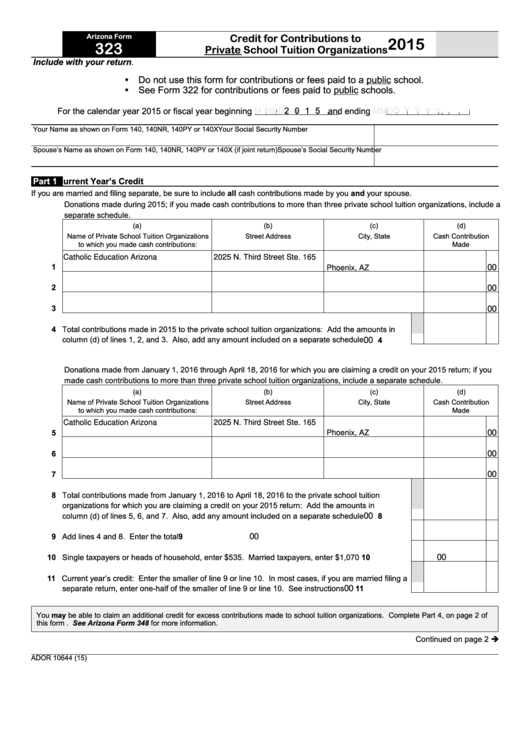

Az Form 323

Az Form 323 - Web 323 credit for contributions toprivate school tuition organizations 2021 include with your return. Do not use this form for cash contributions or fees paid to a. Do not use this form for cash contributions or fees paid to a. Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. Web arizona form 323 author: Web arizona form 323 either the current or preceding taxable year and is considered to have been made on the last day of that taxable year. Ador 10644 (19) az form 323 (2019) page 2 of 3 your name (as shown on page 1). The advanced tools of the. Web a nonrefundable individual tax credit for cash contributions to a school tuition organization that exceed the original private school tuition organization credit claimed on. Credit eligible cash contributions made to a private sto from january 1, 2021, to april 15, 2021, may be used as a tax.

Web a nonrefundable individual tax credit for cash contributions to a school tuition organization that exceed the original private school tuition organization credit claimed on. Web arizona form 323 author: Web how you can fill out the 2017 az form 323. If you claim this credit in 2021 for a cash contribution made from january 1, 20, to 22april 18, 2022, you must make an adjustment on your. Arizona department of revenue subject: Web arizona form 323 for calendar year filers, eligible cash contributions made to a private sto from january 1, 2019, to april 15, 2019, may be used as a tax credit on either the. Web or 2022 arizona income tax return. Web 323 credit for contributions toprivate school tuition organizations 2021 include with your return. Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. Web arizona form 323 for calendar year filers:

Web arizona form 323 either the current or preceding taxable year and is considered to have been made on the last day of that taxable year. The advanced tools of the. Web arizona tax form 323 is created by turbotax when you indicate that you have made cash contributions to a private school tuition organization that provides scholarships or grants. Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. To start the form, utilize the fill & sign online button or tick the preview image of the form. Web arizona form 323 credit for contributions to private school tuition organizations 2019 y y. On the screen to add your contribution, you must max out the form 323 contribution limit, then add another contribution and it will trigger. Web how you can fill out the 2017 az form 323. Az form 301 (to claim any az state tax credit) az form 323 (to claim any original donation given) az form 348 (to claim any plus donation given) Web the forms needed to claim the credit are az form 301 (used for any arizona state tax credit), az form 323 (to claim original donation credits) and az form 348 (to claim.

Fillable Arizona Form 323 Credit For Contributions To Private School

Web arizona form 323 for calendar year filers: Ador 10644 (19) az form 323 (2019) page 2 of 3 your name (as shown on page 1). Web arizona form 323 for calendar year filers: Web the forms needed to claim the credit are az form 301 (used for any arizona state tax credit), az form 323 (to claim original donation.

