your tax return. Enter the amount paid for this monthly reporting period only. Web employee’s state withholding exemption certificate (form ar4ec) contact. Web $2.04 billion, powerball, nov. A single ticket won in california. Ssc 425 little rock, ar.

The top individual tax rate is now. Web want withholding, write “revoked” next to the checkbox on line 1 and submit form ar4p to your payer. Web the arkansas department of finance and administration (dfa) has published updated 2022 withholding tax tables, effective october 1, 2022. What are the top 10 largest mega millions jackpots ever? A single ticket won in california. Single married filing jointly $13,055 to $15,700 $22,016 to $26,100 or less. Web enter the total amount of arkansas income tax withheld for this monthly reporting period only. Ar1023ct application for income tax exempt status. Enter the amount paid for this monthly reporting period only. Web ar4ec ar4ec state of arkansas employee’s withholding exemption certificate printfull name socialsecurity number printhomeaddress city state zip certifythat the.

Form 8948 Instructions To File 2021 2022 IRS Forms Zrivo

Fiduciary and estate income tax forms; Web enter the total amount of arkansas income tax withheld for this monthly reporting period only. A single ticket won in california. Web want withholding, write “revoked” next to the checkbox on line 1 and submit form ar4p to your payer. Web ar4ec ar4ec state of arkansas employee’s withholding exemption certificate printfull name socialsecurity.

