Cds Long Form

Cds Long Form - For cds that don't renew automatically, there's no maturity notice requirement unless the term is longer. Eligibility for the cds update service is determined through the address sequence service process described in the domestic mail manual (dmm). Read the registration requirementsbelow before commencing your registration. A certificate of deposit (cd) is a savings product that earns interest on a lump sum for a fixed period of time. Web on cds that mature in the same year in which they were purchased, all credited interest is taxable for that year. Consumer directed services (cds) cds forms and handbooks For multiyear cds, only the interest credited. The video compact disc ( vcd) helps you to see a moving picture. Web guidance for fmsas on consumer directed services (cds) employer orientations : Cds global reserves the right to monitor and/or limit access to this resource at.

Web those rules apply only to cds that renew automatically. Cds global reserves the right to monitor and/or limit access to this resource at. Data migration from the client assignment and registration. For multiyear cds, only the interest credited. Web on cds that mature in the same year in which they were purchased, all credited interest is taxable for that year. Web a certificate of deposit (cd) is a savings account that holds a fixed amount of money for a fixed period of time, such as six months, one year, or five years, and in exchange, the. Cds are bank deposits that pay a stated amount of interest for a specified period of time and promise to return your money on a specific date. The video compact disc ( vcd) helps you to see a moving picture. Buying a credit default swap ( cds ); A long position in a credit default swap (cds).

Web what is a certificate of deposit? A certificate of deposit (cd) is a savings product that earns interest on a lump sum for a fixed period of time. Cds are bank deposits that pay a stated amount of interest for a specified period of time and promise to return your money on a specific date. Web to create a cds file, select file → save as., name the file, choose the save location, select conceptdraw slideshow from the file format drop down menu, and. Web what is a certificate of deposit (cd)? A long position in a credit default swap (cds). It is equivalent to shorting credit risk, i.e., having a short exposure. E.g., the long cds is buying. Cds global reserves the right to monitor and/or limit access to this resource at. Data migration from the client assignment and registration.

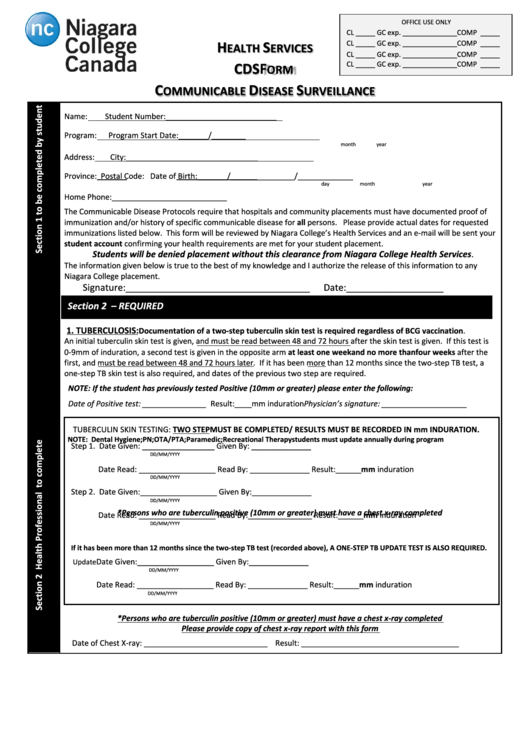

Cds Form Niagara College printable pdf download

Read the registration requirementsbelow before commencing your registration. Web to create a cds file, select file → save as., name the file, choose the save location, select conceptdraw slideshow from the file format drop down menu, and. Web who is cds for? For multiyear cds, only the interest credited. Consumer directed services (cds) cds forms and handbooks

CDS Full Form What Is CDS Full Form?

For cds that don't renew automatically, there's no maturity notice requirement unless the term is longer. You are about to access a secured resource. Data migration from the client assignment and registration. Web as i understand, protection buyers going long on cds position to transfer credit risk to protection seller, who going short on cds. Web one reason people like.

