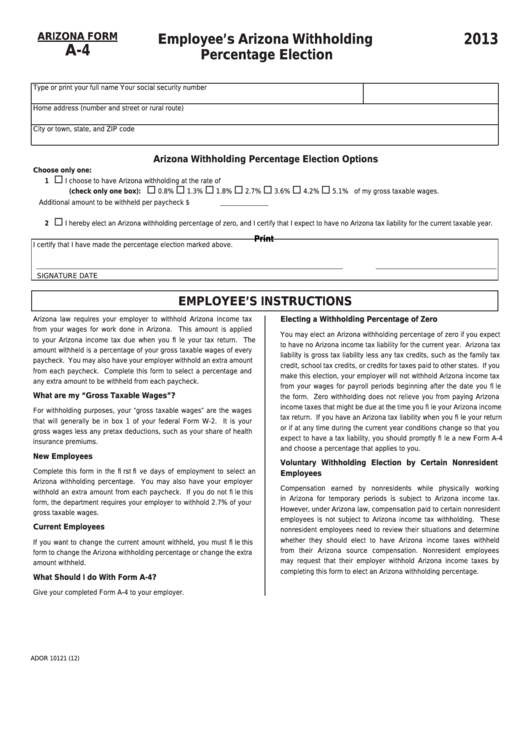

Az Form A4

Az Form A4 - This form is submitted to the. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Web file this form to change the arizona withholding percentage or change the extra amount withheld. Search by form number, name or organization. You can use your results from the. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Use this form to request that your employer. Web search irs and state income tax forms to efile or complete, download online and back taxes. Residents who receive regularly scheduled payments from payments or annuities. Web complete this form to select a percentage of arizona income tax to be withheld, as well as any additional amount to be withheld from each paycheck.

Residents who receive regularly scheduled payments from payments or annuities. Web search irs and state income tax forms to efile or complete, download online and back taxes. This form is submitted to the. Tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new. Web file this form to change the arizona withholding percentage or change the extra amount withheld. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Search by form number, name or organization. This form is for income earned in tax year 2022, with tax returns due in april. State employees on the hris. Use this form to request that your employer.

Web search irs and state income tax forms to efile or complete, download online and back taxes. This form is submitted to the. This form is for income earned in tax year 2022, with tax returns due in april. You can use your results from the. Web annuitant's request for voluntary arizona income tax withholding. Search by form number, name or organization. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new. Use this form to request that your employer. Web file this form to change the arizona withholding percentage or change the extra amount withheld.

AZ Form 12 Inventory Of Property And Debts Complete Legal Document

Web complete this form to select a percentage of arizona income tax to be withheld, as well as any additional amount to be withheld from each paycheck. This form is submitted to the. This form is for income earned in tax year 2022, with tax returns due in april. Residents who receive regularly scheduled payments from payments or annuities. Search.

2021 Form AZ DoR A4 Fill Online, Printable, Fillable, Blank pdfFiller

This form is for income earned in tax year 2022, with tax returns due in april. You can use your results from the. State employees on the hris. Use this form to request that your employer. Web annuitant's request for voluntary arizona income tax withholding.

