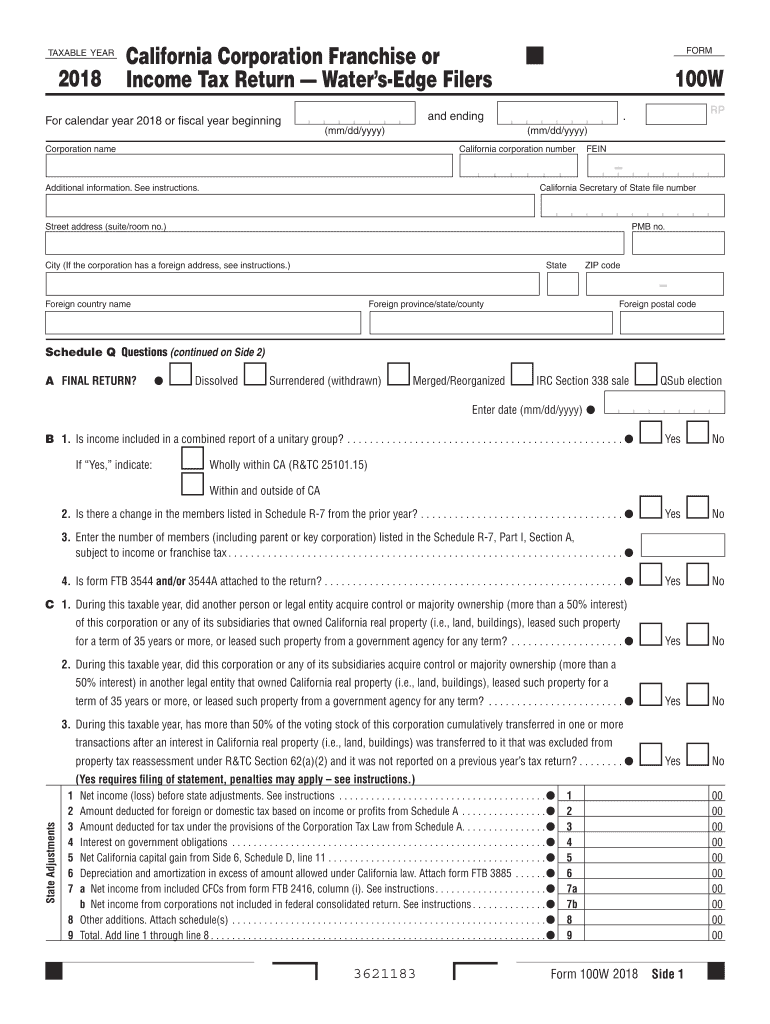

California Form 100W Instructions 2021

California Form 100W Instructions 2021 - Web the california franchise tax board (ftb) jan. Or form 109, line 14. Edit your 100 s online type text, add images, blackout confidential details, add comments, highlights and more. Get your online template and fill it in using progressive features. Depreciation and amortization in excess of amount allowed under california law. Web form 100w for calendar year 2020 or fiscal year beginning (mm/dd/yyyy) and ending (mm/dd/yyyy). Enjoy smart fillable fields and. Web form 100w, line 31; Sign it in a few clicks draw your signature, type it,. Web net california capital gain from side 6, schedule d, line 11 5.

20 released updated instructions for 2021 form 100x, amended corporation franchise or income tax. Edit your 100 s online type text, add images, blackout confidential details, add comments, highlights and more. Always consult with a tax professional if you're unsure about anything. Sign it in a few clicks draw your signature, type it,. References in these instructions are to the internal revenue code. Web 7691213 ftb 5806 2021 side 1 taxable year 2021 underpayment of estimated tax by corporations california form 5806 for calendar year 2021 or fiscal year beginning. Depreciation and amortization in excess of amount allowed under california law. Web remember, everyone's tax situation is unique. Web form 100w, line 31; Or form 109, line 14.

Enjoy smart fillable fields and. Web follow this simple instruction to redact california form 100w in pdf format online for free: Register for a free account, set a strong password, and go through. See instructions for part i, line 4b, line. Depreciation and amortization in excess of amount allowed under california law. Always consult with a tax professional if you're unsure about anything. Web form 100w, line 31; Edit your 100 s online type text, add images, blackout confidential details, add comments, highlights and more. If the corporation filed a schedule r, apportionment and. Or form 109, line 14.

