Az Tax Form 323

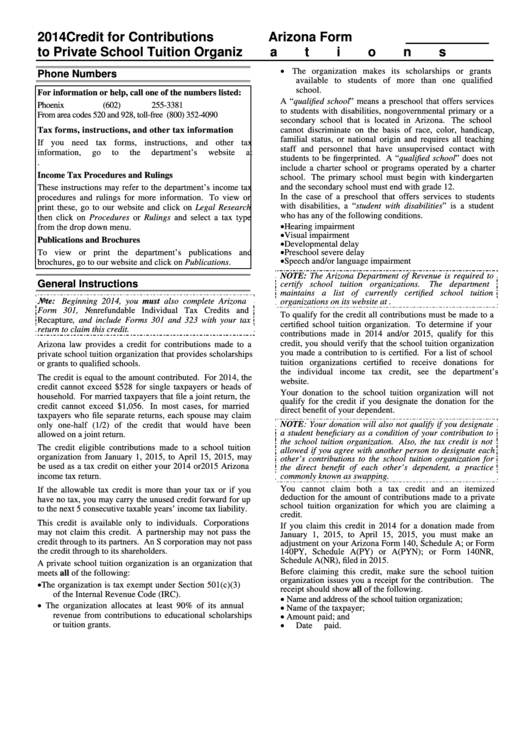

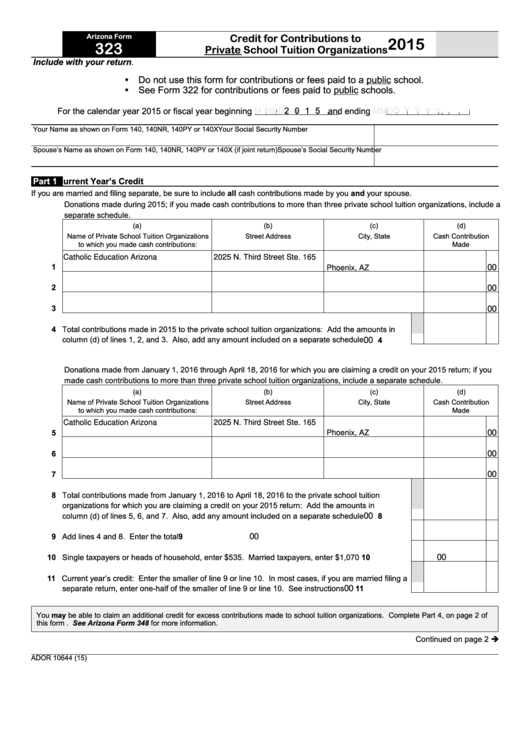

Az Tax Form 323 - Do not use this form for cash contributions or fees paid to a. Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. Web the form is used by all individual taxpayers, regardless of filing status and form type (including partnerships and s corporations that filed a composite nonresident. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic. The amount of credit you must claim on form 323 depends on your filing status. Credit eligible cash contributions made to a private sto from january 1, 2021, to april 15, 2021, may be used as a tax. Web 323 credit for contributions toprivate school tuition organizations 2021 include with your return. Web complete part 4, on page 2 of this form. Print & download start for free. On the screen to add your contribution, you must max out the form 323 contribution limit, then add another contribution and it will trigger.

Print, save, download 100% free! Ad find deals and low prices on tax forms at amazon.com. • do not use this form for cash contributions or fees paid to a. Web arizona form 323 for calendar year filers: Web credit for contributions to private school tuition organizations (original individual income tax credit) this tax credit is claimed on form 323. Do not use this form for cash contributions or fees paid to a public school. On the screen to add your contribution, you must max out the form 323 contribution limit, then add another contribution and it will trigger. Web 2019 credit for contributions arizona form to private school tuition organizations 323 for information or help, call one of the numbers listed: Do not use this form for cash contributions or fees paid to a public school. The amount of credit you must claim on form 323 depends on your filing status.

Web how you can fill out the 2017 az form 323. The amount of credit you must. Print, save, download 100% free! The amount of credit you must claim on form 323 depends on your filing status. Real estate forms, contracts, tax forms & more. Web a nonrefundable individual tax credit for cash contributions to a school tuition organization that exceed the original private school tuition organization. Web complete part 4, on page 2 of this form. Web 323 credit for contributions to private school tuition organizations 2022 include with your return. • do not use this form for cash contributions or fees paid to a. Do not use this form for cash contributions or fees paid to a.