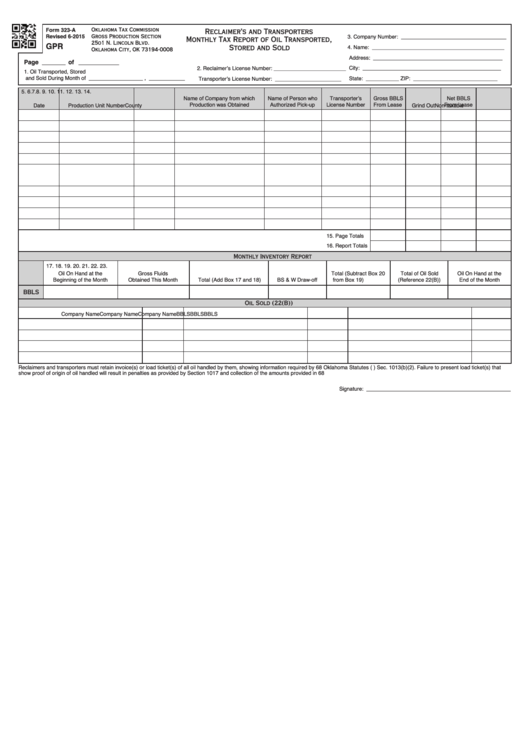

Form 323A Reclaimer'S And Transporters Monthly Tax Report Of Oil

Web arizona tax form 323 is created by turbotax when you indicate that you have made cash contributions to a private school tuition organization that provides scholarships or grants. Web february 17, 2021 6:14 pm. Web or 2022 arizona income tax return. Web arizona form 323 credit for contributions to private school tuition organizations 2019 y y. Web arizona form.

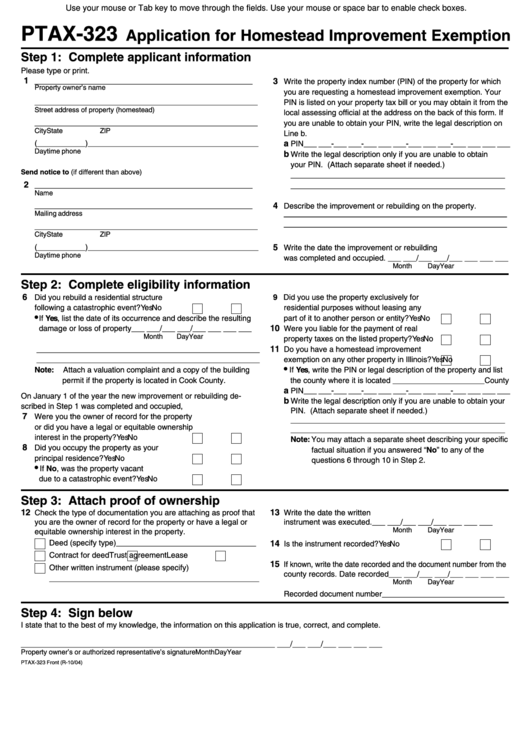

Fillable Ptax323 Form Application For Homestead Improvement

Do not use this form for cash contributions or fees paid to a public school. If you claim this credit in 2021 for a cash contribution made from january 1, 20, to 22april 18, 2022, you must make an adjustment on your. On the screen to add your contribution, you must max out the form 323 contribution limit, then add.