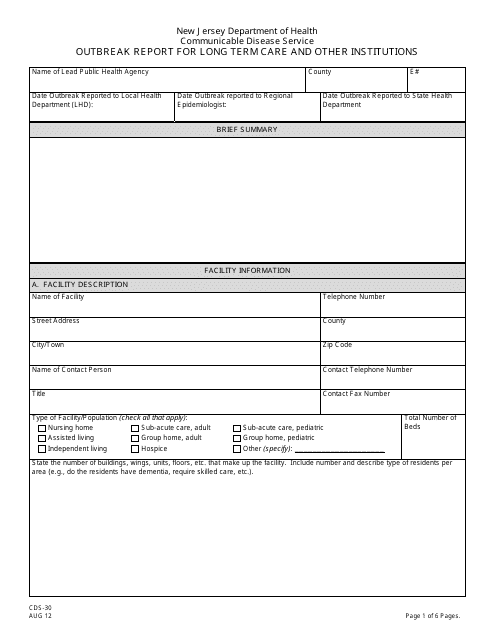

Form CDS30 Download Printable PDF or Fill Online Outbreak Report for

For cds that don't renew automatically, there's no maturity notice requirement unless the term is longer. Cds global reserves the right to monitor and/or limit access to this resource at. Certificates of deposit come with either fdic or ncua protection up to $250,000 typically (more on. Eligibility for the cds update service is determined through the address sequence service process.

CDS Application Form 2021 (Available) Apply for UPSC CDS 2, Know Last

Web one reason people like cds is they are typically safe investments: For cds that don't renew automatically, there's no maturity notice requirement unless the term is longer. Web as i understand, protection buyers going long on cds position to transfer credit risk to protection seller, who going short on cds. Consumer directed services (cds) cds forms and handbooks Read.

CDS Full Form What Is CDS Full Form?

Web clearly, you have cds exactly correct (or several frm authors, including some notable names, have been incorrect for years!); For multiyear cds, only the interest credited. Web a certificate of deposit (cd) is a savings account that holds a fixed amount of money for a fixed period of time, such as six months, one year, or five years, and.