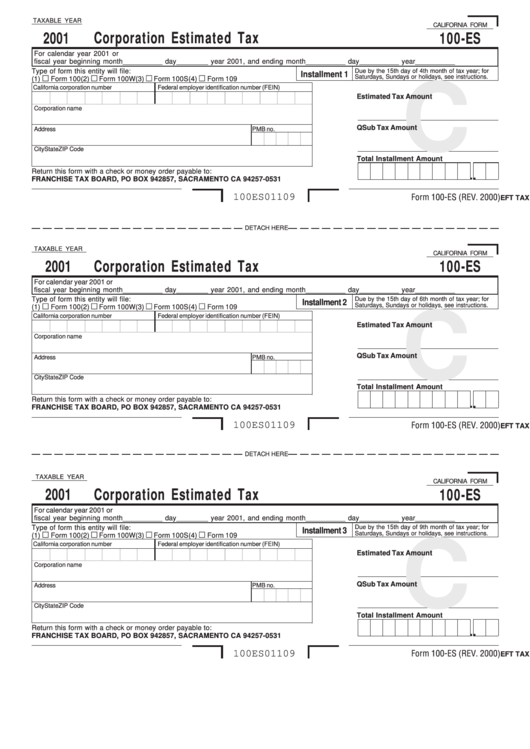

Form 100Es Corporation Estimated Tax California printable pdf download

Get form 100w for more information. Web 7691213 ftb 5806 2021 side 1 taxable year 2021 underpayment of estimated tax by corporations california form 5806 for calendar year 2021 or fiscal year beginning. If the corporation filed a schedule r, apportionment and. Always consult with a tax professional if you're unsure about anything. Edit your 100 s online type text,.

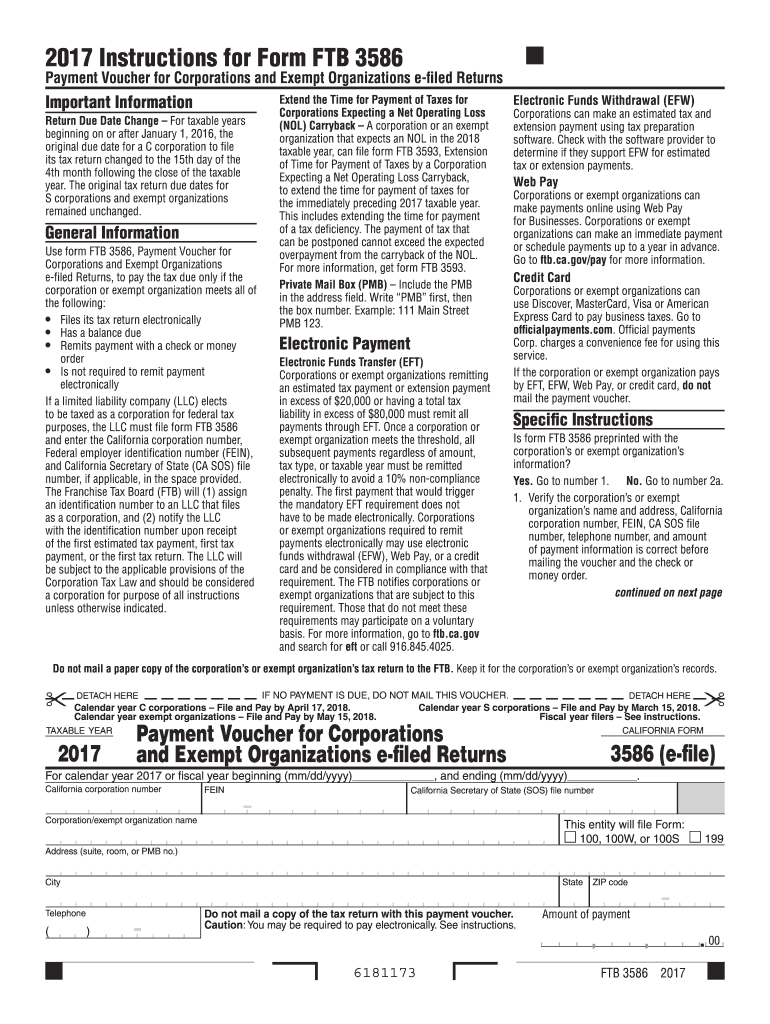

Ftb 3586 Fill Out and Sign Printable PDF Template signNow

Web form 100w, line 31; Register for a free account, set a strong password, and go through. Attach form ftb 3885 6. See instructions for part i, line 4b, line. Web 7691213 ftb 5806 2021 side 1 taxable year 2021 underpayment of estimated tax by corporations california form 5806 for calendar year 2021 or fiscal year beginning.

