Can I File Form 15111 Online

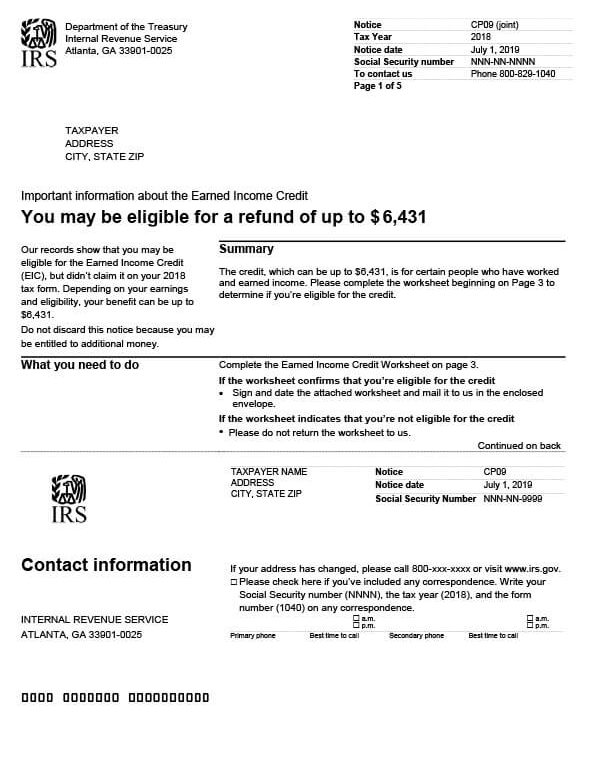

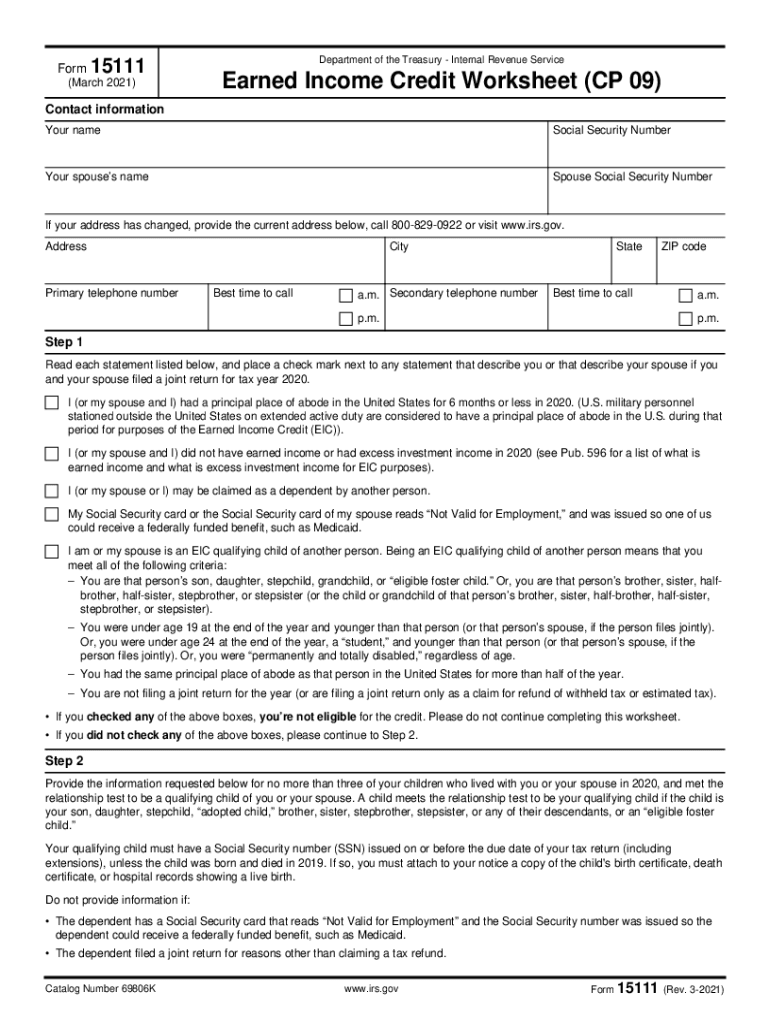

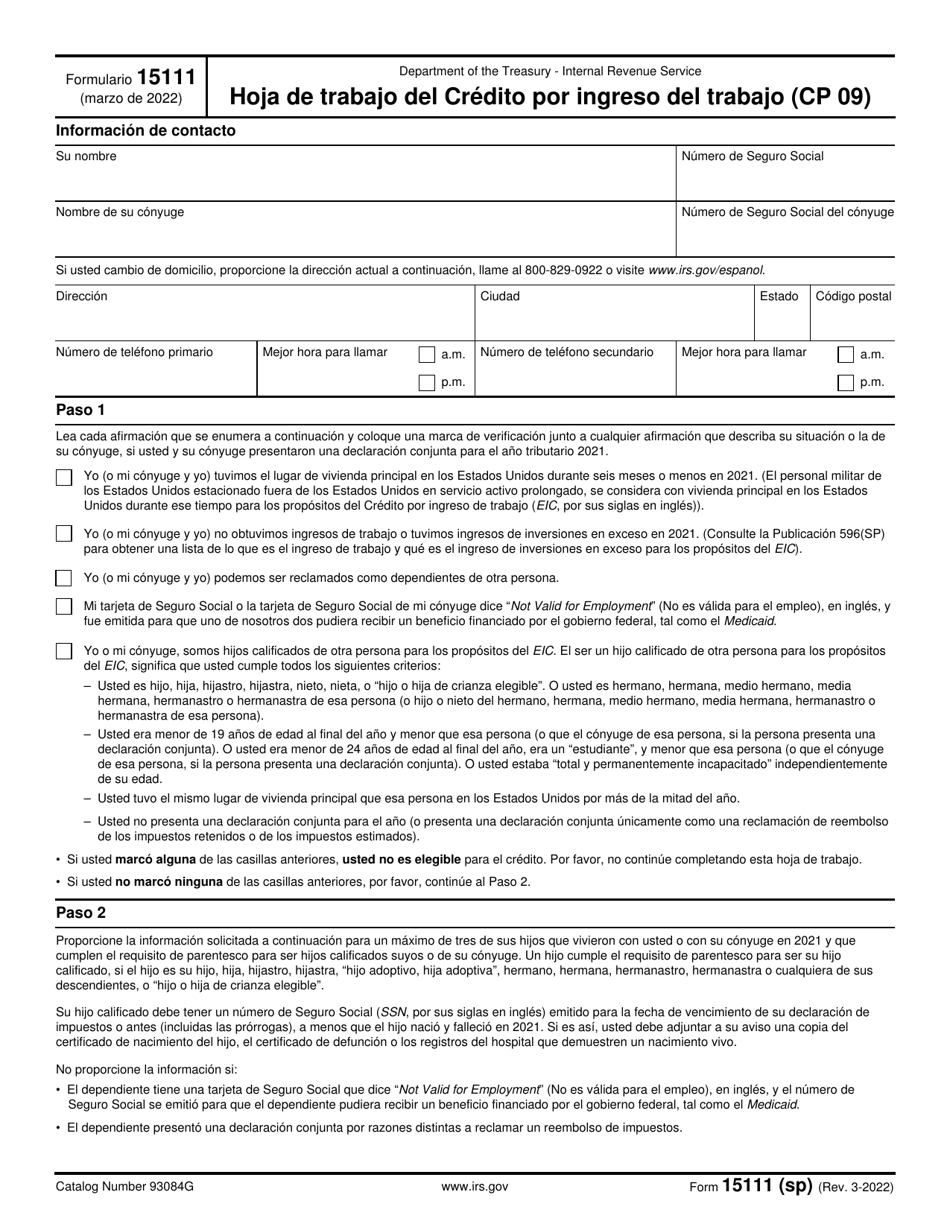

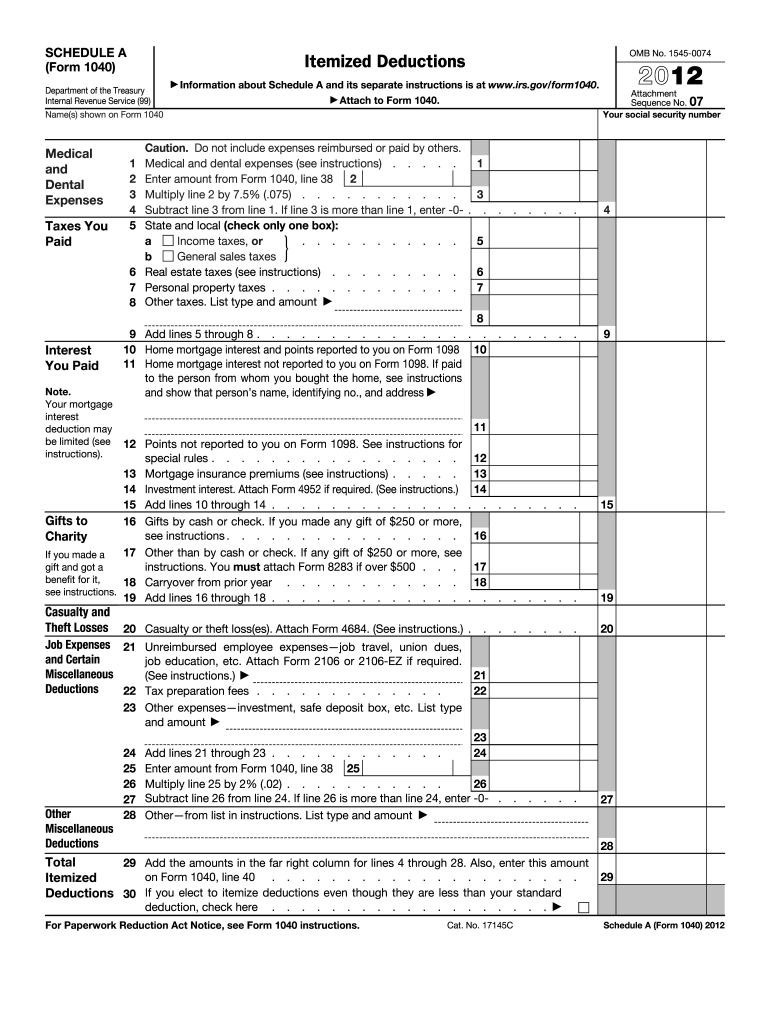

Can I File Form 15111 Online - Web how do i file an irs extension (form 4868) in turbotax online? Web read your notice carefully. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. How do i contact the irs about earned income credit? Сomplete the form 15111 2021 for free get started!. Web to do this, complete a form 1040 and attach form 1040 schedule 8812 to your return. The irs includes a form 15111 earned income credit worksheet with each cp09 notice. It will explain the steps needed to determine your qualifications. Understanding your cp09 notice updated april 5, 2021. It says to fill out form 15111 and send it back in the envelope provided by them.

I cannot find any information. Web edit, sign, and share form 15111 online. Pdf use our library of forms to quickly fill and sign your irs forms online. Web read your notice carefully. Web how do i respond to notice cp09 using form 15111? Save or instantly send your ready documents. Web to do this, complete a form 1040 and attach form 1040 schedule 8812 to your return. To learn about the benefits of filing a form using our. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Your refund if you claim the eitc,.

Web how to claim the earned income tax credit (eitc) to claim the earned income tax credit (eitc), you must qualify and file a federal tax return. I cannot find any information. Web here is a link to the us treasury form 15111 that you can fill out online and then print it to send back to irs with the response from the letter they sent you and print. The irs includes a form 15111 earned income credit worksheet with each cp09 notice. Web complete form 15111 online with us legal forms. Your refund if you claim the eitc,. Web i never saw form 15111 and was not able to locate it. Web edit, sign, and share form 15111 online. Understanding your cp09 notice updated april 5, 2021. Easily fill out pdf blank, edit, and sign them.

