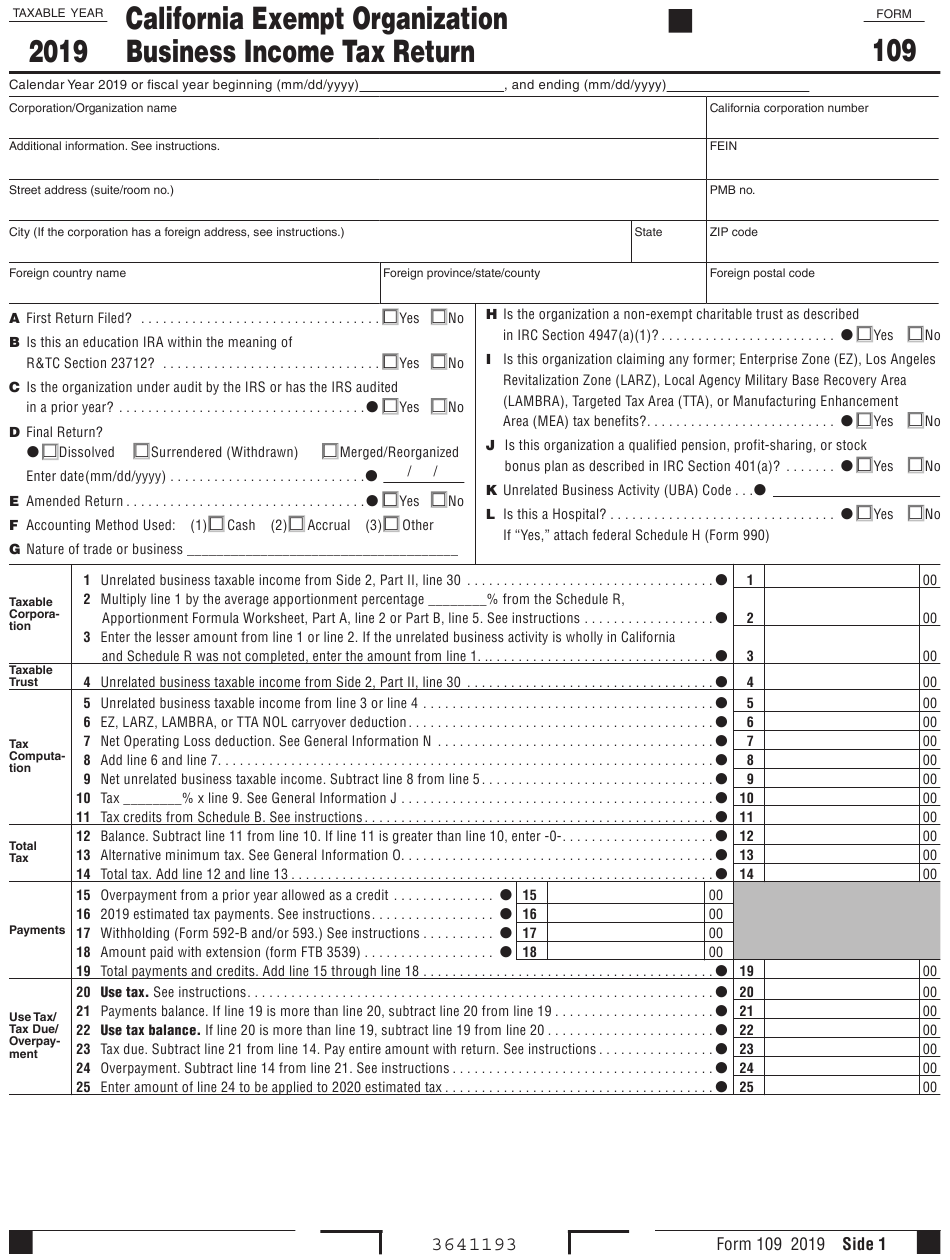

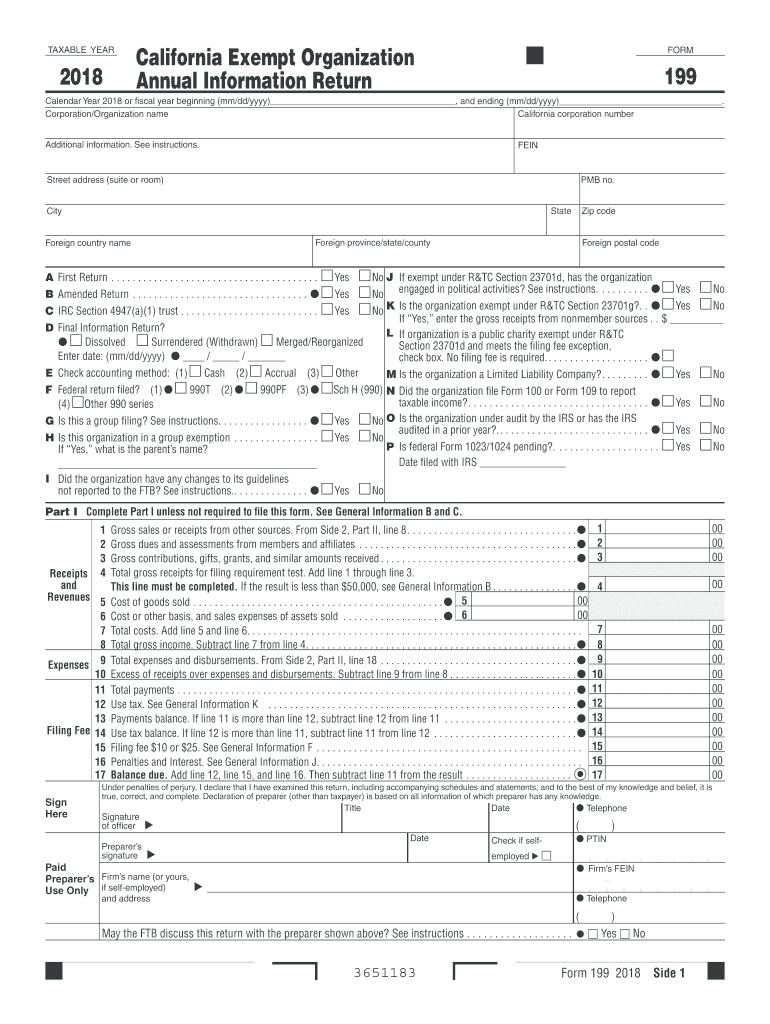

California Tax Form 199

California Tax Form 199 - Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Web california exempt organization annual information return. Please provide your email address and it will be emailed to you. Ad download or email ftb 199 & more fillable forms, register and subscribe now! Web 2020, 199, california exempt organization annual information return booklet this is only available by request. Part ii organizations with gross receipts of more than $50,000 and private foundations regardless of amount of gross receipts — complete part ii or furnish. Basic information about your organization. We support 199 filing for 2021 & 2020 tax year. Organizations with gross receipts of more than $50,000 and private foundations regardless of amount of gross receipts — complete part ii or furnish. Web application, we may request the form 199 to be filed.

We support 199 filing for 2021 & 2020 tax year. Web 2020 california exempt organization annual information return. Select add new on your dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Basic information about your organization. Please provide your email address and it will be emailed to you. Web form 199, california exempt organization annual information return, is used by the following organizations: Also, homeowners’ associations with gross nonexempt function income in excess of $100 are required to file form 100, california corporation. Calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). Web application, we may request the form 199 to be filed. Web 2020, 199, california exempt organization annual information return booklet this is only available by request.

Web up to $40 cash back 2. Web simplified income, payroll, sales and use tax information for you and your business Calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). Web 2020 california exempt organization annual information return. Ad download or email ftb 199 & more fillable forms, register and subscribe now! Web california form 199 has two versions, ftb 199n and form 199. Also, homeowners’ associations with gross nonexempt function income in excess of $100 are required to file form 100, california corporation. Web must file ftb 199n or form 199. California exempt organization annual information return is used by the following organizations: Web application, we may request the form 199 to be filed.

Cal Tax Increase Election w/o GOP?

Part ii organizations with gross receipts of more than $50,000 and private foundations regardless of amount of gross receipts — complete part ii or furnish. Also, homeowners’ associations with gross nonexempt function income in excess of $100 are required to file form 100, california corporation. Web we last updated the exempt organization annual information return in january 2023, so this.

