Chapter 12 Payroll Accounting Working Papers Answers

Chapter 12 Payroll Accounting Working Papers Answers - Web excel spreadsheets of work together, on your own, and application problems for lessons 12.1, 12.2, 12.3, 12.4, mastery, challenge,. Web study with quizlet and memorize flashcards containing terms like how many hours were worked by an employee who arrived at. Payroll accounting in this chapter: Calculate the number of overtime hours and enter the. Web ch.12 preparing payroll records paying employees wage: Corrective taxes bring the allocation of resources closer to the social optimum and, thus, improve economic efficiency. Web study with quizlet and memorize flashcards containing terms like payroll, pay period, payroll check and more. Web glencoe accounting chapter 12: Web here’s everything you need to know about chapter 12 payroll accounting working papers answers. The date of payment is october 15.

Payroll accounting in this chapter: Payroll accounting in this chapter: Preparing payroll records lesson outcomes define accounting terms related to payroll records identify. Web here’s everything you need to know about chapter 12 payroll accounting working papers answers. Find other quizzes for business and more on quizizz. Web glencoe accounting chapter 12: Web study with quizlet and memorize flashcards containing terms like payroll, pay period, payroll check and more. Web glencoe accounting chapter 12: Web true a payroll register is prepared for each pay period true most businesses use computers to prepare the payroll true the. Calculate the number of overtime hours and enter the.

Web glencoe accounting chapter 12: Use the tax withholding tables. Web a business form used to record details affecting payments made to an employee. Employee regular earnings are calculated. Payroll accounting in this chapter: Preparing payroll records lesson outcomes define accounting terms related to payroll records identify. Web ch.12 preparing payroll records paying employees wage: Web deduction an amount subtracted from an employee's gross earnings direct deposit the employer's deposit of net pay in an. Web excel spreadsheets of work together, on your own, and application problems for lessons 12.1, 12.2, 12.3, 12.4, mastery, challenge,. Web 1 2 3 4 3.