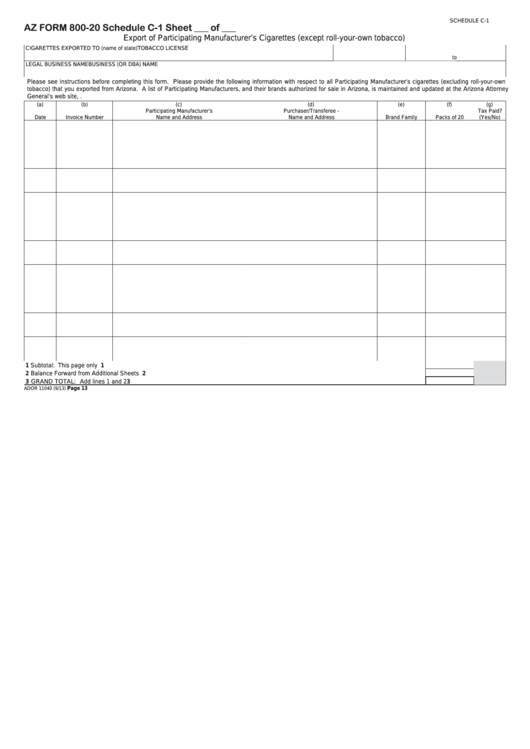

Fillable Az Form 80020 Schedule C1, C2 Export Of Participating

Residents who receive regularly scheduled payments from payments or annuities. You can use your results from the. Use this form to request that your employer. Tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new. This form is submitted to the.

SAP Adobe Form A4 and Letter page sizes My Experiments with ABAP

Web search irs and state income tax forms to efile or complete, download online and back taxes. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. You can use your results from the. Web complete this form to select a percentage of arizona income tax to be withheld, as well as any.

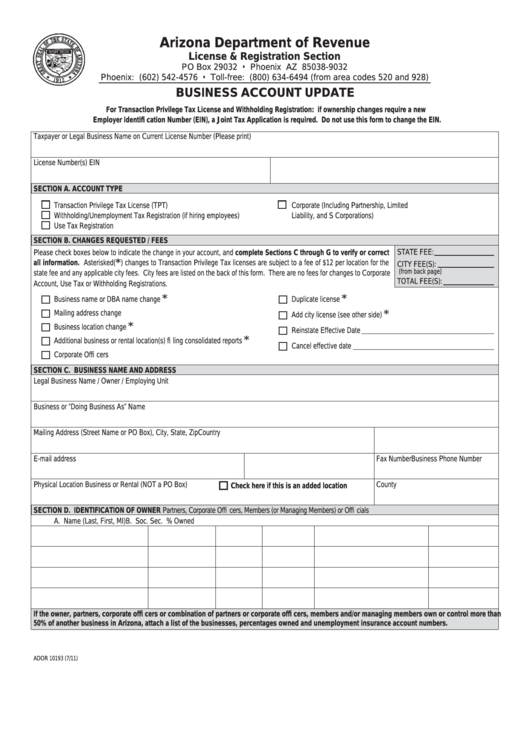

Fillable Arizona Form 10193 Business Account Update printable pdf

Tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new. Search by form number, name or organization. Use this form to request that your employer. Web annuitant's request for voluntary arizona income tax withholding. This form is submitted to the.

