Can I Reaffirm A Credit Card In Chapter 7

Can I Reaffirm A Credit Card In Chapter 7 - Web when you reaffirm a debt in chapter 7 bankruptcy, you enter into a contract with your lender (called a reaffirmation agreement) that makes you personally liable for the obligation despite your bankruptcy. [1] they must perform their stated intention within 30 days of the. The balance on the majority of the cards in your wallet will get wiped out in chapter 7 bankruptcy. In this article, you'll learn about the pros and cons of reaffirming. Web regardless of the reason a debtor chooses to reaffirm, their decision is likely to have a quick and positive impact on their credit score, as the creditor will be required to notify the credit bureaus. Web it is possible to reaffirm credit card debt in a chapter 7 bankruptcy. They come in handy when you want to keep a specific asset while filing for a chapter 7 bankruptcy. The main consequence of a reaffirmation agreement is that it excludes that particular debt from the discharge of your debts. Why you may not wish to reaffirm. Web for instance, if you received a discharge in a chapter 7 case, you can’t receive another chapter 7 discharge for eight years.

The main consequence of a reaffirmation agreement is that it excludes that particular debt from the discharge of your debts. They give your creditors a chance to get you back on the hook for debt you would have otherwise discharged in the bankruptcy by allowing you to reaffirm… Web reaffirmation agreements are voluntary, meaning you’re not required to use them. Why you may not wish to reaffirm. Web when you reaffirm a debt in chapter 7 bankruptcy, you enter into a contract with your lender (called a reaffirmation agreement) that makes you personally liable for the obligation despite your bankruptcy. Here are some important steps to begin rebuilding your credit after bankruptcy. Web if you want to keep your financed car in chapter 7 bankruptcy, your lender might require you to enter into a new contract in a process known as reaffirming the debt. Web reaffirming protects against the possibility of getting your property repossessed when you are still making timely payments. Web for instance, if you received a discharge in a chapter 7 case, you can’t receive another chapter 7 discharge for eight years. If you file for chapter 7, the creditor can…

The main consequence of a reaffirmation agreement is that it excludes that particular debt from the discharge of your debts. If you don't reaffirm, the worst thing a creditor can do. Web that usually happens about 60 days after your “meeting of creditors,” or about 3 months after your chapter 7 filing. Web when you can get a credit card after chapter 7. Web for instance, if you received a discharge in a chapter 7 case, you can’t receive another chapter 7 discharge for eight years. Web reaffirming protects against the possibility of getting your property repossessed when you are still making timely payments. Types of credit cards you can qualify for after filing chapter 7 bankruptcy credit cards that you might qualify for may be secured or unsecured. They come in handy when you want to keep a specific asset while filing for a chapter 7 bankruptcy. Web unsecured credit card debt in chapter 7. Grounds for denial of a debt discharge.

6 Things You Can Reaffirm for Positive Change and Validation

[1] they must perform their stated intention within 30 days of the. Web regardless of the reason a debtor chooses to reaffirm, their decision is likely to have a quick and positive impact on their credit score, as the creditor will be required to notify the credit bureaus. Web that usually happens about 60 days after your “meeting of creditors,”.

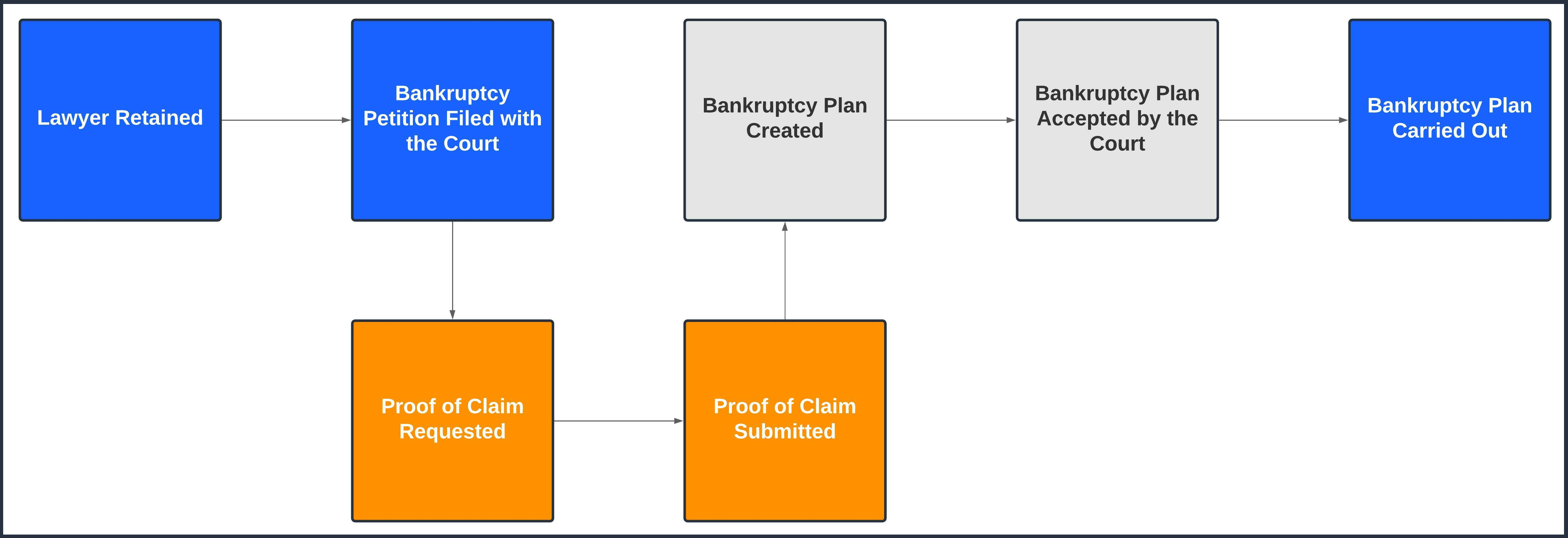

Bankruptcy 101 LoanPro Help

However, keep in mind that while chapter 7 offers many benefits, it might not be the best bankruptcy chapter. Web in addition, no individual may be a debtor under chapter 7 or any chapter of the bankruptcy code unless he or she has, within 180 days before filing, received credit counseling from an approved credit. Web reaffirmation agreements are voluntary,.

