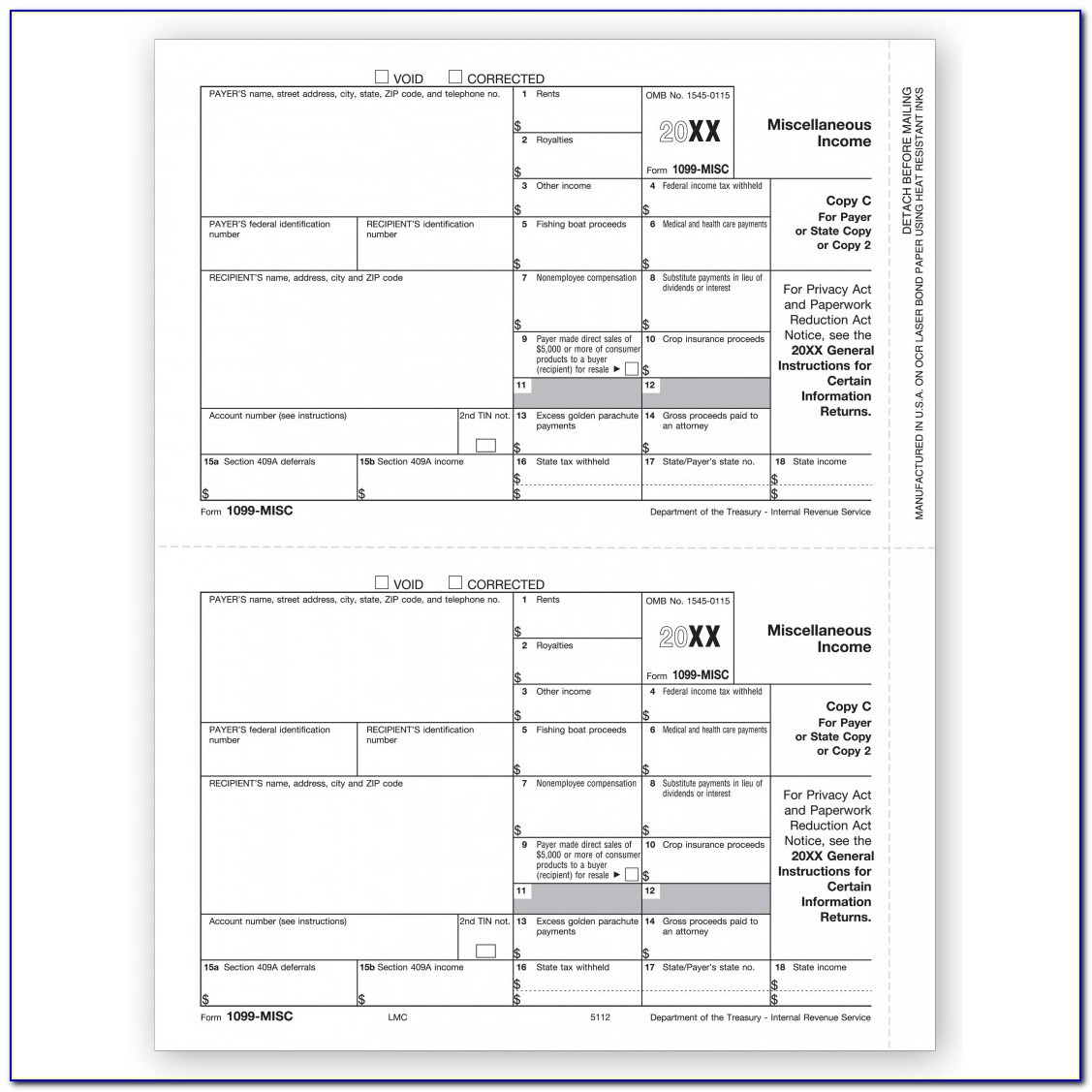

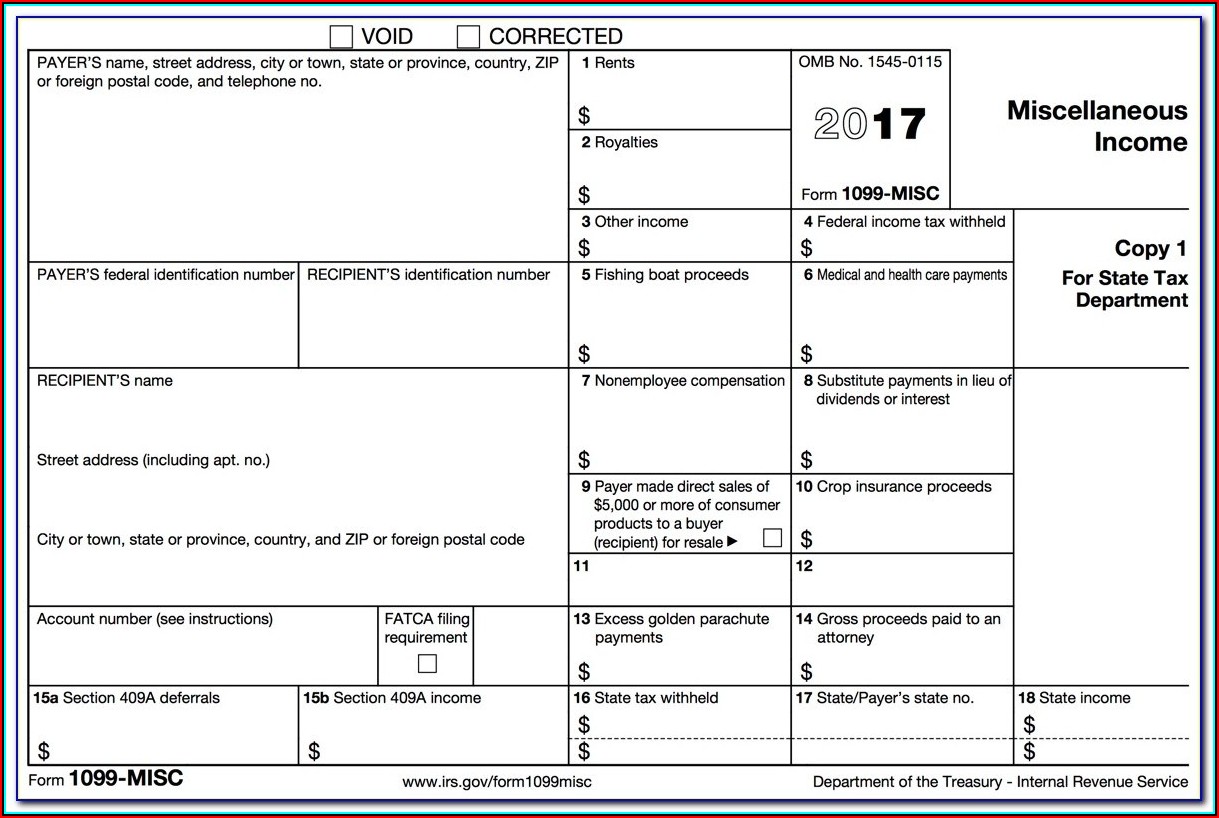

Blank 1099 Misc Form

Blank 1099 Misc Form - For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. Cash paid from a notional principal contract made to an individual, partnership, or. Nor are they required for payments to a c corporation or an s corporation unless the payment is for medical or health care payments or legal services. Payments you make to businesses that sell physical products or goods — rather than provide services. Web instructions for recipient recipient’s taxpayer identification number (tin). Both the forms and instructions will be updated as needed.

Cash paid from a notional principal contract made to an individual, partnership, or. Both the forms and instructions will be updated as needed. Web instructions for recipient recipient’s taxpayer identification number (tin). Payments you make to businesses that sell physical products or goods — rather than provide services. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. Nor are they required for payments to a c corporation or an s corporation unless the payment is for medical or health care payments or legal services.

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Cash paid from a notional principal contract made to an individual, partnership, or. Nor are they required for payments to a c corporation or an s corporation unless the payment is for medical or health care payments or legal services. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Web instructions for recipient recipient’s taxpayer identification number (tin). However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. Both the forms and instructions will be updated as needed. Payments you make to businesses that sell physical products or goods — rather than provide services.

