Ca Form 592 Due Date

Ca Form 592 Due Date - Web for the payment period: January 31st following the close of the calendar year for both residents and nonresidents. The payment periods and due dates are: Web 2022 fourth quarter estimated tax payments due for individuals. Each quarter the partnership or llc must report the distributions to the partners or members and pay the withholding tax due. Web this form contains payment vouchers for foreign partners within california. We last updated the payment voucher for foreign partner or member withholding in february. June 15, 2010 june 1 through august. Specific period and due date. Web 19 rows the supplemental payment voucher and payment are due by the original due.

Web the due dates for california backup withholding are different than federal backup withholding due dates. Each quarter the partnership or llc must report the distributions to the partners or members and pay the withholding tax due. January 1 through march 31, 2010. April 15, 2010 april 1 through may 31, 2010. Specific period and due date. January 1 through march 31, 2020: January 1 through march 31, 2023: Web this form contains payment vouchers for foreign partners within california. Web the tax withheld on payments is remitted in four specific periods. Specific period and due date.

Each period has a specific due date. The withholding agent retains a copy of this form for a. Web each period has a specific due date. Specific period and due date. California usually releases forms for the. January 31st following the close of the calendar year for both residents and nonresidents. Web 2022 fourth quarter estimated tax payments due for individuals. Web the due dates for california backup withholding are different than federal backup withholding due dates. Web when the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. Specific period and due date.

