California Form 3514 Business Code

California Form 3514 Business Code - Welcome to findlaw's cases & codes, a free source of state. 2022 earned income tax credit table. Web 2021, 3514, instructions for 3514 form, california earned income tax credit this is only available by request. Download past year versions of this tax form as. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. If you claim the california eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. Web form 3514 business code rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 42 votes how to fill out and sign ftb 3514 online? Easily add and highlight text, insert pictures, checkmarks, and signs, drop new fillable areas, and rearrange or. Web show sources > form 3514 is a california individual income tax form. Get your online template and fill it in using.

How do we get rid of that form? Web we last updated california form 3514 in january 2023 from the california franchise tax board. Web form 3514 business code rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 42 votes how to fill out and sign ftb 3514 online? Web 603 rows 2020 instructions for form ftb 3514 california earned income tax credit. References in these instructions are to the internal revenue code (irc) as of january 1,. Web show sources > form 3514 is a california individual income tax form. Web 2021, 3514, instructions for 3514 form, california earned income tax credit this is only available by request. This return has business income on ca3514 line 18 but is missing the business city/state/zip code in the address. Cigarette and tobacco products licensing act of 2003. Web deanm15 expert alumni if you are certain that form 3514 does not belong on your return, you can delete it.

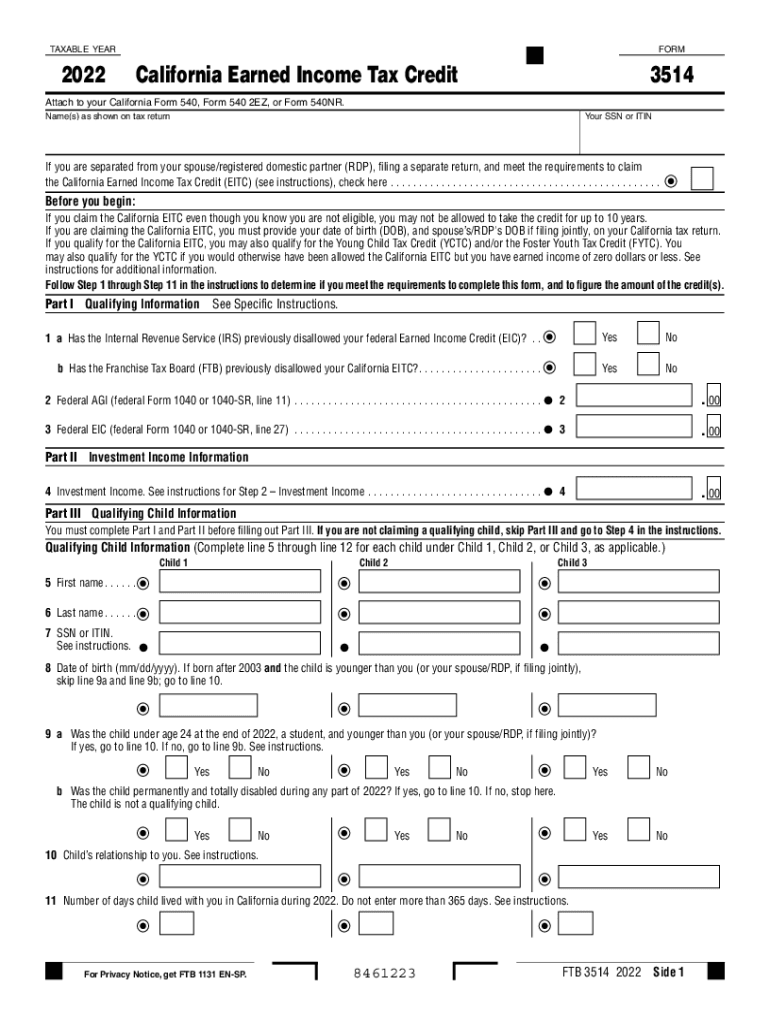

Web business and professions code /. Web a website for the state of california, department of consumer affairs, dental board of california. Please provide your email address and it will be emailed to you. Findlaw codes may not reflect the most. California earned income tax credit. This form is for income earned in tax year 2022, with tax returns due in april. Web 603 rows 2020 instructions for form ftb 3514 california earned income tax credit. You should be signed in and working in turbotax: Web business activity codes the codes listed in this section are a selection from the north american industry classification system (naics) that should be used in completing. Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be.

FDA Form 3514 PDF Food And Drug Administration Federal Food

Web 2021, 3514, instructions for 3514 form, california earned income tax credit this is only available by request. Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c? Web business activity codes the codes listed in this section are a selection from the north american industry classification system.