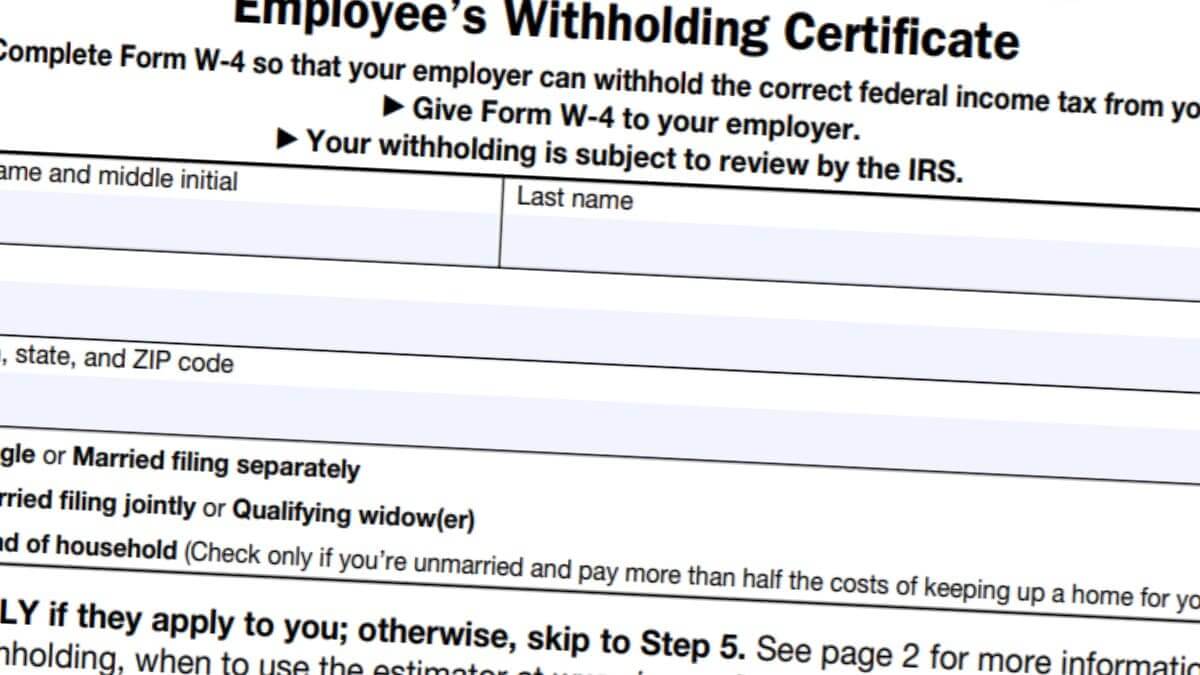

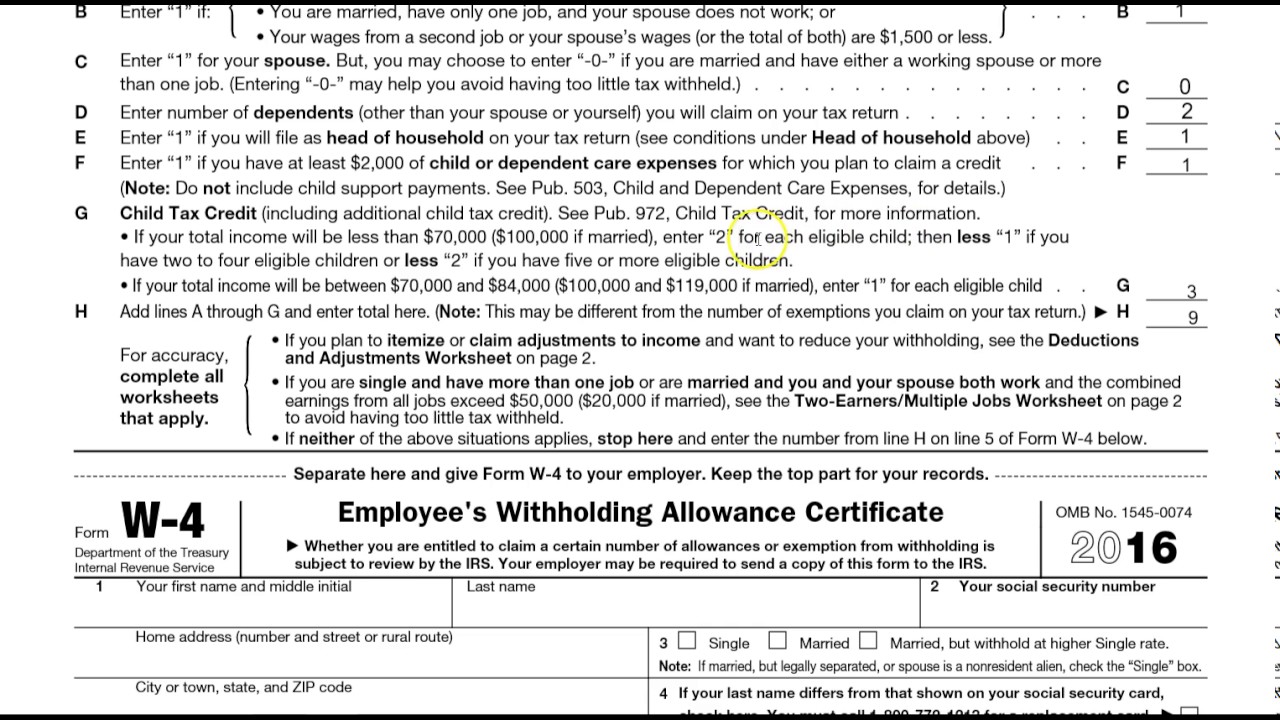

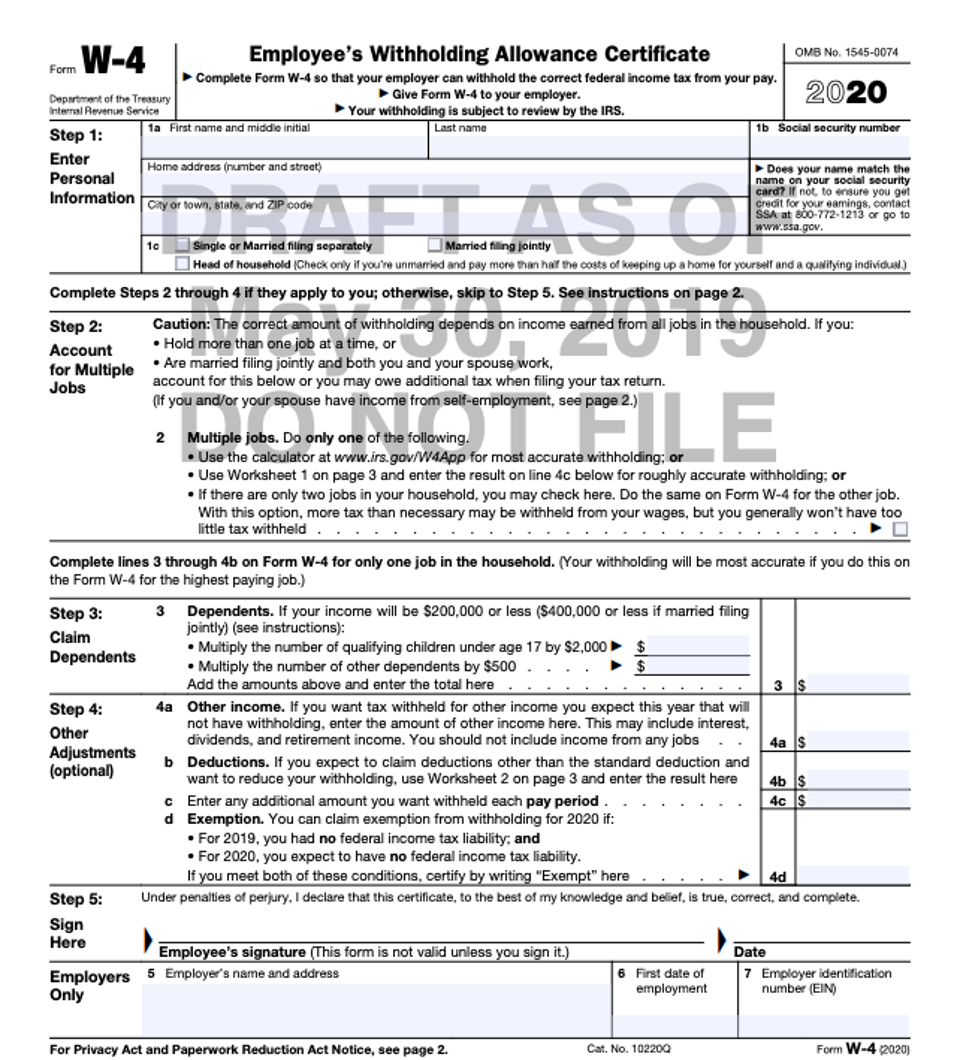

Federal W4 2022 W4 Form 2022 Printable

Web how to claim your withholding state zip number of exemptions employee: Web file this form with your employer. The top individual tax rate is now. What are the top 10 largest mega millions jackpots ever? Ar1100esct corporation estimated tax vouchers.

Arkansas State Withholding Form 2019 Fill Out And Sign Online Dochub

Web 42 rows arkansas efile; If too little is withheld, you will generally owe tax when you file your tax return. The top individual tax rate is now. Web employee’s state withholding exemption certificate (form ar4ec) contact. Web enter the total amount of arkansas income tax withheld for this monthly reporting period only.

W4 Tax Form 2022 W4 Form 2022 Printable

The top individual tax rate is now. Web want withholding, write “revoked” next to the checkbox on line 1 and submit form ar4p to your payer. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. File this form with your employer. A single ticket won in california.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

Ar1023ct application for income tax exempt status. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Enter the amount paid for this monthly reporting period only. If too little is withheld, you will generally owe tax when you file your tax return. Otherwise, your employer must withhold state income tax from your.

How to fill out w4 TechStory

Web employee’s state withholding exemption certificate (form ar4ec) contact. If too little is withheld, you will generally owe tax when you file your tax return. Otherwise, your employer must withhold state income tax from your. Enter the amount paid for this monthly reporting period only. Vice chancellor for finance & administration 2801 s.

Blank W9 Form For 2021 Calendar Template Printable

Otherwise, your employer must withhold state income tax from your. Web the arkansas department of finance and administration (dfa) has published updated 2022 withholding tax tables, effective october 1, 2022. Web 42 rows arkansas efile; Enter the amount paid for this monthly reporting period only. Ar1100esct corporation estimated tax vouchers.

Fillable 2021 w4 Fill out & sign online DocHub