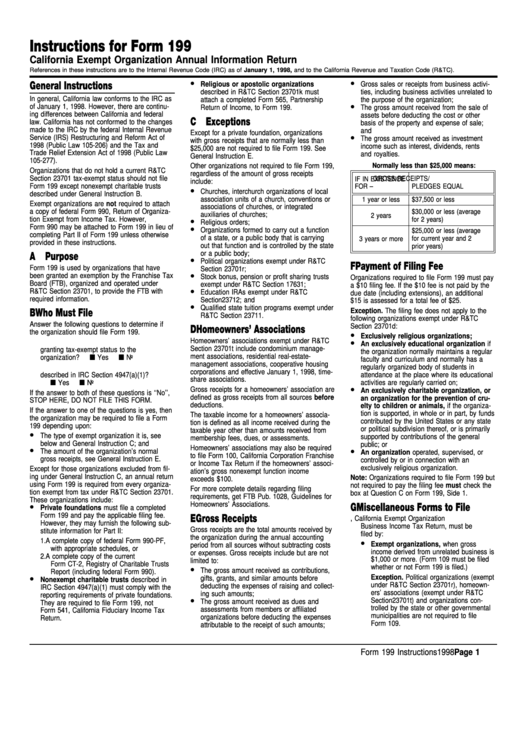

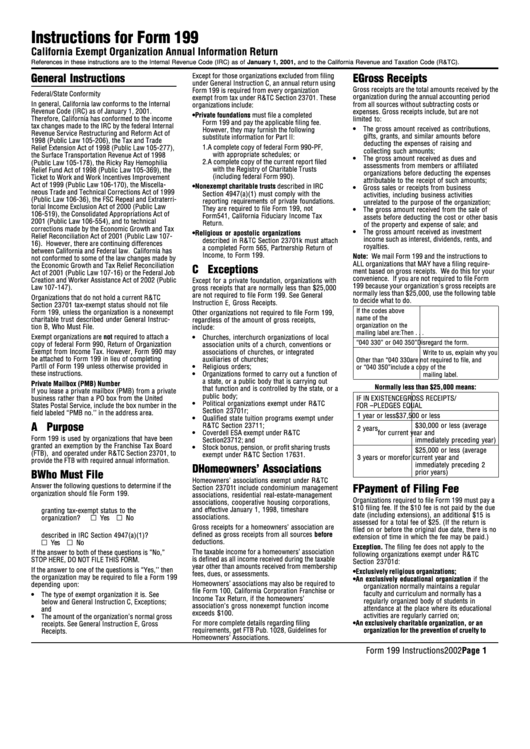

Instructions For Form 199 1998 printable pdf download

Web 2020 california exempt organization annual information return. Web form 199, california exempt organization annual information return, is used by the following organizations: We support 199 filing for 2021 & 2020 tax year. This form is for income earned in tax year 2022, with tax returns due in april. Web up to $40 cash back 2.

Instructions For Form 199 printable pdf download

Basic information about your organization. Web form 199, california exempt organization annual information return, is used by the following organizations: Also, homeowners’ associations with gross nonexempt function income in excess of $100 are required to file form 100, california corporation. This form is for income earned in tax year 2022, with tax returns due in april. Web must file ftb.

California HOA & Condo Tax Returns Tips to Stay Compliant [Template]

Web california form 199 has two versions, ftb 199n and form 199. Calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). If the answer to one of the questions is “yes,’’ then the organization may be required to file a form 199 depending on: Also, homeowners’ associations with gross nonexempt function income in excess of $100 are.

Exemption California State Tax Form 2023

Web application, we may request the form 199 to be filed. Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Web california exempt organization annual information return. Your entity id number or california corporation number. Ad download or email ftb 199.

California Fundraising Registration

Web 2020, 199, california exempt organization annual information return booklet this is only available by request. California exempt organization annual information return is used by the following organizations: Web simplified income, payroll, sales and use tax information for you and your business Web must file ftb 199n or form 199. Ad download or email ftb 199 & more fillable forms,.