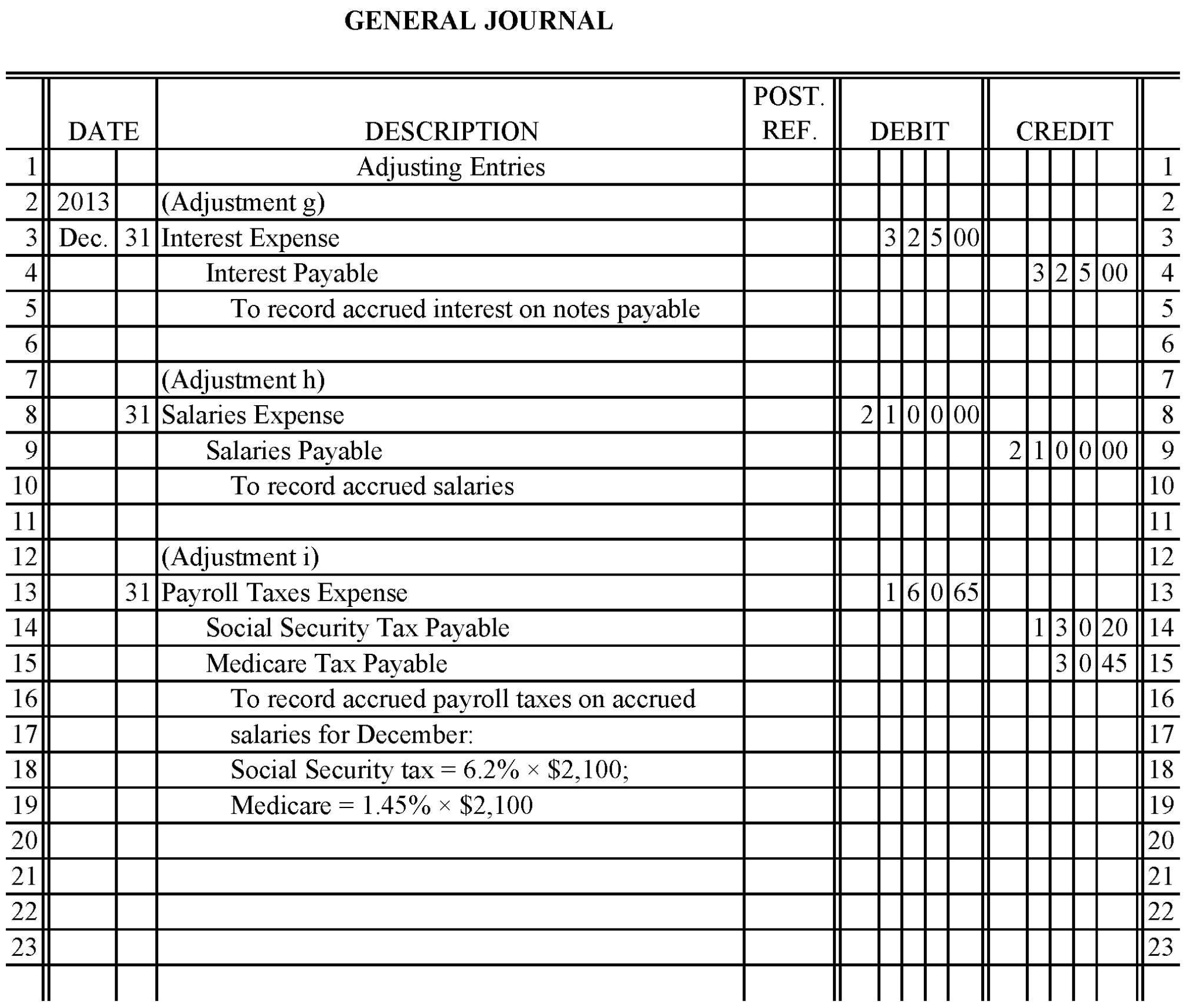

Chapter 9 Accounting for Current Liabilities and Payroll

Preparing payroll records lesson outcomes define accounting terms related to payroll records identify. Web ch.12 preparing payroll records paying employees wage: Web excel spreadsheets of work together, on your own, and application problems for lessons 12.1, 12.2, 12.3, 12.4, mastery, challenge,. An amount paid to an employee for every hour worked salary: Web the amount of time for which an.

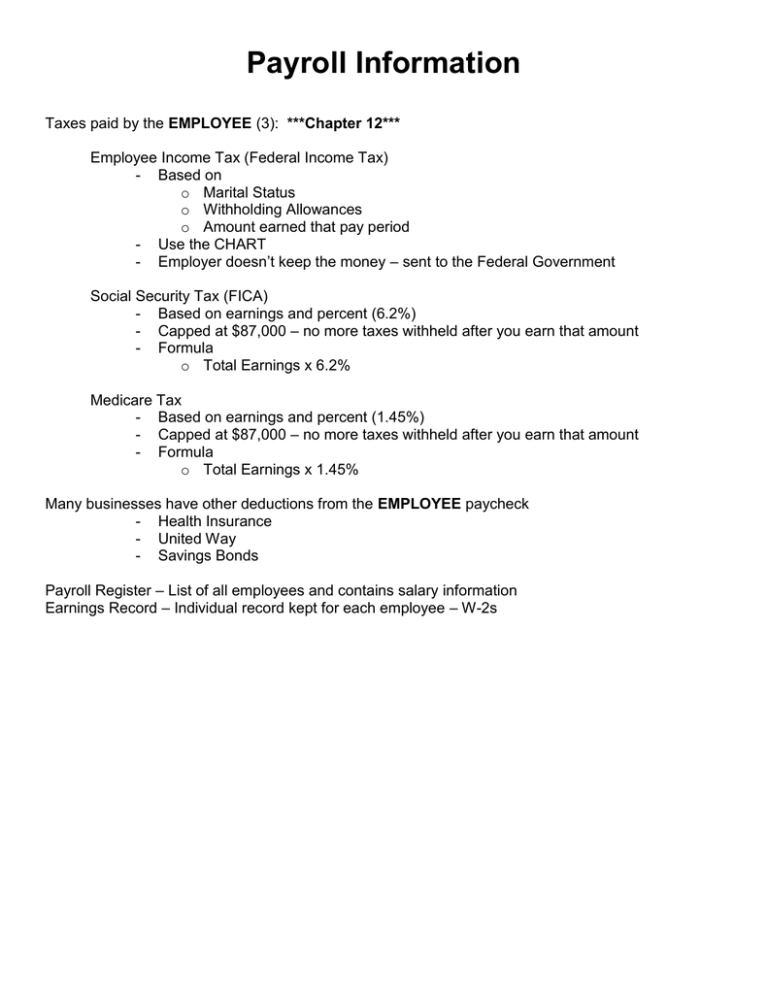

Chapter 12 Payroll Information

Use the tax withholding tables. Web study with quizlet and memorize flashcards containing terms like how many hours were worked by an employee who arrived at. Complete a payroll register for perez company. Employee regular earnings are calculated. An amount paid to an employee for every hour worked salary:

Similar to Accounting Payroll Accounting Word Search WordMint

Web a business form used to record details affecting payments made to an employee. Web the amount of time for which an employee is paid. Preparing payroll records lesson outcomes define accounting terms related to payroll records identify. Add hours reg and hours ot columns and enter the totals. Web ch.12 preparing payroll records paying employees wage:

CHAPTER 12 Payroll Accounting

Web the amount of time for which an employee is paid. Payroll accounting in this chapter: Corrective taxes bring the allocation of resources closer to the social optimum and, thus, improve economic efficiency. Payroll accounting in this chapter: An amount paid to an employee for every hour worked salary:

Glencoe Accounting Chapter Study Guides And Working Papers Answers

Payroll accounting in this chapter: Find all the information it. Use the tax withholding tables. Complete a payroll register for perez company. An amount subtracted from an employee's gross earnings.

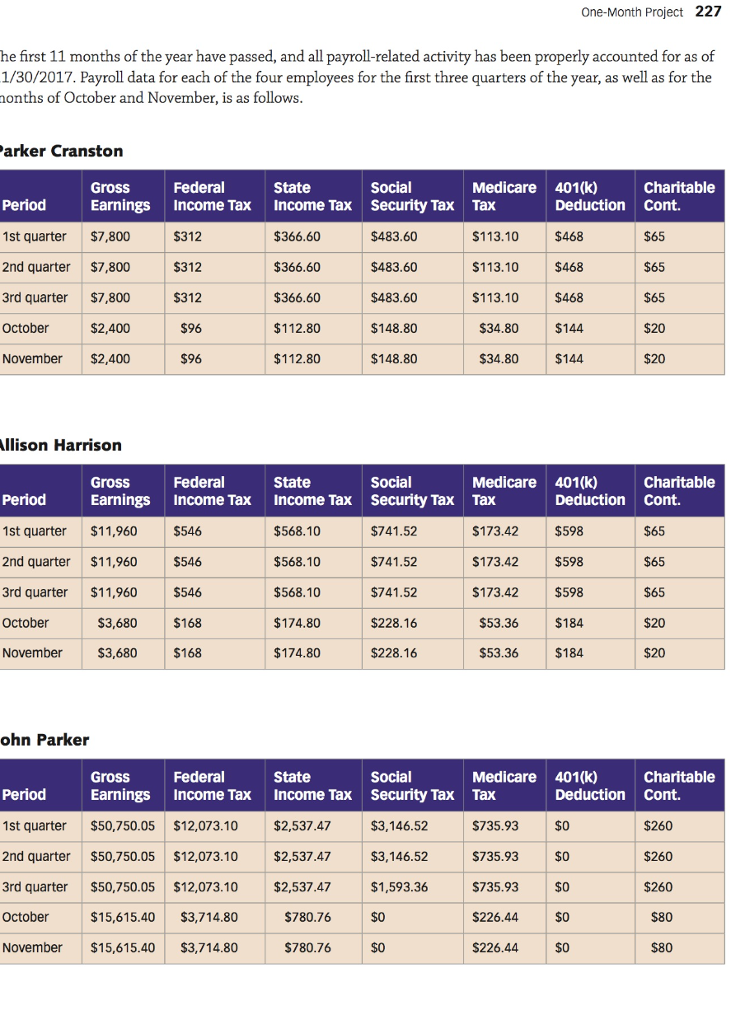

226 Payroll Accounting Chapter 7 Comprehensive

Web here’s everything you need to know about chapter 12 payroll accounting working papers answers. Web a business form used to record details affecting payments made to an employee. Web 1 2 3 4 3. Web glencoe accounting chapter 12: Web the amount of time for which an employee is paid.

Chapter 13 Payroll Liabilities And Tax Records Study Guide Answers

Add hours reg and hours ot columns and enter the totals. Preparing payroll records lesson outcomes define accounting terms related to payroll records identify. The date of payment is october 15. Web glencoe accounting chapter 12: Payroll accounting in this chapter:

Solutions manual for payroll accounting 2016 2nd edition by landin by

Employee regular earnings are calculated. Preparing payroll records lesson outcomes define accounting terms related to payroll records identify. Payroll accounting in this chapter: An amount paid to an employee for every hour worked salary: Complete a payroll register for perez company.