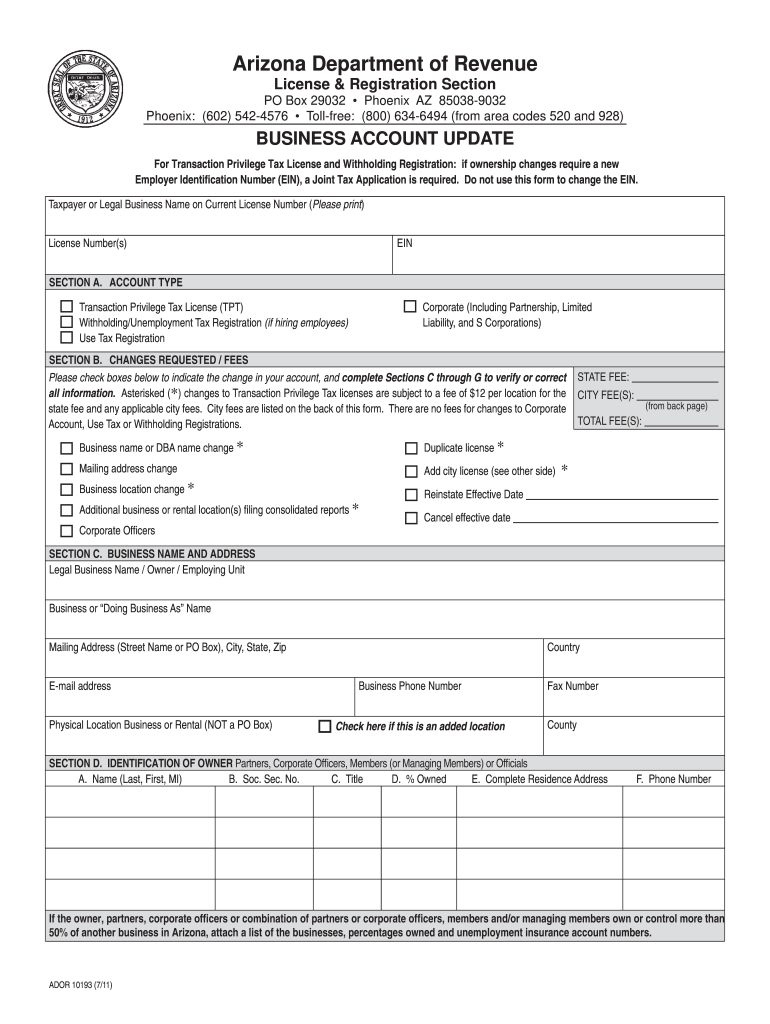

Az Form 10193 Fill Online, Printable, Fillable, Blank PDFfiller

Web search irs and state income tax forms to efile or complete, download online and back taxes. Search by form number, name or organization. Web file this form to change the arizona withholding percentage or change the extra amount withheld. This form is for income earned in tax year 2022, with tax returns due in april. Tax rates used on.

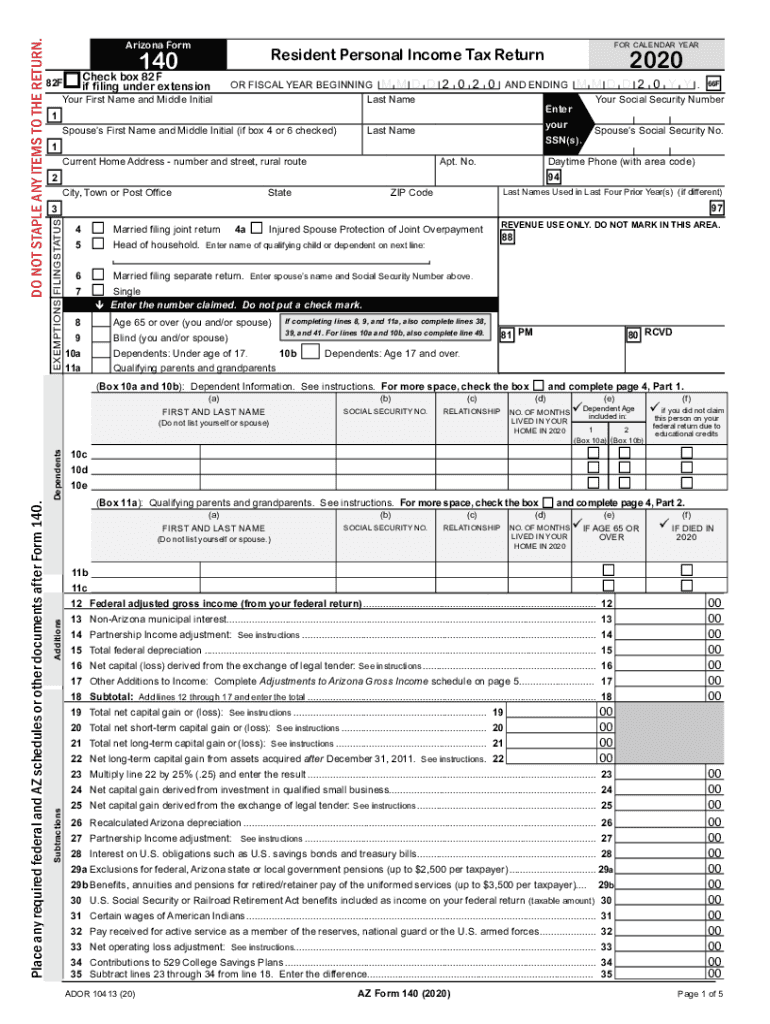

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Web annuitant's request for voluntary arizona income tax withholding. Web search irs and state income tax forms to efile or complete, download online and back taxes. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Web file this form to change the arizona withholding percentage or change the.