Fill Free fillable Form 15111 Earned Credit Worksheet (CP 09

Understanding your cp09 notice updated april 5, 2021. They will expect you to. Pdf use our library of forms to quickly fill and sign your irs forms online. Filing online can help you avoid. You may reply and ask them to calculate your.

12 Form Irs.gov What You Should Wear To 12 Form Irs.gov AH STUDIO Blog

Сomplete the form 15111 2021 for free get started!. This is an irs internal form. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. It will explain the steps needed to determine your qualifications. Web doninga level 15 march 11, 2021 7:18 am that notice could very well be a scam.

Can File Form 8379 Electronically hqfilecloud

Pdf use our library of forms to quickly fill and sign your irs forms online. It says to fill out form 15111 and send it back in the envelope provided by them. To learn about the benefits of filing a form using our. This is an irs internal form. Filing online can help you avoid.

Form 15111? r/IRS

Web my fiance got a letter from the irs stating that she qualifies for eitc. It says to fill out form 15111 and send it back in the envelope provided by them. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. I cannot find any information. Web country of origin:

IRS Notice CP09 Tax Defense Network

Your refund if you claim the eitc,. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web country of origin: Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. I do not know how to add it into site i scanned it to myself and.

2021 Form IRS 15111 Fill Online, Printable, Fillable, Blank pdfFiller

Web how do i respond to notice cp09 using form 15111? Consider filing your taxes electronically. They will expect you to. I cannot find any information. Web doninga level 15 march 11, 2021 7:18 am that notice could very well be a scam since there is no such irs form 15111.

I don't know my PIN or AGI from 2018 because I was married. I am

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. They will expect you to. Web form 15111 i obtained by going to my local irs office and getting it printed out it was not found on google search. This is an irs internal form. No need to install software, just go.

September Newsletter

Filing online can help you avoid. They will expect you to. How do i contact the irs about earned income credit? Free resources to help you file your tax return. To learn about the benefits of filing a form using our.

IRS Formulario 15111 Fill Out, Sign Online and Download Fillable PDF

Pdf use our library of forms to quickly fill and sign your irs forms online. Web march 5, 2021 5:13 am last updated march 05, 2021 5:13 am how can i get form 15111 0 22 2,465 reply 22 replies akinalo intuit alumni march 9, 2021 3:52 pm. Web forms available to file online this page lists the uscis forms.

Irs Fill and Sign Printable Template Online US Legal Forms

Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Complete the eic eligibility form 15112, earned income credit worksheet (cp27) pdf. How do i contact the irs about earned income credit? Web read your notice carefully. Сomplete the form 15111 2021 for free get.

Web March 5, 2021 5:13 Am Last Updated March 05, 2021 5:13 Am How Can I Get Form 15111 0 22 2,465 Reply 22 Replies Akinalo Intuit Alumni March 9, 2021 3:52 Pm.

Web complete form 15111 online with us legal forms. Web form 15111 i obtained by going to my local irs office and getting it printed out it was not found on google search. Web country of origin: The irs includes a form 15111 earned income credit worksheet with each cp09 notice.

You May Reply And Ask Them To Calculate Your.

It says to fill out form 15111 and send it back in the envelope provided by them. Web i never saw form 15111 and was not able to locate it. Free resources to help you file your tax return. Web how to claim the earned income tax credit (eitc) to claim the earned income tax credit (eitc), you must qualify and file a federal tax return.

I May Suggest To Verify If The Irs Attached The Form With That Notice.

Easily fill out pdf blank, edit, and sign them. No need to install software, just go to dochub, and sign up instantly and for free. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Web my fiance got a letter from the irs stating that she qualifies for eitc.

Web Doninga Level 15 March 11, 2021 7:18 Am That Notice Could Very Well Be A Scam Since There Is No Such Irs Form 15111.

Consider filing your taxes electronically. Web read your notice carefully. Filing online can help you avoid. Your refund if you claim the eitc,.