Instructions For Form 323 Arizona Credit For Contributions To Private

Ad ramsey tax advisors are redefining what it means to “do your taxes right.”. Do not use this form for cash contributions or fees paid to a. Web 323 credit for contributions toprivate school tuition organizations 2021 include with your return. Web arizona tax form 323 is created by turbotax when you indicate that you have made cash contributions to.

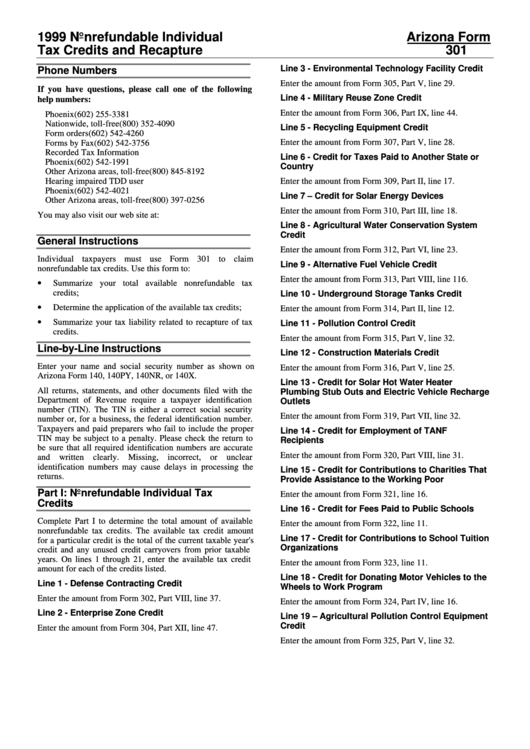

Arizona Form 301 Nonrefundable Individual Tax Credits And Recapture

Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. We help you get your taxes done right, save you time, and explain your unique situation. Do not use this form for cash contributions or fees paid to a. Web arizona form 323 for calendar year filers: On.