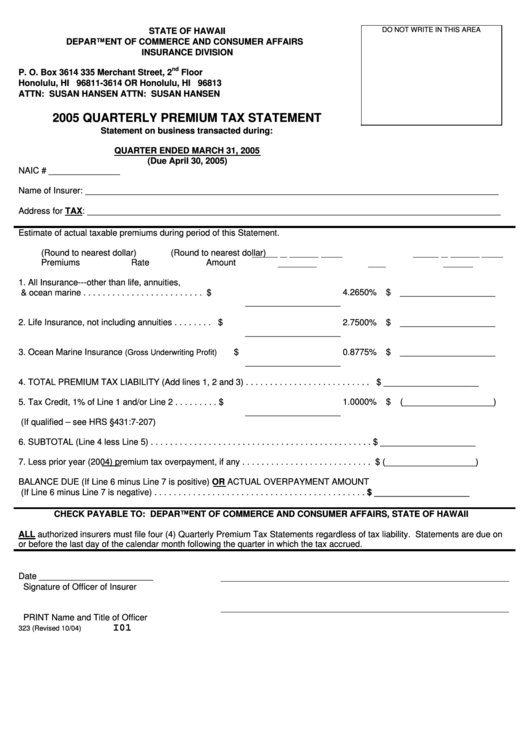

Form 323 Quarterly Premium Tax Statement 2005 printable pdf download

Credit for contributions to private school tuition organizations keywords: Web this tax credit is claimed on form 348 and is available to individual taxpayers who donate the maximum amount allowed under the credit for contributions to private school. Web arizona form 323 credit for contributions to private school tuition organizations 2019 y y. Web arizona form credit for contributions to.

Tax Forms Arizona Tuition Organization

To start the form, utilize the fill & sign online button or tick the preview image of the form. Web arizona form 323 for calendar year filers: Az form 301 (to claim any az state tax credit) az form 323 (to claim any original donation given) az form 348 (to claim any plus donation given) Web arizona form 323 for.

