Can You Cancel A Chapter 13 Bankruptcy

Can You Cancel A Chapter 13 Bankruptcy - If we choose to back out of the bankruptcy… Converting to a chapter 13 bankruptcy from chapter 7 might be an option and help you prevent the loss of your assets, but this is a complicated process and you’ll need an attorney’s assistance. Web what happens if you decide to back out of a chapter 13 bankruptcy? Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option. Web chapter 13 can be denied if the bankruptcy process is not followed. (nd) filing without an attorney. Up to five years for chapter 13… Web if you have priority obligations, you must pay them off in full through your chapter 13 repayment plan. (nd) can you convert your chapter 13 bankruptcy to chapter 7? My husband and i are currently in a chapter 13 bankruptcy.

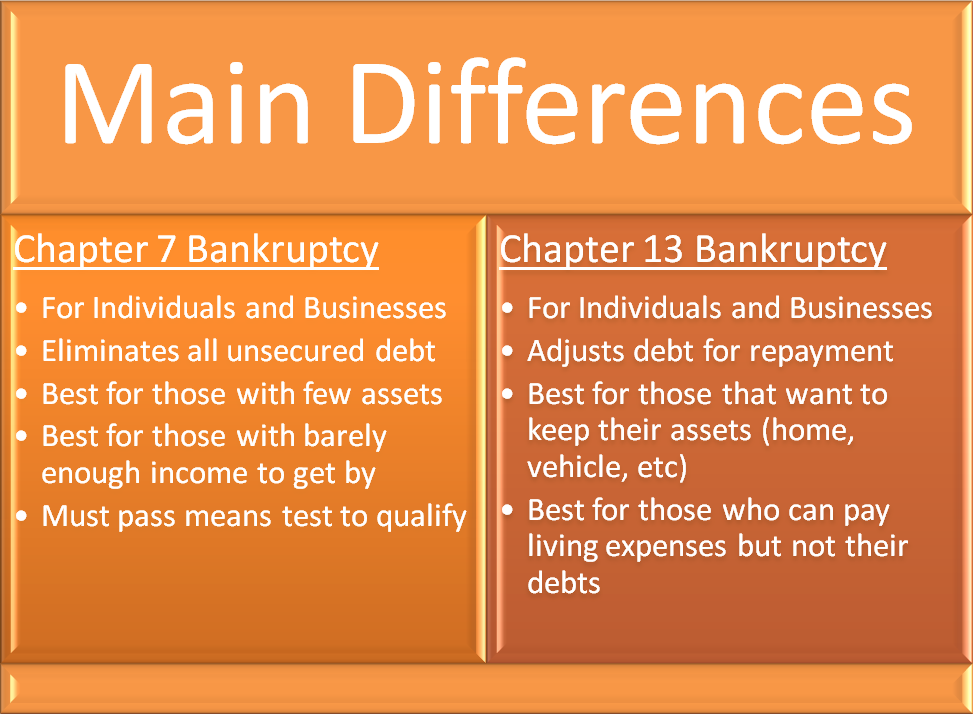

Converting to a chapter 13 bankruptcy from chapter 7 might be an option and help you prevent the loss of your assets, but this is a complicated process and you’ll need an attorney’s assistance. Web chapter 13 can be denied if the bankruptcy process is not followed. The court will analyze your. Obtain a motion to dismiss form from the bankruptcy court clerk. Web if you have priority obligations, you must pay them off in full through your chapter 13 repayment plan. But you can always dismiss any filing. Web you can file chapter 13 more often, but you can’t expect debt to be discharged unless you have waited the. Up to five years for chapter 13… Bankruptcy code permits you to cancel or terminate your chapter 13 bankruptcy case. This chapter of the bankruptcy code provides for adjustment of debts of an individual with regular income.

Obtain a motion to dismiss form from the bankruptcy court clerk. In most cases, chapter 13 bankruptcy provides debtors a convenient and affordable way to pay off their priority. So it's usually best to ask the court to reinstate the original chapter 13. Once it is filed, it will always appear on your credit (for 10 years) that you filed. My husband and i are currently in a chapter 13 bankruptcy. Web a specific process under the u.s. However, you may lose the benefit of being in a bankruptcy. Web for instance, if a debtor loses his or her job or becomes ill, the debtor may not have enough money to pay the chapter 13 plan payments. If we choose to back out of the bankruptcy… Web notice filed post confirmation:

Everything You Need to Know About Chapter 13 Bankruptcy

If changing the plan payment or converting the case to a. If a safe harbor fee notice is filed after confirmation of a chapter 13 plan, but still within the time frame provided for in bankruptcy rule 3002.1, the fees are. Up to five years for chapter 13… Web bankruptcy law allows chapter 13 debtors to file a motion to.

Is Filing a Chapter 13 Bankruptcy Really a Get Out of Jail Free Card

Under relevant bankruptcy law, a debtor should enroll and successfully finish a credit counseling course from an institution approved by the united states trustee’s office. Refiling a chapter 13 case comes with difficulties. Converting to a chapter 13 bankruptcy from chapter 7 might be an option and help you prevent the loss of your assets, but this is a complicated.