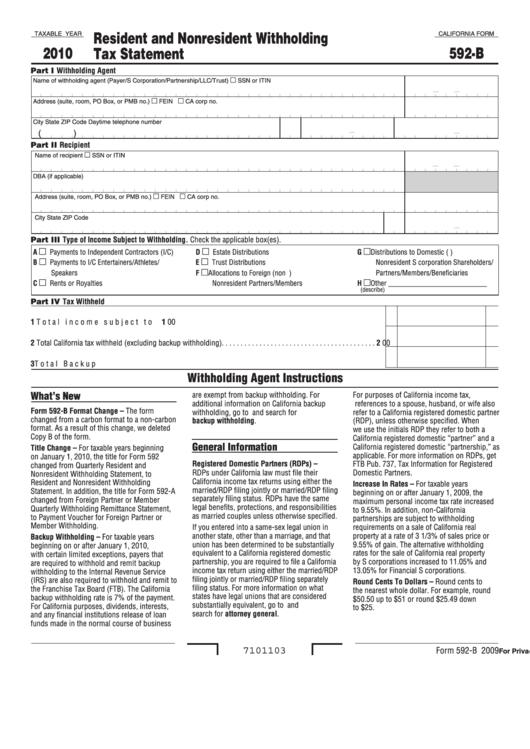

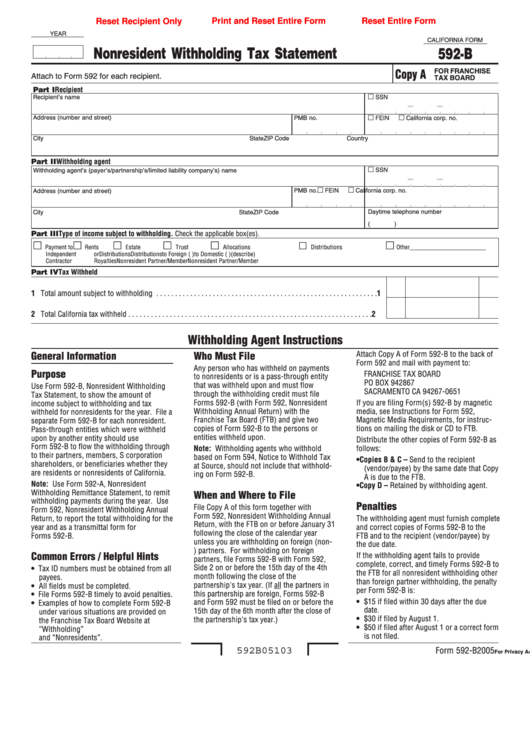

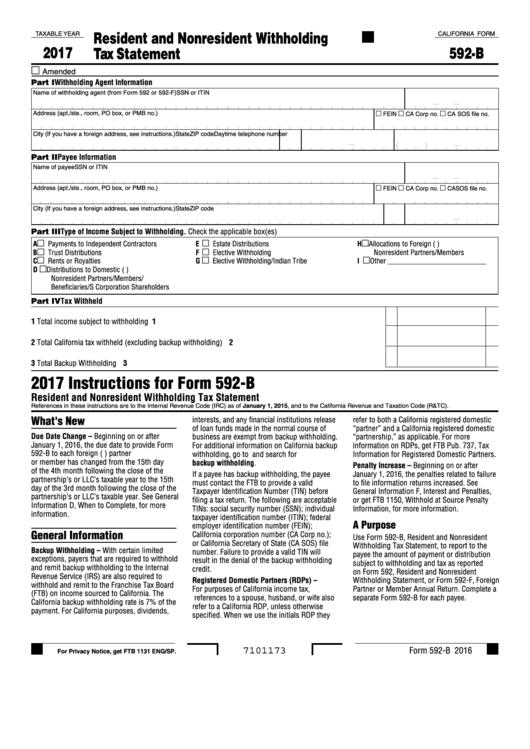

592B Form Franchise Tax Board Edit, Fill, Sign Online Handypdf

Web 2021, 592, instructions for form 592, resident and nonresident withholding statement this is only available by request. January 1 through march 31, 2021: January 1 through march 31, 2010. The withholding agent retains a copy of this form for a. We last updated the payment voucher for foreign partner or member withholding in february.

