California Earned Income Tax Credit Form

California Earned Income Tax Credit Form - Web more about the california form 3514 tax credit. We last updated california form 3514 in january 2023 from the california franchise tax board. Web you must file form 1040, us individual income tax return or form 1040 sr, u.s. The california eitc is treated in the same manner as the federal. If you claim the california eitc even. Web paid preparer's california earned income tax credit checklist californiaform 3596 8471163 attach to taxpayer's california form 540, 540 2ez, or long or short form. Wages, salaries, and tips) subject to california. Web taxable year 2022 paid preparer’s due diligence checklist for california earned income tax credit california form 3596 attach to taxpayer’s original or amended california. Ad our federal tax credits and incentives services can be tailored to your specific needs. Web specific instructions 2022 earned income tax credit table references in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the.

If you qualify, you can use the credit to reduce the taxes you. Mcah created this toolkit for local. If you have a qualifying child, you must also file the schedule eic. If you claim the california eitc even. Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. We last updated california form 3514 in january 2023 from the california franchise tax board. Web you must file form 1040, us individual income tax return or form 1040 sr, u.s. This form is for income earned in. Web you can claim the california earned income tax credit (caleitc) if you work and have low income (up to $30,000). Web more about the california form 3514 tax credit.

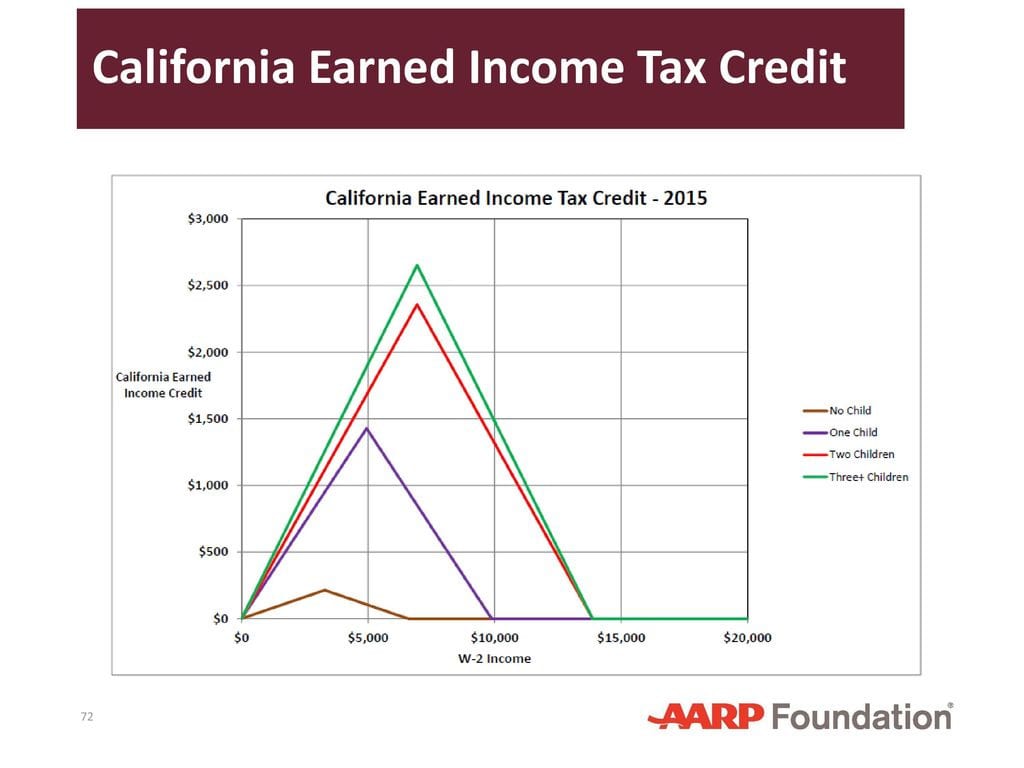

We last updated california form 3514 in january 2023 from the california franchise tax board. The amount of the credit ranges from $275 to $3,417. Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Wages, salaries, and tips) subject to california. Web the california earned income tax credit (caleitc) is a cash back tax credit that puts money back into the pockets of california workers who earn up to $30,000 per year. Web paid preparer's california earned income tax credit checklist californiaform 3596 8471163 attach to taxpayer's california form 540, 540 2ez, or long or short form. For more information, visit the ftb and irs websites. Web more about the california form 3514 tax credit. Web you must file form 1040, us individual income tax return or form 1040 sr, u.s. The california eitc is treated in the same manner as the federal.

