Back Door Roth Form

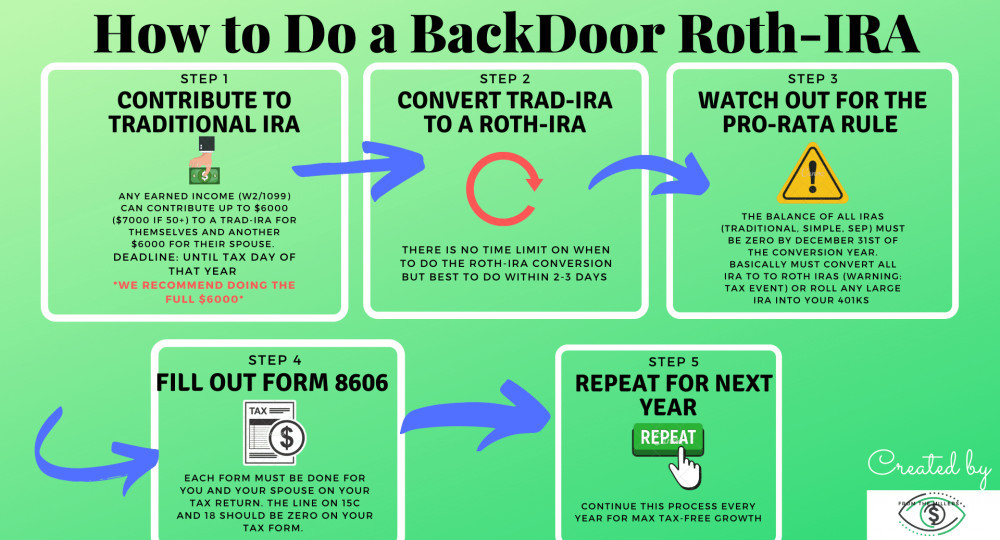

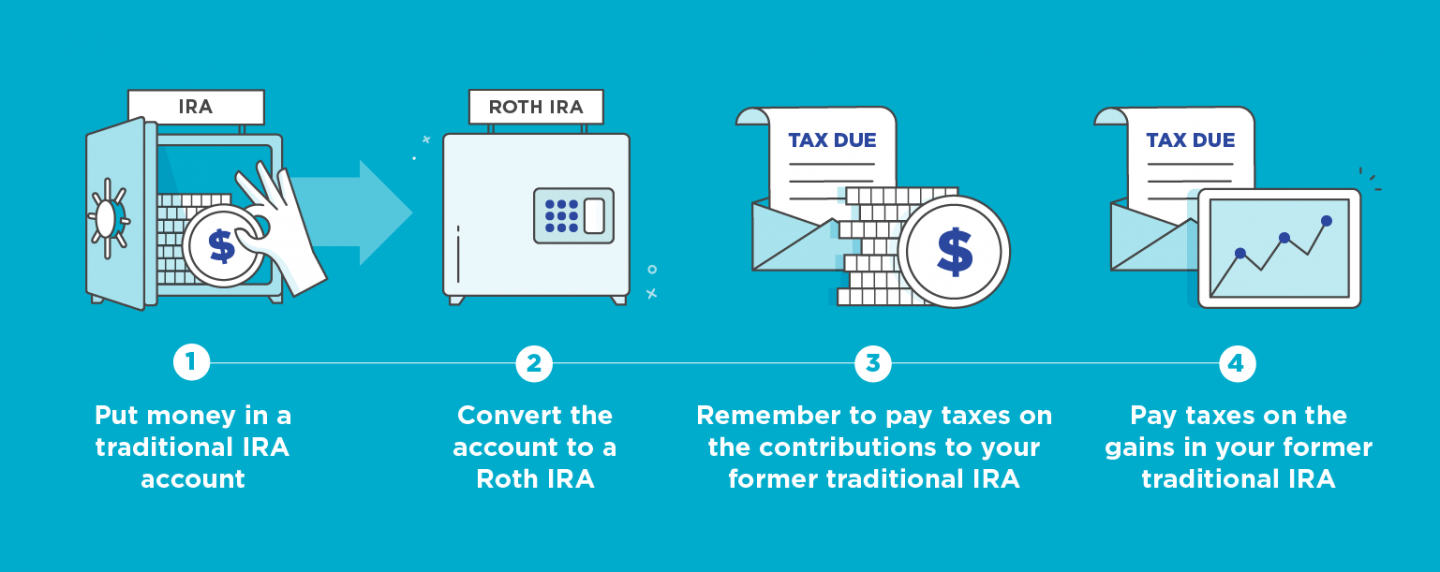

Back Door Roth Form - Web in a traditional ira and 401 (k), retirees need to withdraw distributions each year by april 1 of the year they turn 72 years of age. A backdoor roth ira isn’t a special type of account. Until 2010, income restrictions kept some people out of roth. Web how to set up a roth ira to make a backdoor contribution. Web definitions first, there are three terms which need to be understood when doing backdoor roths: Web what is a backdoor roth ira? Web the backdoor roth ira method is pretty easy. Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or having earnings that put you. The steps for setting up a backdoor roth ira are relatively straightforward: Contribute money to a traditional ira account, making sure your brokerage offers roth conversions (most do).

The steps for setting up a backdoor roth ira are relatively straightforward: Web what is a backdoor roth ira? You are free to withdraw your funds as per your convenience and there is no restriction on the amount of money that can be withdrawn from a roth ira. A backdoor roth ira isn’t a special type of account. Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or having earnings that put you. Do you need a backdoor roth? Web in a traditional ira and 401 (k), retirees need to withdraw distributions each year by april 1 of the year they turn 72 years of age. Web let's learn more about the backdoor roth ira and the role that form 8606 plays in making it a reality. Rather, it’s a strategy that helps you move money into a roth ira even though your annual income would. Contribute money to a traditional ira account, making sure your brokerage offers roth conversions (most do).