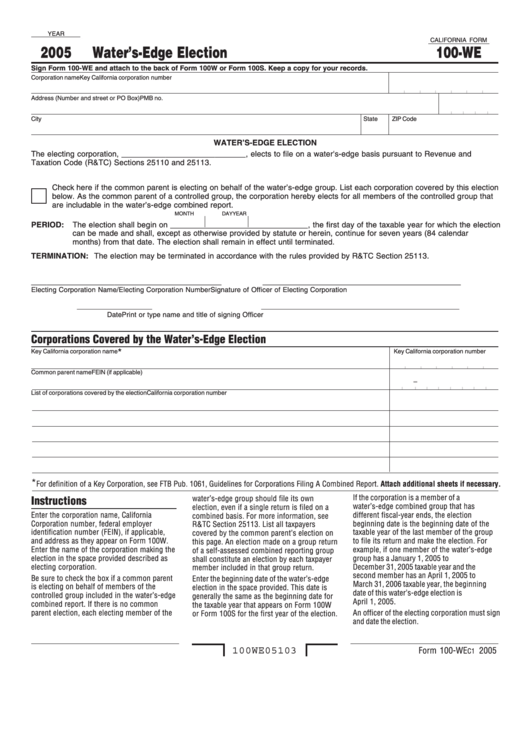

California Form 100We Water'SEdge Election 2005 printable pdf

Edit your 100 s online type text, add images, blackout confidential details, add comments, highlights and more. 20 released updated instructions for 2021 form 100x, amended corporation franchise or income tax. Enjoy smart fillable fields and. Register for a free account, set a strong password, and go through. Web form 100w, line 31;

CA FTB Schedule CA (540) 20202022 Fill out Tax Template Online US

Web 7691213 ftb 5806 2021 side 1 taxable year 2021 underpayment of estimated tax by corporations california form 5806 for calendar year 2021 or fiscal year beginning. Web remember, everyone's tax situation is unique. Attach form ftb 3885 6. Or form 109, line 14. Web form 100w for calendar year 2020 or fiscal year beginning (mm/dd/yyyy) and ending (mm/dd/yyyy).

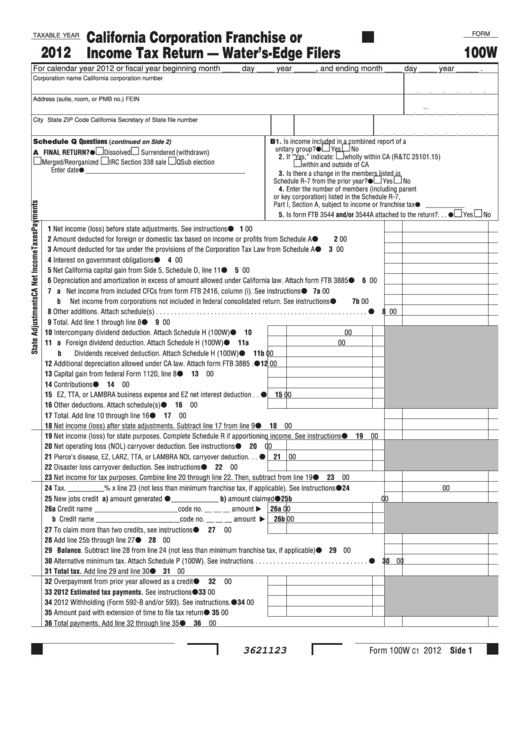

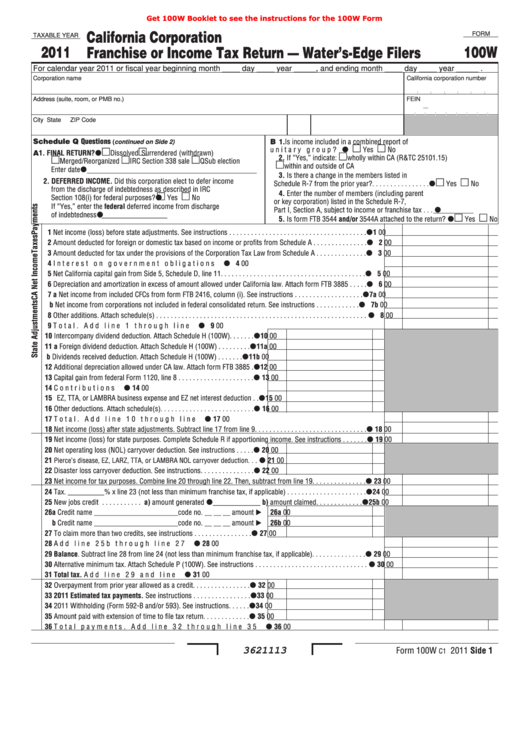

Fillable Form 100w California Corporation Franchise Or Tax

Web 4.8 satisfied 42 votes how to fill out and sign california 100w fill online? Web follow this simple instruction to redact california form 100w in pdf format online for free: If the corporation filed a schedule r, apportionment and. Sign it in a few clicks draw your signature, type it,. Web attach the schedule p (100w) for each member.