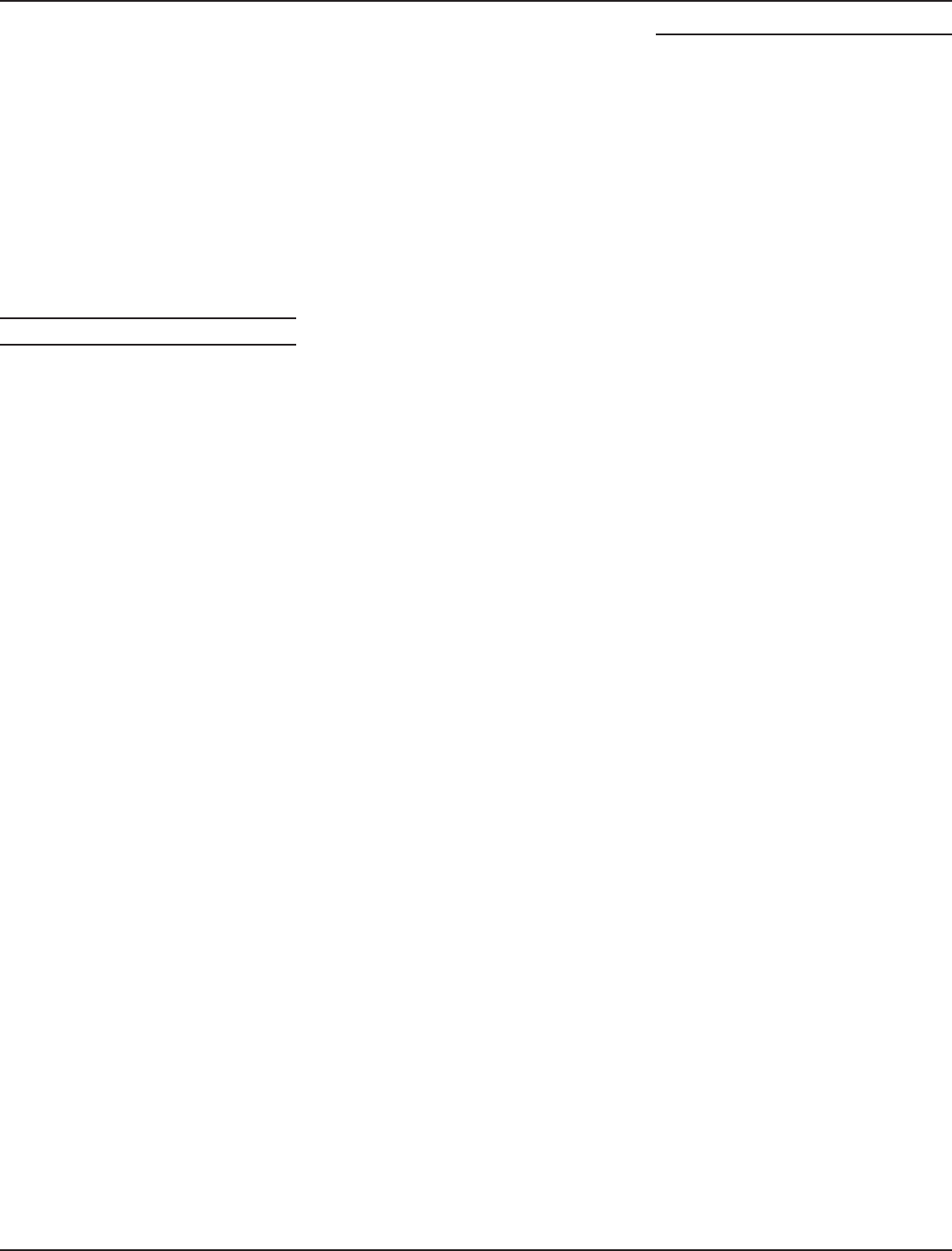

Fillable California Form 592B Nonresident Withholding Tax Statement

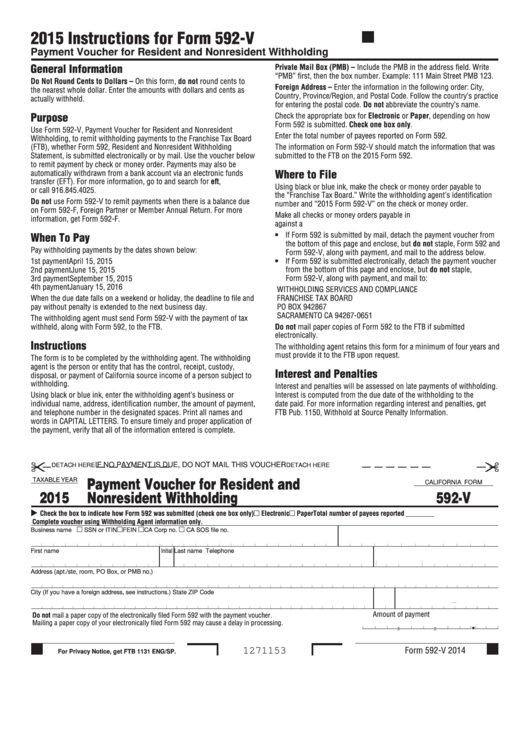

Web these related forms may also be needed with the california form 592. January 31st following the close of the calendar year for both residents and nonresidents. Web 2022 fourth quarter estimated tax payments due for individuals. Web for the payment period: Web california form 592 due date:

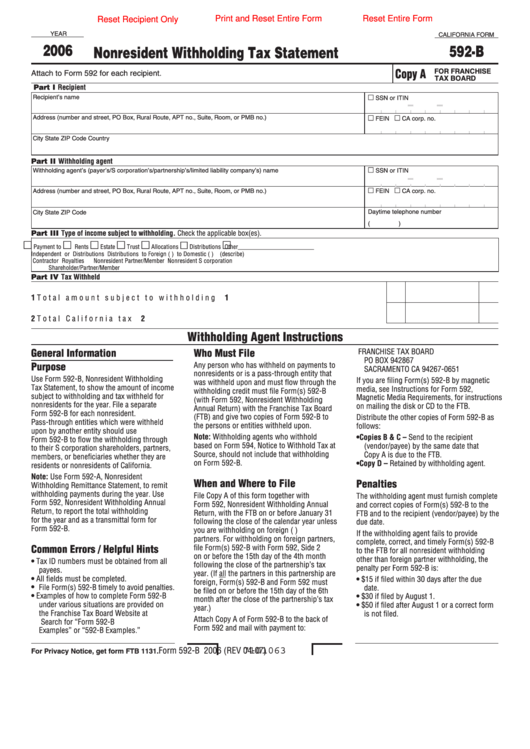

California Form 592 Nonresident Withholding Annual Return 2007

Web each period has a specific payment due date. January 1 through march 31, 2020: Web the tax withheld on payments is remitted in four specific periods. June 15, 2010 june 1 through august. January 31st following the close of the calendar year for both residents and nonresidents.

2013 Form CA FTB 592 Fill Online, Printable, Fillable, Blank pdfFiller

The withholding agent retains a copy of this form for a. April 15, 2010 april 1 through may 31, 2010. Specific period and due date. Specific period and due date. June 15, 2010 june 1 through august.

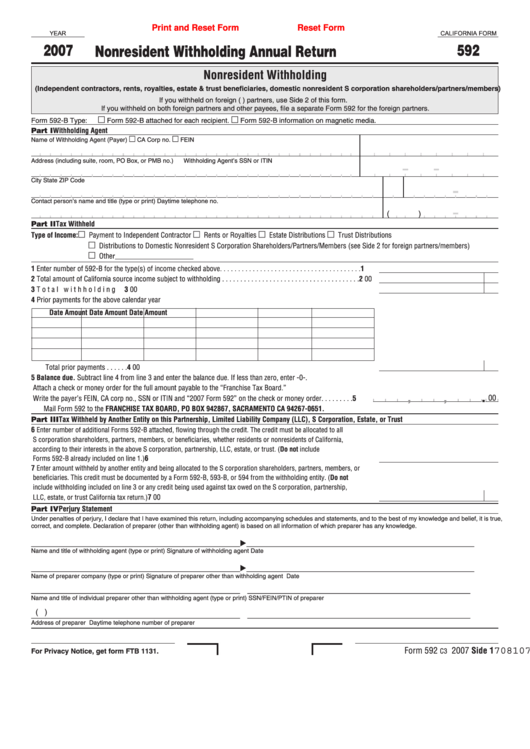

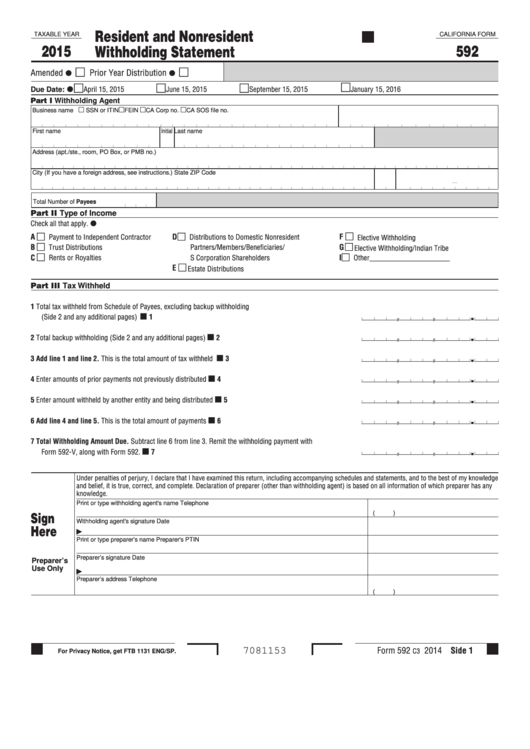

Fillable California Form 592B Resident And Nonresident Withholding

January 1 through march 31, 2023: Web 2022 fourth quarter estimated tax payments due for individuals. April 15, 2010 april 1 through may 31, 2010. Web 2021, 592, instructions for form 592, resident and nonresident withholding statement this is only available by request. The withholding agent retains a copy of this form for a.