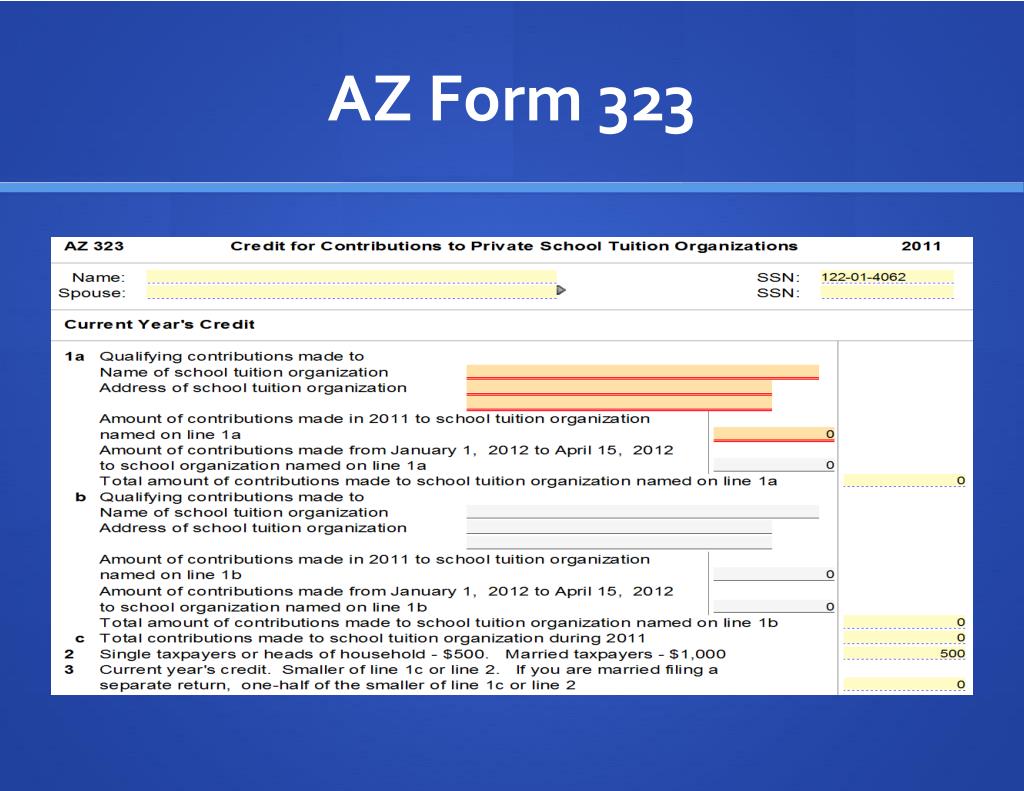

PPT Arizona State Tax Return 2012 PowerPoint Presentation, free

Web the form is used by all individual taxpayers, regardless of filing status and form type (including partnerships and s corporations that filed a composite nonresident. Print & download start for free. On the screen to add your contribution, you must max out the form 323 contribution limit, then add another contribution and it will trigger. Ad ramsey tax advisors.

Tax Forms Arizona Tuition Organization

Web arizona form 323 either the current or preceding taxable year and is considered to have been made on the last day of that taxable year. Print & download start for free. Do not use this form for cash contributions or fees paid to a. Read customer reviews & find best sellers On the screen to add your contribution, you.

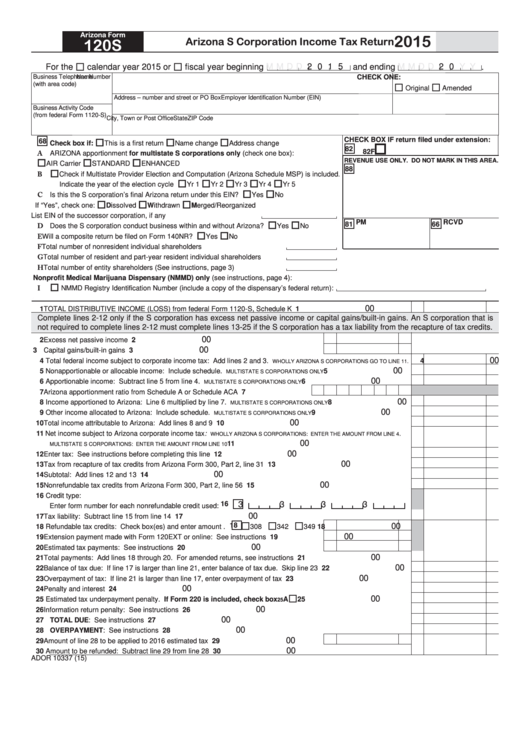

Fillable Arizona Form 120s Arizona S Corporation Tax Return

Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return. Web complete part 4, on page 2 of this form. Ad get lease, contracts & tax forms now. Do not use this form for cash contributions or fees paid to a public school. Arizona has a state income tax that ranges between 2.59% and 4.5%.