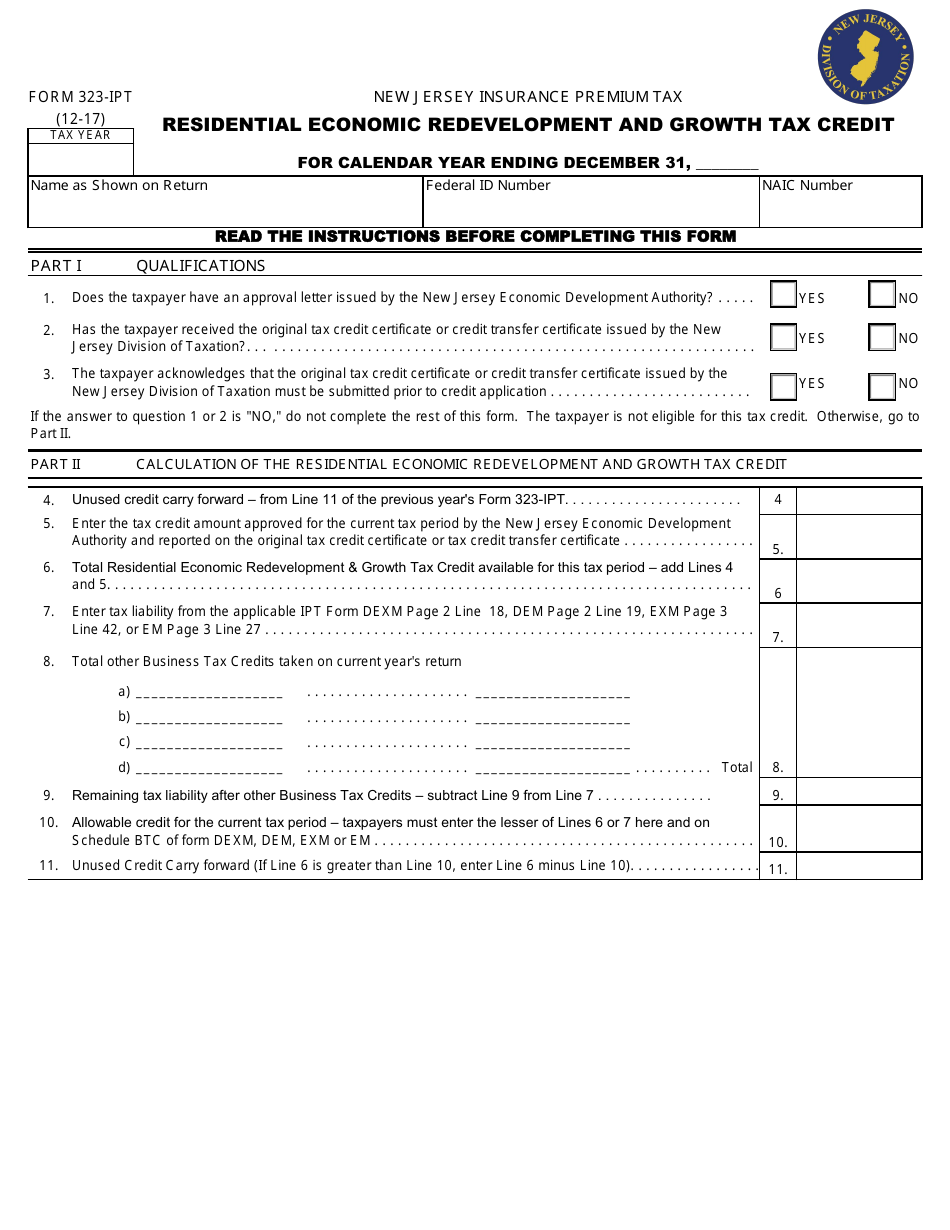

Form 323 Download Printable PDF or Fill Online Residential Economic

Web this tax credit is claimed on form 348 and is available to individual taxpayers who donate the maximum amount allowed under the credit for contributions to private school. Web a nonrefundable individual tax credit for cash contributions to a school tuition organization that exceed the original private school tuition organization credit claimed on. Web how you can fill out.

Form 323IPT Download Fillable PDF or Fill Online Residential Economic

Web arizona form 323 for calendar year filers, eligible cash contributions made to a private sto from january 1, 2019, to april 15, 2019, may be used as a tax credit on either the. Az form 301 (to claim any az state tax credit) az form 323 (to claim any original donation given) az form 348 (to claim any plus.

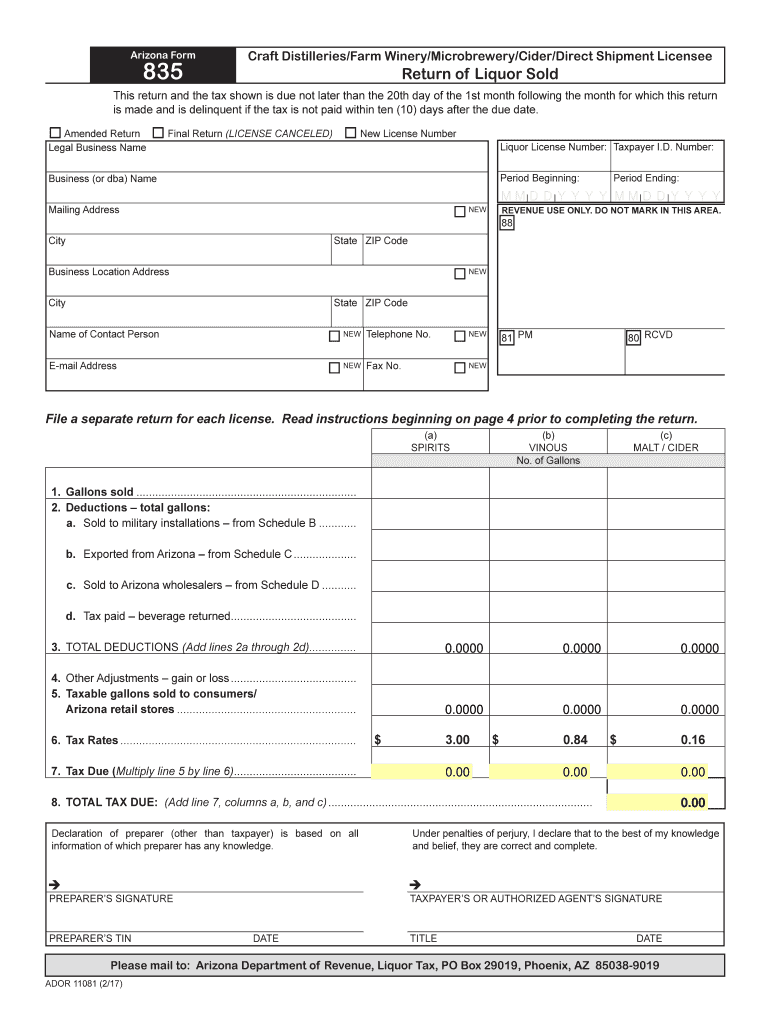

AZ Form 835 20172022 Fill out Tax Template Online US Legal Forms

Ador 10644 (19) az form 323 (2019) page 2 of 3 your name (as shown on page 1). Web arizona form 323 credit for contributions to private school tuition organizations 2019 y y. Web arizona form 323 for calendar year filers, eligible cash contributions made to a private sto from january 1, 2019, to april 15, 2019, may be used.