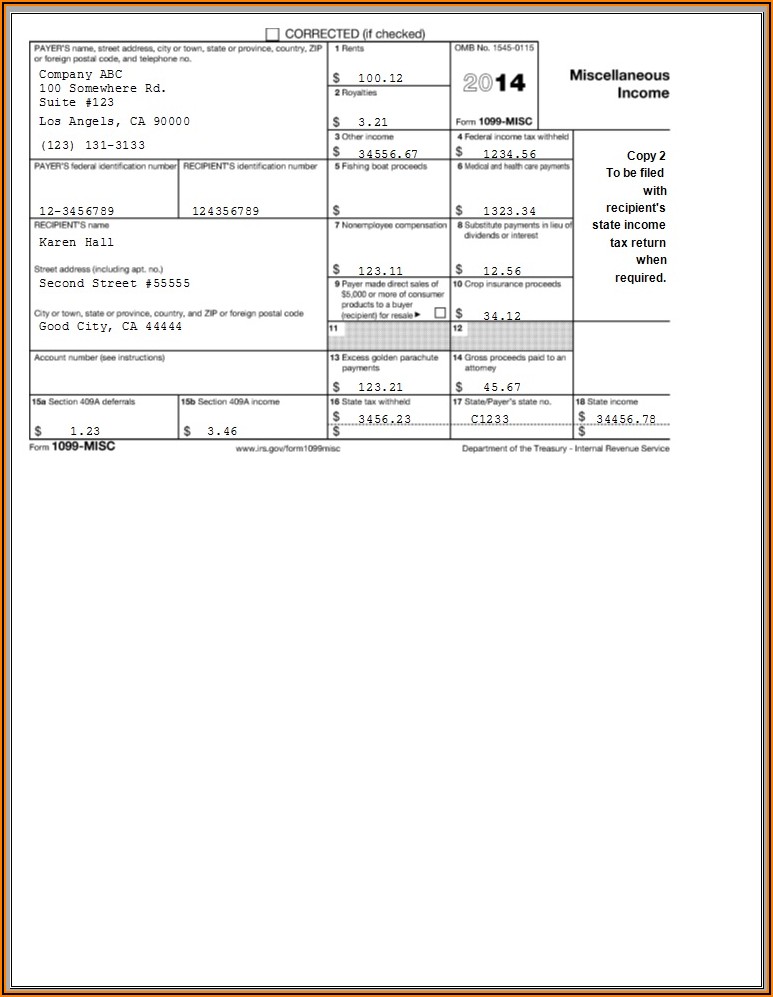

1099 Misc Fillable Form Free amulette

Web instructions for recipient recipient’s taxpayer identification number (tin). Cash paid from a notional principal contract made to an individual, partnership, or. However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. Nor are they required for payments to a c corporation or an s corporation unless the payment is for.

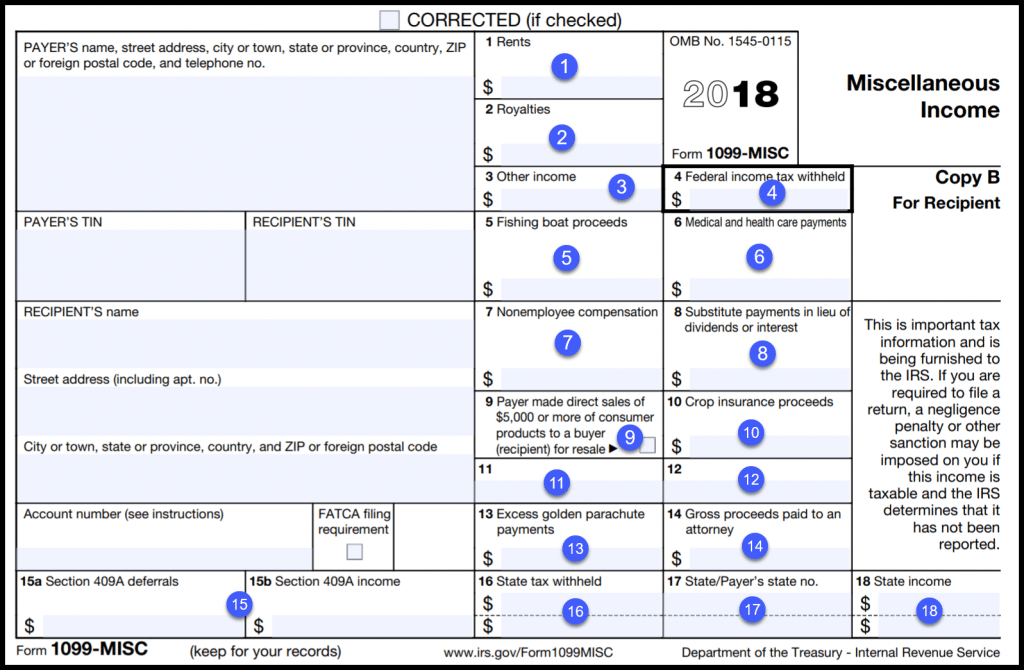

6 mustknow basics form 1099MISC for independent contractors Bonsai

Both the forms and instructions will be updated as needed. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Web instructions for recipient recipient’s taxpayer identification number (tin). Nor are they required for payments to a.

Free Printable 1099 Misc Forms Free Printable

Cash paid from a notional principal contract made to an individual, partnership, or. Both the forms and instructions will be updated as needed. However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. Web instructions for recipient recipient’s taxpayer identification number (tin). For the most recent version, go to irs.gov/form1099misc or.