Web definitions first, there are three terms which need to be understood when doing backdoor roths: Contribute money to a traditional ira account, making sure your brokerage offers roth conversions (most do). The steps for setting up a backdoor roth ira are relatively straightforward: The backdoor roth ira strategy is not a tax dodge—in. Web what is a backdoor roth ira? Do you need a backdoor roth? Until 2010, income restrictions kept some people out of roth. Web the backdoor roth ira strategy is a legal way to get around the income limits that usually prevent high earners from owning roth iras. Rather, it’s a strategy that helps you move money into a roth ira even though your annual income would. Web the backdoor roth ira method is pretty easy.

What Is A Backdoor Roth IRA? How Does It Work In 2021? Personal

Do you need a backdoor roth? Web what is a backdoor roth ira? Web how to set up a roth ira to make a backdoor contribution. The steps for setting up a backdoor roth ira are relatively straightforward: Web let's learn more about the backdoor roth ira and the role that form 8606 plays in making it a reality.

How to Set Up a Backdoor Roth IRA NerdWallet

Do you need a backdoor roth? The steps for setting up a backdoor roth ira are relatively straightforward: Web the backdoor roth ira strategy is a legal way to get around the income limits that usually prevent high earners from owning roth iras. Web the backdoor roth ira method is pretty easy. Web a backdoor roth can be created by.

Back Door Roth Conversion Strategy Back doors, Strategies, Tall

Web let's learn more about the backdoor roth ira and the role that form 8606 plays in making it a reality. The steps for setting up a backdoor roth ira are relatively straightforward: Web what is a backdoor roth ira? Web the backdoor roth ira strategy is a legal way to get around the income limits that usually prevent high.

When BackDoor Roth IRAs Cause More Harm Than Good Wrenne Financial

Until 2010, income restrictions kept some people out of roth. Web let's learn more about the backdoor roth ira and the role that form 8606 plays in making it a reality. Contribute money to a traditional ira account, making sure your brokerage offers roth conversions (most do). (if you have an existing ira, consider how the ira aggregation rule, mentioned.

BackDoor Roth IRAs Premier Tax And Finance

Web the backdoor roth ira method is pretty easy. The steps for setting up a backdoor roth ira are relatively straightforward: Do you need a backdoor roth? Web definitions first, there are three terms which need to be understood when doing backdoor roths: Web let's learn more about the backdoor roth ira and the role that form 8606 plays in.

Mega BackDoor Roth Conversion A Great Option for Supercharging

Web the backdoor roth ira method is pretty easy. Rather, it’s a strategy that helps you move money into a roth ira even though your annual income would. (if you have an existing ira, consider how the ira aggregation rule, mentioned above, will affect the conversion.) Do you need a backdoor roth? Web the backdoor roth ira strategy is a.

Backdoor Roth IRA A HowTo Guide Biglaw Investor

You are free to withdraw your funds as per your convenience and there is no restriction on the amount of money that can be withdrawn from a roth ira. Contribute money to a traditional ira account, making sure your brokerage offers roth conversions (most do). Web the backdoor roth ira method is pretty easy. (if you have an existing ira,.

Back Door Roth IRA Driven Wealth Management San Diego Certified

Web definitions first, there are three terms which need to be understood when doing backdoor roths: The backdoor roth ira strategy is not a tax dodge—in. The steps for setting up a backdoor roth ira are relatively straightforward: Web what is a backdoor roth ira? Rather, it’s a strategy that helps you move money into a roth ira even though.

Back Door Roth IRA H&R Block

Web definitions first, there are three terms which need to be understood when doing backdoor roths: Web the backdoor roth ira method is pretty easy. Do you need a backdoor roth? A backdoor roth ira isn’t a special type of account. Web let's learn more about the backdoor roth ira and the role that form 8606 plays in making it.

The Mega Back Door Roth Using a Solo 401k Plan My Solo 401k Financial

(if you have an existing ira, consider how the ira aggregation rule, mentioned above, will affect the conversion.) Web the backdoor roth ira method is pretty easy. Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or having earnings.

Web The Backdoor Roth Ira Method Is Pretty Easy.

Until 2010, income restrictions kept some people out of roth. You are free to withdraw your funds as per your convenience and there is no restriction on the amount of money that can be withdrawn from a roth ira. A backdoor roth ira isn’t a special type of account. Web the backdoor roth ira strategy is a legal way to get around the income limits that usually prevent high earners from owning roth iras.

Web Definitions First, There Are Three Terms Which Need To Be Understood When Doing Backdoor Roths:

Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or having earnings that put you. The backdoor roth ira strategy is not a tax dodge—in. Rather, it’s a strategy that helps you move money into a roth ira even though your annual income would. Web how to set up a roth ira to make a backdoor contribution.

The Steps For Setting Up A Backdoor Roth Ira Are Relatively Straightforward:

Contribute money to a traditional ira account, making sure your brokerage offers roth conversions (most do). Web what is a backdoor roth ira? Do you need a backdoor roth? Web let's learn more about the backdoor roth ira and the role that form 8606 plays in making it a reality.

(If You Have An Existing Ira, Consider How The Ira Aggregation Rule, Mentioned Above, Will Affect The Conversion.)

Web in a traditional ira and 401 (k), retirees need to withdraw distributions each year by april 1 of the year they turn 72 years of age.