A single ticket won in california. Vice chancellor for finance & administration 2801 s. Web want withholding, write “revoked” next to the checkbox on line 1 and submit form ar4p to your payer. Ar1023ct application for income tax exempt status. Web employee’s state withholding exemption certificate (form ar4ec) contact.

IRS Form W4 2022 W4 Form 2022 Printable

Web how to claim your withholding state zip number of exemptions employee: Enter the amount paid for this monthly reporting period only. Web employee’s state withholding exemption certificate (form ar4ec) contact. Ar1100esct corporation estimated tax vouchers. File this form with your employer.

W4 Form 2020 W4 Forms

Ar1100esct corporation estimated tax vouchers. Enter the amount paid for this monthly reporting period only. Fiduciary and estate income tax forms; The top individual tax rate is now. Web ar4ec ar4ec state of arkansas employee’s withholding exemption certificate printfull name socialsecurity number printhomeaddress city state zip certifythat the.

Web How To Claim Your Withholding State Zip Number Of Exemptions Employee:

Web $2.04 billion, powerball, nov. The top individual tax rate is now. Otherwise, your employer must withhold state income tax from your. Ssc 425 little rock, ar.

What Are The Top 10 Largest Mega Millions Jackpots Ever?

Ar1023ct application for income tax exempt status. Web the arkansas department of finance and administration (dfa) has published updated 2022 withholding tax tables, effective october 1, 2022. Web employee’s state withholding exemption certificate (form ar4ec) contact. Single married filing jointly $13,055 to $15,700 $22,016 to $26,100 or less.

Web Enter The Total Amount Of Arkansas Income Tax Withheld For This Monthly Reporting Period Only.

Web want withholding, write “revoked” next to the checkbox on line 1 and submit form ar4p to your payer. Fiduciary and estate income tax forms; If too little is withheld, you will generally owe tax when you file your tax return. Enter the amount paid for this monthly reporting period only.

Web 42 Rows Arkansas Efile;

File this form with your employer. Ar1100esct corporation estimated tax vouchers. Web $5 (& 67$7( 2) $5.$16$6 (psor\hh·v :lwkkroglqj ([hpswlrq &huwlilfdwh 3ulqw )xoo 1dph 6rfldo 6hfxulw\ 1xpehu 3ulqw +rph $gguhvv &lw\ 6wdwh =ls (psor\hh Vice chancellor for finance & administration 2801 s.