Chapter 7 vs Chapter 13 Bankruptcy Sheppard Law Office

Discharging most unsecured debts such as credit card balances and medical debt, which saves money. Web if you can't continue with your chapter 13 bankruptcy, you might be eligible to receive a hardship discharge even though you haven't completed all of your required plan payments. This chapter of the bankruptcy code provides for adjustment of debts of an individual with.

How do you Qualify for a Mortgage after Chapter 13 Bankruptcy? USDA

But you can always dismiss any filing. Obtain a motion to dismiss form from the bankruptcy court clerk. Web just ask the state judge who tried to order the withdrawal of the chapter 9 petition for detroit. Web bankruptcy law allows chapter 13 debtors to file a motion to dismiss at any time. Web chapter 13 can be denied if.

Can You Cancel A Chapter 13 Bankruptcy

Web just ask the state judge who tried to order the withdrawal of the chapter 9 petition for detroit. In most cases, chapter 13 bankruptcy provides debtors a convenient and affordable way to pay off their priority. Web you cannot have filed a bankruptcy petition (chapter 7 or 13) in the previous 180 days that was dismissed for certain reasons,.

10 Reasons People File Chapter 13 Bankruptcy Callahan Law Firm

In most cases, chapter 13 bankruptcy provides debtors a convenient and affordable way to pay off their priority. For more information on converting chapter 7 bankruptcy to chapter 13… The court will analyze your. Web you will not be able to obtain a bankruptcy discharge under chapter 13 if you do not make timely monthly payments according to the terms.

Chapter 7 Bankruptcy vs Chapter 13 Bankruptcy Arizona Bankruptcy

So it's usually best to ask the court to reinstate the original chapter 13. (nd) can you convert your chapter 13 bankruptcy to chapter 7? However, you may lose the benefit of being in a bankruptcy. If changing the plan payment or converting the case to a. Web if you can't continue with your chapter 13 bankruptcy, you might be.

Can You Cancel Your Bankruptcy? Solicitors in Chepstow & Newport

In most cases, chapter 13 bankruptcy provides debtors a convenient and affordable way to pay off their priority. Web what happens if you decide to back out of a chapter 13 bankruptcy? Web a specific process under the u.s. If we choose to back out of the bankruptcy… Web you can file chapter 13 more often, but you can’t expect.

Infographic Chapter 7 vs. Chapter 13 Bankruptcy Richard M. Weaver

Other options include an irs payment plan or an offer in compromise. My husband and i are currently in a chapter 13 bankruptcy. Up to five years for chapter 13… If we choose to back out of the bankruptcy… Converting to a chapter 13 bankruptcy from chapter 7 might be an option and help you prevent the loss of your.

Life after Chapter 13 Bankruptcy Can You Buy a House?

For more information on converting chapter 7 bankruptcy to chapter 13… Web what happens if you decide to back out of a chapter 13 bankruptcy? If changing the plan payment or converting the case to a. Converting to a chapter 13 bankruptcy from chapter 7 might be an option and help you prevent the loss of your assets, but this.

My Husband And I Are Currently In A Chapter 13 Bankruptcy.

If we choose to back out of the bankruptcy… Discharging most unsecured debts such as credit card balances and medical debt, which saves money. Converting to a chapter 13 bankruptcy from chapter 7 might be an option and help you prevent the loss of your assets, but this is a complicated process and you’ll need an attorney’s assistance. However, even though the court must grant the dismissal of your case, the court may also restrict your ability to file another bankruptcy.

For A Chapter 13 The Case Will Be Dismissed By The Court If You.

This is a motion for voluntary dismissal. a. Web bankruptcy law allows chapter 13 debtors to file a motion to dismiss at any time. Web you will not be able to obtain a bankruptcy discharge under chapter 13 if you do not make timely monthly payments according to the terms of your confirmed debt repayment plan, so it is important to. Web can i switch to chapter 13?

Web If You Can't Continue With Your Chapter 13 Bankruptcy, You Might Be Eligible To Receive A Hardship Discharge Even Though You Haven't Completed All Of Your Required Plan Payments.

Under relevant bankruptcy law, a debtor should enroll and successfully finish a credit counseling course from an institution approved by the united states trustee’s office. For individuals, the most common type of bankruptcy is a chapter 13. In most cases, chapter 13 bankruptcy provides debtors a convenient and affordable way to pay off their priority. (nd) filing without an attorney.

Web You'll Need To Refile If You Don't Pay Your Chapter 13 Payment And The Court Dismisses Your Chapter 13 For Nonpayment.

Web if you have priority obligations, you must pay them off in full through your chapter 13 repayment plan. Afterwards, you will no longer be obligated to make payments under your designated repayment plan. Once it is filed, it will always appear on your credit (for 10 years) that you filed. Other options include an irs payment plan or an offer in compromise.