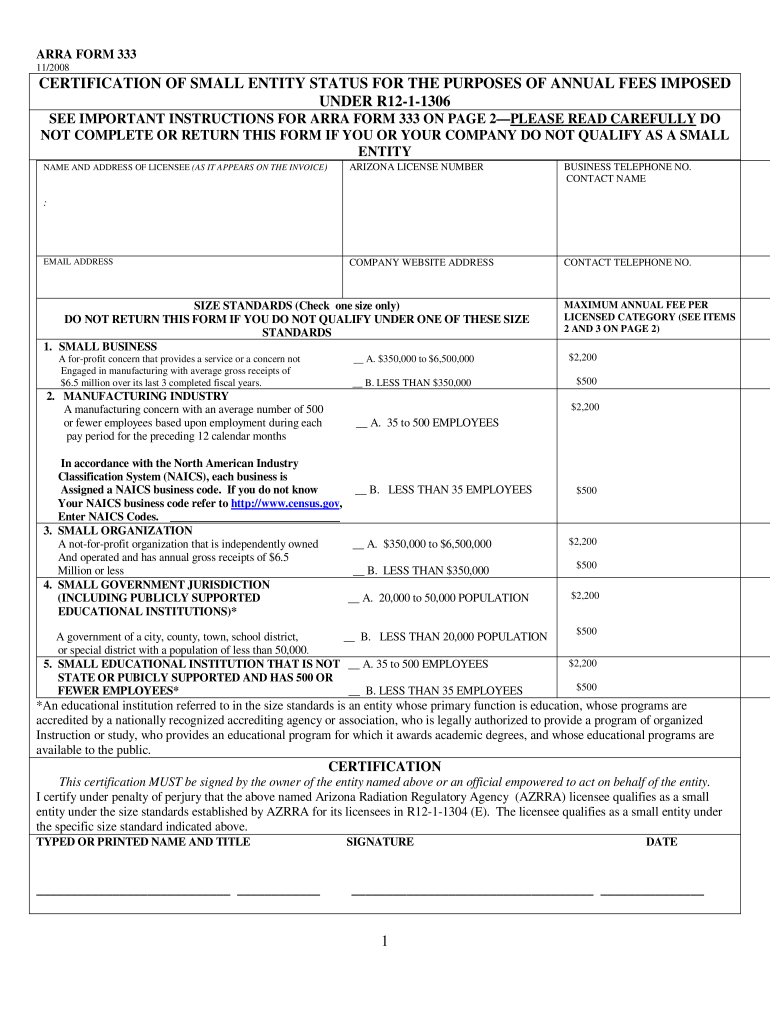

Az Form 333 Fill Online, Printable, Fillable, Blank pdfFiller

Az form 301 (to claim any az state tax credit) az form 323 (to claim any original donation given) az form 348 (to claim any plus donation given) The advanced tools of the. Web arizona form 323 credit for contributions to private school tuition organizations 2022 include with your return. Credit eligible cash contributions made to a private sto from.