3572.1297137561.jpg

Web 2021, 3514, instructions for 3514 form, california earned income tax credit this is only available by request. Web form 3514 business code rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 42 votes how to fill out and sign ftb 3514 online? Web how do i enter a business code.

Fill Free fillable 2016 Instructions for Form FTB 3514 (California

Web 2021, 3514, instructions for 3514 form, california earned income tax credit this is only available by request. Download past year versions of this tax form as. Easily add and highlight text, insert pictures, checkmarks, and signs, drop new fillable areas, and rearrange or. Web 603 rows 2019 instructions for form ftb 3514 california earned income tax credit revised: Web.

4809.1297663227.jpg

Web ca3514 missing business demographic information. Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be. If you claim the california eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. Web deanm15 expert alumni if you are certain that form 3514.

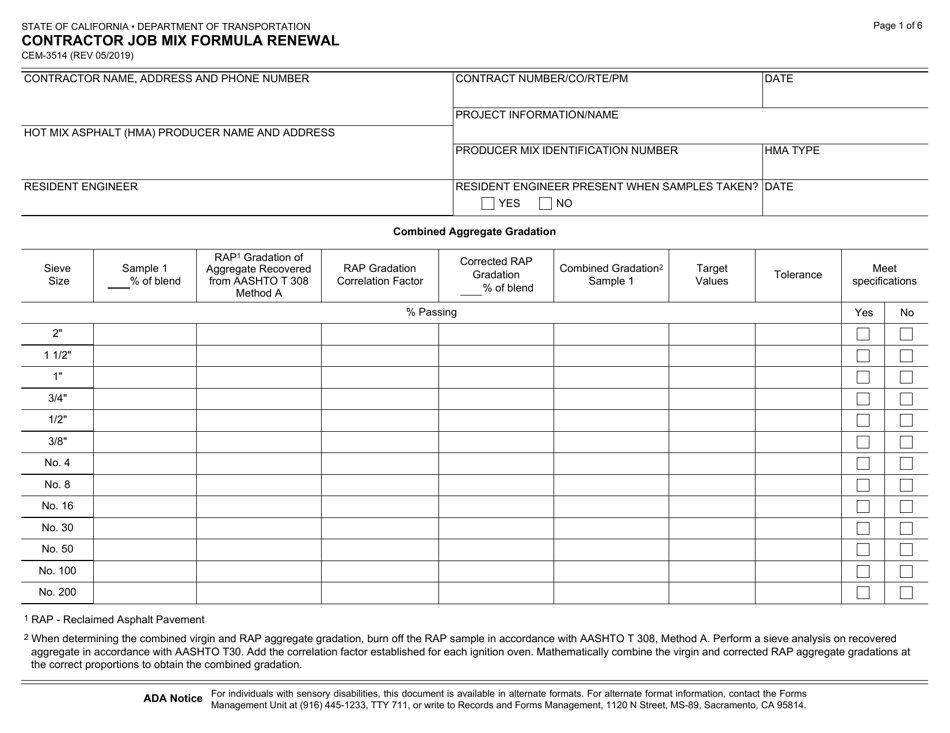

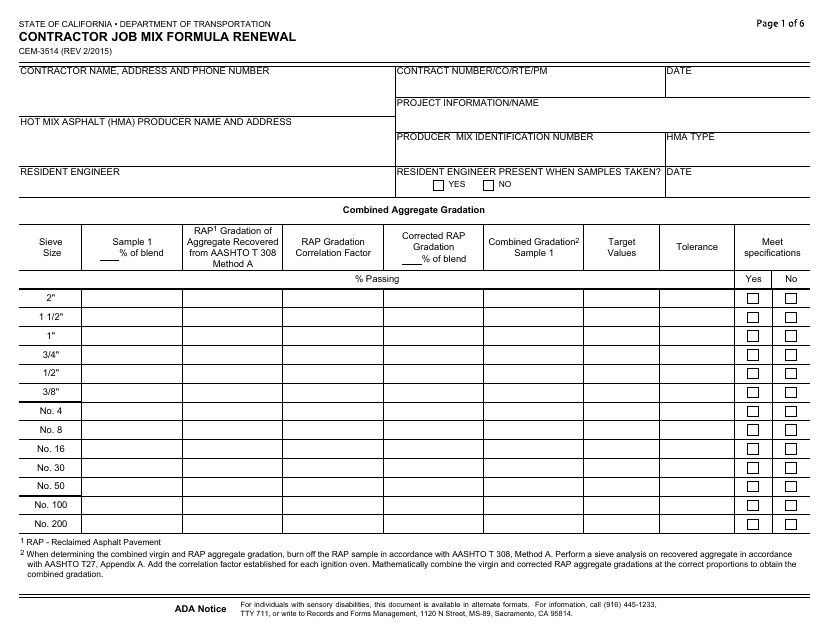

Form CEM3514 Download Fillable PDF or Fill Online Contractor Job Mix

Ask questions, get answers, and join our large community of tax professionals. Cigarette and tobacco products licensing act of 2003. Populated, but we don't have any of that and don't qualify for eic. Web business and professions code /. Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be.

3.3 Source Documents for Cash Transactions

You should be signed in and working in turbotax: States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. Get your online template and fill it in using. Ask questions, get answers, and join our large community of tax professionals. If you claim the california eitc even though you know you are not.

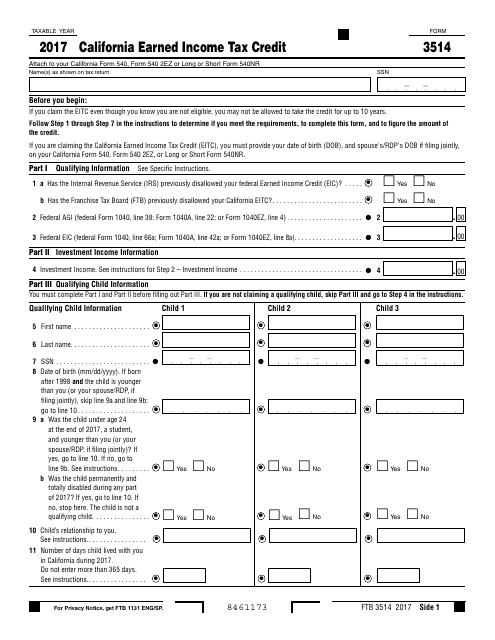

Form FTB 3514 Download Fillable PDF 2017, California Earned Tax

On a previous return i had some business income that might have. Web 2021, 3514, instructions for 3514 form, california earned income tax credit this is only available by request. Findlaw codes may not reflect the most. California earned income tax credit. Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be.

Form CEM3514 Download Fillable PDF or Fill Online Contractor Job Mix

Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be. On a previous return i had some business income that might have. Easily add and highlight text, insert pictures, checkmarks, and signs, drop new fillable areas, and rearrange or. Web ca3514 missing business demographic information. Web deanm15 expert alumni if you are certain that form.