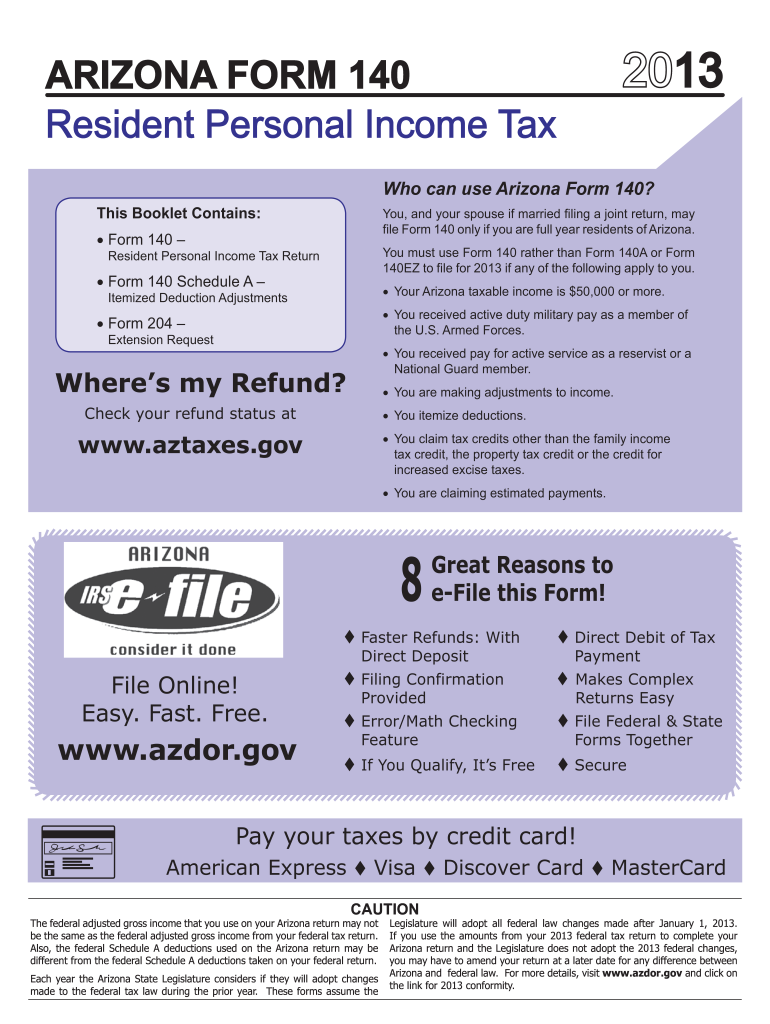

Az 140 Fillable Form Fill Online, Printable, Fillable, Blank pdfFiller

The amount of credit you must claim on form 323 depends on your filing status. Credit eligible cash contributions made to a private sto from january 1, 2021, to april 15, 2021, may be used as a tax. Do not use this form for cash contributions or fees paid to a. Ad ramsey tax advisors are redefining what it means.

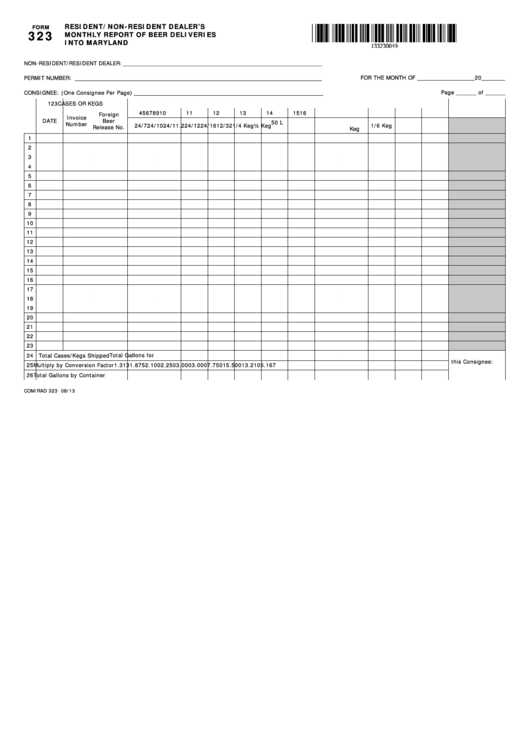

Fillable Form 323 Resident/nonResident Dealer'S Monthly Report Of

Web complete part 4, on page 2 of this form. Do not use this form for cash contributions or fees paid to a public school. Web arizona form 323 either the current or preceding taxable year and is considered to have been made on the last day of that taxable year. Ad get lease, contracts & tax forms now. We.

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Do not use this form for cash contributions or fees paid to a. Web a nonrefundable individual tax credit for cash contributions to a school tuition organization that exceed the original private school tuition organization. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic. Web arizona tax form 323.

Fillable Arizona Form 323 Credit For Contributions To Private School

• do not use this form for cash contributions or fees paid to a. See arizona form 348 for more information. Do not use this form for cash contributions or fees paid to a public school. Real estate forms, contracts, tax forms & more. Web arizona form 323 for calendar year filers:

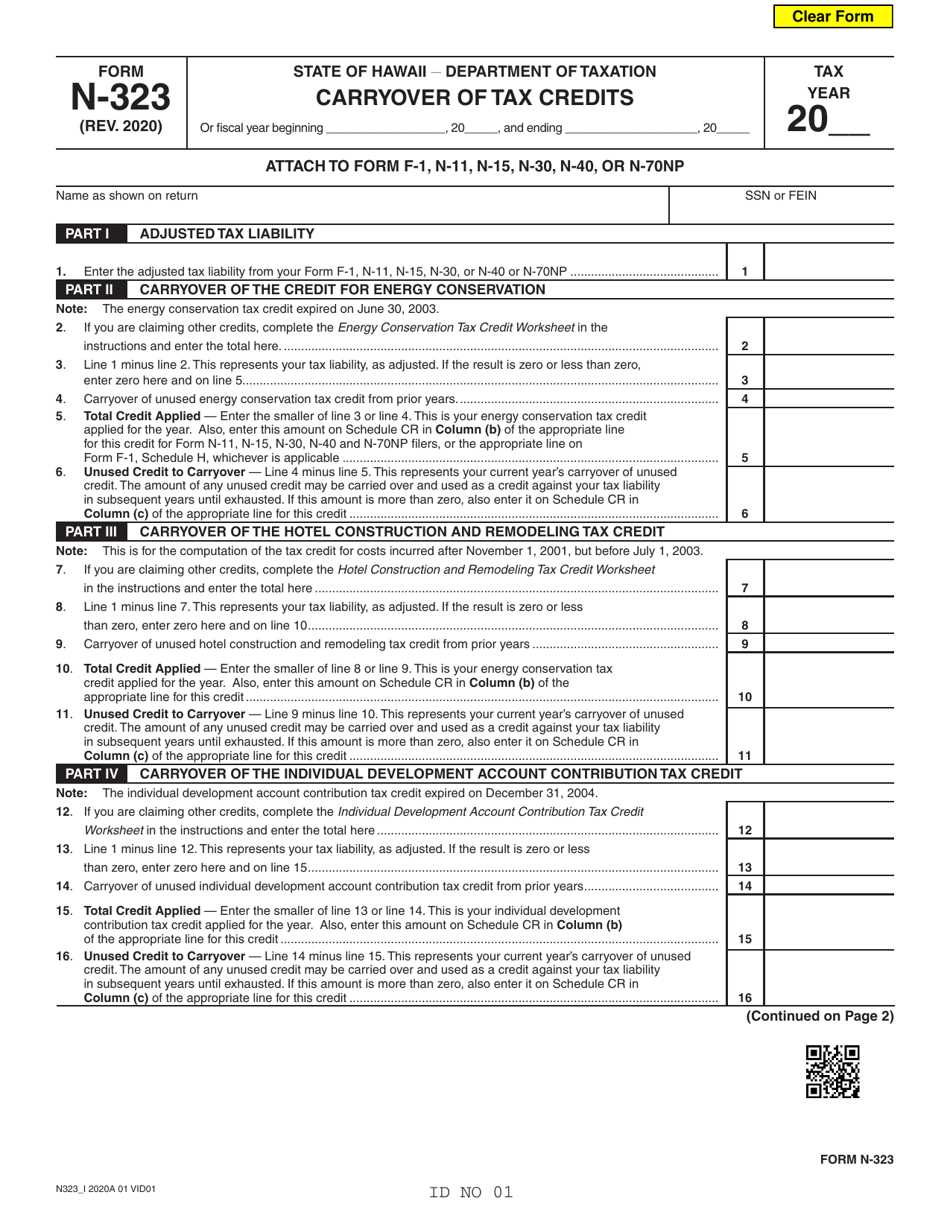

Form N323 Download Fillable PDF or Fill Online Carryover of Tax

We help you get your taxes done right, save you time, and explain your unique situation. Web 323 credit for contributions toprivate school tuition organizations 2021 include with your return. On the screen to add your contribution, you must max out the form 323 contribution limit, then add another contribution and it will trigger. Web arizona form 323 for calendar.

Web February 17, 2021 6:14 Pm.

The amount of credit you must. Web first claim the maximum current year’s credit allowed on arizona form 323, credit for contributions to private school tuition organizations. Web arizona form 323 for calendar year filers: Print & download start for free.

The Arizona Department Of Revenue Will Follow The Internal Revenue Service (Irs) Announcement Regarding The Start Of The 2022 Electronic.

Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return. We help you get your taxes done right, save you time, and explain your unique situation. Print, save, download 100% free! See arizona form 348 for more information.

The Advanced Tools Of The.

Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Web arizona form 323 for calendar year filers: Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. Web the form is used by all individual taxpayers, regardless of filing status and form type (including partnerships and s corporations that filed a composite nonresident.

On The Screen To Add Your Contribution, You Must Max Out The Form 323 Contribution Limit, Then Add Another Contribution And It Will Trigger.

Web how you can fill out the 2017 az form 323. Web 2019 credit for contributions arizona form to private school tuition organizations 323 for information or help, call one of the numbers listed: Web 323 credit for contributions to private school tuition organizations 2022 include with your return. Ad ramsey tax advisors are redefining what it means to “do your taxes right.”.