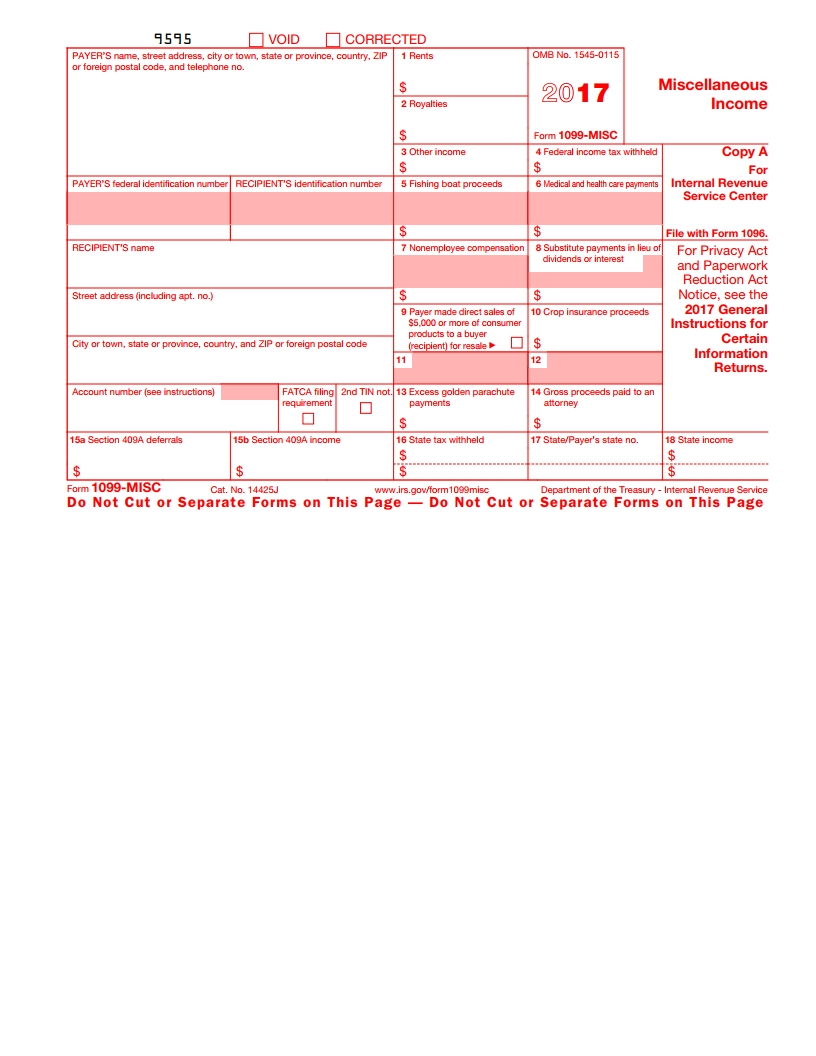

Irs Forms 1099 Are Critical, And Due Early In 2017 Free Printable

Both the forms and instructions will be updated as needed. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Payments you make to businesses that sell physical products or goods — rather than provide services. Nor.

IRS Form 1099 Reporting for Small Business Owners

However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Both the forms and instructions will be updated.

1099MISC Form Template Create and Fill Online

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Nor are they required for payments to a c corporation or an s corporation unless the payment is for medical or health care payments or legal services. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin),.

1099 Misc Blank Form 2019 Form Resume Examples 76YGKqy0Yo

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Cash paid from a notional principal contract made to an individual, partnership, or. Nor are they required for payments to a c corporation or an s corporation.

Performing 1099 YearEnd Reporting

Payments you make to businesses that sell physical products or goods — rather than provide services. Nor are they required for payments to a c corporation or an s corporation unless the payment is for medical or health care payments or legal services. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. However, this form recently changed, and it.

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

Payments you make to businesses that sell physical products or goods — rather than provide services. Both the forms and instructions will be updated as needed. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Nor are they required for payments to a c corporation or an s corporation unless the payment is for medical or health care payments.

Blank W2 Form 2016 Form Resume Examples yKVBbg7VMB

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Cash paid from a notional principal contract made to an individual, partnership, or. Payments you make to businesses that sell physical products or goods — rather than.

Payments You Make To Businesses That Sell Physical Products Or Goods — Rather Than Provide Services.

Nor are they required for payments to a c corporation or an s corporation unless the payment is for medical or health care payments or legal services. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. Both the forms and instructions will be updated as needed.

Cash Paid From A Notional Principal Contract Made To An Individual, Partnership, Or.

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Web instructions for recipient recipient’s taxpayer identification number (tin).