Desktop Form 3514 California Earned Tax Credit Fill Out and

Web 603 rows 2020 instructions for form ftb 3514 california earned income tax credit. References in these instructions are to the internal revenue code (irc) as of january 1,. How do we get rid of that form? Web we last updated california form 3514 in january 2023 from the california franchise tax board. 2022 earned income tax credit table.

I am being asked a question about form 3514, and I have no idea what

Welcome to findlaw's cases & codes, a free source of state. Ask questions, get answers, and join our large community of tax professionals. Populated, but we don't have any of that and don't qualify for eic. This form is for income earned in tax year 2022, with tax returns due in april. Findlaw codes may not reflect the most.

Current As Of July 10, 2023 | Updated By Findlaw Staff.

Web business and professions code /. Get your online template and fill it in using. Web form 3514 business code rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 42 votes how to fill out and sign ftb 3514 online? Web 2021, 3514, instructions for 3514 form, california earned income tax credit this is only available by request.

References In These Instructions Are To The Internal Revenue Code (Irc) As Of January 1,.

On a previous return i had some business income that might have. Easily add and highlight text, insert pictures, checkmarks, and signs, drop new fillable areas, and rearrange or. Web california form 3514 want business code, etc. Web deanm15 expert alumni if you are certain that form 3514 does not belong on your return, you can delete it.

This Return Has Business Income On Ca3514 Line 18 But Is Missing The Business City/State/Zip Code In The Address.

You should be signed in and working in turbotax: Web 603 rows 2019 instructions for form ftb 3514 california earned income tax credit revised: Web 603 rows 2020 instructions for form ftb 3514 california earned income tax credit. Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be.

2022 Earned Income Tax Credit Table.

Populated, but we don't have any of that and don't qualify for eic. Web we last updated california form 3514 in january 2023 from the california franchise tax board. California earned income tax credit. If you claim the california eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years.