Fillable Form 592B Nonresident Withholding Tax Statement 2005

Web these related forms may also be needed with the california form 592. Web for the payment period: Web the due dates for california backup withholding are different than federal backup withholding due dates. Web 2021, 592, instructions for form 592, resident and nonresident withholding statement this is only available by request. Web this form contains payment vouchers for foreign.

Fillable California Form 592 Resident And Nonresident Withholding

January 31st following the close of the calendar year for both residents and nonresidents. Specific period and due date. January 1 through march 31, 2023: April 15, 2010 april 1 through may 31, 2010. The withholding agent retains a copy of this form for a.

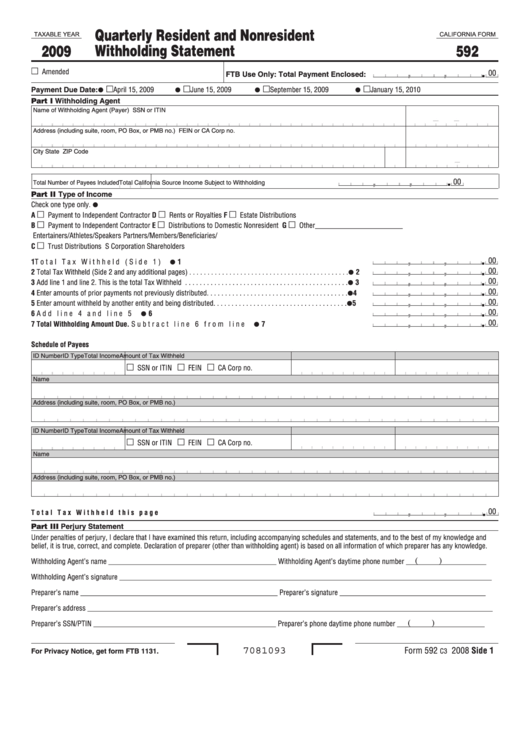

Fillable California Form 592 Quarterly Resident And Nonresident

Web california form 592 due date: January 1 through march 31, 2011. Web due date form 592 is a return that is filed quarterly. Specific period and due date. Web for the payment period:

Fillable California Form 592V Payment Voucher For Resident And

January 1 through march 31, 2020: Web california form 592 due date: Web when the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. Web each period has a specific due date. Each quarter the partnership or llc must report the distributions to the partners or.

Fillable California Form 592B Resident And Nonresident Withholding

Web due date form 592 is a return that is filed quarterly. January 1 through march 31, 2020: January 1 through march 31, 2010. Web this form contains payment vouchers for foreign partners within california. Web the tax withheld on payments is remitted in four specific periods.

View All 175 California Income Tax Forms Form Sources:

Web the tax withheld on payments is remitted in four specific periods. Web when the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. Web 2021, 592, instructions for form 592, resident and nonresident withholding statement this is only available by request. January 1 through march 31, 2021:

Specific Period And Due Date.

Web each period has a specific due date. The withholding agent retains a copy of this form for a. Web each period has a specific payment due date. California backup withholding due dates are the same as the.

June 15, 2010 June 1 Through August.

April 15, 2010 april 1 through may 31, 2010. Web for the payment period: January 31st following the close of the calendar year for both residents and nonresidents. Web this form contains payment vouchers for foreign partners within california.

January 1 Through March 31, 2011.

April 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023 business name ssn or itin fein ca corp no. Web the due dates for california backup withholding are different than federal backup withholding due dates. Web the tax withheld on payments is remitted in four specific periods. Specific period and due date.