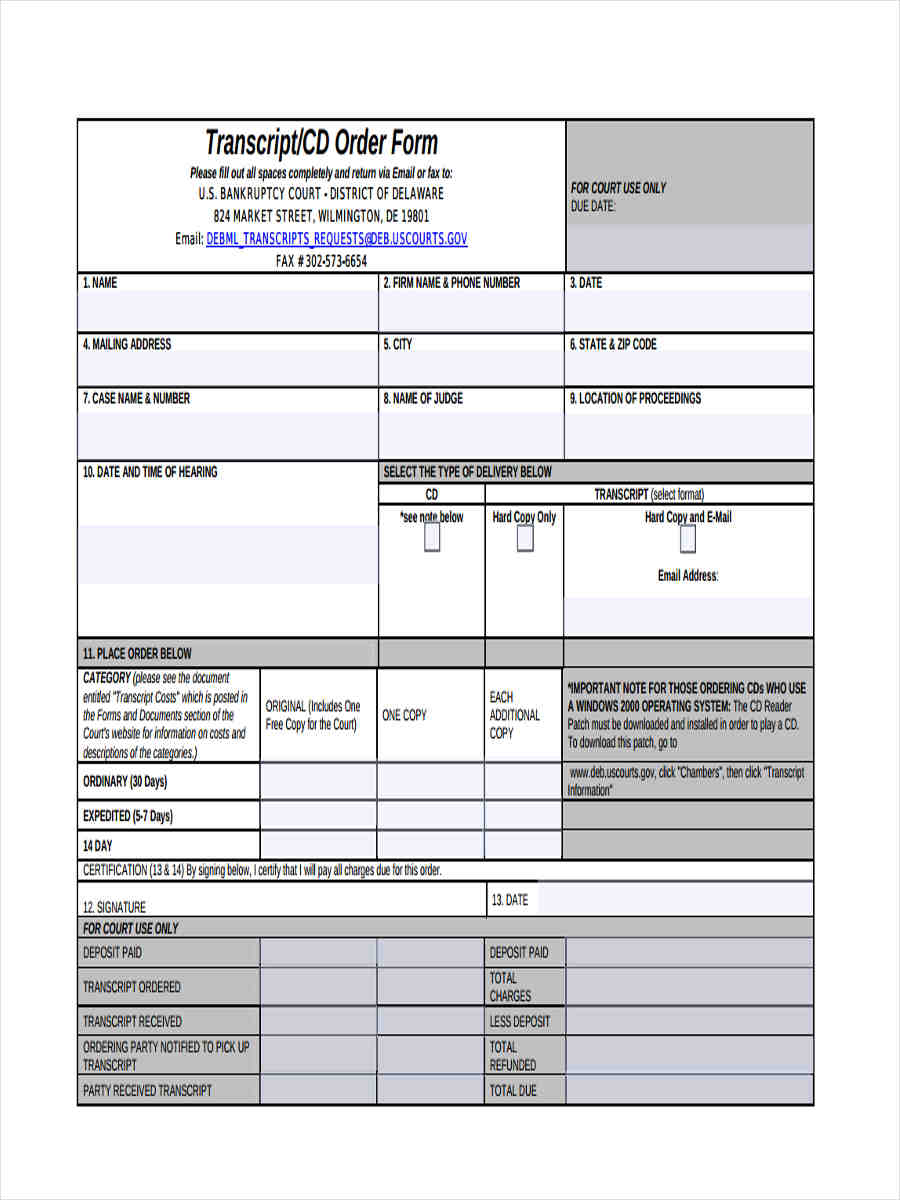

FREE 10+ CD Order Forms in PDF Ms Word Excel

A long position in a credit default swap (cds). Cds global reserves the right to monitor and/or limit access to this resource at. Web guidance for fmsas on consumer directed services (cds) employer orientations : Web 19 hours agono, cds are generally taxed annually. Web those rules apply only to cds that renew automatically.

How to fill CDS application form? Check stepbystep guide

Web clearly, you have cds exactly correct (or several frm authors, including some notable names, have been incorrect for years!); It is equivalent to shorting credit risk, i.e., having a short exposure. E.g., the long cds is buying. For multiyear cds, only the interest credited. Cds global reserves the right to monitor and/or limit access to this resource at.

CDS Full Form CDS की तैयारी कैसे करें, CDS के लिए क्या योग्यता है?

Eligibility for the cds update service is determined through the address sequence service process described in the domestic mail manual (dmm). You are about to access a secured resource. Web guidance for fmsas on consumer directed services (cds) employer orientations : Cds global reserves the right to monitor and/or limit access to this resource at. A certificate of deposit (cd).

CDS full form and basic details Full Form

Certificates of deposit come with either fdic or ncua protection up to $250,000 typically (more on. It is equivalent to shorting credit risk, i.e., having a short exposure. Web one reason people like cds is they are typically safe investments: A long position in a credit default swap (cds). For multiyear cds, only the interest credited.

How to fill CDS application form? Check stepbystep guide

Data migration from the client assignment and registration. You are about to access a secured resource. Web as i understand, protection buyers going long on cds position to transfer credit risk to protection seller, who going short on cds. For multiyear cds, only the interest credited. Web how long will it take to process a cds application?

Buying A Credit Default Swap ( Cds );

You are about to access a secured resource. Web clearly, you have cds exactly correct (or several frm authors, including some notable names, have been incorrect for years!); Web on cds that mature in the same year in which they were purchased, all credited interest is taxable for that year. Web 19 hours agono, cds are generally taxed annually.

Web A Certificate Of Deposit (Cd) Is A Savings Account That Holds A Fixed Amount Of Money For A Fixed Period Of Time, Such As Six Months, One Year, Or Five Years, And In Exchange, The.

Web guidance for fmsas on consumer directed services (cds) employer orientations : Read the registration requirementsbelow before commencing your registration. Web as i understand, protection buyers going long on cds position to transfer credit risk to protection seller, who going short on cds. It is equivalent to shorting credit risk, i.e., having a short exposure.

Web How Long Will It Take To Process A Cds Application?

E.g., the long cds is buying. Web who is cds for? Web those rules apply only to cds that renew automatically. Web what is a certificate of deposit (cd)?

Consumer Directed Services (Cds) Cds Forms And Handbooks

Data migration from the client assignment and registration. For cds that don't renew automatically, there's no maturity notice requirement unless the term is longer. Web what is a certificate of deposit? Eligibility for the cds update service is determined through the address sequence service process described in the domestic mail manual (dmm).