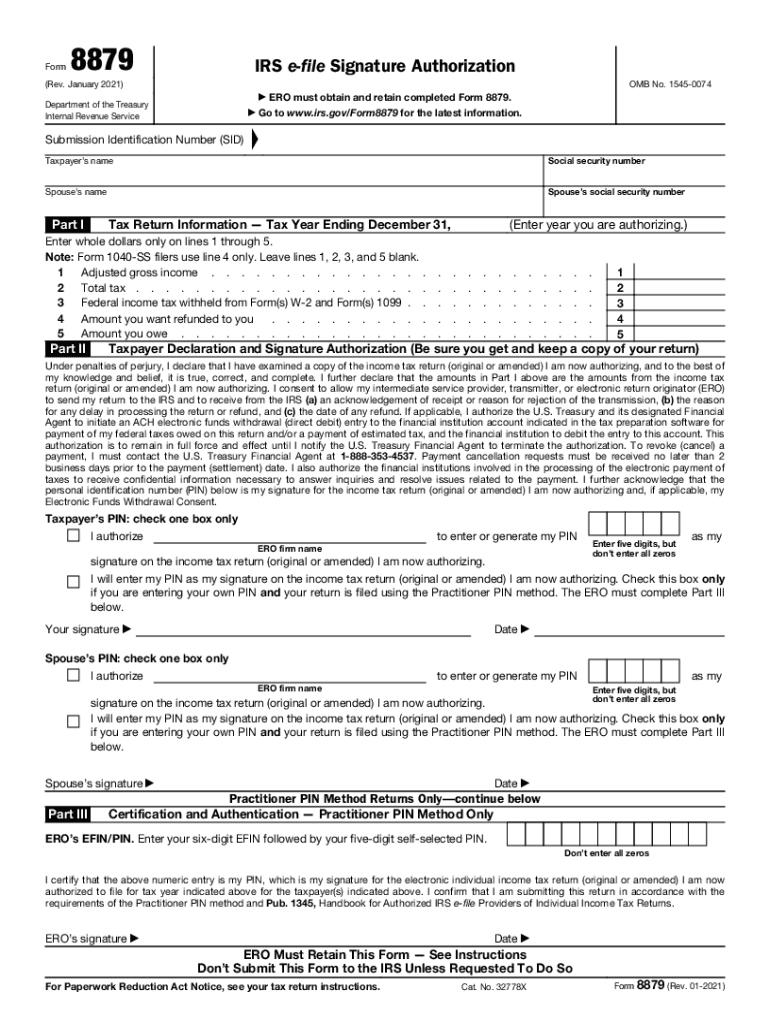

IRS 8879 2021 Fill and Sign Printable Template Online US Legal Forms

Web net california capital gain from side 6, schedule d, line 11 5. Get your online template and fill it in using progressive features. Web form 100w, line 31; Web attach the schedule p (100w) for each member in the combined report behind the combined schedule p (100w) for all members. Always consult with a tax professional if you're unsure.

General Affidavit Form California Free Form Resume Examples goVLdXn5Vv

Web 7691213 ftb 5806 2021 side 1 taxable year 2021 underpayment of estimated tax by corporations california form 5806 for calendar year 2021 or fiscal year beginning. Web form 100w, line 31; Web attach the schedule p (100w) for each member in the combined report behind the combined schedule p (100w) for all members. Edit your 100 s online type.

100w Tax Form Fill Out and Sign Printable PDF Template signNow

Sign it in a few clicks draw your signature, type it,. If the corporation filed a schedule r, apportionment and. Register for a free account, set a strong password, and go through. Or form 109, line 14. Always consult with a tax professional if you're unsure about anything.