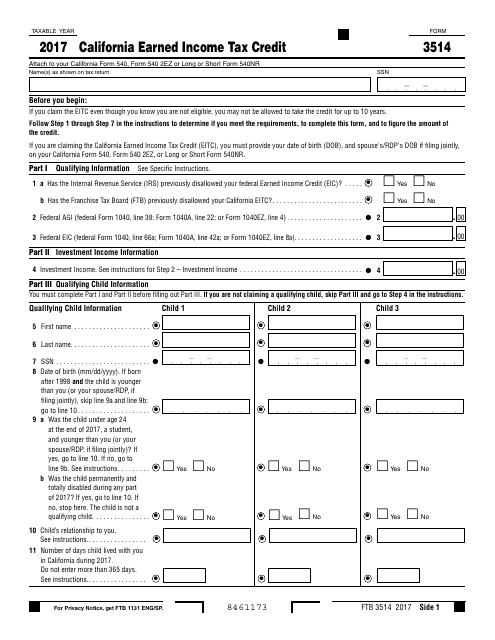

Form FTB 3514 Download Fillable PDF 2017, California Earned Tax

Web you can claim the california earned income tax credit (caleitc) if you work and have low income (up to $30,000). If you qualify, you can use the credit to reduce the taxes you. Wages, salaries, and tips) subject to california. Web you must file form 1040, us individual income tax return or form 1040 sr, u.s. This form is.

California's Earned Tax Credit Official Website —

If you have a qualifying child, you must also file the schedule eic. Web paid preparer's california earned income tax credit checklist californiaform 3596 8471163 attach to taxpayer's california form 540, 540 2ez, or long or short form. Web more about the california form 3514 tax credit. If you qualify, you can use the credit to reduce the taxes you..

Get Your California Earned Tax Credit (Cal EITC) Cash Back

February 18, 2022 the california earned income tax credit (caleitc) puts money back into the pockets of california’s working families and. You must fill out your child/children's qualifying information along with your earned income to obtain the refundable tax credits. Web you can claim the california earned income tax credit (caleitc) if you work and have low income (up to.

California Earned Tax Credit Worksheet 2017

If you have a qualifying child, you must also file the schedule eic. Web california earned income tax credit attach to your california form 540, form 540 2ez, or form 540nr. Web the california earned income tax credit (caleitc) is a cash back tax credit that puts money back into the pockets of california workers who earn up to $30,000.

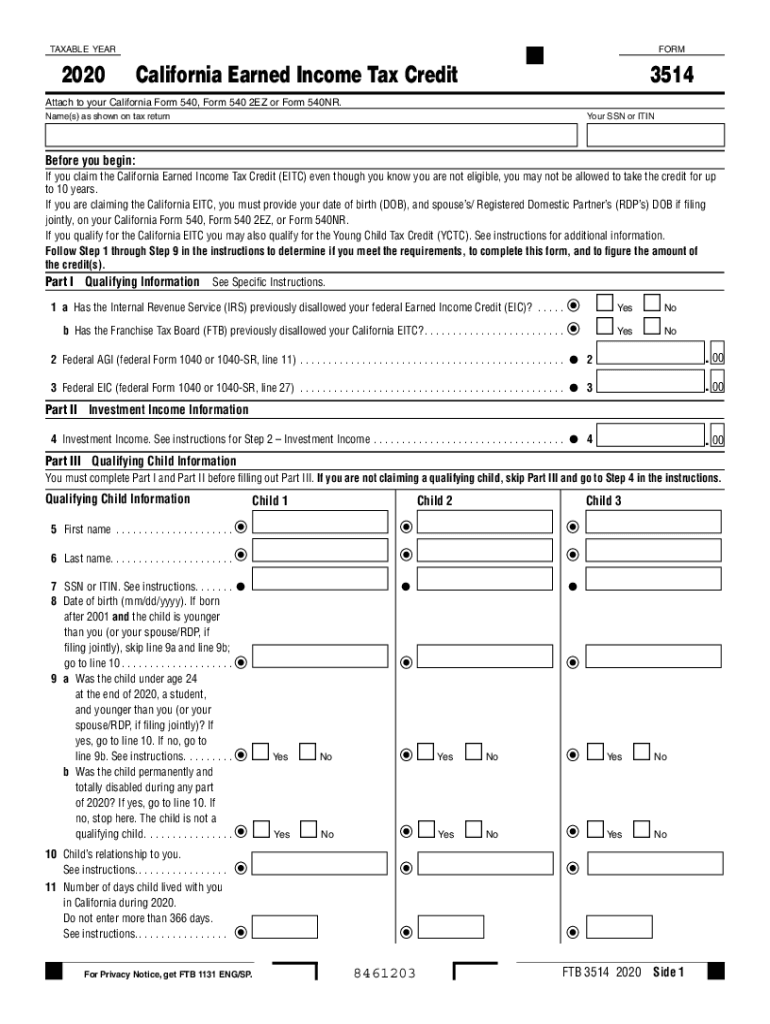

20202022 Form CA FTB 3514 Fill Online, Printable, Fillable, Blank

For more information, visit the ftb and irs websites. The california eitc is treated in the same manner as the federal. You must fill out your child/children's qualifying information along with your earned income to obtain the refundable tax credits. Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. We.