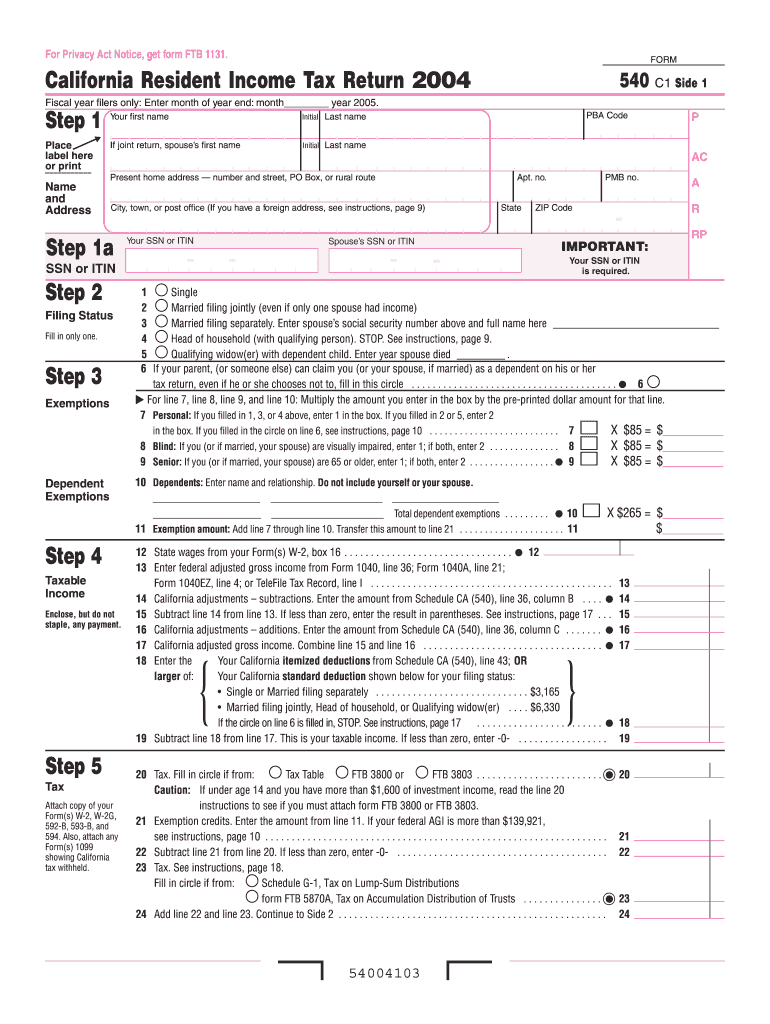

2004 Form CA FTB 540 Fill Online, Printable, Fillable, Blank pdfFiller

Ad download or email ftb 199 & more fillable forms, register and subscribe now! We support 199 filing for 2021 & 2020 tax year. Web application, we may request the form 199 to be filed. Web form 199, california exempt organization annual information return, is used by the following organizations: Also, homeowners’ associations with gross nonexempt function income in excess.

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W within Irs

Please provide your email address and it will be emailed to you. Part ii organizations with gross receipts of more than $50,000 and private foundations regardless of amount of gross receipts — complete part ii or furnish. Web 2020, 199, california exempt organization annual information return booklet this is only available by request. If the answer to one of the.

CA FTB 199 2018 Fill out Tax Template Online US Legal Forms

Ad download or email ftb 199 & more fillable forms, register and subscribe now! Web california exempt organization annual information return. Part ii organizations with gross receipts of more than $50,000 and private foundations regardless of amount of gross receipts — complete part ii or furnish. Web we last updated california form 199 in january 2023 from the california franchise.

Tax Form California Free Download

Web form 199, california exempt organization annual information return, is used by the following organizations: Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Web must file ftb 199n or form 199. Web we last updated california form 199 in january.

Part Ii Organizations With Gross Receipts Of More Than $50,000 And Private Foundations Regardless Of Amount Of Gross Receipts — Complete Part Ii Or Furnish.

Web form 199, california exempt organization annual information return, is used by the following organizations: Basic information about your organization. Web must file ftb 199n or form 199. Web up to $40 cash back 2.

If The Answer To One Of The Questions Is “Yes,’’ Then The Organization May Be Required To File A Form 199 Depending On:

Please provide your email address and it will be emailed to you. Your entity id number or california corporation number. California exempt organization annual information return is used by the following organizations: Web we last updated california form 199 in january 2023 from the california franchise tax board.

Web California Form 199 Has Two Versions, Ftb 199N And Form 199.

Calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). Also, homeowners’ associations with gross nonexempt function income in excess of $100 are required to file form 100, california corporation. Organizations with gross receipts of more than $50,000 and private foundations regardless of amount of gross receipts — complete part ii or furnish. Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022.

Web Simplified Income, Payroll, Sales And Use Tax Information For You And Your Business

Web 2020, 199, california exempt organization annual information return booklet this is only available by request. Web california exempt organization annual information return. Select add new on your dashboard and upload a file from your device or import it from the cloud, online, or internal mail. We support 199 filing for 2021 & 2020 tax year.

![California HOA & Condo Tax Returns Tips to Stay Compliant [Template]](https://hoatax.com/wp-content/uploads/2017/08/CA-filing-fee-1024x786.png)