Agusto, GCR Reaffirm ‘AAA’ Rating, Stable Outlook Of Infracredit

You'll also learn how to qualify for a chapter 7 credit card discharge and whether credit card balances get paid in chapter 7. You would owe that single debt as if you hadn’t filed the chapter 7. The grounds for denying an individual debtor a discharge in a chapter 7. Web a chapter 13 bankruptcy, which restructures your debts so.

ionic 5 tutorials how to create ionic card ionic 5 card chapter 7

Im employed by the dept store that issued the charge, therefore i would like to keep the charge. Web unsecured credit card debt in chapter 7. Web a chapter 13 bankruptcy, which restructures your debts so you pay off a portion of them in three to five years, remains on your credit report for up to seven years and is.

Reaffirm Your Faith in Him iDisciple

That's because most of your accounts are likely unsecured. [1] they must perform their stated intention within 30 days of the. If you file for chapter 7, the creditor can… The main consequence of a reaffirmation agreement is that it excludes that particular debt from the discharge of your debts. They give your creditors a chance to get you back.

REAFFIRM Synonyms and Related Words. What is Another Word for REAFFIRM

You'll also learn how to qualify for a chapter 7 credit card discharge and whether credit card balances get paid in chapter 7. Web certain debts can not be discharged in a chapter 7 or a chapter 13 bankruptcy case. Why you may not wish to reaffirm. The main consequence of a reaffirmation agreement is that it excludes that particular.

Lecture 13Credit Cards (Chapter 6) YouTube

Web regardless of the reason a debtor chooses to reaffirm, their decision is likely to have a quick and positive impact on their credit score, as the creditor will be required to notify the credit bureaus. The main consequence of a reaffirmation agreement is that it excludes that particular debt from the discharge of your debts. Im employed by the.

Teamsters and IATSE Reaffirm 'Mutual Aid and Assistance Pact

Of course getting a credit card soon after bankruptcy. Web it is possible to reaffirm credit card debt in a chapter 7 bankruptcy. However, keep in mind that while chapter 7 offers many benefits, it might not be the best bankruptcy chapter. The balance on the majority of the cards in your wallet will get wiped out in chapter 7.

Nudgee Stakes Kisukano can reaffirm her reputation as one of

Web chapter 7 debtors must file a statement of intention within 30 days of the petition date or the date of the 341 meeting, whichever is earlier. The balance on the majority of the cards in your wallet will get wiped out in chapter 7 bankruptcy. Im employed by the dept store that issued the charge, therefore i would like.

SHOULD I REAFFIRM MY MORTGAGE AGREEMENT AFTER MY CHAPTER 7 BANKRUPTCY?

“reaffirmation” refers to the process whereby a debtor agrees to (re)payment terms with the creditor on a debt instead of having it discharged in the. Web the credit card company knows that you can't file for chapter 7 bankruptcy for another eight years, and so there is lots of time to collect against you, if necessary. Web regardless of the.

Web When You Reaffirm A Debt In Chapter 7 Bankruptcy, You Enter Into A Contract With Your Lender (Called A Reaffirmation Agreement) That Makes You Personally Liable For The Obligation Despite Your Bankruptcy.

Web reaffirmation agreements are a special feature of chapter 7 bankruptcy. Web if you want to keep your financed car in chapter 7 bankruptcy, your lender might require you to enter into a new contract in a process known as reaffirming the debt. Im employed by the dept store that issued the charge, therefore i would like to keep the charge. Types of credit cards you can qualify for after filing chapter 7 bankruptcy credit cards that you might qualify for may be secured or unsecured.

Web A Chapter 13 Bankruptcy, Which Restructures Your Debts So You Pay Off A Portion Of Them In Three To Five Years, Remains On Your Credit Report For Up To Seven Years And Is Less Harmful To Your Credit Scores Than Chapter 7.

The main consequence of a reaffirmation agreement is that it excludes that particular debt from the discharge of your debts. Web reaffirmation agreements are voluntary, meaning you’re not required to use them. Web in addition, no individual may be a debtor under chapter 7 or any chapter of the bankruptcy code unless he or she has, within 180 days before filing, received credit counseling from an approved credit. You would owe that single debt as if you hadn’t filed the chapter 7.

Web It Is Possible To Reaffirm Credit Card Debt In A Chapter 7 Bankruptcy.

the creditor can charge you a higher interest rate. Of course getting a credit card soon after bankruptcy. However, keep in mind that while chapter 7 offers many benefits, it might not be the best bankruptcy chapter. Web chapter 7 debtors must file a statement of intention within 30 days of the petition date or the date of the 341 meeting, whichever is earlier.

Why You May Not Wish To Reaffirm.

In this article, you'll learn about the pros and cons of reaffirming. They come in handy when you want to keep a specific asset while filing for a chapter 7 bankruptcy. You are not required to reaffirm any debt or sign any agreement regarding a debt that has been or will be discharged in your bankruptcy case. Web unsecured credit card debt in chapter 7.