California Earned Tax Credit Worksheet 2017

Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. For more information, visit the ftb and irs websites. Web the california earned income tax credit (caleitc) is a cash back tax credit that puts money back into the pockets of california workers who earn up to $30,000 per year. This.

It’s Tax Time Do you know about the California Earned Tax

With the right expertise, federal tax credits and incentives could benefit your business. If you have a qualifying child, you must also file the schedule eic. If you claim the california eitc even. You must fill out your child/children's qualifying information along with your earned income to obtain the refundable tax credits. Wages, salaries, and tips) subject to california.

California Earned Tax Credit Worksheet 2015 Worksheet Resume

February 18, 2022 the california earned income tax credit (caleitc) puts money back into the pockets of california’s working families and. If you qualify, you can use the credit to reduce the taxes you. For more information, visit the ftb and irs websites. Ad our federal tax credits and incentives services can be tailored to your specific needs. With the.

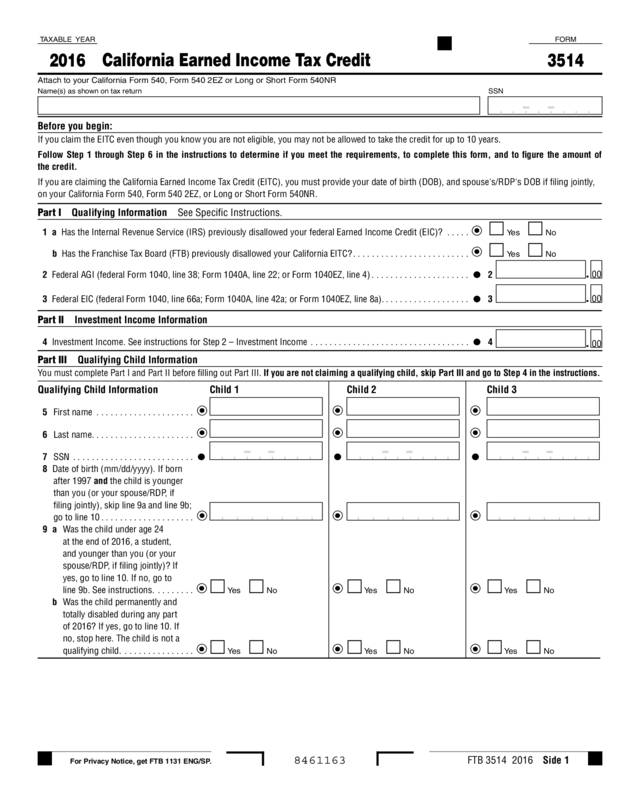

2016 Form 3514 California Earned Tax Credit Edit, Fill, Sign

The amount of the credit ranges from $275 to $3,417. Mcah created this toolkit for local. Web you can claim the california earned income tax credit (caleitc) if you work and have low income (up to $30,000). Web the california earned income tax credit (caleitc) is a cash back tax credit that puts money back into the pockets of california.

California Earned Tax Credit Worksheet 2017 —

Web paid preparer's california earned income tax credit checklist californiaform 3596 8471163 attach to taxpayer's california form 540, 540 2ez, or long or short form. You do not need a child to qualify, but must file a california income tax return to. This form is for income earned in. You must fill out your child/children's qualifying information along with your.

Web The Ca Eitc Reduces Your California Tax Obligation, Or Allows A Refund If No California Tax Is Due.

Web specific instructions 2022 earned income tax credit table references in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the. If you have a qualifying child, you must also file the schedule eic. The amount of the credit ranges from $275 to $3,417. Ad our federal tax credits and incentives services can be tailored to your specific needs.

Web You Must File Form 1040, Us Individual Income Tax Return Or Form 1040 Sr, U.s.

With the right expertise, federal tax credits and incentives could benefit your business. Web the california earned income tax credit (caleitc) is a cash back tax credit that puts money back into the pockets of california workers who earn up to $30,000 per year. Web more about the california form 3514 tax credit. For more information, visit the ftb and irs websites.

The California Eitc Is Treated In The Same Manner As The Federal.

If you qualify, you can use the credit to reduce the taxes you. Web paid preparer's california earned income tax credit checklist californiaform 3596 8471163 attach to taxpayer's california form 540, 540 2ez, or long or short form. If you claim the california eitc even. Mcah created this toolkit for local.

Web Tax Form For Earned Income Tax Credits.

This form is for income earned in. You must fill out your child/children's qualifying information along with your earned income to obtain the refundable tax credits. Wages, salaries, and tips) subject to california. You do not need a child to qualify, but must file a california income tax return to.