Form_A4 Breeyark!

State employees on the hris. Tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new. Web complete this form to select a percentage of arizona income tax to be withheld, as well as any additional amount to be withheld from each paycheck. Web arizona residents employed outside of arizona complete this.

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Web annuitant's request for voluntary arizona income tax withholding. This form is submitted to the. You can use your results from the. Web file this form to change the arizona withholding percentage or change the extra amount withheld. State employees on the hris.

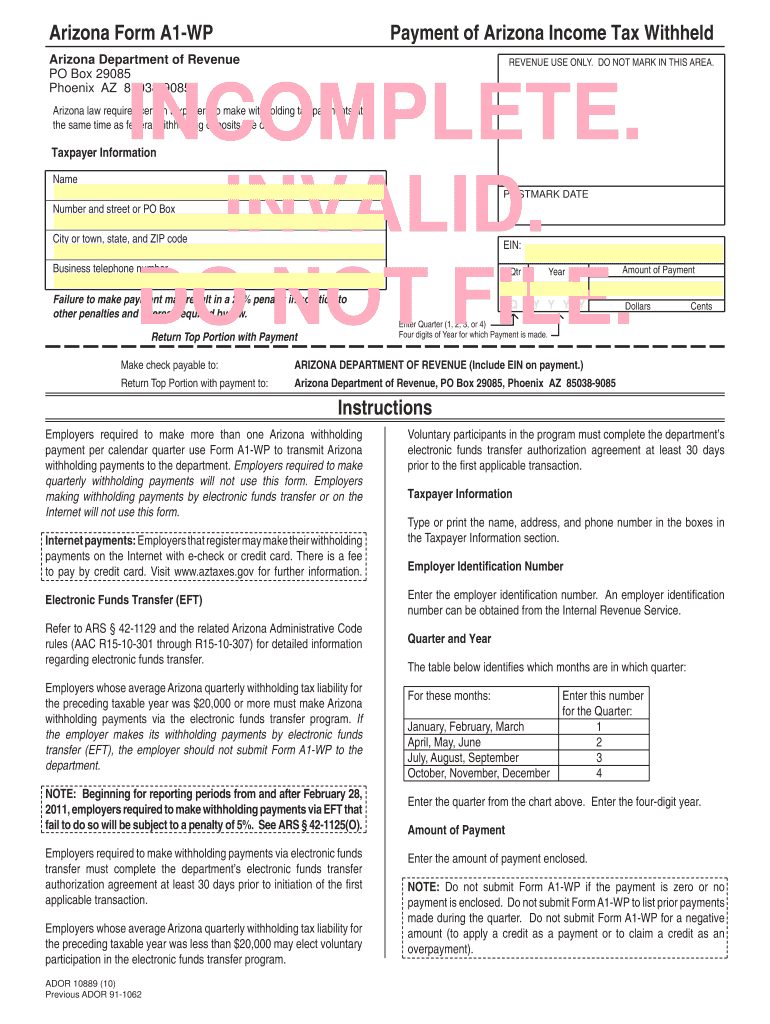

A1 Wp Fill Out and Sign Printable PDF Template signNow

Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. You can use your results from the. This form is submitted to the. Search by form number, name or organization.

Web Search Irs And State Income Tax Forms To Efile Or Complete, Download Online And Back Taxes.

Web annuitant's request for voluntary arizona income tax withholding. Tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new. This form is for income earned in tax year 2022, with tax returns due in april. State employees on the hris.

Web File This Form To Change The Arizona Withholding Percentage Or To Change The Extra Amount Withheld.

Web file this form to change the arizona withholding percentage or change the extra amount withheld. You can use your results from the. Use this form to request that your employer. This form is submitted to the.

Web Complete This Form To Select A Percentage Of Arizona Income Tax To Be Withheld, As Well As Any Additional Amount To Be Withheld From Each Paycheck.

Search by form number, name or organization. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Residents who receive regularly scheduled payments from payments or annuities.