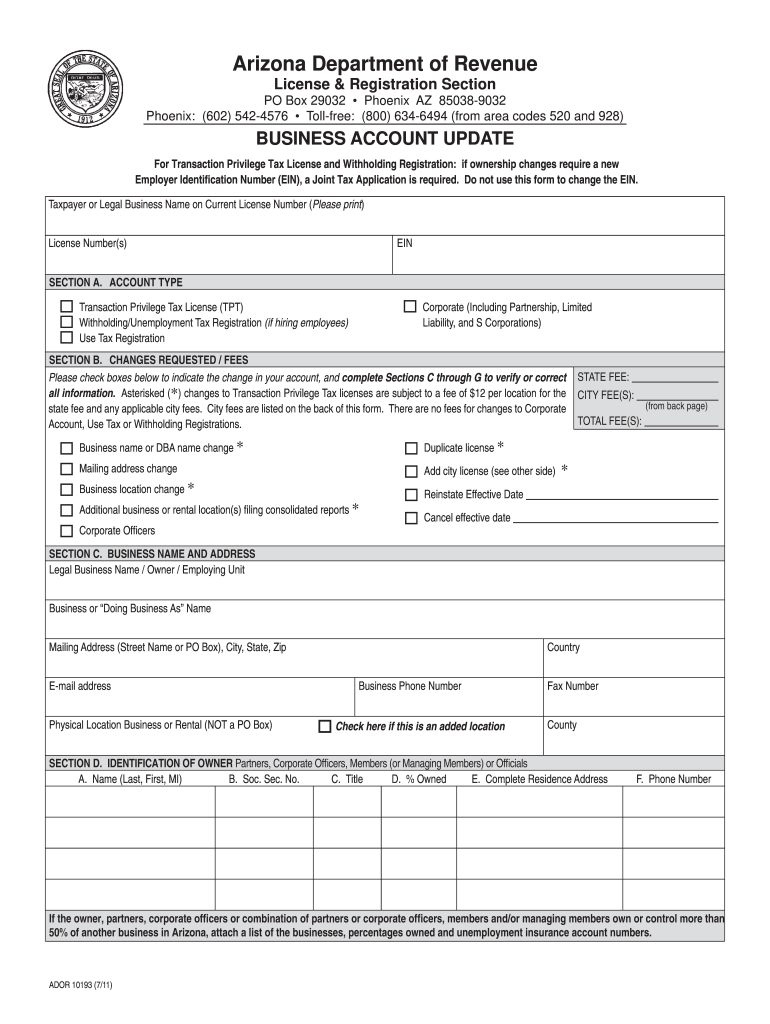

Az Form 10193 Fill Online, Printable, Fillable, Blank PDFfiller

Credit for contributions to private school tuition organizations keywords: Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. Web arizona form 323 for calendar year filers: Web arizona form 323 for calendar year filers, eligible cash contributions made to a private sto from january 1, 2019,.

Web Arizona Form 323 For Calendar Year Filers, Eligible Cash Contributions Made To A Private Sto From January 1, 2019, To April 15, 2019, May Be Used As A Tax Credit On Either The.

Do not use this form for cash contributions or fees paid to a public school. Web how you can fill out the 2017 az form 323. Web february 17, 2021 6:14 pm. If you claim this credit in 2021 for a cash contribution made from january 1, 20, to 22april 18, 2022, you must make an adjustment on your.

Credit For Contributions To Private School Tuition Organizations Keywords:

Web a nonrefundable individual tax credit for cash contributions to a school tuition organization that exceed the original private school tuition organization credit claimed on. Web this tax credit is claimed on form 348 and is available to individual taxpayers who donate the maximum amount allowed under the credit for contributions to private school. Web or 2022 arizona income tax return. Web arizona tax form 323 is created by turbotax when you indicate that you have made cash contributions to a private school tuition organization that provides scholarships or grants.

Do Not Use This Form For Cash Contributions Or Fees Paid To A.

Web arizona form 323 for calendar year filers: Web 323 credit for contributions toprivate school tuition organizations 2021 include with your return. Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. Do not use this form for cash contributions or fees paid to a.

Credit Eligible Cash Contributions Made To A Private Sto From January 1, 2021, To April 15, 2021, May Be Used As A Tax.

To start the form, utilize the fill & sign online button or tick the preview image of the form. Web arizona form 323 for calendar year filers: Web arizona form 323 author: Ador 10644 (19) az form 323 (2019) page 2 of 3 your name (as shown on page 1).