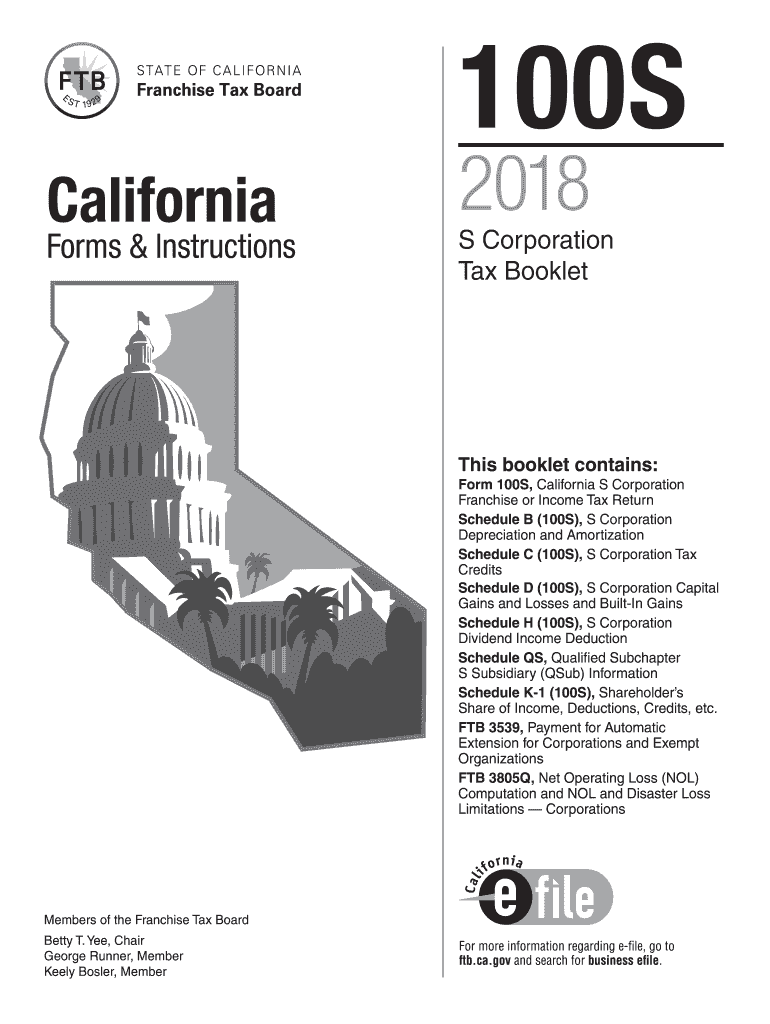

20182022 Form CA FTB 100S Tax Booklet Fill Online, Printable, Fillable

References in these instructions are to the internal revenue code. Web remember, everyone's tax situation is unique. Web form 100w, line 31; Web the california franchise tax board (ftb) jan. Web 7691213 ftb 5806 2021 side 1 taxable year 2021 underpayment of estimated tax by corporations california form 5806 for calendar year 2021 or fiscal year beginning.

Fillable Form 100w California Corporation Franchise Or Tax

Web the california franchise tax board (ftb) jan. Web 7691213 ftb 5806 2021 side 1 taxable year 2021 underpayment of estimated tax by corporations california form 5806 for calendar year 2021 or fiscal year beginning. See instructions for part i, line 4b, line. Get form 100w for more information. Get your online template and fill it in using progressive features.

Web 7691213 Ftb 5806 2021 Side 1 Taxable Year 2021 Underpayment Of Estimated Tax By Corporations California Form 5806 For Calendar Year 2021 Or Fiscal Year Beginning.

If the corporation filed a schedule r, apportionment and. Web follow this simple instruction to redact california form 100w in pdf format online for free: Sign it in a few clicks draw your signature, type it,. Get your online template and fill it in using progressive features.

Depreciation And Amortization In Excess Of Amount Allowed Under California Law.

Web 4.8 satisfied 42 votes how to fill out and sign california 100w fill online? Enjoy smart fillable fields and. Or form 109, line 14. Get form 100w for more information.

Attach Form Ftb 3885 6.

Register for a free account, set a strong password, and go through. Web form 100w, line 31; Web remember, everyone's tax situation is unique. Always consult with a tax professional if you're unsure about anything.

Web Attach The Schedule P (100W) For Each Member In The Combined Report Behind The Combined Schedule P (100W) For All Members.

Web form 100w for calendar year 2020 or fiscal year beginning (mm/dd/yyyy) and ending (mm/dd/yyyy). Web the california franchise tax board (ftb) jan. 20 released updated instructions for 2021 form 100x, amended corporation franchise or income tax. Web net california capital gain from side 6, schedule d, line 11 5.