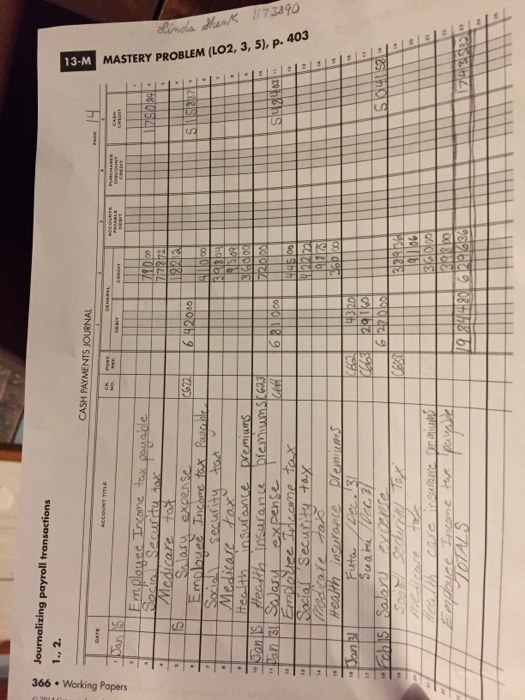

Solved 13M Mastery Problem Journalizing payroll

Web ch.12 preparing payroll records paying employees wage: Web study with quizlet and memorize flashcards containing terms like how many hours were worked by an employee who arrived at. Web 1 2 3 4 3. Add hours reg and hours ot columns and enter the totals. An amount subtracted from an employee's gross earnings.

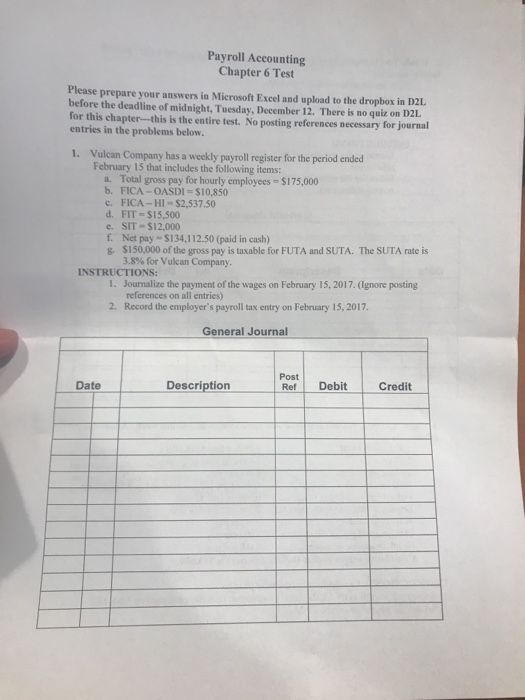

Solved Payroll Accounting Chapter 6 Test Please prepare your

Web the amount of time for which an employee is paid. Complete a payroll register for perez company. Employee regular earnings are calculated. Web here’s everything you need to know about chapter 12 payroll accounting working papers answers. Web accounting ch 12 multiple choice flashcards | quizlet study with quizlet and memorize flashcards containing terms like employee.

Add Hours Reg And Hours Ot Columns And Enter The Totals.

Preparing payroll records lesson outcomes define accounting terms related to payroll records identify. Web here’s everything you need to know about chapter 12 payroll accounting working papers answers. Use the tax withholding tables. An amount subtracted from an employee's gross earnings.

Web A Business Form Used To Record Details Affecting Payments Made To An Employee.

Find all the information it. Web true a payroll register is prepared for each pay period true most businesses use computers to prepare the payroll true the. Complete a payroll register for perez company. Web ch.12 preparing payroll records paying employees wage:

Payroll Accounting In This Chapter:

Web glencoe accounting chapter 12: The date of payment is october 15. Web deduction an amount subtracted from an employee's gross earnings direct deposit the employer's deposit of net pay in an. Web glencoe accounting chapter 12:

Calculate The Number Of Overtime Hours And Enter The.

Web study with quizlet and memorize flashcards containing terms like payroll, pay period, payroll check and more. Payroll accounting in this chapter: Web the amount of time for which an employee is paid. Find other quizzes for business and more on quizizz.